Hedge Fund Manager Bill Miller Has Over One Billion Dollars Invested in Bitcoin

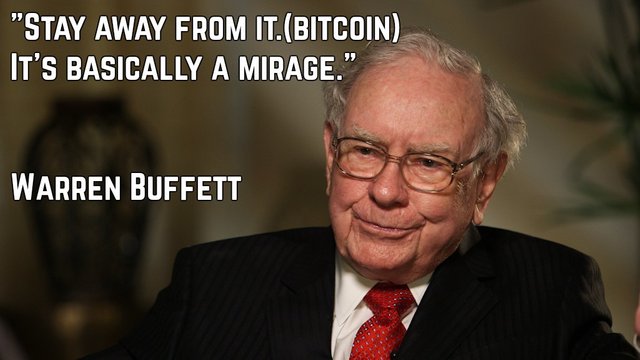

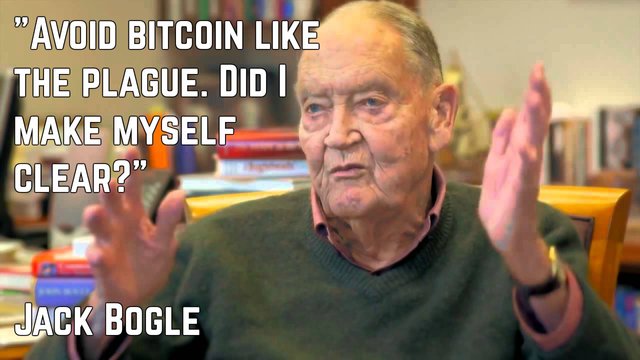

As Bitcoin has surged in popularity, the best known names in the world of high finance have been receiving many more questions about bitcoin in interviews. I’ve personally been disappointed in some of the investors whom I respect the most showing such a closed mind towards cryptocurrencies.

Needless to say, blockchain technology is well outside of the circle of core competencies for either Buffett or Bogle. Even though many users of crypto don’t fully grasp the blockchain either, I get the feeling that Buffett and Bogle’s lack of understanding of the underlying technology makes them vastly underestimate and misjudge the efficacy of cryptocurrencies as an asset class.

While most mainstream Wall St. veterans are rather bearish and even dismissive of bitcoin, one veteran fund manager, Bill Miller, currently holds a little over one billion dollars in bitcoin. Miller is a rare bitcoin bull inside Wall Street at the moment, and a recent blog post on his firm’s website showed a refreshingly objective view of his on bitcoin right now.

“In general, I think the strongly held negative views on Bitcoin fall under the rubric “new things, old thinking.” Whenever we are confronted by something we haven’t seen before we try to understand it by assimilating it to something we have seen before or that we think we understand. We reason by analogy, or we employ metaphors that seem to fit. Sometimes this is effective, other times not. As we gain greater understanding and experience, our thinking becomes (hopefully) better and more accurate.”

While he is is clearly bullish on bitcoin, he does admit that the heavy allocation to crypto in his fund right now(around 50%) will be lessened, but it doesn't necessarily mean he will be selling them either. He is also rational enough to admit the speculative nature of the asset, and that with high reward comes very high risk. I recommend reading the entire blog post of his to get the full scope, linked in the sources.

Sources:

https://money.usnews.com/investing/cryptocurrency/articles/2017-12-08/warren-buffett-isnt-buying-bitcoin

https://www.cnbc.com/2017/11/29/bitcoin-passes-11000-but-jack-bogle-says-avoid-it-like-the-plague.html

https://www.cnbc.com/2017/12/18/bill-millers-hedge-fund-has-half-its-money-in-bitcoin.html

https://millervalue.com/certitude-not-test-certainty/

That is a good line.

I’ve been disappointed by some of the Wall St veteran’s perspectives as well. As much as they think outside the box, I thought they would have looked closer at the “mirage”.

Have to agree, some of the investors I respect the most are missing the' point of this space: asymmetry. Doesn't take a genius to recognize that this is THE market for small bets and huge wins. Who doesn't want an allocation to this sort of asset? It's essentially early stage VC style investment where the payoff can occur in a matter of months rather than years.

Stay away from the Internet. Its impact will be no more than the fax machine.

Yada yada.

Meanwhile, the rest of the world looks with interest to this new technology.

THANKS FOR THE UPDATE

I WOULD LOVE TO FOLLOW YOU

PLEASE FOLLOW BACK

I DEF WILL SHOW LOVE ;)

many thanks has shared information my friend