History of U.S. Income Tax

Although the United States was largely founded on the displeasures the colony had with the English king, specifically “taxation without representation” and mistreatment of our citizens, our country has evolved to institute a number of taxes to fund the social policies, wars, and other roles of government.

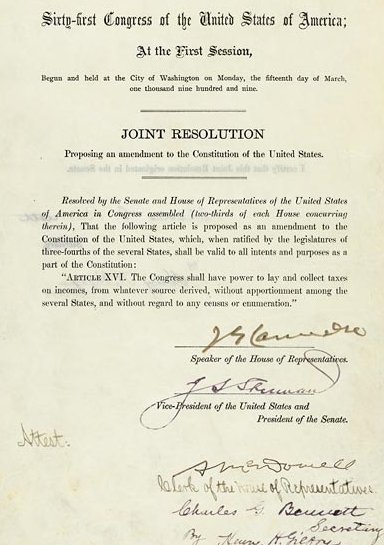

It was President Abraham Lincoln that initiated income taxes to pay for the civil war through the Revenue Act of 1861. Without it, America may have become two separate countries, with slavery lasting many more generations. In 1913 the 16th Amendment to the Constitution was ratified by 42 states, more than the required number, giving Congress the power to collect income tax.

New taxes were imposed to fund Americas involvement in WWI. After which the Great Depression hit, and the United States found itself in the most severe economic turmoil in our history. Unemployment raged and reached almost 25% of the workforce. New income taxes greatly helped the measures which pulled America out of ruin, by funding President Roosevelt’s New Deal programs like the Tennessee Valley Authority and the Works Progress Administration that created over 8 million jobs. Social Security was also instituted, as the United States was one of the only industrialized countries to not have some form of unemployment insurance.

The next big jump in income taxes went to fund WWII and the defeat of Axis powers. America’s military forces were weak, small, and untrained. The money and sacrifices were required to win the war. The world pulled together to overcome tyranny at great cost. The global community took a stand to not allow a repeat of WWI and WWII. Since then, our military has been strong and one of the best funded forces in the world.

href="

Nobody Likes Paying Taxes.

Then again, nobody like paying for groceries, gas, airline tickets, medical services, etc. The reality is that good and services cost money. We all like to have law enforcement and fire trucks arrive when we call for emergency services. We all like the benefits of roads, bridges, and trains. Americans expect forest fires to be put out and aid given during natural disasters. We want justice to be served when we become the victim of a crime and the perpetrator locked up in a jail or prison. Without government funding, we would not have lasers, phones, the Internet, or be exploring space. We like our food and medicines tested for authenticity and safety. Then there are the soldiers that protect our borders, freedoms, and interests by fighting overseas so we don’t suffer with war on our soil. There are costs to being a country. America, although fervent in independence, is more than just a collection of individuals. We are a nation. We invest in the future in a collective way, which results in far greater accomplishments.

Relativity of Taxes

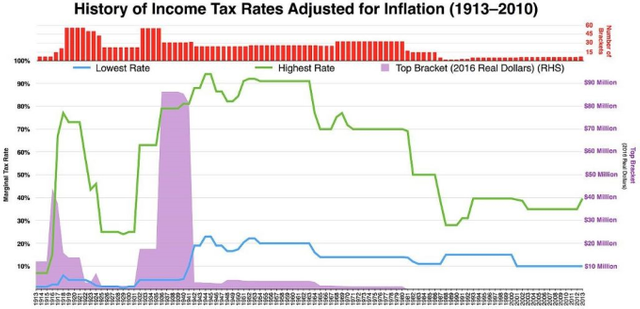

So overall, how much taxes do we pay? Compared to the past 100 years, Americans are paying low relative income taxes nowadays.

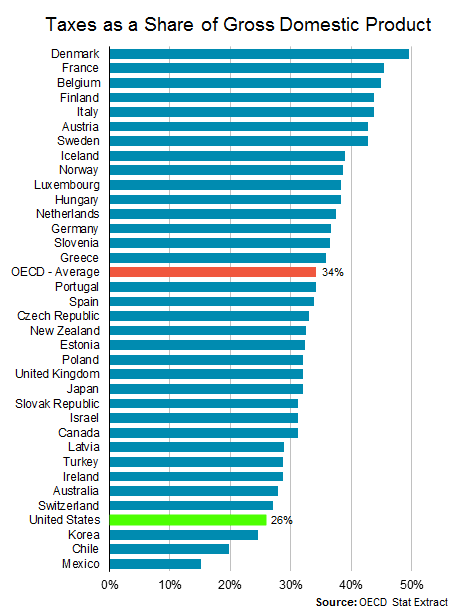

Additionally, the U.S. tax burden is low relative to other countries.

Overall, taxes are not fun. When we spend money at the store, we get an immediate and tangible benefit. When we pay taxes, they go towards the many thing we expect to be in place, but aren’t directly and immediately apparent in our lives. There is a disconnect, but that does not devalue the purpose. When we look at the history and numbers, Americans have kept pressure on taxes pretty well. There have been spikes, but the very document that allows for Income tax also grants freedoms to the people to scrutinize and elect representatives that control tax rates and how they are spent.

Image source:

Income tax is pointless. Call me communist but I really believe that society can be built on taxless foundations. It's a huge theory of social economy, but there are some examples in history how society worked without taxes. Nowadays capitalist foundations simply survive due to taxation. How can one economical system survive on that when thousands of people are going to debt slavery every day and is not trying to boost it's production capacities. Sorry, english is not my native language. I have wrote on this during my seminars in my native language. Especially on the subject: Third World Economy and why is it going to surpass Western countries in next 50 to 100 years.Thanks for this great article.

I think we owe it to ourselves and prosperity to look at all possible economic models. History is a great teacher.

One thing that I think is recognized, is that the United States was initially small in size and number of people, yet rose very quickly to become a financial, technological, entertainment, agricultural, and industrial powerhouse in just a few hundred years. That is amazing and largely due to free trade and freedom of individuals to choose their calling. It also creates a great disparity between economic classes and promotes monopolies that can further take advantage of customers. Every system has pro/con's. The key is to find the best that meets the communities expectations.

interesting summary.

So much to say about tax...

Steem on

I'm happy paying tax as long as I feel it's being spent right which unfortunately doesn't happen as often as I'd like!

I know the feeling! Lots of things that I don't agree with or think are a waste. But I know I am not seeing, and more importantly, appreciating everything my taxes do. To be honest with myself, I take for granted our military, roads, bridges, telephones, Internet, 911 services, etc.

Yep. I think most people don't realise what their taxes actually pay for and just feel like they are being 'robbed' when paying tax.

excellent POST.. DEATH and TAXES are for sure.

No taxation without representation. Income tax is a fantasy but if you don't pay it; you go to jail. Governments never learn.

Is this tax yearly or sales tax

Income (taxed yearly).

Taxation is theft. Taking from one individual and giving to another is an infringement of liberty.

What about taking from all who can afford it to provide opportunities, protection, and aid for the prosperity others and the community as a whole?

Better idea. We smash the current paradigm and allow people to create their own money. That way no one has to take from anyone. The top 1 percent have all that currency for a reason. The problem is the system itself and goes way beyond politics or finance.

And what happens when homelessness rises sharply, food supplies dwindle, economic unemployment goes rampant, roads and bridges fall into disrepair, monopolies gain in strength, and our military dissolves (like it did before WWI and WWII). Bad actors will rise. Tactically it sounds wonderful, for the individual, but in reality the national and global stabilization is greatly impacted.

By the way, after the revolutionary war, banks and cities did produce their own currency. It did not work out so well. People's life savings were wiped out, trade between communities was severely hampered, and the federal government couldn't fund roads between states and establish a military to defend our borders. History teaches great lessons.

Indeed, history does teach..not to side with tyranny....including financial tyranny. New ideas require patience and faith. We didn't have the blockchain after the revolution ;) so it is a brand new paradigm.

I totally agree with you there! New technologies and even more so, new expectations should drive us forward to a better future. Personally, I would like to see less big-government as technology and people become more involved. I am okay in contributing to the common defense, etc. But I also want assurances it is not wasted and that I have a voice where spending actually goes.

You forgot to mention 100% of US federal income tax goes to paying the interest on The Federal Reserve debt. All the services we use are paid for with state or other taxes. Money the federal government uses or distributes is printed out of thin air by the Federal Reserve Bank, and interest is charged on that "loan".

The national debt is tremendous! I think it is time we start reducing it, else we may end up like Greece.

Mathematically speaking... it will never happen. Unfortunately the US as most of the rest of the world's economies are headed for a collapse of unprecedented proportions.

It can happen if GDP rises sharply. But it would be painful to allocate that much to reduce debt.

The problem is the debt is ever increasing because The Federal Reserve prints the money out of thin air, and we are constantly charged interest on it. Its kind of like the USA has 7 maxed out credit cards and only a part time job at Mcdonalds. It is never going to happen. I wish it were not the case, but at this point we are beyond reprieve under the current Federal Reserve System anyway.

I believe the printing of money simply dilutes the value, thus increasing inflationary effects. Additionally, the country actually owes money to other entities. Think bonds, which there are holders (people and other nations) that we must pay interest to.

The Federal Reserve, and later FDIC, were established to stabilize the diverse U.S. banking system that was erratic (1907 was a bad year), reverse mistakes of the Great Depression, and keep national finances stable during World Wars. A lot of lessons were learned and the system has been modified several times, to become a largely independent body (to insulate it from politics and short term desires). Overall though, the U.S. currency is seen as the global pillar for international trade and finance. So, the system has done many thing correct. It is also heavily criticized for its power and relative autonomy. We should look at both sides when evaluating the several interacting federal financial instruments. There are pro/con's to that story and as always, there is room for improvement.

One way to look at the value of something is to understand the consequences if it ceased to exist. We would likely be in the greatest financial depression in history if the Fed did not act aggressively several years ago.

The Federal Reserve Bank was put into place to put the USA back into a position of permanent economic servitude and debt. It is not possible the debt can be repaid. In order for something to be a valid contractual agreement by law, something of value must be exchanged. The Federal Reserve bank (a private bank, not a government entity) prints money from nothing and then charges interest on it, therefore the debt is odious on its face. The Federal Reserve Bank created this problem, so I am not sure giving them credit for not totally collapsing a fraudulent system they created is appropriate.

This is the model for all fiat currencies, including crypto-currency. The value is in the belief of its users, not a tangible item (like commodity or representative currencies). The Fed created huge opportunities for a burgeoning America and contributed to the very economic powerhouse it is today. Look at any economic leading country in the world. They will have something similar, for the exact same reasons we have it.

There are problems and risks, as well as huge opportunities for improvement over time, but it would be unfair not to also recognize the benefits and contributions it has made to the historical growth and strength of the U.S.

It is surprising to me that US taxes are relatively low compared to other countries. Great read!

The whole thing is a giant ponzi scheme and ron paul will reveal them lol