S1E3 of NYPN. Bitcoin and litecoin price increases explained by rising tensions between the US and North Korea

Not Your Parents News

Recent increases in bitcoin and litecoin prices are well explained by rising tensions between the US and North Korea.

Prices for bitcoin, litecoin and many other altcoins have been experiencing a generally rising trend for several years. This general uptrend has accelerated in the last year. Some have attempted to explain the price increase as due to rising maturity of the altcoin industry. Many real applications are already operating with great success (e.g. Steem on steemit.com, etc.). Others have attempted to explain the price increase as a momentum trade based on high interest in the myriad of ICOs that are being offered to the market. For bitcoin itself, some of the price rise is attributed to survivorship bias. After having survived many potentially fatal catastrophes occurring in the years after initial launch, many see value in Bitcoin solely on the basis that it did not succumb to an early demise.

All of these explanations have merit and are probably all contributing factors to the generally rising prices.

But in addition, as the data below will show, bitcoin and litecoin are perceived and are now being used as "relatively low risk stores of long-term value" in the face of a world in a state of turmoil and constant change.

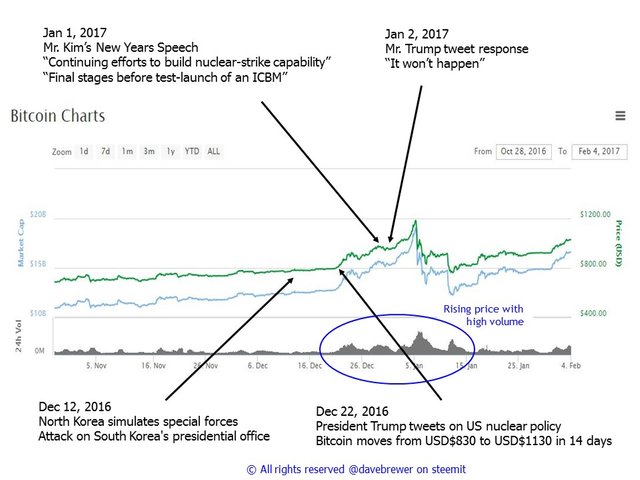

The first set of data is from December 2016 and early 2017. In a tit-for-tat series of exchanges, Mr Kim and President Trump ratcheted up tensions between the two countries with a series of war games, speeches by Mr. Kim indicating he intended to develop nuclear strike capabilities with ICBMs having world-wide reach, and tweet threats from President Trump that that would not be allowed to happen.

Bitcoin prices increased by almost 50% in a period of just two weeks. Volume was much stronger than normal.

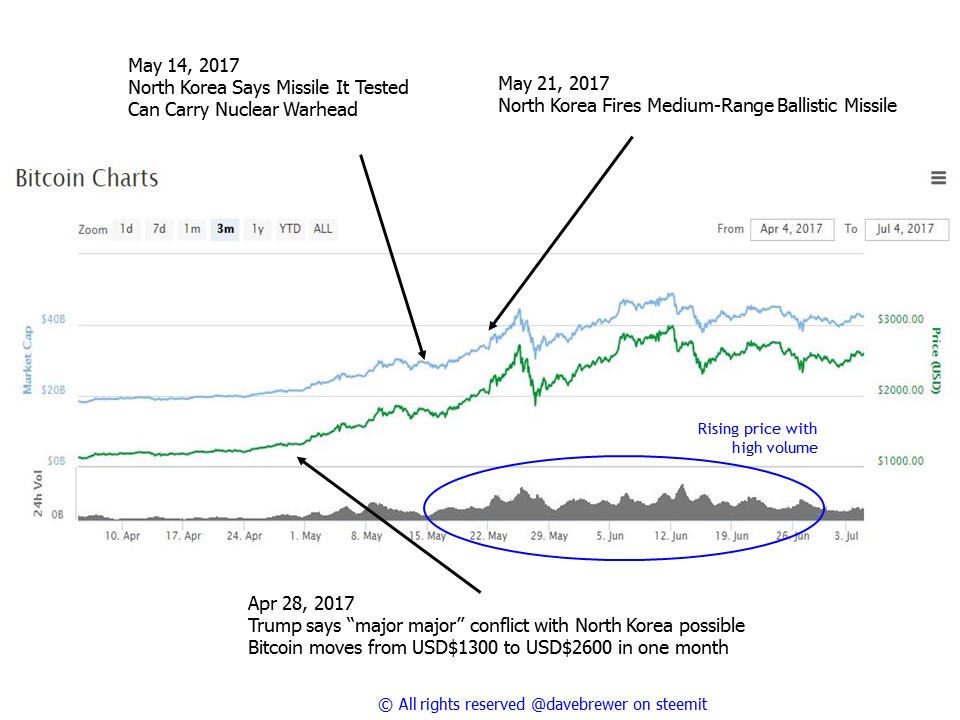

The second set of data focuses on bitcoin price activity in late April and May 2017. President Trump threatened in late April that "major major" conflict with North Korea was possible. North Korea followed up with successful tests of two different missile types on May 14 and May 21.

Bitcoin prices doubled in less than one month. Volume was much stronger than normal.

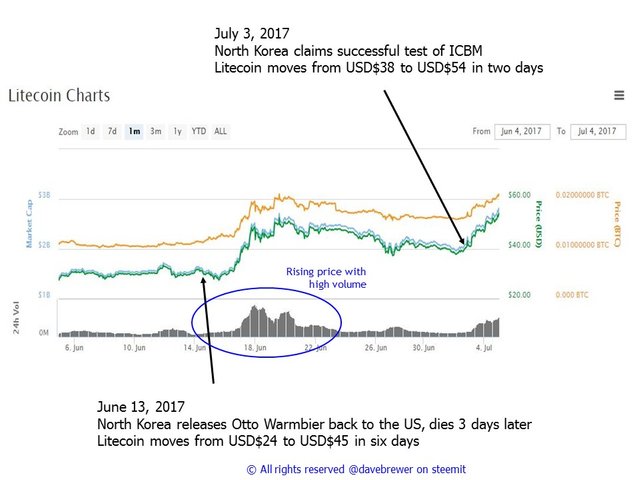

The final set of data focuses on litecoin price activity in late June and early July 2017. The Otto Warmbier incident and President Trump's tweet response resulted in litecoin almost doubling in under a week. North Korea's successful test of a multi-stage ICBM capable of reaching the US mainland was announced on July 3, 2017. This caused very significant price increases in just two days.

Litecoin prices increased by almost 50% in a period of just two days. Volume was much stronger than normal.

Why the switch from analyzing bitcoin in the first two sets of data, and then analyzing litecoin in the second set of data? Bitcoin appears to be range bound and have limited upside potential until the upcoming SegWit concerns are resolved. There remains considerable recent concern that bitcoin could end up splintered across two blockchains. These concerns are unlikely to be resolved before August 1st. Whereas bitcoin was perceived as providing appropriate "safety" for investing or storing value six months or more ago, that is no longer true at this moment.

In contrast, litecoin has already moved beyond SegWit concerns based on a successful implementation being in the rear view mirror. Litecoin appears to be perceived as having less technical risk than bitcoin at this moment.

The majority of buying and upside pressure on litecoin over the last two days has been coming out of Korea and China. Volumes are extraordinarily high from these two countries, per data from coinmarketcap.com.

These results are explained by the hypothesis that many people in these countries are worried about how the rising tensions between North Korea and the US will be resolved. President Trump has shown a resolve and willingness to use military force in a way that his predecessor never did. A preemptive strike by the US on North Korea cannot be ruled out with the current administration. Likewise, although suicidal, a preemptive strike by Mr. Kim on South Korea or Alaska can also not be ruled out. Either action would then draw China into the dispute, with unknown outcomes after that. Could tensions be ratcheted down and the situation brought back under control after a preemptive first strike by either side? Or are we at the beginning of WW3? If you were living in Korea or China, you would be very concerned about how this dispute will be resolved. You would be worried about your future and your savings.

It is much easier and faster to move a portion of your life savings into litecoin (or bitcoin or other altcoins) than it is to move from fiat currency into the traditional long term store of value in times of crisis. Precious metals, such as gold, silver, etc. are more time consuming to purchase. You also have to take physical possession of the metals and then store them securely to achieve best confidence on using PMs as a store of value in times of crisis.

Conclusion: the data demonstrates that bitcoin and litecoin are now perceived and are being purchased and used as long-term stores of value during time of crisis, in a way similar to how precious metals were previously used. This should provide some confidence to those who would like to invest a portion of savings into bitcoin, litecoin and altcoins as a diversification strategy. Altcoin prices are not highly correlated to other asset classes which makes them attractive for diversification. The altcoin asset class has technical risk which does not exist with physical bullion or other hard assets, but does provide many interesting benefits that are not available with bullion and other hard assets (e.g. low transaction costs, ease and speed of transactions, etc).

If you find this article or others in this series interesting, please resteem or upvote if you would like to see the series continue.

Not Your Parents News provides original content that is currently only available on steemit.com

Season 1, Episode 3. Not Your Parents News

STEEM On !!

Dave

References from your parents news are included below. All images from coinmarketcap.com

Dec 12, 2016

North Korea simulates special forces attack on South Korea's presidential office

https://www.nytimes.com/interactive/2016/12/22/world/americas/trump-nuclear-tweet.html

Dec 22, 2016

Trump’s Nuclear Weapons Tweet, Translated and Explained

https://www.nytimes.com/2017/01/02/world/asia/trump-twitter-north-korea-missiles-china.html

Jan 2, 2017

‘It Won’t Happen,’ Donald Trump Says of North Korean Missile Test

http://www.reuters.com/article/us-usa-trump-exclusive-idUSKBN17U04E

Apr 28, 2017

Exclusive: Trump says 'major, major' conflict with North Korea possible, but seeks diplomacy

https://www.nytimes.com/2017/05/14/world/asia/north-korea-missile-nuclear.html

May 14, 2017

North Korea Says Missile It Tested Can Carry Nuclear Warhead

https://www.nytimes.com/2017/05/21/world/asia/north-korea-missile.html

May 21, 2017

North Korea Fires Medium-Range Ballistic Missile

https://www.nytimes.com/2017/06/20/world/asia/otto-warmbier-north-korea.html

June 20, 2017

Otto Warmbier’s Death a New Wedge Between U.S. and North Korea

July 4, 2017

North Korea claims successful test of intercontinental ballistic missile

Good work here. Those news events could explain the price action partly.

Partly is the key word. I agree

STEEM On !!

Dave

Interesting approach @davebrewer.

There are many aspects that may be involved in the rise of the cryptos in 2017. A large part of it is pure economicly, at least that is what I think.

Another influence is the breakthrough of blockchain tech into the mainstream. More people get attracted towards cryptos that way. Countries like Japan moving fast forward on Bitcoin. That was a boost.

The far-east region of the world has also be known to be very innovative, embrassing new technologies fast. China had invented many things before the West caught up and claimed they (re)invented the wheel.

Litecoin is way ahead in taking innitiative in new technologies, like SegWit. Charlie Lee quit his job to go full time developing on Litecoin. That is taking initiative that shows Litecoin means serious business.

For many it is a safe haven for investments and life savings, even if it could drop to half in value with cryptos it is prefered over being left with zero in the traditional bankers money economy. My guess that is also part of it.

And my approach to it is that blockchain technology is an innovative system and people are starting to adopt it and intregrate it into their daily life just like they did with the internet and mobile phones. Cryptos are a huge part of that, offering an alternative economy.

This started to break through into the mainstream end 2016 and really rocketed in 2017. And where in the Bitcoin realm they fight over a bone, I think Litecoin was able to get it for dinner.

And maybe even Litecoin will become the crypto equivalent for gold instead of Bitcoin soon.

So, in some degree I do agree with you, as traditional economics, politics and fear do have an influence, how can it not have? But I think it has different causes. Yes, a change for the good even.

Thanks for reading, and taking time for a thoughtful response

You're welcome.

Congratulations @davebrewer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPUpvoted to help all Steemit users

Not even close. It's the collapse of the US dollar and global debt instruments. This is why we're up 250+% on BTC this year. Not any of this bullshit. Most crypto investors stopped listening to fake news many many moons ago.

"Collapse of US dollar and global debt instruments"

Sounds like your explanation is altcoins are an alternative store of value, other than US dollar, etc.

Congratulations @davebrewer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPInteresting article. I was about to post a similair post. The biggest group of uneducated investors in mankind get's a shot to determine the price of a crypto. It's an interesting world we live in. I really advice people to take a look at: https://www.coincheckup.com I'm really enthusiastic about this site, they let you analyze every single coin out there. On: https://www.coincheckup.com/coins/Litecoin#analysis For the Litecoin Detailed analysis