Inflation – the biggest tax of all

It’s pretty obvious that magicking money out of thin air destroys its purchasing power - no PhD from Yale required to figure that out. If what you use as money is being diluted, a unit of it buys less stuff. What previously cost 1,000 now costs 100,000.

Unless you are a protected insider to the scam, you must sweat harder just to stand still... or get out of the system entirely via cryptos.. but more on that later..!

Since August 15, 1971 when Tricky Dicky kickstarted modern money printing people the world over have used two coping strategies:

- Earn ever higher amounts of government fiat through hard work

- Store fiat in real estate, equities, precious metals etc.

Up until lately this kinda worked. Most of us have been to fortunate to see our salaries, house values, and investments rise just enough to keep things afloat.

Until the so-called Great Recession of 2008-2009 that is.

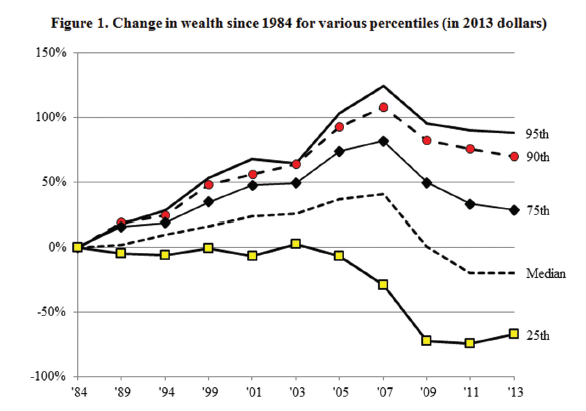

(OK the chart is bit old now but the situation is now far worse. The source document is excellent).

No Soup for You!

Wealth inequality has been growing in the US/West since the early 80s. But the middle class got absolutely hammered by money printing circa 2009-2013.

The trillions in fresh new currency created by the US Federal Reserve and their cronies went first to their buddies (politicians, banks) then trickled down to those who already owned real estate, equities, and other tangible assets. These segments of society, the 90th and 95th percentile of households in the chart above, literally made out like bandits.

Joe and Josephine Six Pack got fuck all of course. Inflating the quantity of money has always been a tax on the ordinary person. The peasants are last in line to get the new money well after it has already caused prices to rise.

But I’m good right - I got gold and silver?

Maybe. You’ll have to pay Capital Gains tax (CGT) and this is where the inflation tax really starts to suck ass.

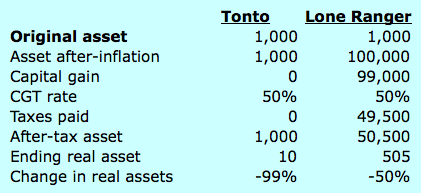

You see, tax rates and tax bands never adjust to align with the loss of purchasing power of the currency. The government doesn’t accept the new reality that 100,000 now buys what 1,000 used to buy.

Let’s say the Lone Ranger buys one 1oz gold coin for 1,000 currency units. Tonto his friend doesn’t. Instead he keeps his 1,000 in the bank. Then the Wild West Central Bank inflates and now it takes 100,000 currency units to buy 1oz of gold and 1,000 buys only 1/100th what it did before. The table below shows the Lone Ranger, despite being hedged in gold, has only preserved 50% of his original purchasing power (lost 50% to CGT).

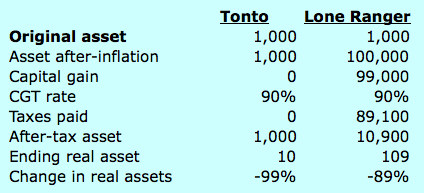

OK you say, well preserving 50% is better than Tonto, who’s lost basically everything in the inflation (his original asset of 1,000 ends up with "real" value of only 10). But what if a 90% tax on gold investors is introduced in response to the economic crisis. To you know, bail out the latest too-big-to-fail insiders (hint: not you or me)

Well, here's what happens. The government ignores the loss of purchasing power and taxes most of the ‘gains’ the Lone Ranger made trying to protect himself.

OK smart ass, so now what?

The dirty little secret with gold (silver) is that they are NOT outside of the hermetically sealed world of big government, fiat money and taxes. You must report your profits in fiat and pay your taxes in fiat.. or else those nice men with guns come and put you in a cage.

The takeaway point here guys and gals is to avoid, within the bounds of the law (or not if you prefer to risk it) as much Capital Gains tax as you can. Fortunately it's not all that hard. And cryptocurrencies have just blown away most remaining barriers, making it even easier!!!!!

Check out my apps here:

Android - Silver Coin Valuer PRO and Gold Coin Valuer PRO

iOS - Silver Coin Valuer PRO and Gold Coin Valuer PRO

We in the United States are required to pay capital gains on crypto profits. So if you are not paying that tax you will likely get audited. Better report it. Same as it ever was.

https://www.irs.gov/uac/newsroom/irs-virtual-currency-guidance

"required to pay", yep and required to pay even if you live permanently outside the US and haven't been back in years and have no intention to ever move back. Fortunately not everyone is a US citizen.

Yes the US one of the only places to tax you even if you leave.

Yeah that sucks pretty bad. I believe we are one of the few nations in the world that requires this. Awful, terrible, immoral.

Lol. Like people will willingly report they got money off of cryptos.

I certainly will. I am a believer in paying as little tax as possible. I know there are enough legal loopholes out there to avoid a decent portion of taxes. Why risk getting involved with an unfriendly branch of the government who can seize all of your assets without due process and put you in jail to too. No thanks, I prefer to stay off the government's radar.

I think you're one of the few. Last tax season less than 1000 people reported gains from Bitcoin. Though nothing wrong with playing it safe. However I would like to point out that many people did obey the law and fell onto the IRS radar anyway. All it takes to have the IRS seize your money is just plain bad luck. Still, I hope the tax loopholes work out for you. Maybe I'll look into that myself.

Wow only a thousand, jeez. You can bet they will be looking this year. 1st and foremost, keep track of your losses, those can be deducted from your gains. If you are on an exchange and you have a crappy trade that sucks you can use that loss to pay less capital gains. There are other things you can do from other categories too of course. I know luck does play a part in things, but why tempt them.

I'll be honest I'm not to worried currently. While I'm sure the IRS wants to enforce taxes on cryptos it's beyond impractical at this point. There's no real way to track or tax it. Maybe one day in the future. But I still might look into what you've mentioned anyway. Like you said might not hurt.

As it stands though I doubt most people will be filling Bitcoin taxes or any crypto for that matter.

Resteeming this fantastic write-up of inflation, devaluing of the US Dollar, and some great history as well. Thank you walktothewater. Awesome post!

Thanks, appreciate the resteem :)

It is great when I see that the criminals of the governments and central banks are being exposed for their crime on unlimited printing of money and tax(extortion) from their people.

Hi, yes it does seem to be finally getting through the thick skulls of the masses (suppose they are too worn out from commuting, junk food and working like slaves). Robbing Peter to give to Paul while skimming off the top.

You're right about the capital gains on gold and silver but I don't think that is a reason to avoid them. But cryptos are definetly a solid investment which I'm loving.

Agreed. I have more metals than cryptos.

Nothing wrong with that. I'm the opposite. More cryptos but some silver. I actually wrote about inflation myself recently. Like to see more of your stuff sometime. Think you and I see eye to eye on stuff like inflation.

Congratulations @walktothewater! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!