Alibaba could buy out Groupon for over $15 a share

Alibaba wants to become Google, Amazon, Netflix, Uber, and a little bit of Groupon mixed into one. Some might think that with Alibaba’s recent sale of Meituan-Dianping (China’s Groupon) that they are exiting the online to offline group buying daily deals business. But those that follow the story more closely understand that Alibaba doesn’t want to be involved in a merged Meituan-Dianping agreement which would further dilute its original stake in Meituan. So what I think is happening is that Alibaba is deciding to exit the extremely competitive Chinese consumer and instead bet on US consumer.

Buying up US companies was Alibaba’s original plan to begin with since going public even if they keep denying it. They have been trying to enter the US consumer with alibaba.com but it has been a little tricky to get mass adoption. So Jack Ma could be seeing this as the right time to use the 900 million dollars they received from the Meituan sale plus the remaining 40 billion they are probably about to spend this calendar year in acquisitions to buy out it’s first US company. Jack Ma could go full force in buying out Groupon and put one of his own generals to lead the company.

Alibaba is already facing a little longer than expected uphill battle of getting US consumers to buy Chinese goods, let alone in bulk. There is already a sense of skepticism from US consumers of buying from Chinese sellers in China because of counterfeiting concerns. I think Jack is realizing Groupon is the funnel Alibaba needs to merchandise goods into America. Instead of marketing +5 LOTS for sale to individual buyers in America Alibaba could use Groupon’s group buying system to incentivize merchants to move goods faster into America bypassing the issue of credibility. Groupon’s push into 3rd party Merchant Stores aligns perfectly with Alibaba’s business model of 3rd party sellers as it is. The Chinese already offer the cheapest goods in the world right now at scale. The potential to sell goods to Americans this way alone makes Groupon worth over $10 billion to Alibaba easily!

All this and not to mentions the 4 in 1 banger Groupon actually is. It’s a Local Activities, Travel, Goods, and Food delivery business. Groupon is just getting started in the food delivery business with their recent purchase of OrderUp. Groupon’s 28 million relationships with restaurants and food vendors should bring pretty nice scale to this rapidly growing food delivery company. Of course some would argue why Alibaba doesn’t just buy the leader Grubhub if that was the case. But because Grubhub already trades at a near 2 billion dollar market cap which is where Groupon is currently at too, and nearly 1/4th of the potential businesses that Groupon’s multi-ecosystem of local everything and travel deals offer, its obvious why Jack Ma is interested in the Groupon brand over Grubhub. Plus all the new experience Jack Ma’s team would gain from the purchase. Oh forget it! This is the best purchase on the planet for him.

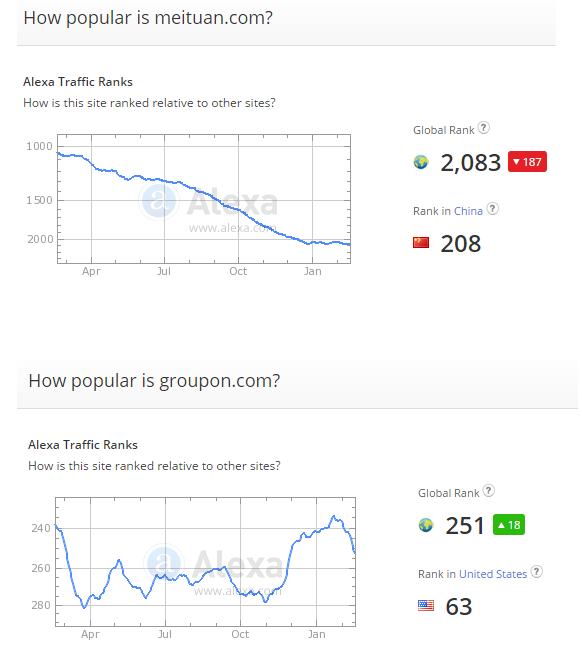

Note: I hear from my Chinese friends that the China is already competitive with pricing as it is so getting a daily deal might not seem very attractive in relation to just searching Alibaba’s near bottom basement prices. Meituan appears more as a commercial in China than it does a place to purchase goods and services. In China haggling and bargaining is a way of life as it is while in every other part of the developed world, not so much. Even with all that revenue Metiuan is bringing in and double the employee count of Groupon, it still only holds a 208 ranking in china and a +2000 global rank. Groupon fares much better still. Plus lets not forget that the US consumer has nearly 8 to 10 times the disposable income as the average Chinese citizen.

Well described