NEO - Changing Smart Economy Explanation

Neo started his story sometime in 2014 as AntShares (ANS). AntShares was founded by two people Da Hongfei and Erik Zhang, and is known to be the "First Chinese blockchain platform" by the Chinese Ethereum.

In June 2017, AntShares made a complete rebranding, and has since been known as NEO. At a conference held in June Da Hongfei announced the following things:

- Collaboration with China Certification to map various assets through an e-contract

- A new patent for the interoperability of various blockchain chains and distribution among them

- Cooperation with new partners such as: Bancor, Agrello, Coindash, Nest Fund, Binance, etc.

Chinese Ethereum?

Although NEO is known to many as the Chinese Ethereum, it may not be the case. The comparison of this project with Ethereum was mainly due to the fact that Ethereum already has a stable ecosystem, and both platforms serve to create other projects. Of course, there are various similarities between these two projects, but the way they use blockchain logic and their primary focus is completely separated.

Digitalization of real property

Although NEO and Ethereum have similarities, there is a big difference in their focus. According to the whitepaper, NEO is focused on asset records using smart contracts.

NEO is a decentralized and distributed bookshop protocol that digitizes physical assets into digital enabling their registration, storage, transfer and trading over the peer-to-peer network.

NEO uses e-contracts to have a list of transfers of digital assets. With it, digital tokens are generated via e-contracts, and function as fundamental data that can be used to record shares, credit agreements, financial contracts, credit bills, accounts and currencies. They can be used for crowdfunding, share trading, stock employee options, peer-to-peer transfer, loyalty programs, private funds, supply chain, etc.

NEO's mission is digital assets available to everyone. Bitcoin wants to create a financial system, NEO is about building a system that connects property from the real world.

As we have said before, it is similar to Ethereum, but Ethereum's whitepaper is focused on creating an abstract base layer that will be used by other projects that will build DAPPS over it. While NEO is an abstract layer over which others will build projects that should focus on connecting, managing and trading digital assets.

They want to get support from the Chinese government

Neo whiteper contains one interesting statement:

The Fiat currency can be directly used as a currency on the NEO blockchain.

Since it is possible to use the fiat currency directly on the blockchain, NEO goes a step further and separates itself and its technology from Ethereum and other projects. The team behind him firmly argues that NEO is not a digital currency, but a blockchain protocol. This is probably the way to distance yourself from the legal problems that exist in China due to the connection with digital currencies.

The Chinese government is likely to see digital currencies as a threat, especially Bitcoin. But the people behind the NEO play smartly so it is designed that there is a big chance of falling into the state regulatory framework no matter what kind of approach China chooses to apply to digital currencies.

To make sure that they go into state regulation, and to get government support, NEO claims to have built KYC (know your customer) and AML (anti-money laundering) APIs. Also, the team claims that if someone loses their private keys, there is a mechanism that will be able to recover funds without interfering with a third party.

E-Agreements

The NEO team believes that the tokenization in the current form is defective and therefore they are developing their solution.

Currently the token transfer is the same as the transfer of money, which means that tokens can be transferred from sender to recipient with or without one party. Such a transfer method is quite ok if it is a currency, which does not bear any responsibility, but is not acceptable with tokens that carry a property that may impose certain responsibilities and obligations on the recipient.

As a result, the transfer of NEOs is carried out in the form of e-contracts. In most cases, when transferring assets, a digital signature is required, signed with private keys from both sides. In some cases, an additional third party signature may be required. While asset transfer records over NEO serve as a solution to a blockchain to transfer asset outside blockchain.

Most of the ERC20 tokens (Ethereum), don't ask recipient anything, he has no choice but must receive what someone sends to his address. If someone wants to send 10 tokens to address x, address x can not refuse the transaction. This could lead to unwanted consequences and possession of the property you do not want.

NEO wants to solve this problem, the recipient will not be forced to impose anything, since an e-contract must be signed so that assets can be moved to an address.

Confirmation of identity in the real world is fundamental to confirming the right to property. In most cases, legal contracts require the signature of both parties.

Given that the authentication step is optional, NEO will require the user to request their digital certificate from a Certification Body if necessary. NEO works on a similar TLS certificate and should be used as an authorization authority to confirm whether an address belongs to anyone claiming it.

Different nodes

The mission of this project is digital assets available to everyone, which means it's imperative to design a system that is easy to use. It is a good way to develop it, and the division into the blockchain logic on which the system functions is the following:

- Bookkeeping nodes

- Confidence pages that reach tolerance and validate each block of transactions

- The digital signature of the node is included in each block

- Full nodes

- Nodes that store historical data, and detect and transact transactions

- End users

- Small nodes or clients (web browser or applications)

- It is not necessary to have the whole blockchain transaction history

Tolerance mechanism

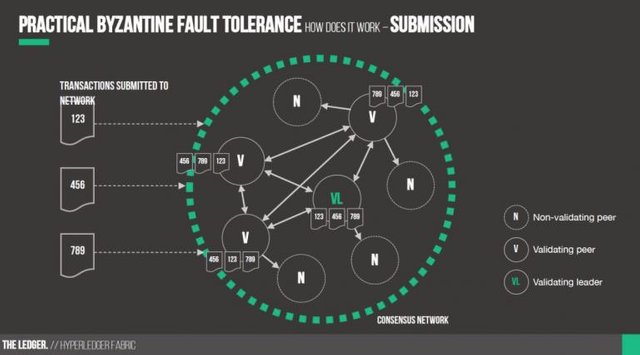

The tolerance mechanism used by NEO is called Practical Byzantine Fault Tolerance or delegated Byzantine Fault Tolerance or abbreviated dBFT.

We are sure you are surprised and that it is not clear to you at this time. Most of us expected it to be something like Proof of Work or Proof of stake, since this is a third thing, how do these tokens at all stand? Where is the reward for those who verify the blocks? Let's first explain why its mechanism of tolerance actually works and how it looks like its interaction with blockchain.

How to distribute nodes where no one knows anything about the second node and how can they receive information at different times, different states, and how to do it all in tolerance? That is, how can we be sure the transactions will be valid, in the right order, whether it's just two or a million transactions? An example of how this works in the real world can be identified with clock synchronization and differences in time between them.

Every hour in the world that is not atomic (the atomic clock can be self-corrected) has a different mechanism under which it works, depending on it that there are different precision, so in time there are different deviations. Here we talk about mechanical, quartz and digital mechanisms. When you notice that your lesson deviates from the rest, check how many hours a valid or official source is, and you are upgrading it depending on it. Computers work this alone through NTP or a service that constantly communicates with the NTP host and corrects the system clock accordingly.

For distributed systems, the difference in time can become a nightmare and cause cascading breaks or inconsistencies in the network that is difficult to spot. Similarly, if the transaction (or, in the case of NEOs, a property) is accepted from the # 1 sequence in order (A, D, C, B), and node # 2 initiates transactions in the order of (B, C, D, A) to decide which node is correct? How can we protect ourselves from the fact that an incorrect order of transactions affects the other nodes in the system?

Practical Byzantine Fault Tolerance or by NEO Delegated Byzantine Fault Tolerance (dBFT) address this problem in a similar way to the clock, which is a confidential source check.

NEO launched a slightly different version of PBFT, a version that has a blockchain of 2 different participants. Bookkeeping nodes and NEO users. Each of them has different control over the voting process and the determination of the election. In an article published on cryptoinsider.com, the co-founder of the NEO stated:

dBFT voting process is the dynamic generation of input and output transaction validators and the provision of a universal tolerance mechanism for public and private blockchains.

Specialized bookkeeping nodes achieve tolerance in dBFT blockchain thanks to delegated voting. Two thirds of the nodes should accept a new blockchain version so that it can be accepted. Such a system is protected from unnecessary threats and radical changes in the implementation of blockchains that could reduce the participants' confidence.

After years of studying and researching crypto-industry and blockchain technology, we came to the conclusion that the delegated Byzantine Fault Tolerance best suits this system.

Let's go back to the NEO whitepaper, there is a paragraph explaining which nodes are selected for shared validation within the blockchain.

If the "one man" mode is considered a vote after adding a block to reach a tolerance then? By a joint decision, a tolerance is reached by adding bookkeeping nodes that are believed to be generated before the addition of the block. There are no votes after the events have already taken place. In a public blockchain, this method of predefined decisions can be made by voting within a chain. Selected bookkeeping nodes can be combined in the joint signing of each new block. In a scenario where decisions would be made after the events were made, there would be more need for confirmation by nodes, while the way in which all decisions were made before the events were made at all were ideal for simulating the final trade.

This is a logical argument for selecting bookkeeping nodes, but it turned out later that bookkeeping knots need identification and certain levels of technological capacity. It seemed that reputation would be crucial in selecting who would be a bookkeeping node but technological capacity would do so little if the capacity limit was set too high. It is, in fact, because if someone has a reputation but does not have enough capacity, it will be selected, it will try to be the main node, but its reputation will fall, which will reduce the likelihood of being re-elected for that role.

To shorten the story and stop complicating, NEO blockchain requires confidence that someone would have the role of bookkeeping knots, which is a good thing.

From their white paper:

In the "one man" mode, the vote after the events have already been made to vote while the content of the block is known. Such a way is not good for public blockchains, especially if there are no identifiable data. Namely, such way is not good, especially for some financial transactions. On the other hand, "joint mode" suggests trust in bookkeeping nodes. Of course, it may happen here that 1/3 (or more) nodes join in some kind of criminal enterprise. Therefore, for nodes of this type, identification by the control parties is necessary. This is necessary for two reasons, the first reason is that its reputation and technological capacity can be corrected, and the other reason is that if a node goes to the evil side, there always remains a cryptographic proof that can be investigated.

We can conclude that "one man" mode selects anonymity, where trust is questionable. While 'joint mode' selects trust, but anonymity is excluded because identity authentication is required.

Blockchain asset

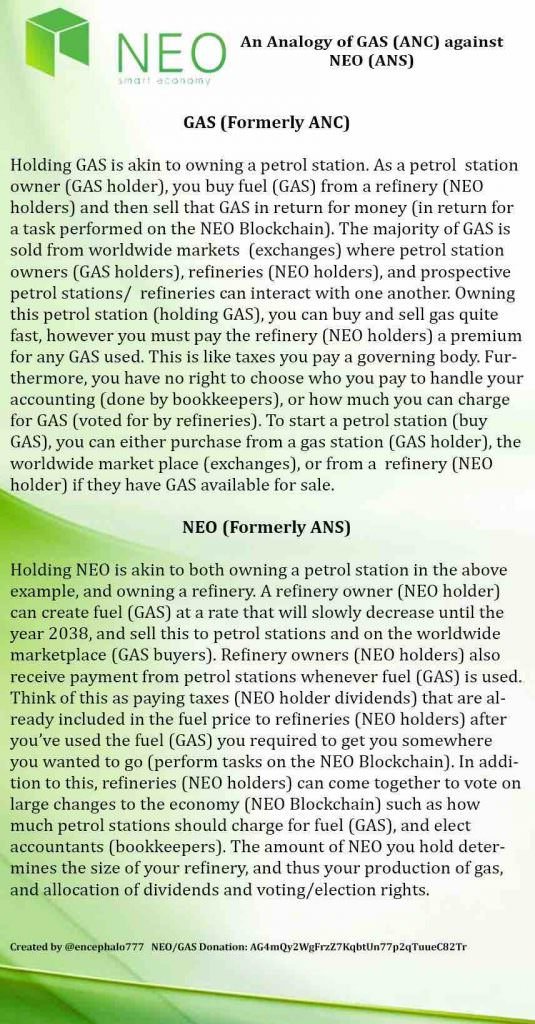

Each blockchain has a different ecosystem and NEO is different. When you buy NEO tokens, you have acquired the right to vote and the right to dividends in the form of GAS tokens.

- NEO

- Bookkeeper voting

- Right to dividends in the form of GAS

- The right to vote on key decisions in the NEO blockchain

- GAS

- Payment of services on the blockchain

- Payment of fees for services

To better understand the difference between NEO and GAS Token, and what is their role in the blockchain, see the infographic made by the reddit user / r / Encephalomagne

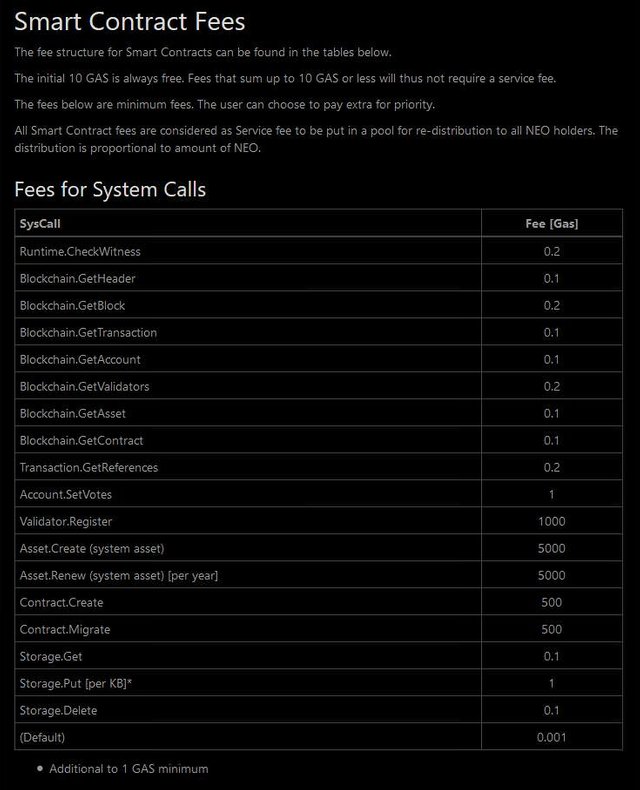

Fees

- Compensation collected by bookkeeper nodes

- It is not clear how much this fee actually is, but it is important to note that all transactions are free if 2/3 of the knots agree on that.

- Fees for transactions

- Amounts charged if someone wants to execute some advanced functionality on a blockchain such as: creating an asset, registering a bookkeeping node, and in the future updating and freezing assets.

NEO token distribution

To the genesis NEO block, 100 000 000 NEO tokens were created that are divided into certain parts that are listed in their white paper.

- 10% (10 million) is intended for the first investor

- this amount is divided into the first angel investors and VC funds that gave them support at the very beginning

- 17% (17 million) is intended for the first phase of the ICO

- October 2015, 2100 Bitcoins were collected

- 1200 Bitcoin was collected from individual investors

- 900 Bitcoin was collected from one institutional investor

- 23% (23 million) is intended for the second phase of the ICO

- August 2016, for a period of two weeks, 6069 Bitcoins were collected, worth $ 3.8 million

- 50% (50 million) is intended for the Antshares team (NEO team)

- Locked for 1 year after the launch of Mainnet

- After 1 year, the team of funds becomes available and with it long-term finances the company's operations

NEO tokens are whole numbers, that can not be divided into decimals

While BTC, ETH, LTC and almost every other crypto currency can be split into small parts and decimal places, NEO is not the same. The idea behind NEO is to keep the tokens as shares of shares, so even as you can not have 0.01 Amazon or Google shares, you can not have 0.01 NEO.

Crypto exchanges share NEOs in smaller parts so they can charge their trading fee and allow you to send NEO tokens that are not the full number, but if you try to send a portion of the NEO tokens to the official NEO wallet, they will be forever lost.

Let's take a look at Bittrex:

- Amount of purchased NEO tokens: 10 NEO

- Bittrex Fee: 0.35 NEO

- Transfer to official wallet: 10 - 0.35 = 9.65 NEO

- The amount you get on your wallet: 9 NEO

- The amount lost forever: 9.65 - 9 = 0.65 NEO

Some crypto exchanges here do not charge commission, so if you send 10 NEO tokens to the official wallet, there will be all 10 tokens appearing there.

NEO pays dividends

As previously stated, NEO Tokens are more similar to traditional shares, but this is the case with most other crypto currencies. For shares, the dividend payment is mostly in cash (fiat currency), but with NEO, the situation is slightly different, so dividends are paid in the form of a GAS token.

The Crypto Stock Exchange generally does not support the payment of these dividends (Bittrex does not support, while some support it), so NEO token should be transferred to the official wallet so that they can receive it. Those who do not receive GAS will not be able to use services on the blockchain, because most services require GAS to pay fees. Of course, you can always buy GAS on one of the stock exchanges and so get this token if you need one of the services.

Creating blocks on a blockchain

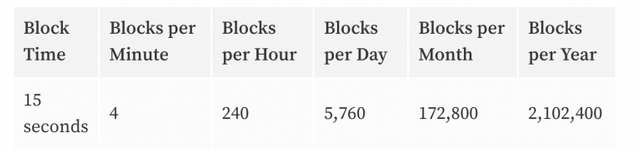

One interesting paragraph in the NEO Whitepaper says that the time of generating a new block is 15 seconds, but that it is possible to change that time if it would be necessary for the network to process the blocks faster. This would increase network bandwidth.

Currently, block generation is manually set to 15 seconds. With a sufficiently low network latency and connection of the internal nodes in the future, the blocks will be created every second. With a bandwidth of 100Mbit / t and external cryptographic hardware, the NEO blockchain is able to process thousands, and perhaps even tens of thousands of transactions per second.

You can see the list of created blocks on the Antshares blockchain explorer.

Tehnical overview

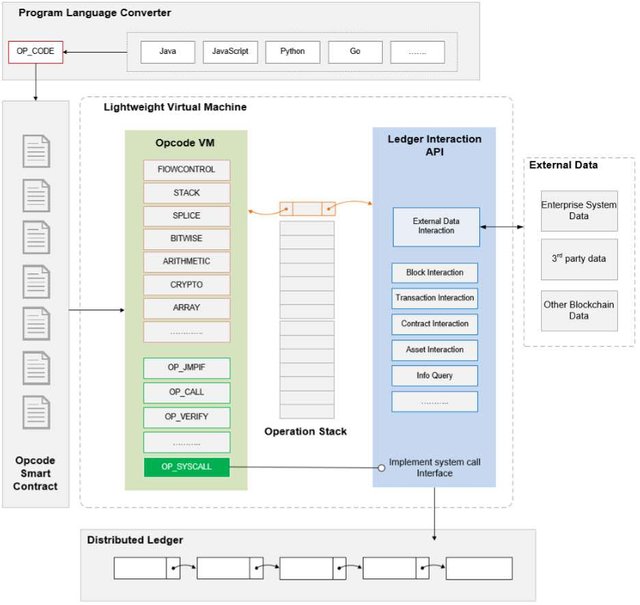

Unlike Ethereum, where it is necessary to learn a new language in order to create applications on its blockchain, NEO has no such prerequisite. For NEO it is possible to program in popular developer languages, and these are the technologies that are supported:

- JSON-RPC

- C #

- Visual Basic

- .Net

- Java

- C

- C ++

- Python

- Go

- JavaScript

In the picture below, look at the logic about compiling the code and executing it on the NEO virtual machine

And, for the end, we bring you a list of operating systems that can turn on NEO virtual machine.

- Docker

- Red Hat

- Ubuntu

- Windows 7 SP1

- Windows Server 2008 R2

And they said that they will support those as well:

- Debian

- FreeBSD

- Linux Mint

- openSUSE

- Oracle Linux

- OS X

- Fedora

For those who want to know more about the technical part of the NEO blockchain, and to start developing applications on it, here are some useful links:

Tags: #steemitisbeautiful #news #steemit #blog #life , #busy , #smokenetwork #jerrybanfield #OCD-Resteem #acidyo #sndbox #slowwalker #brian-rhodes #eveuncovered #vcelier #UpvoteForUpvote #TrevonJB #CraigRant

Special thanks and support to: @hr1 , @bue , @welcoming , @surpassinggoogle , @gaman , @minnowpond , @trevonjb , @jerrybanfield , @craig-grant , @knozaki2015 , @gavvet , @papa-pepper , @curie , @stellabelle , @sweetsssj , @kevinwong , @kingscrown , @officialfuzzy , @steemtrail , @kaylinart . Keep up the great work, without you Steemit would not be the same.

I must buy some...

Great, it will definetly grow bigger over time.

I'm a big fan of NEO. I really like it and had invested a lot.

Really think it's better than Ethereum from many perspectives, hope more people read your detailed introduction!

Hello,

I hope so too as it's very educational and explained in detail. I also think it's better than Ethereum if they will follow right direction.

@surpassinggoogle

@jerrybanfield

@hr1

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Thank you @followforupvotes