Sanakoev Letter 7

Hi Fellow Steemians,

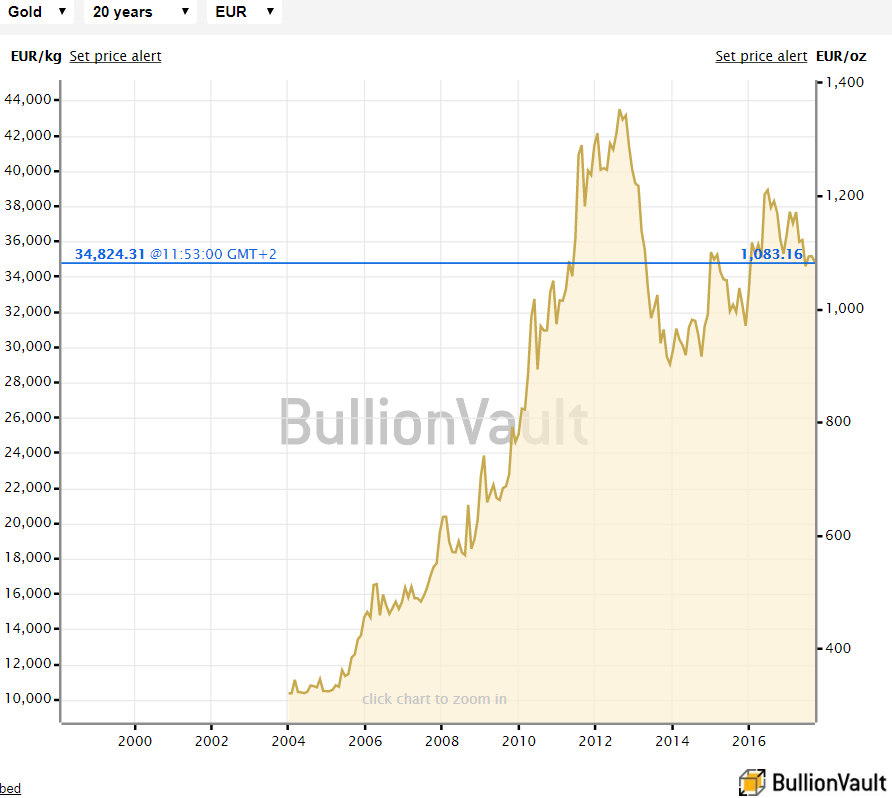

This post is about the importance of owning gold. Below you can see the long term (spot) price chart of gold in EUR per kilogram.

What are reasons to own gold?

- The richest nations in the world are the most indebted, and the easiest to pay off a part of these debts is to revalue gold upward. Another way is to print money, which will also benefit gold.

- The typical gold allocation in a pension investment fund is about 0.1%. Increasing that to 0.2% will make the gold market explode (the entire gold mining market cap is smaller than the market cap of Apple).

- Every asset in the world is in a bubble (bonds are in a 35 year bubble, stocks recently surpassed the tech bubble highs), so there is no much room to hide, except maybe in fiat currency and in gold or other commodities.

- Gold is a hedge against politicians making mistakes and central banks making policy errors.

- Central banks have been quietly accumulating since 2009, yet they reassure us that gold is a relic of the past.

- Got your interest? Definitely read the following in-depth report: https://www.incrementum.li/en/journal/in-gold-we-trust-report-2017/

What are downsides of gold?

- It's hard to get it through customs controls at airports

- It doesn't pay dividends

- It is not used for daily-life payments

What are the options to invest in gold?

- "Paper" gold (bank IOUs backed by gold): not recommended at all for long-term holding

- Physical gold (coins and bars that you can hold in your hand, no counter-party risk): to be kept in a safety deposit box (preferably in a safe jurisdiction),

- Gold mining stock/equity: leveraged play on the gold price, but at least you don't need a safety deposit box (the stock is kept at a custodian your bank or broker cooperates with, your assets will be frozen if the bank or broker goes bankrupt, but your assets won't be lost)

- Physically-backed gold products by reputable companies, for example Sprott's Physical Gold Trust (ticker: PHYS)

- Leveraged plays on gold miners, for example https://finance.yahoo.com/quote/JNUG/ , not suitable for long-term holding, only for day-trading

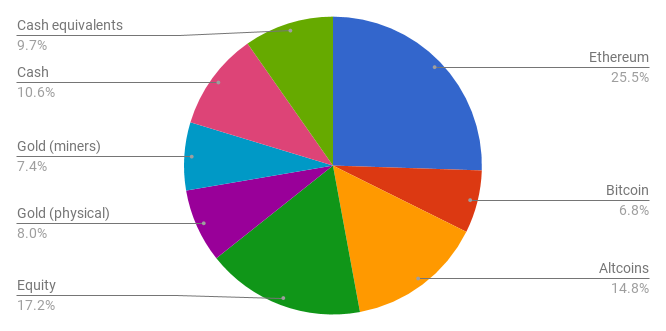

As with all posts about investments, such posts are not worth much if the author doesn't put his money where his mouth is. Below you can see my portfolio, to gauge the size of my gold position:

.png)

I started building my gold position years ago, and have been increasing throughout the years. On Monday, I am going to invest cash to increase my gold mining position by 2%:

.png)

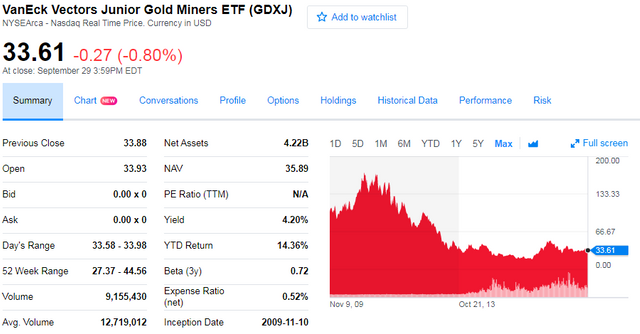

The specific asset I will buy is an ETF of junior gold miners and explorers, which appears to have made a multi-year bottom:

Of course, there are no guarantees that this trade will lead to financial gains. I am not a financial adviser, etc. and so on. :-)

Happy investing,

Sanakoev

you are a good writer..

Thanks!

Gibbe da bullion.