The Bond Market Is Flashing A Warning, But Is Anyone Listening? By Gregory Mannarino

OK my pride of lions, I think it's time for me to give you a visual as to what is occurring in the bond/debt market, and the current flattening yield curve.

First allow me define for you what it means to have a flattening yield curve, and why it's important.

A Flattening of the yield curve is a situation that describes the relationship between short and long-term bonds (debt).

Generally a 30 year bond would have a greater yield then let's say a 10 year bond. The higher yield is offered to the investor because of the risk associated with holding a Long term debt instrument.

All the talk, even from the mainstream financial media about the current flattening yield curve comes down to this: it indicates that there is growing concern among investors regarding the longer-term macro economic outlook-it is just that simple.

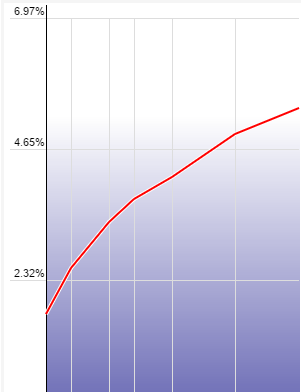

Have a look at this first chart below.

This is an example of what a normal yield curve looks like, this particular chart is from 2004.

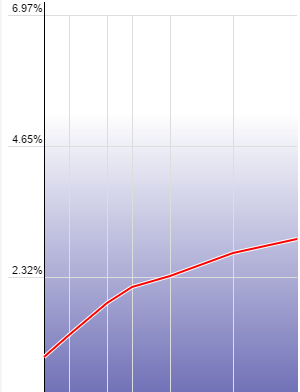

Now have a look at this other chart below.

This is our current yield curve. Notice anything?

What this says to me, and should say to you as well, is the longer-term macro economic outlook is not as blissful as the mainstream financial Pundits would like you to believe.

Well seeing is believing, and after getting a visual on the differences between a normal yield curve and our current situation, what do you think about this?

Gregory Mannarino

Greg, I think with what we are seeing with the dollar getting weaker, cryptocurrency sky rocketing, metals begining to move in the right directions. The yeild curve is flatning. I believe this maybe the starting of a collapse. Stockmarket is all over the board. Something for sure feels unusual. Great article. Thanks for what you do.

I believe this is the greatest time to be alive. To get very wealthy.

There will diffently be a wealth transfer. I also belive it will involve silver, gold and cryptocurrency

Good to have a diverse portfolio.

There's one more hard asset that most people are over-looking... It's Common Coinage which I believe will increase 100 fold in buying power once the Federal Reserve (Debt) Notes collapse... Pocket Change...

The venezuelan bond yield curve is inverted.

The bonds are rated CCC

http://www.worldgovernmentbonds.com/country/venezuela/

Definitely something to watch. I never knew the importance of the bond market until watching you! Upvoted and resteemed thank you

Looking at your graphs above I think it's wise to invest in the Crypto Market as other traditional ways to earn interest including bonds aren't working as good as it used to be.

Master Gregory,

Long term macro-economic thinking makes me want to shelter my grandchildren! Their lives will likely be twisted (like the impoverished childhoods of my parents who were born in 1924). Boil the cabbage one day and drink the water the next.

PPT will be there to save the day. Not worried here.

What if one day the PPT is told not to intervene?

Gold and silver is a good play. With cheap metal prices.

All together now.. ROARRRR! I just tagged you in a video on my page Greg, give it a look cheers👍🏻

Gold, Ground, Grub, Guns, Gas.....and Silver, Crypto Currencies. Mike Maloney talks about it. I will go with those for now.

I like the three g's gold guns getaway plan hahaha

I am listening greg what should we do next to prepare

duck and run?

Greg I've been listening to your reports for a while now and respect you for trying so hard to help others achieve the same success level you have .. kept up the great work and sharing your knowledge ..

I dont want to do that though

hide out in the safety names like AAPL AMZN GOOGL...they never go down...the NDX is like a money market that pays 20%....lol