If you are making money in the market, be careful...

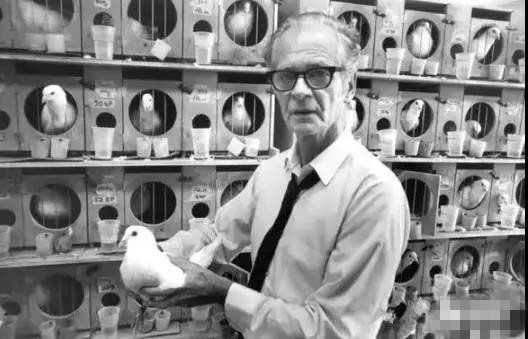

Burrhus Frederic Skinner, (1904-1990), American psychologist, founder of new behaviorist psychology.

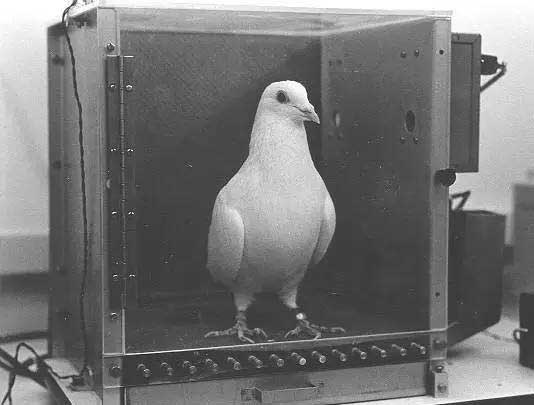

Skinner is a very interesting psychologist. Unlike some unspoken and self-talking analysis, Skinner's research is based on experimental observations and designed a classical experimental method – Skinner box.

Experiment 1:

Put a very hungry mouse into a box with a button and drop the food each time you press the button.

Experimental results:

The mouse quickly learned the connection between the button and the food.

Experiment 2:

Place a mouse in a box with buttons. Each time the mouse does not press the button, the box is hit by electric shock.

Experimental results:

The mouse learned to press the button to avoid the "shock."

This model does change the behavior of the mouse.

It is worth noting that the difference between Experiment 1 and Experiment 2 is that once the punitive feedback of Experiment 2 disappears, the white mouse immediately stops pressing the button, and the reward feedback is different. The mouse still presses the button tirelessly. Only after a lot of failure experiments, the behavior pattern will disappear.

The most interesting thing is when the reward is obtained with random probability:

Experiment 3:

When the mouse presses the button, there is a certain probability that the food will be obtained.

Experimental results:

The mouse keeps pressing the button.

When the food is no longer dropped, the learning behavior of the mouse disappears very slowly. As the probability is getting lower and lower, the learning behavior of the mouse pressing the button does not change until the pressing button 40-60 times to drop food, and the mouse will still continue to press the button for a long time.

Similarly, experimenting with pigeons has the same effect. More interestingly, different pigeons have formed different "superstition" cultures. In the case of a probability of dropping food, the response of the pigeons is intriguing.

Some pigeons will rotate around the place, some pigeons will dance strangely, some will peck boxes and so on. The mouse also appeared bowing, repeatedly jumping and so on. They all developed a pattern of behavior in the hope of causing food to drop, but the dropping food was completely random.

The animals being tested, forcibly explaining the causal relationship, developed a completely different superstitious culture for the identical external environment.

What's even more savvy is that if we increase the probability of dropping food when the pigeons jump to "feed for dance" and strengthen this mode, after the pattern disappears, after more than 10,000 failures, the behavior will slowly disappear.

Is such a model effective for animals, is it effective in humans? Someone really did the experiment on people.

The results of the experiment are also valid for humans. There is not much difference in human beings. There is no less than an animal for the “interpretation of obsessive-compulsive disorder” and superstition.

Gambling is one of the most typical examples. The table is a favorable setting for the casino bookmaker's probability, and it is not complicated. So why are gamblers still trapped in it and difficult to extricate themselves? A simple slot machine allows countless people to lose almost all their savings.

Considering the settings of online games, getting item rewards is always presented in a probabilistic way. For example, if you want to get a unique item, you need to complete a specific task (such as killing a monster). After the mission is completed, there is a certain probability of getting the item, not every time. This will make the player press the button as hard as the mouse. If you definitely have it or not, the effect will be different.

Similarly, in the face of fluctuations in markets with unknown causes, changes in the index, and bizarre behavior patterns have emerged. Once the profit is obtained because of the buying of a stock, the reason may be completely unrelated to the speculator's own interpretation, but different people will still produce different prediction modes.

Just like the food that appeared after dancing with the pigeons, because phenomenon A caused a profit result a, investors began to believe that phenomenon A is the reason for profit.

Slowly began to develop a variety of genres. All kinds of genres, all of which have defended themselves in the historically fulfilled situation, think that they have found the source. However, there is not much difference between them and the pigeons.

It’s just because some of the past behaviors and characteristics have been rewarded, and if you don’t do it, it’s not a terrible trap. Sometimes right, sometimes wrong, that is the terrible trap.

Experiments show that the response from reward feedback and disappearance feedback is different. The probabilistic pattern of food formation is far stronger than the electric shock.

In other words, once some kind of superstitious beliefs about market price changes are formed, it is difficult to “quit”. Because the underlying assets may go up or down, it is very likely that temporary gains will be made for the wrong opening of the position. This is different with build a house or make a meal that has the directly unsuccessful feedback.

What is terrible is not the failure, but a successful experience for the wrong reasons. This is the horror part in the market. Any wrong mode can get a certain amount of reward feedback, thus forming a mode superstition.

This is a similar place between the market and the casino. It is easy to form a probabilistic illusion, which makes people addicted and unable to extricate themselves. It's no wonder that so many people compare capital speculation to gambling, and there are similarities.

How do we face ourselves in the face of complicated markets and various unknown factors?

If we stay in the market Skinner box, we can never get rid of the simple circle of attribution to superstition. No matter how you summarize the historical price chart, there are no differences in the nature of the product's rate of return.

The only way out is to get out of the box, look at the world outside the box, and see the mechanics of the box itself. Instead of emphasizing, how much money I made because of how I did it, because how many times happened, and then in most cases, I thought that smart was holding.

To put it bluntly, most of the so-called " Quantitative Trading" is just a quantitative version of superstition. No matter how much the pigeons study the dance steps, it is not the reason for dropping the food. Even the dance steps are accurate to the millimeter, and the rhythm is accurate to the second is still useless.

Jumping out of the box to understand the real reason behind the asset price is the only correct way out. So what is the look outside the capital market box?

As the great Soros said:

"The history of the world economy is a series based on illusions and lies. To gain wealth, the practice is to recognize the illusion, invest in it, and then quit the game before the illusion is recognized by the public.”

If you find a bubble, buy a bubble and leave first before it breaks. Rather than summarizing all kinds of superstitions that are helpless.