Bond market techicals update

US Treasuries sold off again sharply last week, underperforming global counterparts. From the previous peak 3 months ago, the 10y US Treasury yields are now 15-20bp higher, whereas Bund and Gilt yields are 10bp lower;

While the narrative seems to be that the US economy is back on a solid growth path, the rise in oil prices have increased uncertainty about the immediate US Rates trajectory, hence the volatility.

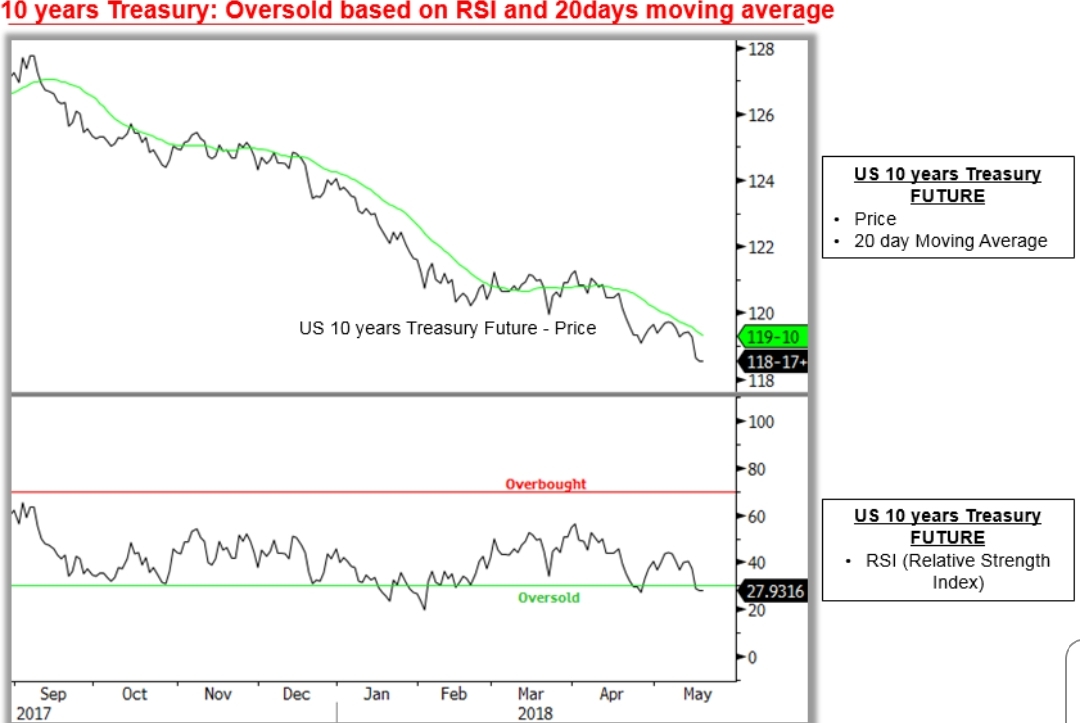

Let’s have a look at some technicals, as you can see from the chart below, this is the price of the 10years Treasury Future, based on the Relative Strength Index we notice that it is oversold, also vs its 20 days moving average.

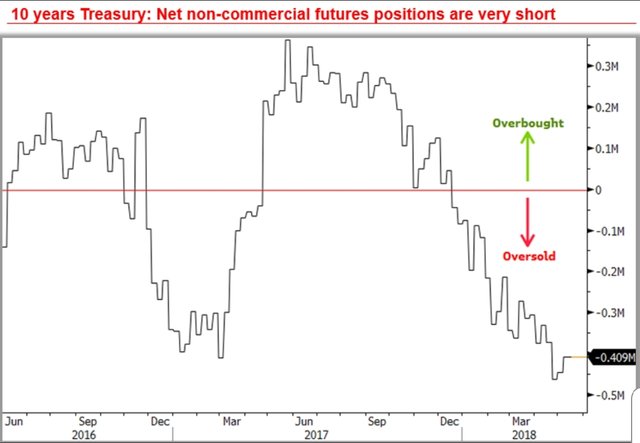

In addition, when looking at speculative positioning we still see that investors are very short

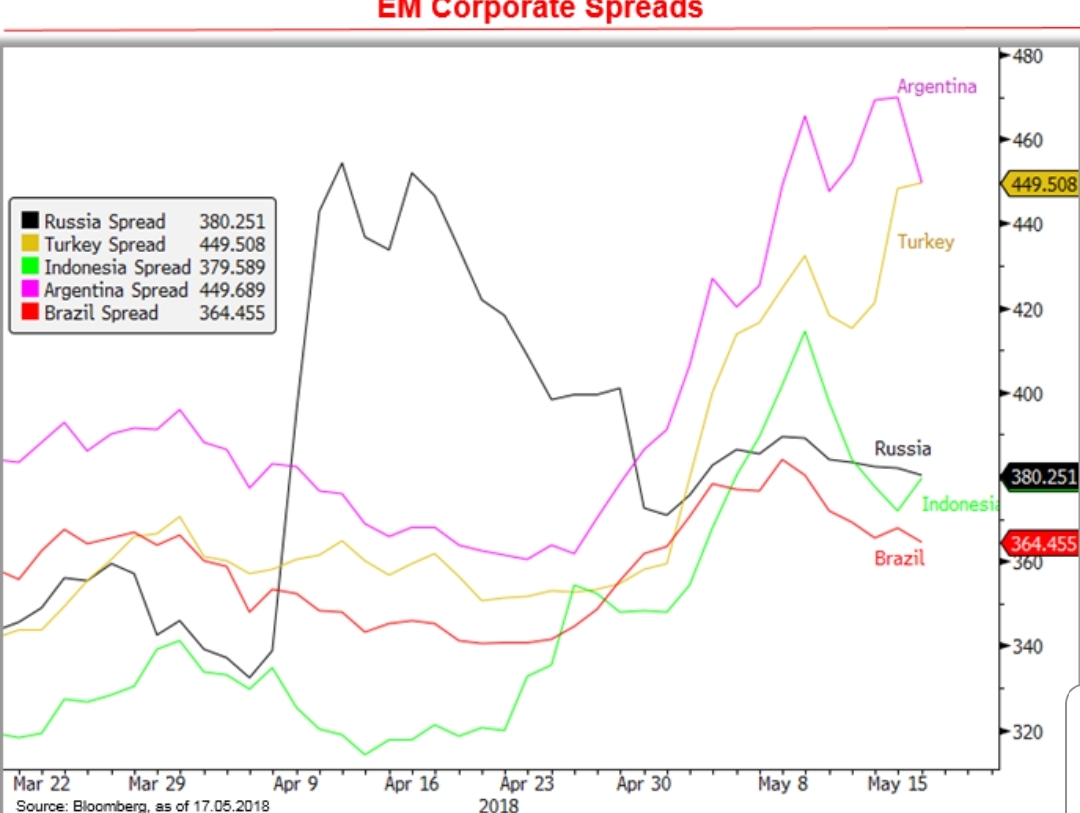

Let’s look at Emerging markets and check out some of the recent movers, this graph below, as of yesterday prices, shows EM Corporate spreads in USD in the past 2 months.

Concerns about late-cycle dynamics, USD funding, QE unwind, and valuations have triggered some weak price action and relatively strong fund outflows in selective areas, namely in Argentina and Turkey which as you can notice have been the laggards, explained mainly by idiosyncratic reasons, coupled of course with generally weaker investors’ sentiment across the board which did not help the price action there. Indonesia as well accelerated its widening in spreads late April, mostly due to increased supply and the Rupee volatility, however we saw recently some retracement in spreads. Interestingly, Indo spreads now match Russian corporates’ spreads, which saw a good reversal since the ‘wides’ from the sanctions’ times in early April. Finally, just a word on Brazil, which was the relatively most resilient region, being fundamentally robust.

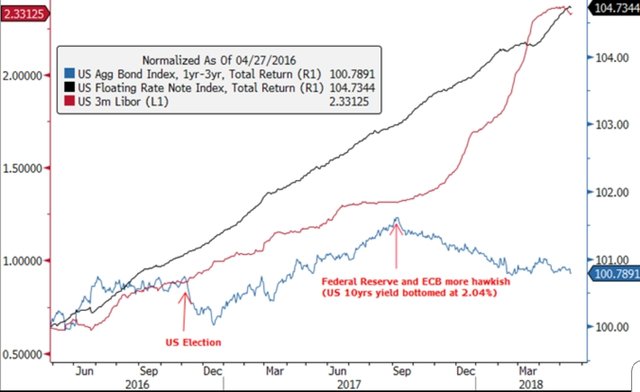

To conclude I would like to say that in the current environment there is a strong investment case and that is for Floating Coupon bonds, as you can see from the chart below,

the black line shows the total return of the Floating Rate Notes’ (FRNs) Index in the past 2 years, which has constantly outperformed the short duration IG index. Despite Brexit, US Elections and geopolitics, FRNs offered stable and gradual positive returns. I believe its natural characteristic of anesthetizing duration risk and its current attractive carry are indeed a compelling value proposition for protection against rates volatility as well as liquidity alternatives/enhancements.

this post is helpful and informative. Thanks for sharing this post. God bless you

that's pretty cool to know.....