Bitcoin

In a groundbreaking move, Uber has announced its partnership with Bitcoin, the world's most renowned cryptocurrency, revolutionizing the way passengers pay for their rides.

With this integration, Uber users can now seamlessly utilize Bitcoin to settle their fares, offering a new level of convenience and accessibility.

This collaboration comes as no surprise amidst the growing global acceptance of cryptocurrencies.

By embracing Bitcoin, Uber is tapping into a burgeoning market and providing its users with more payment options than ever before.

This not only caters to tech-savvy customers but also aligns with Uber's ethos of innovation and adaptability.

The process is simple: users can link their Bitcoin wallets to their Uber accounts, allowing for swift and secure transactions.

Whether it's a quick ride across town or a longer journey, passengers can now enjoy the ease of paying with Bitcoin, eliminating the need for traditional fiat currencies.

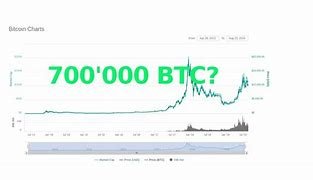

Investing in Bitcoin has yielded substantial profits for many individuals, catapulting it to the forefront of the financial world.

Since its inception, Bitcoin has experienced remarkable growth, generating significant returns for early adopters and seasoned investors alike.

The allure of Bitcoin profits lies in its decentralized nature and finite supply.

Unlike traditional currencies controlled by central banks, Bitcoin operates on a peer-to-peer network, immune to government manipulation or inflationary pressures.

With a predetermined cap of 21 million coins, scarcity drives up demand, contributing to its increasing value over time.

Early investors who recognized Bitcoin's potential reaped immense rewards as its price soared from mere cents to thousands of dollars per coin.

These visionary individuals saw beyond the skepticism and volatility, embracing Bitcoin as a hedge against economic uncertainty and a gateway to financial freedom.

Investing in Bitcoin has become synonymous with the pursuit of unprecedented financial gains in the digital age.

The allure of Bitcoin profits is undeniable, drawing in investors from all walks of life with the promise of lucrative returns and a stake in the future of finance.

One of the primary drivers behind Bitcoin's profitability is its decentralized nature.

Unlike traditional fiat currencies, which are subject to the whims of central banks and governments, Bitcoin operates on a peer-to-peer network, free from external control or manipulation.

This inherent autonomy has fostered trust among investors seeking refuge from the uncertainties of traditional financial systems.

Moreover, Bitcoin's limited supply is a fundamental factor contributing to its profitability.

With only 21 million coins ever to be mined, scarcity drives up demand, resulting in exponential price appreciation over time.

Exponential Growth: Bitcoin has witnessed remarkable price appreciation since its inception, with early adopters experiencing exponential gains as its value surged from negligible amounts to thousands of dollars per coin.

Those who invested early and held onto their Bitcoin have seen their investments multiply many times over.

Store of Value: Bitcoin is often hailed as "digital gold" due to its limited supply and decentralized nature.

As a hedge against inflation and economic instability, Bitcoin has proven to be a reliable store of value, attracting investors seeking to preserve their wealth over the long term.

Portfolio Diversification: Incorporating Bitcoin into a diversified investment portfolio can help mitigate risk and enhance returns.

Bitcoin's low correlation with traditional asset classes such as stocks and bonds offers diversification benefits, potentially improving overall portfolio performance.

When investing in Bitcoin, it's crucial to be aware of several key factors to watch out for to make informed decisions and mitigate potential risks:

Volatility: Bitcoin is known for its price volatility, with rapid and unpredictable fluctuations in value.

Be prepared for sudden price swings, which can result in significant gains or losses in a short period.

Keep in mind that volatility is inherent to the cryptocurrency market and invest only what you can afford to lose.

Security Risks: Protect your Bitcoin holdings by prioritizing security measures.

Use reputable cryptocurrency exchanges and wallets with robust security features.

Enable two-factor authentication and consider using hardware wallets for added protection against hacking and theft.

Never share your private keys or sensitive information with anyone.

Regulatory Environment: Stay informed about the regulatory landscape governing Bitcoin in your jurisdiction.