The Great Australian Blight

“Blight” is a botanical term that refers to the extensive discoloration, wilting, and death of plant tissues, not too dissimilar to the erosion, devolution and depression of the Australian economy. That may seem like a harsh assessment of an economy that has been ticking along quite nicely for decades, an economy so strong it hasn’t had a recession in 25 years, one that sailed through the 2008 Global Financial Crisis without a single quarter of negative GDP. But beneath the surface, the economy is rotten to the core, and like blight, it’s spreading fast.

Digging stuff up and selling it to China isn’t the hallmark of a healthy economy, particularly when it’s combined with a Greenspan-esque property bubble that’s largely propped up by the same Chinamen that swooped up your resources, added value in their country, and re-sold them at a tidy profit to other developing nations. The so-called “lucky country” has certainly lived up to its namesake thus far, almost entirely thanks to it’s generous endowment of resources, a break that has masked decades of incompetent fiscal, monetary and economic policy that is best summed up in the following cartoon:

How a country with vast lithium reserves and a great big desert in the middle, has failed to become the world leader in solar innovation, is testament to the stupidity of the Australian government. The “no worries mate, we’ll just dig up some coal and burn it” attitude will undoubtedly cost Australia dearly in years to come, when renewable energy becomes a matter of necessity not choice.

That being said, economic strategy (or its lack thereof) is the least of Australia’s problems at this point. Like most countries, Australia’s economy runs on a Ponzi currency system, a little understood concept that is explained in my book, The Economics of the Economy. In short, this means that banks create currency out of thin air to make loans. No joke. Banks, not the central bank, but regular banks like ANZ, NAB, CBA and St George don’t make loans by lending out deposits, they simply type up some numbers on a computer and create deposits by dishing out loans (a credit balance on one account is also a debit balance in another).

Now, if banks create currency out of thin air to make loans, where does the currency to repay interest come from? More loans! Just as a Ponzi investment scheme requires new investors to pay off old ones, a Ponzi currency system requires new loans to be issued so there is enough currency in circulation to pay off old loans. Don’t believe me? Look at the Australian Debt Clock: total private debt is $2.7 trillion and the total broad money supply is $2 trillion – Australians owe more than the amount of currency in the entire economy! And that’s just the private debt, total debt including government liabilities exceed $6.3 trillion, triple the amount of currency in the entire economy.

The thing about Ponzi structures is that they can’t go on forever, and a Ponzi currency system is no different – eventually the originator runs out of investors (or in this case borrowers) and when there’s no one to refill the punch bowl, everyone sobers up. The tipping point is fast approaching for Australia as the RBA’s monetary vodka reserves run dry. Interest rates are already down to 1.5% and yet GDP is falling. After a 25 year debt binge, the hangover ain’t going to be fun.

The good news is that you’re not alone, the Yanks, Poms and more or less every other country in the world also run on Ponzi currency systems of their own. Note that I’ve labelled it a system, not a scheme. There is nothing conspiratory about the currency system. In theory, debt can grow in perpetuity as long as the economy grows along with it, but this is only sustainable when credit is used to expand productivity.

The majority of debt in Australia has been used to fund home ownership, an activity that doesn’t expand productivity. What it does expand is property prices, the accumulation of which causes an asset bubble, one that in Australia has now ballooned to become among the largest in the world.

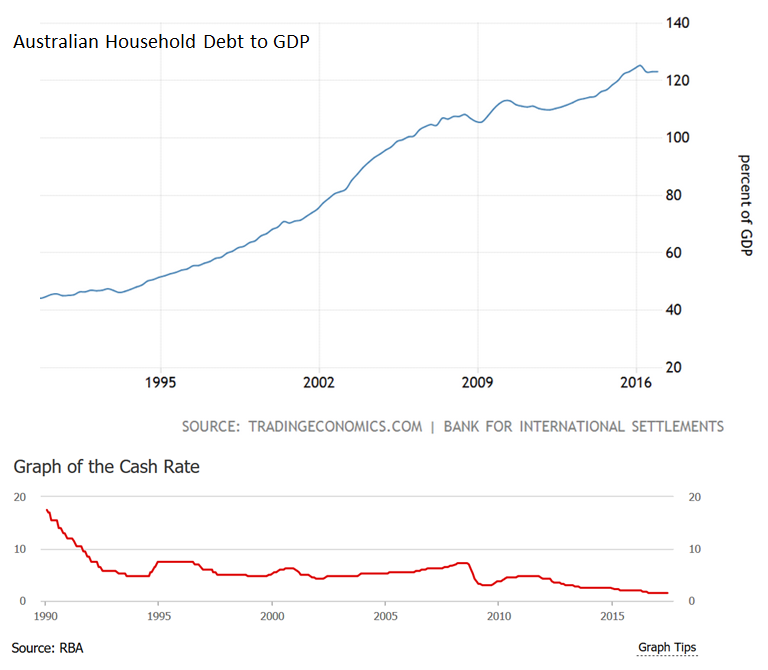

Australia’s household debt to GDP ratio is now 123%, second only to Switzerland. The ratio has climbed steadily over the last three decades, facilitated by progressively lower interest rates:

How long can this trend continue? I’d give it 6 months to a year, 18 months tops:

Australia’s biggest employer (China) has spent the best part of the last decade building ghost cities all over the country. This building spree fueled demand for Australian raw materials, but in the process it clocked up so much debt that its credit rating was recently downgraded for the first time in 30 years. China simply doesn’t need anymore infrastructure at this point, and since Australia can’t make solar panels, cars or anything else useful it can sell to them, the downward trend in GDP is set to continue.

Adding to its economic woes is Australia’s ageing population. Over the next 5 years, Australia will have 1/4 million more retirees, many of which are probably looking at their pension savings and wondering how they’re going to afford retirement. And rightly so, many pensions are grossly underfunded, and a repeat of the 2008 global financial crisis will wipe out what’s left, forcing many to sell their properties to fund living and healthcare expenses. At this point, a repeat of the 2008 global financial crisis isn’t just possible, it’s highly likely.

For the sake of all my friends and family that live in Australia, I hope that I’m dead wrong about all this, but the evidence overwhelmingly says otherwise. My unsolicited advice would be to cash in while you still can, and get into a rental home before the market crashes – you’ll most likely be able to repurchase the same property or better at a 50% discount in the next 2-3 years. Good luck!

Resteemed and followed. Hope you will return the favour :)