Weak taka cheers up remitters|Remitters....

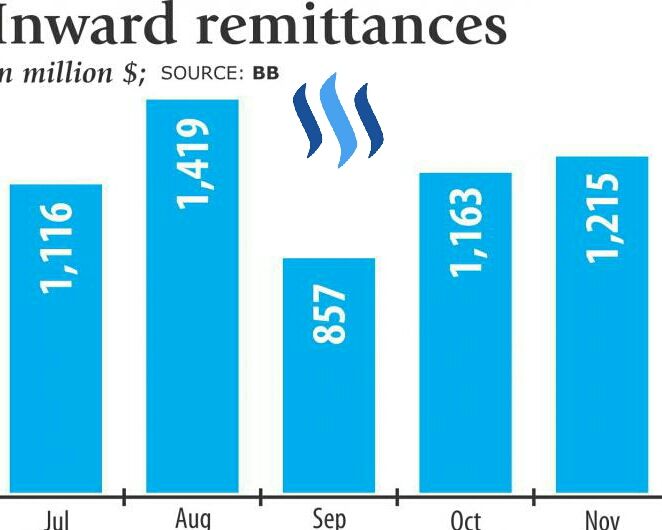

Remittance financial gain rose twenty seven.64 p.c year-on-year to $1.21 billion in Gregorian calendar month, because the depreciation of the Bangladeshi monetary unit against the yank dollar created causation cash to East Pakistan a lot of remunerative, in line with information from the financial institution.

November's inflows was additionally four.47 p.c above that of Gregorian calendar month once migrant staff sent home $1.16 billion, and took the whole receipts to $5.76 billion to this point within the current year, up 10.76 p.c within the same amount from a year earlier.

Bankers say the depreciative Bangladeshi monetary unit against the dollar has helped People's Republic of Bangladesh receive a lot of remittances in Nov.

The native currency has been depreciative heavily against the yankee dollar over the previous couple of months, prompting Bangladeshis living abroad to remit more cash through banking channel, they said.

The inter-bank charge per unit was Tk eighty two.30 on Nov thirty, up 1.85 % from Tk eighty.80 on Gregorian calendar month two, in step with the financial institution.

Bills for assortment sell rate, that importers pay to banks to shop for USD, additionally went up to Tk eighty five per yankee dollar within the middle of last month from Tk eighty two.50 in July.

Mamun-Ur-Rashid, administrator of ordinary Bank, aforementioned the slippery price of the Bangladeshi monetary unit against the dollar inspired the migrant employees to send their cash through formal channel.

The senders earlier selected digital hundi, AN misbr cross-boundary money dealing system, he said.

In case of digital hundi, remitters deposit the number to a trafficker in their host country. the seller then instructs his network in People's Republic of Bangladesh to deposit the total to the accounts of mobile money service (MFS) suppliers.

Through this misbr channel the recipients in People's Republic of Bangladesh tend to induce an even bigger total than what they'd have if the money was sent through official channel.

Rashid aforementioned the financial institution has recently asked MFS suppliers to suspend suspicious accounts of agents, WHO settle cross-country money transactions by bypassing the money wash and coercion funding laws. The directive paid off by means of boosting remittal financial gain.

Md Arfan Ali, administrator of Bank Asia, aforementioned the remittal flow inflated in recent months because the migrant employees area unit currently obtaining a favourable rate.

Syed Mahbubur Rahman, administrator of Dhaka Bank, aforementioned People's Republic of Bangladesh has benefitted from variety of recent initiatives undertaken by the govt and also the financial institution.

The BB shot has asked banks to recruit agents abroad to gather remittances from migrant employees. It additionally requested Bangladesh's embassies to require measures aimed toward encouraging employees to use official channel to remit cash, Rahman aforementioned.

Expatriate Bangladeshis sent home $12.77 billion in 2016-17, down 14.47 % year-on-year. The flow was rock bottom in six years, that plunged the country's accounting balance within the deficit zone.

It is a good post that have great educative value. Carry on...........

Thank you.

We have shared many beautiful and very important news with you. We need to know who we are on this platform with the news

Thanks bro @reyadapon very important news.