Enron 2.0? Asia's Largest Commodity Trader Halted After Crashing To 16 Year Lows On S&P Downgrade!

If the first Enron wasn't enough, this could be the next one according to this new report. We are constantly reminded that the financials of all companies are outstanding yet they tend to quickly become the opposite when the truth is uncovered.

What concerns me as always is the counter-party risk. The ripple effect.

This is a short article you may find interesting:

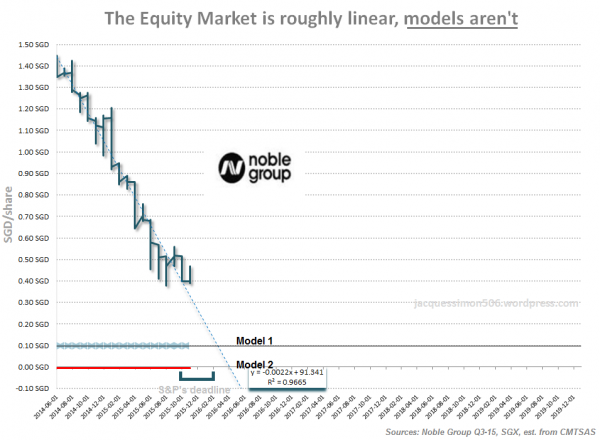

Once Asia's largest commodity trader, Noble Group has been halted after crashing almost 30% this morning following S&P lowering its corporate credit risk rating to CCC+, citing continuing weak cash flows and profitability...

"We downgraded Noble because we believe the company's capital structure is not sustainable,"

"The negative outlook on Noble reflects the potential that the company will face distress and a non-payment of its debt obligations over the next 12 months,"

This is the lowest prices for the Singapore-based firm since 2001...

"Our balance sheet - the strongest in recent history - represents a significant advantage as we continue to identify high value growth opportunities across the products and geographies we operate in. Maintaining our investment grade rating with the international rating agencies is a vital part of this strategy."

- Noble Group 2014 Annual Report, p. 27

According to Noble Group, on September 30th 2015, the company had $15.5bn banking facilities and $1.669B in RMI (ready marketable inventories).

$11.1bn of these $15.5bn banking facilities is uncommitted and are contingent on ability of maintaining investment-grade rating in the future.

Noble claims to have $900M of cash and 1.669B$ in RMI (ready and marketable inventories).

Their 1.669B$ in RMI have claims on related- party notes that are under collateralized by their commodity merchant activity and therefore should be excluded from their liquidity headroom.

Noble Group currently uses $3.4B of borrowing facilities that are uncommitted.

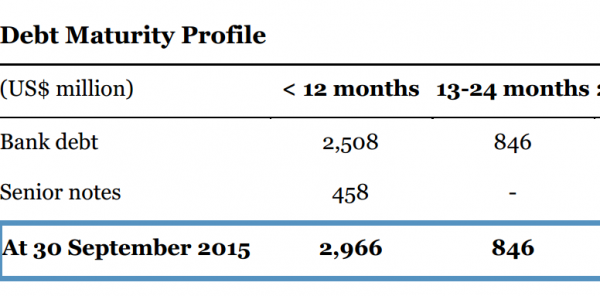

Noble Group is left with only 1B$ of unutilized committed borrowing facilities and $900M of cash ready available to meet $2.966B of debt scheduled in the next 12 months.

Global Currency Collapse well under way. We are well into act 2 of the final chapter.. I can't believe people are still surprised.

So true

https://steemit.com/commodities/@c-sigmashow/noble-group-imploding

PBOC will do everything they can to flood liquidity into this bankrupt company. If not, there's a group of Ontario that will recapitalize it ;-)

No doubt!

Damn. Deja Vu. When Will Society Ever Learn Not To Re-commit Sins Of The Past?