How to get Mudra Loan

How to get Pradhan Mantri MUDRA Yojana (PMMY) Loan

MUDRA or Micro Units Development & Refinance Agency Limited is an institution setup by the Government of India for development and refinancing activities relating to micro units. MUDRA was announced by the Hon’ble Finance Minister in the 2016 Budget. Under MUDRA, loans are provided under three schemes namely ‘Shishu’, ‘Kishor’ and ‘Tarun’ to signify the stage of growth and funding needs of the beneficiary micro unit. This loan can be availed by Micro Units and Entrepreneurs in India. In this article, we look at the procedure for obtaining MUDRA loan.

MUDRA

One of the biggest bottleneck for SMEs in India is the lack of financial support from the formal banking or financial sector. The lack of formal financing hampers growth of small businesses and makes them ineffective at competing with larger players. To remove this bottle neck and provide finance to micro units or Entrepreneurs, MUDRA Bank has been setup as a subsidiary of SIDBI.

MUDRA would be responsible for refinancing all financiers or financial institutions engaged in financing of Small Businesses, Societies, Trusts Section 8 Companies, Co-operative Societies, Small Banks, Scheduled Commercial Banks and Rural Banks which are in the business of lending to micro or small businesses engaged in manufacturing, trading and services activities.

Loan under MUDRA

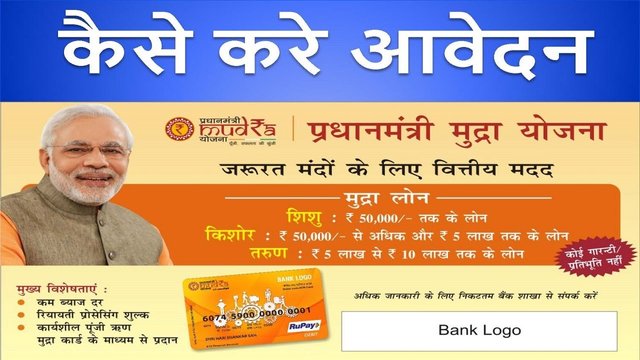

Loan is provided currently under three schemes in Pradhan Mantri MUDRA Yojana. The three schemes are as following:

Shishu: Loan of upto Rs.50,000/=

Kishor: Loans of above Rs.50,000 to Rs.5 lakhs.

Tarun: Loans of above Rs.5 lakhs to Rs.10 lakhs.

MUDRA Loan Eligibility

Any Indian Citizen who has a business plan for a non-farm sector income generating activity such as manufacturing, processing, trading or service sector and whose credit need is less than 10 lakh can approach either a Bank, MFI, or NBFC for availing of MUDRA loans under Pradhan Mantri Mudra Yojana (PMMY). The terms and conditions of the lendor would have to be followed for availing of loans under MUDRA. The lending rates are as per the RBI guidelines issued in this regard from time to time. Since, MUDRA is a refinancing institution, loans are not offered directly by MUDRA but through existing NBFCs, Financial Institutions, Banks, Primary Lending Institutions, etc.,

The target audience for MUDRA loans are millions of Proprietorship / Partnership Firms running a small manufacturing unit or service sector unit like shopkeepers, fruits/vegetable vendors, truck operators, food-service units, repair shops, machine operators, small industries, artisans, food processors and others, in rural and urban areas.

MUDRA loan is provided in the form of a MUDRA card wherein the borrower can avail credit in a hassle free and flexible manner through a RuPay card. The MUDRA card will provide working capital arrangement in the form of Cash Credit or Over Draft and can be used by drawing cash from ATM or making purchases using Point of Sale credit card swiping machines. MUDRA card also allows for repayment of the amount as and when surplus is available, thereby reducing interest burden.

To obtain MUDRA loan the borrower can approach the branch of a bank or financial institution providing MUDRA loan with the following documents and information.

MUDRA Loan Application

Business plan

Proof of Identity like PAN / Drivers License / Aadhaar Card / Passport and more.

Residence proof like recent telephone bill / electricity bill or property tax receipt and more.

Applicant’s recent photograph less than 6 months old

Quotation of machinery or other items to be purchased

Name of supplier or details of machinery or prices of machinery

Proof of identity / address of the business like tax registration, business license and more.

Proof of category like SC/ST/OBC/Minority, if applicable

Top 10 Public Sector Banks providing MUDRA Loan (as per total number of accounts as on October 11, 2015)

UCO Bank – 4,79,476 MUDRA Loan Accounts

State Bank of India – 4,67,062

Canara Bank – 3,35,270

Bank of India – 2,73,784

Syndicate Bank – 2,14,228

Indian Bank – 1,90,129

Punjab National Bank – 1,83,594

Bank of Baroda – 1,20,010

Central Bank of India – 1,11,820

Allahabad Bank – 1,10,044

Top 10 Private Sector Banks providing MUDRA Loan (as per total number of accounts as on October 11, 2015)

HDFC Bank – 5,57,41, MUDRA Loan Accounts

IndusInd Bank – 4,95,954

Axis Bank – 4,36,323

ICICI Bank – 34,311

Ratnakar Bank – 28,408

Yes Bank – 9,627

Karnataka Bank – 4,958

Karur Vysya Bank – 3,222

South Indian Bank – 2,368

Lakshmi Vilas Bank – 1,449

Top 10 Regional Rural Banks providing MUDRA Loan (as per total number of accounts as on October 11, 2015)

Uttar Bihar Gramin Bank – 1,11,509 MUDRA Loan Accounts

Pragathi Krishna Gramin Bank – 70,892

Karnataka Vikas Grameena Bank – 46,549

Kerala Gramin Bank – 44,525

Madhya Bihar Gramin Bank – 34,928

Baroda UP Gramin Bank – 32,743

Baroda Rajasthan Ksethriya Gramin Bank – 29,913

Andhra Pragathi Gramin Bank – 24,834

Pallavan Grama Bank – 22926

Allahabad UP Gramin Bank – 22,618