Meet Mitt Romney’s Frank Nitti: Paul Traub

According to well-known white collar defense attorney, Darryl A. Goldberg, Ponzi schemes remain on the radar of the DOJ because there were many fraud schemes during the era of George W. Bush still in need of closure.

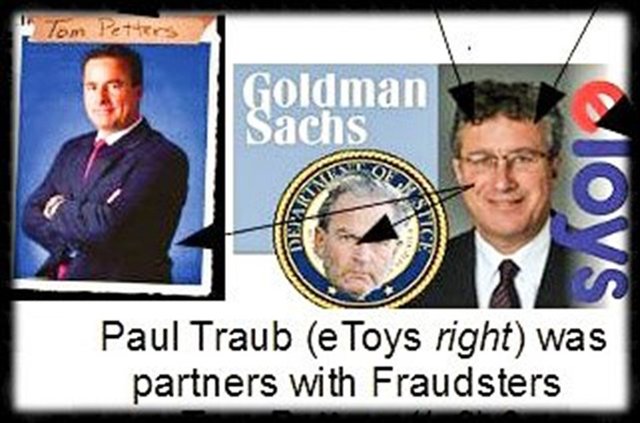

Frank Vennes/Metro Gem, Palm Beach Links Capital, Allen Stanford, Mike Catain, Stage Stores, Rothstein, Okun 1031 Tax Group, Marc Dreier, Bernie Madoff, Kay Bee, Mattel/Learning, Lancelot, SkyBell, Tom Petters Ponzi and eToys ate more than $100 billion dollars in fraud.

Dozens of these racketeers went to prison, for a total of nearly 500 years.

That is, except for Mitt Romney’s guy – Paul Traub!

Traub is like Al Capone’s partner in crime, Frank Nitti, who eluded justice until Elliot Ness was assigned to the Capone cases.

Though Paul Traub is involved in many fraud cases, and obviously Traub is perpetrating many state and federal crimes, the Paul Traub case still lacks its version of Eliott Ness!

Romney’s Bain Capital, along with Thomas Lee Partners, Goldman Sachs, Michael Glazer, Wells Fargo, United States prosecutors Colm Connolly, Mark Kenney, Roberta DeAngelis, James Lackner all are – one way or another – linked to these cases.

Additionally, those parties, like Paul Traub, are never even investigated, much less prosecuted or imprisoned for their own involvement.

Ironically, Paul Traub also worked on many fraud cases like Enron, Kmart, and Adelphia.

Outside of those, Traub is visibly linked to parties or directly involved in more than $50 billion dollars in frauds of Fingerhut, Stanford, Okun 1031 Tax Group, Stage Stores, Mattel/Learning, Wells Fargo, Rothstein/Discala, Palm Beach Links Capital, Frank Vennes/Metro Gem, Kay Bee, Lancelot/ SkyBell and eToys.

Our federal system of justice is supposed to investigate these strings of fraud, but the DOJ is embarrassingly absent and nowhere to be found.

It appears from this reporter’s view that the DOJ is afraid of Paul Traub for reasons that will become apparent by the end of this article.

NATIONWIDE CROOKED NETWORKED PARTIES

The Morris Nichols Arsht & Tunnel (“MNAT”) law firm is in Delaware.

MNAT sneakily works for Bain Capital and Goldman Sachs, who appears to be partners in “Bankruptcy Ring” rackets in numerous schemes.

Romney owned The Learning Company that was merged with Mattel, and the dealings were aided by Goldman Sachs & MNAT.

Romney also owns Stage Stores, where Jack Bush and Michael Glazer were Directors (by the way – did you know Bush & Romney are distant cousins)!

Stage Stores’ executive assistant was a man named Barry Gold.

Traub Bonacquist & Yellen had a breakup. Stephen Mayka and others left, because Paul Traub was getting regularly known by nickname as the “Brown Bag King of New York.”

Whistleblower Laser Haas has been battling Romney and his bankruptcy ring for nearly two decades.

Laser was pointed in the right direction by Traub’s former partner, Stephen Mayka; which included revelations that Paul Traub and Barry Gold were actually secret partners.

Prior to Stage Stores, Barry Gold and Paul Traub’s new firm of Traub Bonacquist & Fox (TBF) worked with guys like Larry Durant and Jack Bush in various cases such as Lauria Brothers, Witmark and Romney’s Jumbo Sports.

Simultaneously, when Michael Glazer was Director at Stage Stores, Glazer was also seated as the CEO of Bain Capital’s Kay Bee. Glazer is now the CEO of Stage Stores.

Mitt Romney owns a Bermuda entity named “Sankaty”; which some say proves Romney is really worth billions (and that’s possibly why Mitt hides his taxes.)

Also, Romney is now with his son, Tagg, and Mitt’s brother Scott, in Solamere Capital LLC investment firm.

Solamere was strange bedfellows with Allen Stanford. So much so that when Stanford went to prison for 50 years, many of his executives are now at Solamere.

Assistant United States Attorney Colm Connolly quit the DOJ to become a partner of MNAT law firm.

Speciously, Connolly’s switching of sides ties into Goldman Sachs ripping off eToys IPO & the Learning Company merge with Mattel, resulting in a catastrophic loss of billions of dollars for the Mattel investors.

[RELATED: WHISTLEBLOWER: DOJ Wall Street – Get Rich Quick – Revolving Door$ ]

Coincidentally, Romney’s 2012 Campaign claims that their candidate was “retroactively” retired from Bain Capital, as of August 2001, back to February 11, 1999.

This just so happens to be the exact period of time Colm Connolly was a partner of MNAT [Connolly’s DOJ resume]. (archived)

But, hold on, this “revolving door” of switching of between the dark sides doesn’t stop there.

On August 2nd, 2001, after a million dollar bribe was offered to, and turned down by, eToys executive Laser Haas – Colm Connolly returned to the Department of Justice.

This time Connolly became the United States Attorney in charge of many of the cases whistleblower Haas and eToys shareholder Robert Alber were asking Connolly’s office to investigate and prosecute.

MNAT lies under oath (MNAT continues to deceive to this very day) to conceal Goldman Sachs & Bain Capital affiliations, in order for MNAT to be the court approved Debtor’s counsel for eToys.

Paul Traub and his various firms also lied under oath (Traub confessed it was deliberate) to conceal Barry Gold, Bain Capital and other schemes and artifice to defraud so that Traub is approved as eToys Creditors counsel.

Laser the Liquidator is the Delaware Bankruptcy Court-approved head fiduciary over eToys; and Laser gets punished for refusing to join Romney’s gangs and Mitt’s version of Frank Nitti – Paul Traub.

Goldman Sachs had taken eToys public in Delaware; but eToys was ripped off of millions of shares that eToys received less than a shocking $20 for, that Goldman Sachs ultimately carved up with handpicked parties in a pump-n-dump “spinning” scheme.

While benefiting from lies under oath, MNAT asked for permission to Destroy eToys Books and Records, which Paul Traub happily agreed with.

Prior to eToys filing a bankruptcy claim, Traub’s firm was the “Unofficial Creditors Committee” counsel.

In that position, Paul Traub schemes a $100 million Wells Fargo deal; selling BabyCenter.com to Johnson and Johnson for $10 million.

Neither the Wells Fargo deal nor the Johnson and Johnson deal were ever disclosed to court-appointed liquidator eToys fiduciary, Laser Haas.

MNAT and Traub colluded with Sachs and Bain Capital to destroy the eToys public company, get eToys assets to Bain/Kay Bee as cheaply as possible, and assure the end of Laser’s career since he wouldn’t stop fighting to expose these racketeering schemes.

Part of the plot included getting creditors to persuade Haas to use one of his companies, instead of being named CEO of eToys (under the guise it would save everyone money and Laser would not have to fly back and forth from eToys offices in Los Angeles to the Delaware Bankruptcy Court).

Hence, Laser’s entity of Collateral Logistics Inc., (CLI) was the entity approved to run eToys; and MNAT was ordered to submit Laser/ CLI paperwork for payment.

This doomed Laser and his CLI entity.

MNAT and Traub tried to sell all of eToys assets to Bain/Kay Bee, for $5.4 million, undercutting its real worth.

Laser halted the sham auction after he noticed the foul deal and he began blowing the whistle.

Despite all sides scheming to destroy eToys and fleece every last dime from the company, Laser managed to compel bids in the tens of millions of dollars, including a deal with Scholastic, which Traub and MNAT talked everyone out of.

Another deal was a merger with Playco/Toys International, which MNAT and Paul Traub also nixed.

In the Playco instance, eToys was set to be paid 100 cents on the dollar for all its retail inventory.

Paul Traub scuttled the good deal, but Traub failed to inform Haas that he was also counsel for Playco.

This essentially means Traub broke the law, by deceiving parties in both cases.

During those times, Barry Gold and Paul Traub formed Asset Disposition Advisors (ADA) to replace Laser’s CLI in eToys.

But the narrative quickly changed once Haas pushed to sue Goldman Sachs and Paul Traub suggested Barry Gold be hired for the SEC case.

The success of this ruse guaranteed further the absolute end of eToys public company and the destruction of Haas’s Liquidator career.

Once inside, Barry Gold, was aided and abetted by Paul Traub as Creditors counsel, and MNAT as both eToys counsel, who was also ordered to be counsel for Laser/CLI.

These nefarious plots were utilized to usurp Haas/CLI and the bad faith parties, after which unlawfully locking Haas out of eToys.

MNAT, Barry Gold and Paul Traub were now free to reduce the sale prices of eToys assets, to Bain/Kay Bee (this is a racketeering crime mandating federal prosecution).

At the same time, MNAT and Barry Gold nominated Paul Traub’s firm to be the one to sue Goldman Sachs in NY Supreme Court (case# 601805/2002).

Of course, this doomed the eToys shareholders because, in essence, it was a pony show – Goldman Sachs was suing Goldman Sachs.

Years later, Traub, as a partner of Marc Dreier’s law firm, settled eToys (renamed ebc1 after Bain/Kay Bee stole eToys.com), for a mere $7.5 million (instead of the hundreds of millions anybody else, like the eToys federal whistleblower Haas would have obtained).

Robert Alber spearheaded the eToys shareholders group; and Alber directly questioned Traub and Gold on the stand about their relationships.

Both then lied and denied they were affiliated under oath.

As a matter of fact, Barry Gold signed a court Declaration, under penalty of perjury, stating that he and Traub (as debtor and creditors) were at “extensive” arm’s length.

Obviously, this is far from the actual truth.

MNAT, Barry Gold, and Paul Traub also lied through their teeth, telling the Chief Judge that the eToys shareholders didn’t need a Committee (as allowed by law) or independent counsel (that would be separate and paid for by the case); because MNAT, Barry Gold and Paul Traub “had the shareholders’ backs.” Another blatant untruthful statement since Paul Traub, MNAT, and Traub’s secret partner, Barry Gold, completely robbed the eToys shareholders blind.

MNAT, Barry Gold and Paul Traub also told the eToys judge that Laser Haas gave away eToys and “waived” $10 million dollars in fees and expenses. An obvious lie that you would have to be born yesterday to believe.

PAUL TRAUB HELPS ROMNEY DEFRAUD KAY BEE

MNAT, Barry Gold, Paul Traub, Goldman Sachs and Romney’s Bain Capital, Michael Glazer, were all comfortable that they had the “fix” being “in” with MNAT partner (Colm Connolly) planted into the Delaware Justice Department, as the United States Attorney, assuring they would get away with all the eToys, Mattel and Fingerhut schemes; this emboldened the rackets (gangs) to do more stealing.

Prior to Kay Bee’s first bankruptcy case, in 2004, and just a short time after usurping Laser Haas out of eToys, in 2002, Michael Glazer paid himself $18 million and Bain Capital $83 million.

Having MNAT’s partner, Colm Connolly as a planted federal prosecutor also helped guarantee no federal agency would show scrutiny into the Kay Bee case.

Just in case further protection was needed to solidify success of the schemes, MNAT openly represents Bain Capital in the Kay Bee case; and Paul Traub asks to be the one to prosecute Glazer and Bain.

Of course, all the Machiavellian parties are continuing to lie/deceive, by omission and falsity, in order to conceal their incestuous relationships.

Even Traub and Barry Gold double-dipped with their ADA entity; and Romney’s Sankaty does so, as well seeking payments from the bankruptcy cases – unlawfully.

Laser cried foul and informed the DOJ Deputy Director, Lawrence Friedman, who responded by a direct email to Laser with a promise to be on top of it all.

Unfortunately, the Delaware Department of Justice had Laser’s Kay Bee case Complaint stricken & expunged from the record.

Shortly after, DOJ Deputy Director Lawrence Friedman chose discretion over valor and resigned. (archived)

It’s not as if the FBI, SEC and DOJ aren’t aware of Paul Traub’s bad ethical acts.

The eToys case whistleblower has direct emails and letters from DOJ Deputy Directors, federal investigators, the U.S. Trustee’s office and multiple Inspectors General, as well as the 1st, 2nd and 10th Disciplinary Departments of NY State Supreme Court.

All of those state and federal watchdog agencies, speciously and staunchly, refused to investigate – much less prosecute – Paul Traub and his associates; because the cui bono is for the very lucrative partners of Goldman Sachs and Romney’s Bain Capital.

Should justice one day come, Mitt Romney may have to give up one of his 3-car elevators for his La Jolla mansion.

As the Picower estate can tell you, federal case clawbacks are a bitch!

TRAUB CONTROLS TOM PETTERS PONZI

While all these other “Bankruptcy Rings” and public company destructive frauds are transporting, Paul Traub is partners in other frauds, nationwide.

Some of them include, but are not limited to, the Tom Petters Ponzi case.

Mitt Romney and Tom Petters were both lauded as miracle-working businessmen.

The difference is, no federal agent or agency appears to have the guts to touch Traub or Romney.

Petters owned multiple billions of dollars in assets. Such as Petters Magazines, Petters Companies, Sun Country Airlines, Fingerhut and Polaroid.

Former federal Minnesota prosecutor turned Receiver, Doug Kelley, was the court-appointed fiduciary to take over Tom Petters Ponzi cases, after the FBI raided Petters, in September 2008.

Kelley stated upon public record stipulating Paul Traub had considerable “control” over Tom Petters and that Traub’s law firm was acquired by Marc Dreier after Paul’s firm was caught, in eToys, for failing to disclose the Barry Gold conflict of interest.

Fingerhut was being sued by Laser and eToys, but Traub’s friends Barry Gold and MNAT settled the litigation of eToys v. Fingerhut.

Then Petters Ponzi acquired Fingerhut!

Until the FBI raided Petters Ponzi, Fingerhut’s home office was listed as 655 Third Ave. NY

Guess what? 655 Third Ave. was Traub’s headquarters!

Inexplicably, Fingerhut was not seized by the feds when the FBI raided Tom Petters Ponzi.

Instead, public records and newspapers indicate that Bain Capital & Goldman Sachs gave Fingerhut $50 million in June 2008, mere months before the FBI raided Petters (Traub) Ponzi on September 2008.

Apparently, Traub rearranged the ownership.

Polaroid was also acquired by Petters Ponzi; however, Polaroid was seized by the feds, unlike Fingerhut.

Continuing to do schemes and artifice to defraud, Polaroid was sold in a sham auction for $83 million.

Ritchie Capital, unaware of the frauds, had given Petters/Traub over $100 million in loans for Polaroid just a few months prior to the FBI seizing Polaroid.

When the feds seized Polaroid, courts blocked Ritchie Capital and NY aggressive businesswoman, Lynn Tilton, from bidding on Polaroid.

As a matter of fact, Ritchie Capital lost a ruling, this past week.

Ritchie Capital isn’t entitled to recompense because of conflicted DOJ “revolving door” dynamics and judges ruling contrary to what’s right and in total disregard of the law.

The Justice Dept also appears to be rigged in Minnesota, according to the information provided to this reporter.

Marty Lackner was involved in Tom Petters Ponzi billion dollar feeder funds; Marty’s brother is James Lackner.

That would be Minnesota Assistant United States Attorney James Lackner, who was head of DOJ Criminal Division that presided over crimes like Tom Petters/Paul Traub Ponzi.

Even more absurd are the facts concerning Receiver Douglas Kelley.

Prior to becoming the court-appointed fiduciary of Petters Ponzi – we kid you not – Douglas Kelley was actually Tom Petters personal attorney.

In other words, how is Frank Nitti allowed to investigate Al Capone?

Taking this Twilight Zone of injustice even further – Paul Traub’s client, Gordon Brothers, bought Polaroid for the $83 million.

Gordon Brothers was the 2nd highest bidder after the Minnesota system of (perverted) justice blocked Ritchie Capital and others (like Lynn Tilton) from bidding on Polaroid.

Subsequently, it was then announced, that Paul Traub became a co-principal of Gordon Brothers.

Then Gordon Brothers claimed it had found a mystery $2 billion dollar license deal, which – oddly enough – no one seemed to know about during the lengthy, Polaroid auction, process!

By the way, similar to the fact that Madoff’s sons – Andrew and Mark – can no longer answer questions because they are both buried deep in the ground.

We can no longer ask Marty Lackner questions either.

Marty Lackner appears to have been “suicided” also!

As the saying goes – dead men tell no tales.

PAUL TRAUB WAS MARC DREIER PARTNER

Meanwhile, Laser Haas’ relentless pursuits forced Traub’s TBF to disband, which pushed Paul Traub to do his shenanigans as a partner of Marc Dreier’s law firm, of Dreier LLP.

In 2008 and 2009 light started being shined on the situation when some of Traub’s associates started pleading guilty, or they were convicted.

Frank Vennes was sent to prison. Bruce Prevost, David Harrold and Bob White plead guilty.

Mike Catain, Larry Reynolds and Greg Bell were also sent to prison for their involvement in Traub’s scams.

Many others were also placed in secluded cells, whilst racketeer Paul Traub doesn’t even get investigated.

Minnesota DOJ, aided by conflicted Receiver, Doug Kelley, who consistently touts the fraud damages caused by Paul Traub/Tom Petters Ponzi, stating – falsely- the scams endured $3.7 billion.

This is rather odd – being that Mike Catain confessed that $12 billion was laundered in Minnesota, and Larry Reynolds confessed an additional $12 billion in money laundering in Las Vegas and Los Angeles.

Further earth-shattering details and maybe why the feds seek to cover up the massive amount of money laundered, is the fact that Larry Reynolds is a fake name. His real name is Larry Reservitz and he did part of his $12 billion, in money laundering, living in Las Vegas, as part of WISTEC (the witness protection program).

In fact, the estimated total in the Petters’ fraud scheme according to an article by the Wall Street Journal was $40 billion dollars. (archived)

Marc Dreier pleads guilty and, as a result, he received 20 years in prison (which, by the way, Marc Dreier is speciously serving of all the places – in Minnesota).

Tom Petters pleads not guilty but he is convicted and sentenced to 50 years in prison.

However, Paul Traub, despite being listed as a “control” of Tom Petters Ponzi, was mysteriously not even mentioned by any of the prosecutors at the Department of Justice.

TRAUB DOUBLE DIPS OKUN 1031 TAX GROUP

In a separate, but even more bizarre shocking instance, Paul Traub is counsel for Ed Okun’s 1031 Tax Group.

1031 exchanges are a tax permit to avoid capital gains by reinvesting the profits into another property within a short period of time.

Ed Okun received 100 years in prison as a result of his 1031 Tax Group issues.

Enigmatically, Okun swears up and down that he was set up. Okun argues, heavily, that all his customers/clients should have gotten 100 cents on the dollar.

However, Okun says the bankruptcy Trustee was giving away everything for pennies on the dollar when it wasn’t necessary.

Obviously, Ed Okun wasn’t aware at the time that Paul Traub constantly stabs his clients in the back.

Whilst Paul Traub represented Okun 1031 – Traub’s TBF partner (moving over to Olshan Fromme), Michael Fox, of TBF – actually was the attorney for the Okun Creditors & Okun bankruptcy case Trustee.

This tends to explain the schemes of bizarre sales for pennies on the dollar, and there is good cause for concern about whether or not Paul Traub or his buddy Michael Fox did an eToys-style deceit with who got those “pennies on the dollar” super-sweet deals!

BACK TO ETOYS FRAUDS

In getting away with everything else, Paul Traub betrays his court-approved clients and the eToys shareholders he swore he was protecting by denying the stockholders their own counsel and creditors committee.

Traub settles the eToys v Goldman Sachs NY Supreme Court case for $7.5 million – which Traub’s partners of Barry Gold and MNAT approved of – despite it being against the law for them to be affiliated with each other.

As noted by the 3rd Circuit case, of In re: Arkansas, “Bankruptcy Rings” where lawyers (like MNAT and Paul Traub), betray their clients; which is why Congress fixed the law commanding lawyers to swear – under oath – that they disclosed everything!

Observably, Traub did the eToys v Goldman Sachs NY Supreme Court case settlement as Dreier LLP; which means SDNY District Court Honorable Justice Jed S. Rakoff is being made a mockery of, like every other court Traub comes in contact with nationwide.

RACKETEERING RETALIATIONS

Noticeably, in the Stage Stores case, the judge ruled no fraud was done. Then the Stage Stores judge sought to punish shareholder Dov Avni, who the court ruled was wasting everyone’s time about allegations of deceitful dealings.

Stage Stores court ruled that, despite the fact that Dov Avni only held a small sum of $4,500 worth of stock, the U.S. Marshals were to seize $300,000 from Dov Avni.

As noted by the end of TBF’s Supplemental Stage Stores Affidavit, Traub repeatedly states – “upon information and belief” – Barry Gold had nothing to do with Traub’s firm being hired in Lauria Brothers, Witmark or (Romney’s) Jumbo Sports.

Michael Fox said Traub never met Barry before eToys. However, that is a false statement since this letter shows Barry Gold hiring Paul Traub.

Observably, this is babbling banter, disingenuously obfuscating the real issue at hand related to the Stage Stores case, which was whether or not Traub failed to disclose his relationship to Barry Gold.

Robert Alber, another shareholder, was offered a bribe as well, which he turned down.

Alber, as a result of an assassination attempt, had to shoot and kill career criminal Michael Sesseyoff.

Regrettably, Alber, like Madoff’s sons, and Marty Lackner, are no longer able to see justice or tell his tale; because of the complicated issues of the Sesseyoff assassination attempt, Alber is now also sitting with his name on a tombstone, in the ground – dead.

TRAUB DECEIVES NY SUPREME COURT OF APPEALS

In the beginning of 2013, after Romney lost his 2102 POTUS run, whilst the schemers were settling the New York Supreme Court case of eToys (renamed ebc1) versus Goldman Sachs, for a billion dollar fraud, Paul Traub and his associates, Michael Fox, Harold Bonacquist, Susan Balaschak, Barry Gold and Judge James Garrity (that represented Paul Traub, in eToys) were dodging a justice bullet concerning the SDNY Bankruptcy case of In re: Cosmetics Plus (SDNY Bankr 01-11771).

Originally, Traub worked the Cosmetics Plus case, of 2001, as TBF.

After the eToys whistleblower caused TBF to disband, Paul Traub worked numerous cases, as Dreier LLP.

In 2008, after Petters, Dreier and Madoff were arrested, Paul Traub did a huge attorney at law No, No!

Juxtaposing, in a merry-go-round manner, between acting, as if TBF, or as Dreier LLP, Paul Traub held onto several hundred thousand dollars of a Cosmetics Plus escrow account.

Resultant of this effort to misappropriate the funds, Paul Traub wound up before a FIVE JUDGE PANEL at the New York Supreme Court of Appeals.

Paul Traub violates the law, habitually with what seems like immunity!

Whether or not it is as TBF, or Dreier LLP, or other law firm entities Traub hopped around to (such as Epstein Becker & Green) the fact of the matter remains that Traub was “caught” red-handed, for lying under oath in eToys; and TBF was sanctioned (clawed back) for $750,000.00.

The eToys punishment is also a matter for the New York State BAR, and New York Supreme Court, as a matter of New York Professional, Disciplinary Code and Rules of Law.

Paul Traub – and any/all of Traub’s partners and associates (like Barry Gold) – are required by Conduct laws to inform the New York Supreme Court of Traub (and other TBF bad faith acts by Michael Fox) doing a Professional Code of Conduct violation.

Remember, Traub (and Michael Fox) actually confessed to the fact they intentionally left bogus affidavits to stay in the docket record.

If any other person did just 1 or 2 of these 100-plus massive racketeering enterprises of Paul Traub’s, then he or she would be in prison for several decades.

Mr. “Brown Bag of New York” must really know who gets the bag monies; because Paul Traub’s dozen Ponzi schemes and billions in frauds, including being in “control” of Tom Petters Ponzi, aren’t even investigated, much less prosecuted, by the authorities.

To this very day, mastermind Paul Traub still remains – like a Teflon Don – inexplicably and intolerably (speciously) – ‘Scot Free’!

It took 20 years to jail Tom Petters and Bernie Madoff…

Should it take 3 more years to jail Paul Traub?

Are the Marty Lackner, Robert Alber and other specious untimely demises, like the murder of Jack Wheeler, to continue remaining uninvestigated because Teflon Nitti Don, Paul Traub, is a part of Goldman Sachs/Mitt Romney’s, get-filthy-rich-quick schemes?

Who will investigate Paul Traub for his several obvious decades of documented crimes?

It’s for sure that SEC Chairman Jay Clayton isn’t going to do so!

Because as a matter of ethics – and conflicts of interest – Jay Clayton isn’t allowed to touch this case either.

Clayton worked at Sullivan and Cromwell, who is another key part of the criminal conspiracy to destroy eToys. (SullCrom represented Sachs in the eToys case.)

Clayton’s wife has also worked for Goldman Sachs for 20 years. She is in the very Mergers and Acquisition division of Goldman Sachs; which would have been involved in the Mattel merger and eToys fraud.

Until it was redacted, Jay Clayton’s résumé, also bragged about being invested in Bain Capital.

Then there’s the Minnesota U.S. Attorney’s office; James Lackner is still there, but his office still refuses to prosecute Paul Traub.

As for the Delaware DOJ, when Robert Alber was killed, Assistant U.S. Attorney Ellen Slights had an FBI SPECIAL AGENT call Laser Haas and threaten him with prosecution, if Haas didn’t immediately redact Ellen Slights’ name.

We see how that worked out since our whistleblower is still pursuing justice and not holding back any of the documented facts of the case or other cases he has knowledge about, telling this reporter everything.

Ellen was Colm Connolly’s assistant, and it appears her husband just became a Delaware Court Judge.

This leaves Washington D.C. federal court.

Being that Laser Haas sent copies to Trump, Sessions, SEC, FBI, Ellen Slights and the U.S. Trustee’s office – and it has been more than 6 months since he did so – they are obviously not going to do anything.

Laser can’t even file an appeal. The Clerk of Court made sure of that by waiting 3 weeks to docket another case he presented – HAAS v. TRUMP – after the court had dismissed it.

That being said, Mitt Romney’s Ponzi pal, Paul Traub, is still guilty of hundreds of crimes and benefiting from federal corruption (like Colm Connolly).

Paul Traub may be a Teflon, Ponzi Don; but even the original Teflon Don – NY John Gotti – got his comeuppance in the end!

As noted upon the Minnesota Court record, Paul Traub is publicly known to be connected to eToys fraud, whether Traub confessed deceits about planting Barry Gold & lying under oath intentionally. Additionally, Paul Traub was partners with fraudster, Marc Dreier, who is currently serving 20 years in prison.

Furthermore, Traub was “control” partner of Tom Petters Ponzi. Petters is doing 50 years in prison. On top of all those, beyond all reasonable doubt issues – clear and convincingly – Paul Traub has many other frauds he was actively participating in. Those schemes and artifice to defraud include, but are not limited to, Larry (Reservitz) Reynolds, Frank Vennes, Lancelot/Sky Bell, Palm Beach Links Capital, Kay Bee, Playco, Okun 1031, Fingerhut, Polaroid, Kay Bee and the NY Supreme CT billion dollar defraud of eToys. Yet somehow he is still a registered attorney in NY as seen by this link.

All these cases Paul Traub is protected in benefit the ill-gotten gains of Goldman Sachs & Bain Capital.

As former USAG John Ashcroft is quoted (archived), Bankruptcy Court corruption includes collusion of judges with high-ranking members of the Justice Department, where justice is hindered, witnesses and victims are extorted, having nowhere to turn!

It is uncontrollable tyranny that can’t be stopped when the very people sworn to protect the rule of law are involved in these enrichment schemes at the expense of others.

And that ain’t right!

Happy Christmas for now - next year brings the good fight!

Other Articles In This Wall St Exposure Series:

1. [Does Wall Street Bully or Bribe Prosecutors? Revolving Doors At The DOJ]

2. [How Goldman Sachs And Bain Capital Defrauded Mattel Investors And Got Off Scot-Free]

3. [DOJ Gifts Romney’s Bain Unlimited Get Out Of Jail Free Cards]

4. [WHISTLEBLOWER: DOJ Wall Street – Get Rich Quick – Revolving Door$]

5. [Meet Mitt Romney’s Frank Nitti: Paul Traub]

More to come stay tuned!

----------------------------------------------------

Socials:

Twitter: An0nkn0wledge

onG.Social: An0nkn0wledge

Gab: An0nkn0wledge

SUPPORTING MY WORK:

If you want to support my work and make a difference to journalism/investigation, you can subscribe to my Patreon and become a THOUGHT CRIMINAL or make a one time payment in Cryptocurrency below. I even accept pre-paid gift cards!

Steemit (leave a memo with your name and message then i'll give you a shout out on Steemit, Resteem your work and post some of your Steemit work on my Twitter account depending on the content as a thank you.)

Patreon: https://www.patreon.com/AKswriting

BTC: 1237PnfRsNXV2Ks16mHSZ1G7buwfyva331

BCH: 16CxxRLFJTvUmVCzdFXzVLjpTXvUW1Te3X

LTC: LQQC8i4p9ph4MppnGY7eRQLg2T2SbhPneB

ETH: 0xd7E20e359Da35E8f71110eE67a7ddbD912f6b98e

EOS: 0xd7E20e359Da35E8f71110eE67a7ddbD912f6b98e

Well researched and fascinating as F!

Leaks tend to be. ^_o

My god... who in the fuck would name their company "Fingerhut"?!!?

It's just an awful name for a business...

I had to look that shit up and can tell you I was a bit relieved that it was a catalog retailer.

This Paul Traub guy seems to be above the law. It's absolutely mind-boggling that he's tied to over $50 Billion in fraud... I guess the bigger the lie the more people will believe it. Playing both sides and backstabbing his partners is outrageous, how does this guy sleep at night?

Looking forward to the next installment!

When multiple people he worked with were convicted of fraud. You forgot that bit and it's important and yes you get it playing both sides and backstabbing clients insane right?

Hi @an0nkn0wledge

I saw you upvoted my last post. I just want to tell you that I'm really grateful. Thank you so much. It means allot to me.

I'm now following you.

@kingsley-clement

post very useful for me, thank you @anOnknOwledge, sharing posts very good, creative ideas in issuing posts very unique and useful, I really liked it, it made my mind more deeply.

Nice

Wonderful post. Keep it up. I follow and upvote you. Pls.do same for me.

good post regards me @mizi23

Great post I have ever read

@Originalworks

The @OriginalWorks bot has upvoted and checked this post!

Some similarity seems to be present here:

http://www.quoterland.com/meet-mitt-romneys-frank-nitti-paul-traub/

This is an early BETA version. If you cited this source, then ignore this message! Reply if you feel this is an error.

Interesting, well organized. Thanks for sharing!