Interest Rates and Labour

Most of the people who work, need to work to eat, cloth and shelter themselves. This means that the supply of most of the labour is price invariant. In other words, up to a point, it doesn’t matter how low wages are, a lot of labour will still be supplied. There is a smaller cohort of people who don’t think it is worth their effort which leads to a reduction in participation rate.

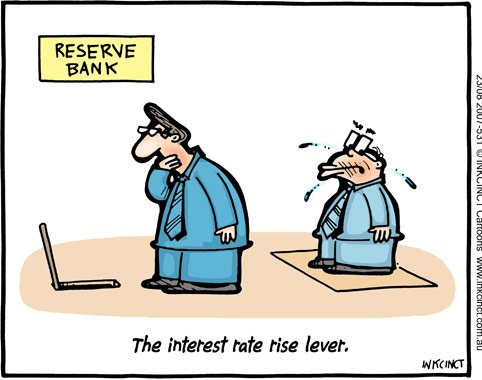

As financial capital (i.e. money) and labour can (partly) substitute each other as factors of production then low interest rates put downward pressure on wages.

With lower wages, demand for labour increases leading to low unemployment. Lower wages and lower participation rates decrease aggregate demand however this is offset by debt increases which are encouraged by the low interest rates.

So, in 2018 it is no mystery that wages are low with low unemployment and low participation. They are all effects of low interest rates and increasing levels of debt.

Low or stagnant wages distort economic activities making some sectors in the economy more vulnerable such as those reliant on consumer spending. From a supply perspective, changes to the costs of the various factors of production lead to the combination of inflation and deflation at the same time. Asset inflation mean some supply chains, those heavy on assets, will experience price rises while labour intensive supply chains will experience price softening.

@OriginalWorks

The @OriginalWorks bot has determined this post by @robsverdict to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!