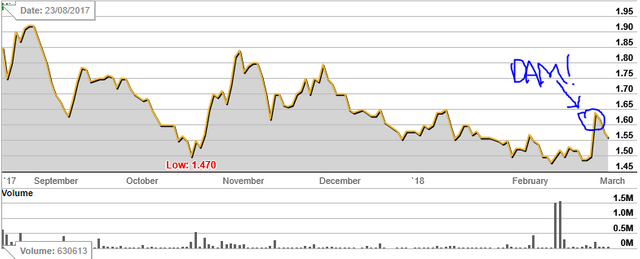

February Investment Report

February saw volatility come back to share markets in a big way. Ultimately my performance was disappointing (portfolio decreased in value), however I did make back some ground on the ASX200 which is somewhat comforting. At the moment my buying watchlist is very slim and my priority is freeing up some more cash. I currently only have about 3% of my portfolio in cash (a few dividends are on the way). I would be much more comfortable holding around 20-30%. I'm not convinced markets are priced well at the moment and I would like to be able to act on any opportunities that present themselves should a sell off occur.

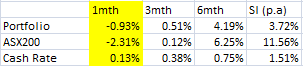

Monthly Performance ( 4/2/2018 - 4/3/2018)

Cumulative Performance

Most of my outperformance (vs ASX200 TR) can be attributed to the performance of ISX and the opportunistic purchase of Accent Group (AX1) the night before they released results.

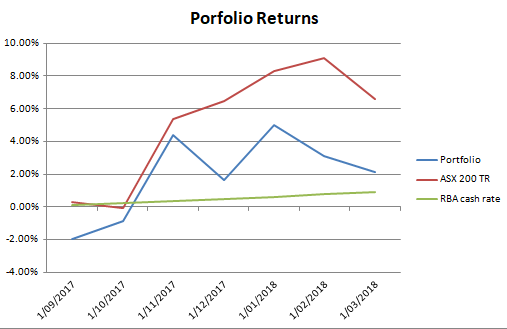

ISX:

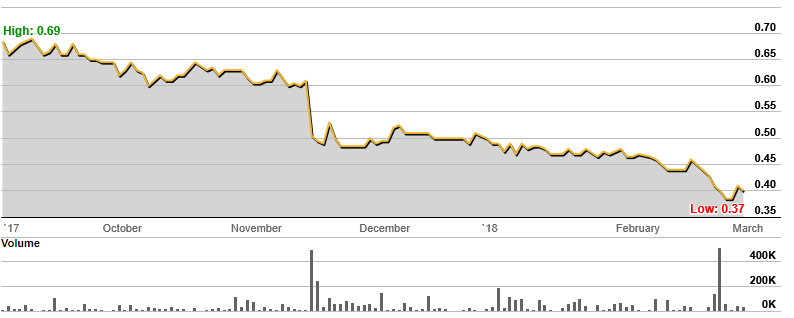

AX1:

ISX seems to be well on track to become cash flow positive within a year. I hope that my patience here will start to pay off. It does have a very large valuation to grow into and I would like to sell a small parcel on a surge.

I bought a small parcel of AX1 with the idea that their half year results would be good and that more acquisitions and brand expansions are likely imminent. The results were good, and I am still confident some more good news is on the way. I think the valuation is still attractive considering that high single digit growth is achievable into the foreseeable future. I'm not convinced Amazon will cause these guys too much trouble. I have a price target of at least $1.30 here.

Some stocks that detracted from my performance were Healthscope (HSO) and Ramsay (RHC). Both had underwhelming results and concerns over future growth prospects. HSO is testing my patience and I do find myself wondering whether it might be a good idea to cut my losses (ave price around $2.4) and fold the money into Ramsay or just bolster my cash balance. My thinking is that if HSO does begin to grow profits in a meaningful way heading into 2019 and beyond then it is more than likely that RHC will as well. RHC has a long proven record of consistent growth and a more diversified business geographically, meaning that it is probably less risky. RHC is very much a bottom draw investment for me. I need to do some more research in relation to HSO and the sector in general and decide my course of action.

Changes to the portfolio:

PTL- Sold out here before results for a decent loss at 46c (ave price~ 58c). So far it seems to have paid off, it's now trading around 41c. Interestingly a director has just bought a substantial amount after half yearly results were released. I will keep an eye on this one however but it would have to be at an absolute bargain of a price given the tough operating environment it is currently in.

WND- Waited until after results were released to hop in .....Crap. Up 10%. I wish I trusted my gut a bit more here (see earlier posts), I got a small parcel at $1.65 after suffering from FOMO. I am interested in doubling up if the share price continues to decrease. I'm a big fan of this one.

Buying Watchlist:

WND- like it, looking to pick up some more on weakness.

CASH/CASH equivalents- getting nervous about markets at the moment and I currently will not be able to capitalize on any sell offs because I'm only holding around 3% cash.

Selling Watchlist:

HSO- need to do more research here and make up my mind. Growth is expected by management heading into FY 2019 but I can't help thinking that Ramsay is the way to go in the private hospital space, even when you consider the premium valuationcompared to HSO. I think Ramsay's out performance of HSO will likely continue.

WMK- In a bear market it is likely the discount to NTA will fall and I will get some reward from this position, in recent times performance has been terrible. Even though they use a market neutral strategy they should be able to make small gains in a bull market even if it is only 2-4% p.a or at least break even. I just have to be patient here. Still hoping to do well out of this one. Hopefully they lift their game and this trade doesn't become an absolute stinker.

WLE- Looking to decrease my holding on strength and a premium to NTA, but in no rush.

Overall Investment allocations:

Investment Portfolio: 84%

Acorns Portfolio (conservative): 16%