Is everyone wrong on the National Debt? Should we embrace it rather than fear it?

We hear it all the time. It is seemingly a non partisan issue across the political spectrum. Everyone agrees the national debt is a huge problem that needs to be addressed. But is this correct? Mark Twain once said "It ain't what ya don't know that gets you in trouble, it's what you think you know for sure that just ain't so". This could be one of those situations and it is arguably keeping our society from fully living out our potential.

Back in August of 2011, the rating agency Standard & Poors downgraded US debt from AAA to AA+. Mind you this is the same dubious rating agency that rated worthless mortgage-backed securities as AAA and we all know how that worked out. Right after the announcement, US Treasury yields plunged and eventually went to historic lows. So, why did this outcome occur. Weren't markets supposed send US interest rates through the roof? The fact is, the United States Federal Government is the sovereign issuer of the US Dollar and can meet any liability at any time if it is denominated in Dollars. As long as the government is the monopoly issuer of the currency and has a freely floating exchange rate, there is no constraint on its ability to pay its bills unless it decided not to like Russia did in 1998. Keep this in mind whenever someone tells you the US is broke and we are going to be just like Greece, Venezuela or the old Wiemar Republic if we don't make "significant reforms" which is just code for massive austerity cuts. S&P didn't site the US's ability to pay its liabilities as the reason for the downgrade. They sited political volatility and uncertainty as the reason because the Tea Party pushed the US to the brink when they refused to raise the debt ceiling. Below is a monthly chart of the US 10 year note yield at that time.

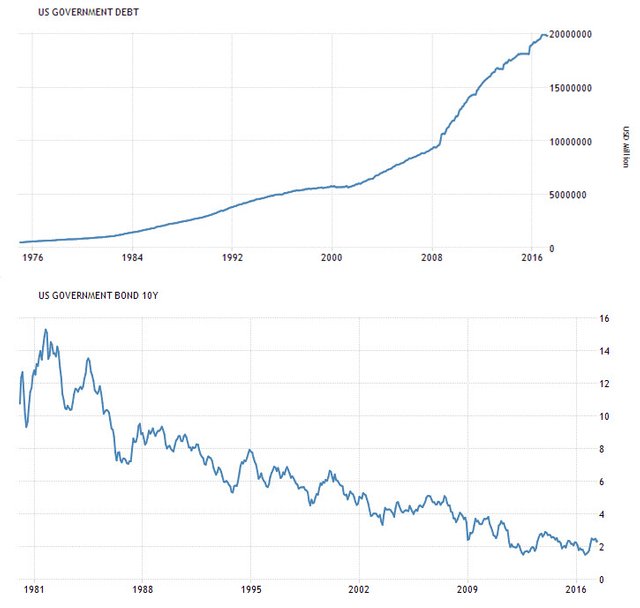

Another ominous quandary to consider is the question of whether or not interest rates will go up in the face of rising public debt. Back in 1980 the federal government had a debt-to-gdp ratio of 40% and interest rates were 20%. Today the government has a 100% debt to GDP ratio and interest rates are coming off historic lows. In reality interest rates were that high back then and this low now because the Federal Reserve put them there. The government sets its own interest rate and is not bound to the interest rate the market gives it. US Treasuries follow the Fed. Not the other way around. FOMC board governors don't know this either. Below is a chart that fully refutes the notion that rising public debt leads to rising interest rates.

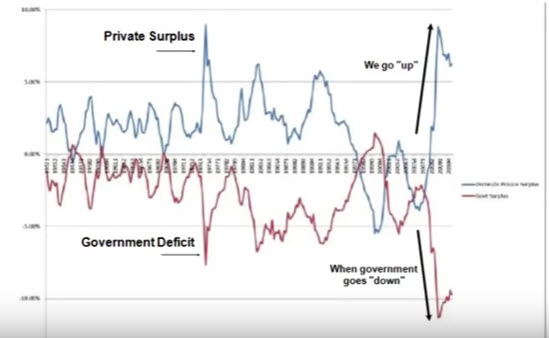

Our country has always had a national debt. We've been accumulating deficits ever since our conception and during the times when our government ran surpluses a recession followed. With the federal government deficit the government adds more money to the non government than it's taking away from us in taxes. When it runs a surplus it is taking away more money than it took away from us initially in taxes. A balanced budget amendment would be a highly self-destructive policy. Our government must be allowed to issue debt and issue currency freely as it sees fit. There is no crisis of national solvency. Our country is not broke. The real "solvency" vulnerability is on the private sector side and basically anyone or any entity that falls under the currency "user" category which is much different than a currency "issuer". Once the private sector levers up too much and starts deleveraging the government has to come in and make up for that in order to keep the economy going. If it doesn't, GDP will contract heavily. The fact is, the Federal Government deficit equals the non government surplus. Below is an illustration given by Stephanie Kelton, Ph.D .Professor of Economics at the University of Missouri-Kansas City which empirically illustrates this reality.

Private surplus in the last chart just means corporate surplus, I'm not sure why you use the word "we" there. "We" are represented by the gov't line since our tax dollars are what finance the gov't- at least initially (maybe just theoretically -eye roll), until our taxes aren't enough and the gov't relies on issuing bonds to raise the rest of the cash it needs.

I used to think the debt did not matter either but i have changed my mind. It takes something like $5 dollars of borrowed money to raise our GDP by $1. And interest payments on the debt is so large that the only we have been able to pay it is it "issue" more money, watering down our currency to make payments. Somewhere along the line printing money to make payments on old borrowed sums stops making sense, like making mortgage payments on a house after its value got cut in half, you are underwater and bailing with a bucket stops helping.

so the debt is important

We don't even have to sell Treasuries to run a deficit. We can just create the money. And if those new Dollars are met with rising amounts of goods and services and overall output, productivity then inflation risks will be limited. We should nationalize the Federal Reserve and start lending to states and municipalities for massive infrastructure upgrades.