Holiday Spending Pushes US Credit Card Debt Over $1 Trillion

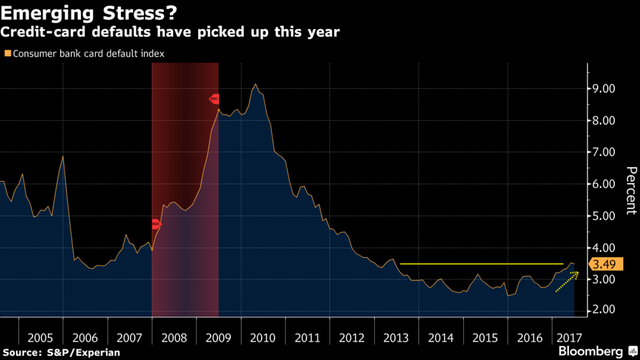

US credit card debt is at the highest that it has been since the end of 2008.

The recent holidays helped to push the total over the $1.02 trillion mark, though this isn't the first time that consumer credit card debt is said to have passed the $1 trillion dollar threshold. And despite the holidays now being over, millions will still be paying for it for many months yet to come.

Over the holiday, consumers on average were spending about $1,054 on their expenses with their credit card. And this is on top of the average household US credit card debt that's estimated for Americans, the median debt is roughly $15,654 on credit cards.

Around the end of September 2017, credit card debt allegedly stood around $808 billion, according to the Federal Reserve and the Fed has said that it plans to have 2-3 quarter point hikes this year. With each hike, it's estimated that about $1.5 billion will be added to credit card interest charges.

Along with the debt from credit cards, there is about $1.36 trillion in student loan debt, another $1.21 trillion in auto loan debt, and more than $8 trillion in mortgage debt.

Previous survey's have found that about 17 percent of those currently struggling with debt say that it's because they had to put unexpected medical costs on credit. And it might be even higher numbers than that. A separate survey found that it was about 37 percent of respondents who said they were in debt because of medical bills.

It's estimated that only about 1 in 5 Americans are able to pay off their credit card balance in full every month.

Most of the debt allegedly belongs to men, but that's because they are said to make more expensive purchases, while women make smaller but more frequent purchases.

Millions of people are facing a black hole of debt that they'd like to get rid of and one of the most popular resolutions for many people this new year is the goal to get their finances in order: save more, spend less, and pay off debt.

Financial experts have been seizing the opportunity to suggest that this news could play as a reminder for many that perhaps it's time to focus on their debt and try to get it paid off. Having debt limits the ability to save and really limits a persons ability to deal with any emergency that might come up.

It Can Also Provide An Inflated Sense Of Purchasing Power...

Others insist that it's terrible news for the future and a sign that there's a need for change. And for those who are already struggling to pay down their debts, they might find it surprisingly more difficult to reach their goal of being debt-free if interest rates go up.

Pics:

Pixabay

S&P/Experian via Bloomberg

Sources:

http://www.businessinsider.com/consumer-credit-debt-rises-in-november-2018-1

https://www.marketwatch.com/story/us-households-will-soon-have-as-much-debt-as-they-had-in-2008-2017-04-03

http://www.washingtonexaminer.com/us-banks-buoy-reserves-as-credit-card-debt-hits-102-trillion-record/article/2645320

https://www.cnbc.com/2017/07/11/credit-card-users-rack-up-over-1-trillion-in-debt.html

https://finance.yahoo.com/news/average-us-household-owes-15654-credit-card-debt-171830579.html

https://finance.yahoo.com/news/enjoy-life-fullest-2018-top-100414863.html

https://www.cnbc.com/2017/11/06/many-gift-givers-wont-spend-more-than-50-this-holiday-season.html

https://www.bankrate.com/credit-cards/total-us-credit-card-debt/

https://www.cnbc.com/2018/01/05/how-to-knock-out-holiday-credit-card-debt.html

https://www.bloomberg.com/news/articles/2017-08-10/in-debt-we-trust-for-u-s-consumers-with-12-7-trillion-burden

https://www.usatoday.com/story/money/2018/01/08/credit-card-debt-hits-new-record-raising-warning-sign/1014921001/

https://www.cnbc.com/2018/01/02/americans-racked-up-more-than-1000-in-holiday-debt.html

https://www.wsj.com/articles/the-nations-credit-card-tab-hits-1-trillion-1491593929

Related Posts:

Study: Spending Money On Others Promotes Happiness

https://steemit.com/money/@doitvoluntarily/study-spending-money-on-others-promotes-happiness

Mixing Money With Friendship

https://steemit.com/money/@doitvoluntarily/mixing-money-with-friendship

Is Your Coffee Costing You More Than You Realize?

https://steemit.com/writing/@doitvoluntarily/is-your-coffee-costing-you-more-than-you-realize

And these so-called analysts have the nerve to call cryptos a bubble. LOL Student loans are the biggest debt bubble on the planet! Naive kids with useless, overpriced degrees, graduating into the worst job market in decades. What could possible go wrong?

The defaults are coming!

I have realized after the new year people really don’t shop anymore and I have realized the sales are not up to where they are and sometimes people even sell what they get for the holidays

Well, the reason why the Fed is unwilling to raise interest rate is because the stock market is booming and debt obligation are largely kicked off to the sidelines. Why care too much about the debt when there's no urgency to pay short term obligation? Our inflation based economy will effectively reduce all those real value of debt obligation to nothingness.

However, when consumption machine stops to work, that's when we'll see a real disaster. People will then realized the lies they have been fed with by the government. The only way to be prepared is to diversify into cryptos.

@doitvoluntarily, the world is awash in debt and this trend will continue as all fiat currency comes into existence as debt. This is just personal debt, if you add in the debt/deficit the gov't has created on behalf of its citizens, we can easily add a 5-10 time multiple to individual debt levels. This system is not sustainable and will collapse under it's own weight, or we enter a hyperinflationary period where debts get paid by inflated fiat currency. This is setting up to be a very ugly period in the financial markets again, look for 2019 and 2020 to be the worst part of what is coming down the road. It's best to get your financial house in order, trade the cryptos and own physical precious metals.

wonder if its even significant.

The debt is significant at a personal level, the gov't debt is pretty much insignificant until the creditors put a stop to it. The creditors to gov't debt and bonds are stuck and can't call in the loan or the whole system collapses, so they just diversify and take real assets as payment. This is why gold and silver will start to gain traction again this year, I wouldn't doubt if we see new highs in the precious metals within a couple of years or sooner.

even at a personal level though i think it depends what you use the money for.

Ah, the Consumermas holiday. Family time and good food is all we need to celebrate. Credit card interest is an absolute rip off. If you don't have the physical money to buy something, you probably don't need it.

Thanks for sharing!!! Who owns all this debt?

thanks for sharing with us dear @doitvoluntarily Resteemed

Damn never knew it was the highest it’s been. Thanks for sharing!

Fell into the fire myself. Wanting to show appreciation to some of my peeps, I did the expeditious thing and CHARGED IT! Intend to pay off immediately but I still feel stupid. Gonna start knitting scarves for next year right now! Thank you for the post. Be safe, be well.

Life on credit, a terribly bad habit. And an evil of the western world.......