My TIMM Trading Pit Commentary - Wk Of 2/11/19

TIMM (Traders’ & Investors’ Mentor Market) provides the tools analysts need to share their insights in a central location, TIMM becomes a market where traders and investors can shop for the insights they’re looking for.

The Trading Pits are, in some ways, the main meeting place for TIMM. Here you will see folks sharing insights and asking questions about markets.

Commentary from this past week includes:

Gold just hit a 4 hr supply zone, if the trade is going to work, will need help from the US dollar, meaning it must get stronger.

I don't trade copper, but here was a nice set-up I saw yesterday on the 4 hr chart that hit the supply zone this morning.

Stopped out of oil trade, equity markets are breaking down.

Went long oil, need some help from the equity markets if trade is going to work out.

Price fell from that Nasdaq 100 4 hr supply level, I pointed out yesterday.

Two 4 hr supply levels I'm looking at on the Nasdaq futures...I need to see the turn though.

Bonds back down at a 60 min demand zone. But not a good idea to go long, level no longer fresh and the price didn't make a new higher high.

The Euro bounce off of a 4 hr demand zone...this was a great set up because the price level was outside of the extremes....the curve as I talk about in my post.

Farting around, just missed my trade set-upon the Nasdaq 100 futures.

Here's that zone on the Aussie dollar I talked about last week, working out as planned.

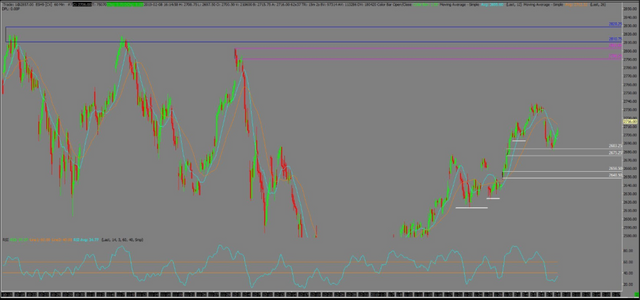

US-China trade talk optimism, levels on the S&P 500 I'm looking at are the following:

Japanese Yen broke out to the down side from some consolidation last week. There is room to move down further, looking for a pull back to a 60 min supply zone.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

It seems as though a topping trend is building despite the recent bounce in equities and while most of it is due to uncertainty, most can become realities fairly quickly. I am surprised we have yet to see a secular shift into defensive names yet.

Posted using Partiko iOS

Watch the 2800 level on the S&P 500, that's the next level where price might turn.

Congratulations @rollandthomas! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard: