The Deutsche Bank Fiasco Explained

by James Corbett

corbettreport.com

October 5, 2016

You have no doubt heard by now about the precarious situation that Deutsche Bank finds itself in, including the impending US government fine for selling faulty mortgage-backed securities in the run up to the financial crisis. The lamestream media is busy running stories about German bailout rumors, and bank's uncanny ability to not quite die...yet. But in case anyone is tempted to draw comparisons with the 2008 financial crisis, rest assured that the failure of Deutsche Bank would be no "Lehman Bros. moment." It would be incomparably worse.

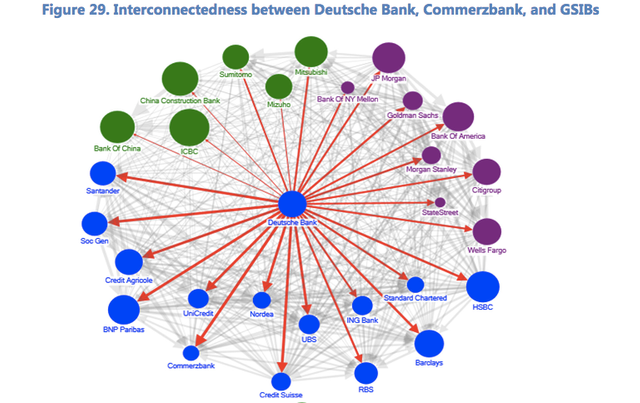

Deutsche Bank is not just one of the largest banking and financial services companies in the world (although it is that). It is also one of the most inter-connected banks in the world. As the IMF helpfully pointed out earlier this year:

"Deutsche Bank is also a major source of systemic risk in the global financial system. The net contribution to global systemic risk is captured by the difference between the outward spillover to the system from the bank and the inward spillover to the bank from the system based on forecast error variance decomposition. Deutsche Bank appears to the most important net contributor to systemic risks in the global banking system, followed by HSBC and Credit Suisse. Moreover, Deutsche Bank appears to be a key source of outward spillovers to all other G-SIBs as measured by bilateral linkages."

And here is the handy dandy diagram they provided to demonstrate those "bilateral linkages" that could contribute to "outward spillovers" to the other "G-SIBs" (that's "globally systemically important banks" to all of you not versed in Bankster-speak):

But more to the point, this doesn't just mean that their CEOs play golf together every year or two. These linkages include derivatives counterparties. What this diagram is really showing us is that when/if Deutsche Bank goes under it will create a derivatives black hole that threatens to draw in most of the largest financial institutions in the world...each one of which would then create its own black hole of derivatives debt.

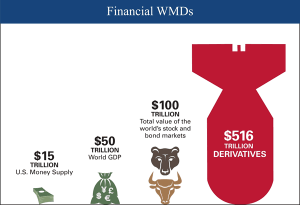

Now you'll remember that derivatives are bets on the performance of some other thing, like an asset, index, interest rate, etc. Like any bet, it can happen between two or more people and things can get very messy when one of the people involved doesn't have the money to pay up in the end. But derivatives can get even more wild, since the amounts in question can add up to trillions of notional dollars, i.e. money that does not actually change hands...unless everything falls apart and someone is left holding the bag.

This is why Warren Buffett famously referred to derivatives as "weapons of mass destruction."

This is also why the 2008 crisis was so severe. If AIG had not been bailed out then its $527 billion in credit default swaps with Goldman Sachs, Morgan Stanley, Bank of America and Merrill Lynch (as well as DB and dozens of other European banks) would have unwound and potentially brought down the global financial system. And so the banksters held the proverbial (or not-so-proverbial) gun to Congress' head and achieved the largest bailout in corporate history.

So if all of that was done on the basis of AIG's half-a-trillion or so in counterparty risk, what are we looking at with Deutsche Bank?

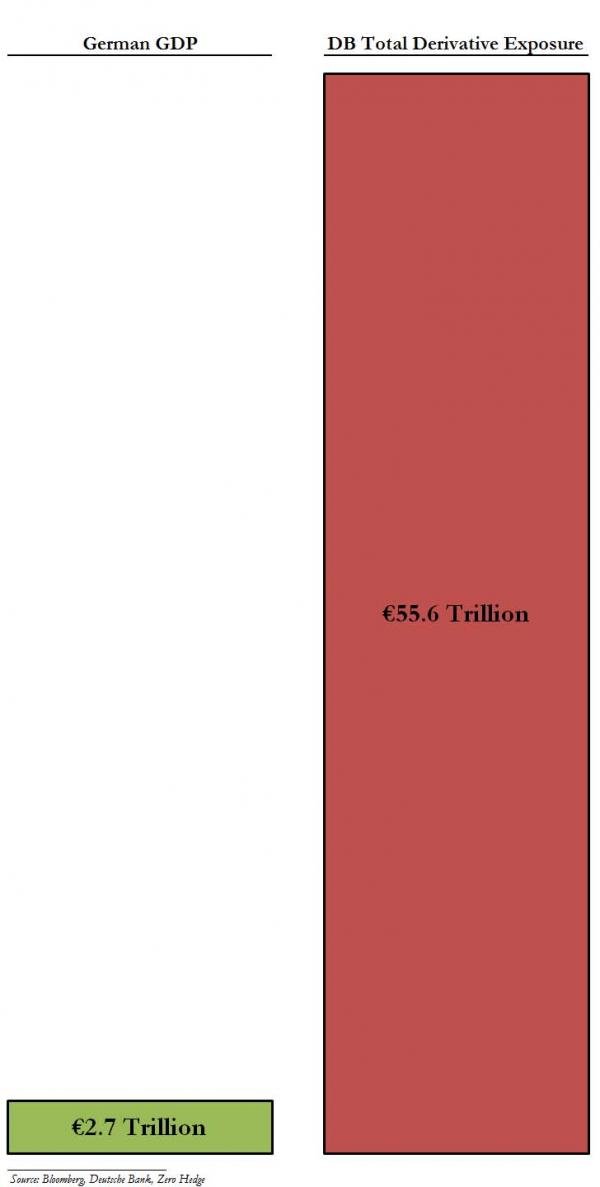

Well, in 2013 its notional derivative exposure was 55.6 trillion euros. Let's put that in perspective with a graphic from ZeroHedge comparing DB's derivative exposure to the Gross Domestic Product of Germany.

Does that look frightening? Well, don't worry. Deutsche's derivative black hole has been pared back to a much more modest 46 trillion or so euros, a mere 15 times German GDP.

Does that make you feel any better? I didn't think so.

Well, maybe this will make you feel better: In the wake of the 2008 meltdown, the banksters put their heads together to come up with some new regulatory guidelines for containing the derivatives exposure mess. These changes were articulated by the G20 at the 2009 Pittsburgh conference. While the protesters outside were being abducted in broad daylight and being introduced to the LRAD, the banksters' political puppets were busy hammering out the following:

"All standardized OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by end-2012 at the latest. OTC derivative contracts should be reported to trade repositories. Non-centrally cleared contracts should be subject to higher capital requirements."

(Interestingly, this idea was first proposed in a white paper published by the Bank for International Settlements (yes, that Bank for International Settlements), then announced at the G20, then handed off to the Financial Stability Board (which I've discussed before) to insure compliance, and then adopted by the individual central banks that make up the BIS membership. And that in a nutshell is how global marching orders are given without the need for an explicit "global central bank" with authority over everyone.)

So theoretically this new regulatory regime, combined with the fact that many of Deutsche Bank's derivatives will be hedged by other trades, will mean that we won't be looking at a 46 trillion euro black hole if Deutsche goes under...

...Unless.

Unless the regulations that the banksters enacted to "control" the derivatives problem were mere window dressing to distract the public while the banksters carry on with their world-threatening casino games.

Unless the IMF, which went to great pains to single Deutsche Bank out as the most precarious bank in Europe, might have ulterior motives for destabilizing the existing financial order and bringing in one governed by their own soon-to-be global reserve instrument.

Unless the US government has its own reasons for pulling the rug out from under the ECB by imposing a fine that they know would cause Deutsche to go under.

Unless the ECB actually welcomes such an event (and the recalcitrance of Germany to bail the bank out) as an excuse to flex its muscle and intervene directly with a miracle bailout that "saves the world" in the nick of time.

But we all know such august institutions as these would never cause a crisis in order to benefit from it, would they?

And on a completely unrelated note, Deutsche Chief Executive John Cryan is in Washington this week to meet with US officials on the sidelines of the IMF's annual meeting. Sleep tight, everyone!

@corbettreport

You know what's the problem with all these impending doom senarios? Nobody, ever, EVER seems them coming. No matter what the numbers show, the "analysis" and all that crap, nobody really knows or understands the workings of the economy because underneath those numbers there is a massive network of chaotic transactions that we do not know about. Nobody knows about.

If the economy was so predictable we would be able to divert all the crises, all the crashes. Thing is nobody knows when one cycle begins and when another one ends. It is random. Formulas, algorithms are no different than gambling.

Every single month someone pops up talking about a "crisis". Eventually someone gets it right. Don't forget. Even a broken clock is correct twice a day.

I don't need to know exactly how long the gravity of tens of trillions of dollars worth of debt can be defied to understand that a fat bank account or generous pension plan or the prospect of a viable career after years of expensive education is, at best, a dubious way to prepare for the future.

Yes, the individual transactions are certainly complex and intertwined, but the trends and imbalances are easily identified - for anyone that cares to look. Our problem is regulatory capture. Nobody is minding the shop, while the average saver/investor is being exploited. At the same time, the average saver/investor has misplaced faith in the regulatory regime. No, nobody can predict when the cracks will open up, but we know that they will - and millions will suffer. The "broken clock" / "nobody knows" trope isn't helpful to a thoughtful conversation.

Great analysis @corbettreport

One of tuthe best articles I have read in a while!

I was aware of most of this, but truly enjoyed your suburb translation for these surcumstaces of great implication.

It's important people read this.

Great job!

Buy Bitcoin and silver

Thanks for the article. Been following and reading about Deutsche the past month or so, awaiting the impending doom.

Thanks for writing and sharing this James, It's a crazy world we're in right now and I hope more people can see before that day gets here.

Excellent text.