My BEST Investing Advice Today!

My Best Advice For Investing Today

^^For me this is about "doing the right thing." Right now, I'm going to help you protect yourself as an investor.

Let me start by saying right off the bat: I'm not selling anything. You'll find no affiliate links here, or products that I'm paid for at all. I'm a pilot by trade; drone enthusiast; father, and self directed investor. I'm going to recommend some things - but none of these tips reward me in any way. I spend a lot of time chatting with other pilots I fly with. We share ideas. I have decided to condense these ideas on Steem, so that they can be referenced, recorded and shared by the general public. I plan to continue this series, so follow me for updates.

1.-I haven't see a bull market like this since 2000.

There's no denying that markets are HOT RIGHT NOW. Emotions and hype are running high. Half the folks are scared of the next crash - while the others are jumping into everything. Either of those approaches is a mistake. I made several poor choices in the past 20+ years of Investing. It wasn't until last year that I recognized these repeated mistakes and found some "anchors" to keep myself grounded with sound financial direction in this sea of emotion and hype.

2.-Examples of my mistakes you can learn from.

+Not using advice.

+Buying on my emotions.

+No diversifying.

The first mistake I made was on Microsoft back in the late 90's. I got in on the decline of the tech bubble when the stock was headed down around mid $30's. I thought it would not go any lower and I followed it down and bought more - losing half. Three things: You don't know what the bottom will be until the entire market has collapsed. Don't buy multiple times on the way down. Don't put your eggs in one basket. I was enticed by Microsoft. It was HOT! It was the stock to own. I bought it on emotion. Paying for some sort of advisor or newsletters could have saved me.

The other one was oil & natural gas in 2009. We saw stocks plunge in 2008; oil and gas spiked, then fell after that. At that time, we had heard for years that we would eventually run out of oil. OPEC controlled prices forever and there was no reason to think that it wouldn't spike up again because of the Saudi's influence. So, I bought a lot of oil and gas ETFs, ETNs at about $20/share (they had been $150/share. How could I go wrong? Today, they are worth $4.60/ share and my 401k administrator forced me to liquidate the Natural Gas at a huge loss because it was an MLP structure. I'm sitting here 10 years later on $20k of losses (not including natural gas) waiting for it to go back up. I bought it on emotion - what I "thought" vs. what a professional advised. I also didn't diversify. About 1/3 of my brokerage dollars in my 401k was oil & gas. ETF's and ETN's don't track oil barrel prices linearly. That was the other part of my mistake. I had no advisor service. Now, we have a ton of oil under the Dakota's!! Who'd have thought??!!

Rather than bore you with more loss stories (there are more - just not as high) - I'm going to address our current economic situation and how you can limit your losses. You can reap the benefits RIGHT NOW. But you've got to get in quick.

3.-The Facts We Know Right Now...

+Investors are at an extreme buying mode.

+The markets are still climbing.

+Cryptocurrencies (Bitcoin, alt coins) are HOT investments.

+What made sense before - no longer applies!

People are buying virtual, intangible assets & stocks. Facebook's IPO was irrational to me. Who would buy a stock in a company that was literally virtual and had no tangible product that you could put your hands on? I didn't buy it. This told me that investors were buying on pure emotion. I didn't fall into it. Although, Yahoo and Google had preceded them. But at least they provided services and some physical tech projects. Next, Bitcoin. It's not even physically present! If the plug is pulled on the internet (think EMP, or complete cyber-destruction) - no virtual stock or currency will exist. With just those two examples, the old school rules don't apply anymore - with the exception of "not having all your eggs in one basket". The plug gets pulled, you lose it all. Better own some physical investments (gold, silver, real estate, etc).

Should you buy? Or, should you have more in cash in case of crash? Right now, you should be buying still. It's not over yet. But, you should have something in cash for the buying opportunity when the next crash happens. I'm a believer in diversification. Some cash, some gold stocks, physical silver and gold, dividend paying stocks, crypto currencies - all should be present.

4.-The Best Thing I Did In My Entire Investment Experience.

+Pay for some investment newsletters.

+Buy non-traditional investments.

+Buy small amounts of everything in many sectors.

Two years ago, a pilot friend of mine led me on to a couple newsletters. My fiend has been very successful and is always on the leading edge - before hot investments became common knowledge. The things he spoke of made me nervous - but he was making huge returns. So I decided to try one of the newsletters. Although he had paid thousands for a couple of these, I found a less expensive versions from the same sources.

Let me start by saying, "there are going to be people out there who claim to have had a poor experience with any advisor service." I don't care about the past, because we've learned to move on and things can improve after a rough patch. With that said, let me outline the tried and true services that I can attest to keeping me lined up as a focused, educated investor. Once again, I am not an affiliate - I simply use these. They don't need affiliates, because they have word of mouth recommendations like mine!

**I signed up with Stansberry Research about two years ago. Porter Stansberry (you can Google him) is the founder. Http://www.stansberryresearch.com #stansberryresearch

**Another Stansberry colleague- Dr. Steve Sjuggerud - is one of my favorites called Daily Wealth & True Wealth Systems.

**Number 3 is by Dr. David Eifrig - Retirement Millionaire & Income Intelligence.

Finally, Gold Stock Analyst, (http://www.goldstockanalyst.com) by John Doody is where I get my gold stock info from.

**TradeStops is a stock tracking service I use to keep tabs on trends of all my stocks. It's automated to notify you when something stops out on a trailing stop loss, or when there's an entry signal. Www.tradestops.com

I pay about $99 to $500 each, per year. I have recouped those fees many many times over. My 401k brokerage portfolio went from about 25 stocks (that were "crowd favs") - to about 80+ that most haven't heard of before. I'm sold. These guys' cumulative advice is so diverse and ahead of the game, that I don't buy anything on my own impulse anymore. I also sell when they say sell. Without these services, my portfolio would be the same old boring mutual fund pile.

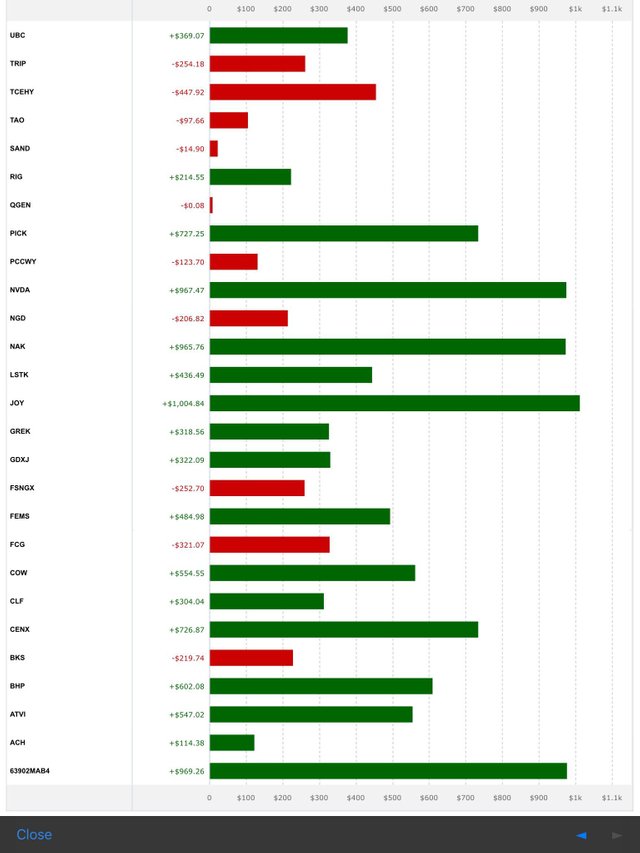

I know it's scary to plop down $500 on a newsletter or advisory service, but think of it as insurance. Also, while we are in a bull market, you WILL get more than your money back if you do exactly as they SAY. Timing is everything- and their timing is better than mine or yours. I made back many more times the amount I paid for the newsletters.... see below. This is just through June. Don't laugh, I am not rich - but my 401k (now 16 years old is doing great). Thanks to paying attention to the above resources.

In my next installment - I'm going to explore and share my experience with #bitcoin and crypto currency mining options and purchasing. After that, I'll explain a little more about how the gold stocks work and the other newsletters function. SO, please follow me and I'll follow you. If you feel I've been useful, please upvote. I've got a lot more to share during this bull market!!

thank for the investment advice, will take in into consideration, followed

Great post! Looking forward to your next post. Followed!

That is a lot of information! I have been doing a lot of research these last few months on investing and developing my own style of investing . You sir have just put some new tools in my capable hands and for that I thank you keep up the hard work I will be following you!

Great! Glad I can share it. I'm working on a Genesis Mining/cloud bitcoin mining article next... stay tuned. Those newsletters I mentioned are worth it. Turns out - Steve's newsletter (True Wealth) is only $99. Tradestops - I paid only $99 also!!! The GSA one is more - like $399. But all worth it so far. Got my money back thanks to them.