DOLLAR COST AVERAGING

WHAT IT IS:

Dollar cost averaging is a strategy in which an investor places a fixed dollar amount into a given investment (usually common stock) on a regular basis. The investment generally takes place each and every month regardless of what is occurring in the financial markets. As a result, when the price of a given investment rises, the investor will be able to purchase fewer shares. When the price of a particular security declines, the investor will be able to purchase more shares.

HOW IT WORKS (EXAMPLE):

Let's assume an investor decides to purchase $1,000 worth of XYZ Corp. at the same time every month for four months. In this example, we'll also assume that the stock first declines in value, but then rallies strongly.

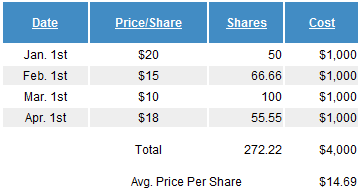

As you can see in the table above, using a dollar cost averaging strategy the investor would have purchased 272.22 shares for a total of $4,000. His/her average price per share for this period would have been just $14.69 (calculated as follows: $4000 / 272.22 = $14.69). With the stock ending at $18 at the end of this period, the investor's total position would now be worth $4,900 (calculated as follows: 272.22 shares * $18 = $4,900). As a result, the investor would actually show a profit of $900 on his/her overall position despite the fact that the stock declined in value over the full four-month time period (dropping from $20 to $18).

By comparison, if the investor had decided to invest $4,000 in shares of XYZ Corp. all at once at the beginning of this period, then he/she would have purchased 200 shares at a price of $20 per share. With the stock finishing at $18 at the end of the four months, the investor would have shown a net loss of -$400 on the stock.

This example clearly illustrates the benefits of dollar cost averaging, especially during periods of volatile share prices.

WHY IT MATTERS:

Millions of investors around the world use dollar cost averaging because it offers the following benefits:

It's an attractive option for investors who want to contribute to their investment portfolios on a regular basis.

It eliminates the issue of market timing. As a result, an investor's returns will be determined more by the overall trend in a given stock as opposed to the investor's specific entry price. In addition, it helps investors reduce their cost basis on securities that decline in value.

Congratulations @bwashington1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP