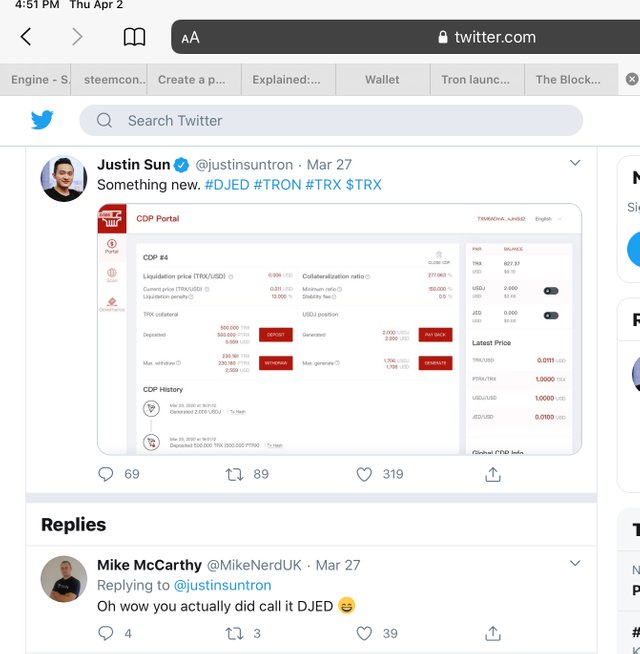

Mr. Justin Sun creates a new credit facility and stable coin DJED on TRON to compete with MakerDaO on Ethereum.

In big financial news for Tron Blockchain, Justin Sun, the founder of Tron (TRX), announced on March 29 the launch of Djed, a collateralized loans system that can be compared to the MakerDAO based on the Ethereum Blockchain. Mr. Justin Sun, CEO of Tron, has previously promised TRX community members a decentralized stablecoin be backed by TRX and the BitTorrent Token (BTT). The Djed name was suggested by Mike McCarthy, a Tron fan who describes himself as a TRX whale.

In the Egyptian language Djed is a word which means stability.

This was announced by Mr Sun on Twitter;

source

The Djed platform is currently live on the Tronscan.org domain. Djed is a Tronscan and not a Tron Foundation project.

The Djed is a credit facility, and as a lending platform, Djed uses Collateralized Debt Positions (CDP). Its users need to pay an interest rate called a Stability Fee on their loans, the amount of which is determined through by the Interim Risk Team at Djed. The Djed platform is said to be modeled after the MakerDao platform on the Ethereum blockchain, which is opensource.

This huge Financial News

source

Especially in light of the huge financial troubles caused by the recent 50% drop in Bitcoins price in a single day, the corresponding drop in Ethereum’s price, which triggered smart contracts on Ethereum to liquid the Ethereum collateral for hundreds of Ethereum backed loans, which resulted in the MakerDao selling hundreds if not thousands of Ethereum, which created huge downward pressure on the price of Ethereum and this downward pressure triggered more liquidation, whic triggered more Ethereum selling by the MakerDao. It was a mess. I wrote about it here link

For those of you who have never heard of the MakerDao I will explain in this excerpt from my article which I will put in quotes, so you can skip the material if you wish. Just look for the next 👉 symbol.

What is the MakerDao?

MakerDAO is basically a credit facility that issues loans with a certain interest rate called the stability fee against a collateral called Ethereum. The loans are paid to borrowers in Dai. Each Dai is worth one dollar USD. The stability fee or interest rate is raised to reduce selling pressure on the Dai and help keep it pegged to the dollar and vice versa. The DAI stability fee or interest rates for borrowers was 1%, but later the stability fee increased from 1% to 3.5%.

Who Controls the System?

The holders of the MakerDAO Token MKR token influence certain aspects of the protocol such as: What should the be the annual borrowing fee be (stability fee)?, How much collateral should be backing each CDP? (collateralization ratio) and Shutting down the protocol in the case of a sudden drop in the price of Ether or another situation (emergency shutdown)?

What does the MakerDao do and why are there so many transactions?

The MakerDao provides loans in Dai, against assets, mainly Ethereum and in some instances Bitcoin held by Bitgo.

For Example

If you deposit one Ethereum worth $150 USD in the MakerDao you can ask for a 50 Dai loan and 50 Dai is worth 50 dollars USD. Your asset, the Ethereum, is held as collateral and you get it back when you repay the loan. This process of depositing your Ethereum as collateral and getting a loan is known as collateralization. The ratio of collateral to loan is $150/$50 or 3:1. This is called your collateralization ratio. The minimum ratio is 1.5. If the price of Ethereum falls, your ratio will fall. Once the dollar value ration of your Ethereum collateral gets to 1.5 your Ethereum collateral will be liquidated or sold to pay back your loan.

Why Collateralize your Ethereum?

As an investor your rate of return on Ethereum is variable, for example if the price for Ethereum increased 5% in one month your ROI was 5%. If you owned $100 worth of Ethereum your 5% ROI was worth $5 USD. But what if you owned 10 times as much Ethereum? $1000 worth of Ethereum at a 5% ROI would mean $50 USD. If you had 100 times as much Ethereum your 5% ROI would be worth $500 USD.nSo to make more money, you need to buy more Ethereum. But with collateralization you can buy more Ethereum without having more money.

👉Now back to Mr. Justin Sun, Tron, Trondcan and Djed👇

Event Significance

I think we should pause for a moment to grasp the incredible significance of this event. The true beauty and utility of open source code is that it can be used as the base code for innovations. The Ethereum blockchain is considered the Legacy blockchain for smart contracts. The costs of transacting there include both Ethereum or Ether and Gas. There are other blockchains which use Smart Contracts and nonfungible tokens, similar to the Tokens used on the Ethereum blockchain for decentralized finance and other forms of Commerce. But the Ethereum blockchain is so famous, that it has maintained a lock or virtual monopoly on this type of commerce with most legacy industries preferring to expand to DeFi or decentralized finance vehicles on the Ethereum blockchain.

The irony of the situation is that if you look at the technological credentials of other blockchains like Wax and Enjin, they are setting the new software Token standards for this financial-technology niche. The latest nonfungible token developed by developers at Enjin over the last two years, has become officially accepted by the international Token standardization organization and has become the most widely used ERC Token for smart contract Tokenization commerce on the Ethereum blockchain. I hope you grasp the irony of this situation. Wax and Enjin were known as the home for gamers on the blockchain. But as they developed Tokenization technology to create unique tokens for game components their technological prowess was constantly tested by gamers, who understand how to exploit technological weakness to win games. Then when commerce entered the picture and gaming components meant money these software savvy gamers made Wax and Enjin “up their game”. This phrase “up your game” is an English idiom, which means the software underlying the Wax and Enjin Tokenization had to have the best security as gaming hackers are an informed and technologically superior group. They spend hours playing games and basically testing the software for weak spots as they play and trade. You can be assured that if they found any weak points they could exploit to make money, they would then spam those weaknesses for profit.

Forgive me, spamming a weakness is like a denial of service attack where you repeatedly engage the computer server entry point, but the purpose of this spamming is to repeatedly earn money from a weakness in the software. Which may be small, like five cents, but when you exploit it 100 times a minute it becomes five dollars a minute and 300 dollars an hour. I know these numbers sound crazy, but that’s how exploits are used, and once found, shared in chat groups. Then the developer closes these exploits and the gamers move on, testing the system for weaknesses. It is this environment in which software was developed, which was then exported to financial realms,, like the Ethereum blockchain. This my friends is capitalism at its finest, where the profit motive creates innovation. In Steem-centric blockchain terms you only have to look at the success of Steem monsters and Splinterlands to understand.

Thus Mr. Justin Sun brings this advanced technology to a blockchain not known for gaming, but for money making and for having millions of users. The potential on a blockchain where transaction fees like Ether and Gas are non-existent is staggering. I have previously written about the presence of Steem and SBD on the Steem blockchain and how Steem Engine uses customizable JSans, python language constructs ( I think) married to a single(?) smart contract template to offer infinite variability on Steem-Engine using python and java script developers, a much cheaper route then smart contract developers. Now that the multi-functional non-fungible Token has been perfected on the Ethereum chain and accepted as the new standard by the international token standard organization, that open source software could be brought to the Steem Blockchain , where transactions are free and a MakerDao or Djed facility could be on this blockchain.

Investors who understand credit facility do these transactions a lot of the Ethereum Blockchain, that’s why the MakerDao does Billions of dollars worth of business a day. This would create a large demand for Steem tokens as you must own Steem Tokens and resource credits which come with them to transact on out blockchain.

Transactions here are free if you own Steem. See info on that below under Resource Credits in the Post Credits🤞

This is a monumentous occasion because now that Mr Justin Sun has done this once on the Tron blockchain he can do it again here. Many of you might ask the question of why he would do that? Because it’s very profitable.

Stay informed my friends.

Written by Shortsegments, blogging for 24 moons on the Steem blockchain.

POST CREDITS

Articles on the MakerDao

https://steemit.com/hive-167922/@shortsegments/proposed-ethereum-makerdao-investment-model

https://steemit.com/hive-167922/@shortsegments/microsoft-quietly-making-cryptocurrency-history

Article on Resource Credits

https://steemit.com/hive-123507/@shortsegments/4qrz8q-what-are-resource-credits

RESOURCE CREDITS

Definition: Resource Credits are non-transferable credits given to each account based on how much Steem Power it has, which get “spent” whenever a user transacts with the Steem blockchain. This term is defined by it’s creators, the software developers who work for Steemit and publish information on their blog called @steemitblog .

What function do Resource Credits perform on the Steemit Platform?

They are a form of currency you spend to enact or perform transactions on the platform.

What are Transactions?

They are votes, comments, transfers and power ups. You pay or expend Resource Credits when you perform transactions or interact with the Steemit platform. Each transaction has a specific cost in Resource Credits, if you have enough resource credits to cover the cost, you can perform the transaction.

How much do transactions cost?

These are the costs I see on www.steemd.com:

comments 1,570,000,000

votes 282,000,000

transfers 259,000,000

powerups 259,000,000

If you don’t have enough resource credits you get an error message telling you that you are unable to perform the transaction or interaction. You should also be aware that the cost of transactions varies depending on factors that effect blockchain perform and the available supply of resource credits.

Articles on Justine Sun

https://messari.io/article/justin-sun-announces-djed-a-makerdao-lookalike-built-on-tron

https://www.theblockcrypto.com/linked/60246/tron-launches-its-own-makerdao-like-stablecoin-system

This very interesting.

It was very long, but please tell me if I understand this correctly.

You are saying that the technology to create a “credit facility” exists on Ethereum in the MakerDao.

We can use Ethereum we deposit in the MakerDao and this credit facility to borrow money to buy more Ethereum and the loans are secured by the Ethereum we already deposited.

So long as Ethereum appreciates faster then the loans interest rate, we make money.

We don’t need good credit, we just need Ethereum.

We don’t need to be “accredit investors” worth a million dollars?

We just need Ethereum.

This bank on the Ethereum blockchain increases the demand for Ethereum, which increases the price.

Justin Sun has replicated the MakerDao on Tron.

He could do that here.

Steem price could increase because investors could come here to make money because everything is cheaper here and transactions are free, no payment of Ether or Gas the tokens you pay to transact on the Ethereum blockchain.

The computer source code is all open source, so it’s legal to use the MakerDao source code.

We already have a stable coin SBD, we already have Nonfungible tokens, we just need developer support to install and modify the open source code here.

So we just need Mr Justin Sun to do here, what he just did on Tron?

Did I get most of it?

Thank you for your comment.

And thank you for the detailed reply. Yes you have understood the main points. I can tell you read some of the other articles. I appreciate that also.

!giphy thank+you

giphy is supported by witness untersatz!

I actually understood very little, but what I did understand looks very good to me.

Thank you for your comment.

!giphy thank+you

giphy is supported by witness untersatz!

I tried using DJEd the other day and it's coming back with some bugs. Takes too long to get the funds in. I'll wait and watch

Good to hear your trying it. I am curious if the pooled TRX function will help it , but we will see how volatility in Tron effects CDPs

I want to buy Tron, it’s listed in SE but there are no sellers. I wonder if we will be able to eventually but Trin in SE and invest in DJED?

Did this help Steem spike?

I think do, it’s big news. A credit facility is useful.

I think so too.

!giphy big + gain

giphy is supported by witness untersatz!

That looks like she is talking about a make member

Djed on arrival :)

!giphy solid+product

giphy is supported by witness untersatz!

Stable on arrival. It’s interesting the Steem spiked today.

I just checked the steem price.

How was it?

25% up.

Wow! Good News!

Good News.

It is now called JUST

which is only a little bit weird.

DJED to JUST?

So fast? It just launched and bane changed already?