Why You Should Allocate To Commodities

My last investment post touched on why I think the melt up remains intact for cryptocurrencies. Now I will go into more detail on why I believe commodities offer us considerable upside in the years to come, as well.

In light of the recent market pullback, it seems the narrative of the Fed Put is diminishing in its power. Pundits and analysts who have known nothing but decreasing interest rates and a 30 year winning trade in bonds are slowly awakening to the fact that their job is about to get much more difficult.

Rather than simply parking assets in bonds and stocks and letting the Fed’s stimulus provide you with a free lunch everyday, fund managers and analysts are now going to begin searching for ways to capitalize on a dynamic, changing, unprecedented market setup.

These are all questions worth asking. Yet, how does one position to profit from these stories unfolding? Well, like you, I have no clue what is going to happen, and unless you have a friend with a crystal ball, you’ll have to make an educated guess.

Here’s mine:

While it’s impossible to tell where markets go from here, I have a difficult time finding an argument against commodities going up. There is simply too much in favor of this trend playing out over the coming years, which will see commodity prices increase materially compared to where they are today.

Some of these trends are:

- Inflation

- Increase in Trade Wars (see tariffs)

- Fixed Income Blow Up (bonds are scary)

- Reversion to the Mean

- Already in an Uptrend

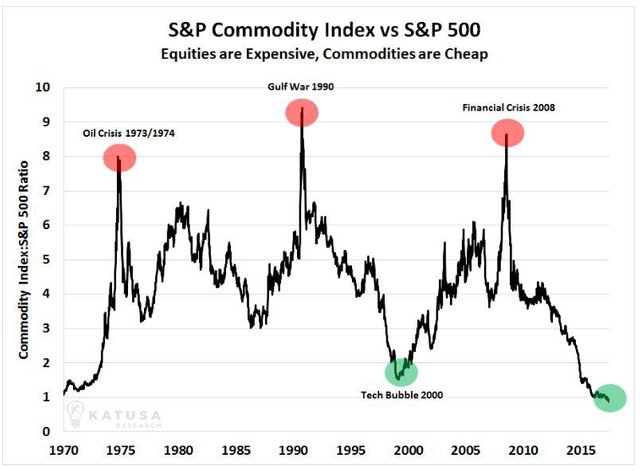

Some may look at the chart above and say that the ratio does not matter because it could mean that equities are so severely overvalued that the ratio is skewed. I agree, it is likely that the ratio is at an outlying extreme because equities are artificially expensive, while commodities are undervalued. So, while equities are likely to come down in price, commodities are also poised to appreciate.

From an absolute sense, it is tough to tell where commodity prices go from here. Yet, from a relative perspective, commodities relative to equities (and bonds) are set to outperform handedly over the coming years.

Something else to keep in mind is capital flight. It’s likely that capital will have to flee bonds, and possibly equities, once the liquidity within the market dries up (see LIBOR). With rising interest rates, risk assets take a hit because their relative performance diminishes when once can simply attain interest holding cash.

Speaking of cash, pay close attention to the strength of the US Dollar. As the dollar weakens, commodities are set to fly higher. However, once the dollar inevitably strengthens again commodities weaken, as investors are more inclined to hold an appreciating dollar rather than converting weakening dollars into physical assets, like commodities.

While the strength of USD is the single most important driver of commodity cycles, this cycle has other things going for it. Commodities relative to equities are at all-time lows. Bond markets are saturated with central bank stimulation, and the 30 year complacency trade in bonds is done, so capital flight from bonds seems a reasonable expectation. This capital will most likely flee bonds for equities or cash, yet the value of cash is weakening. So, it will then look at equities and realize that equities are extremely overvalued (i.e. FAANG, blue-chips, Boeing, defense, etc.) real estate is overvalued, and ultimately, realize the only place left for it to go is commodities.

I will not recommend any stocks, but some of the trends already underway within the commodities space are the following:

- Uranium

- Battery Storage

- Electric Vehicles

- Copper

- Vanadium

- Gold

- Silver

- Soybeans

Do your own due diligence, but I highly recommend any market participant get their allocation to commodities covered over the coming months. Depending on your risk appetite, I recommend you research ETF’s that cover commodities and speculate on miners, suppliers, and other ancillaries to more specific trends within the commodities umbrella for more leverage.

It’s healthy to mention that while this trend may go on a short-term run, I am getting into this trend on a long-term investment horizon. Longer term timelines increase the likelihood of success, as it gives the narrative more time to play out, and in general, markets tend to go up. It also does not hurt that, as a species, we grow in population and consume increasingly more in commodities and raw materials, and the cyclical nature of commodities creates underinvestment that leads to overinvestment, creating lots of wealth in between.

"I laugh, that there's a certain kind of cyclical nature to life and that I don't have to worry because whatever isn't there right now, it's coming back again." – Walter Mosley

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

I'm glad someone on Steemit has actual investing acumen besides buying cryptos only! Yes, I like the chart of commodities at the all time low now and during the tech bubble. Equities are heavily overvalued. Yes, bonds may be overvalued now and people could fly to commodities as a safe haven. However, in the past during market turmoil, people flood to dollars because they are stable (in the short term), and people need dollars to pay off their debts. Having said all of that I have investments in gold, silver, and oil. The breakdown of my portfolio right now is about 33% Commodities, 33% Cash, and 33% crypto. I own 0 equities for all the reasons you stated. Keep up the great work! I will follow you.

Your allocation strategy is travelling along similar lines as my own. You are right, the USD is the traditional safe haven asset. However, a new narrative is emerging that I find very fascinating: the narrative that the USD and treasuries are no longer a safe haven (bond yields rising while USD weakens).

This narrative will surely be responsible for fleeing capital to wind up in other areas besides USD/treasuries, and I feel that currently undervalued sectors (i.e. commodities and cryptocurrencies) have a very high likelihood of receiving a generous proportion of this capital. Best time to position is before the flight takes place, which has arguably already begun and will only increase/accelerate moving forward! Glad to have you along on the journey @jfitmisc!

But what about during a recession. If the government doesn't print any money and the yield curve is flat and not ascending, then bond yields will go down and wouldn't bonds and the USD gain in strength? This causes deflation for a year or so, the USD went up in 2009 and commodities went down. I know - its counterintuitive. Do you have any links of this narrative changing?

You are right, a deflationary event (or panic in foreign markets) would cause capital inflows into USD/bonds driving yields down as they did during the GFC. However, much of this bond buying was the result of the governments directing their "printed" money into bonds (QE) , and it seems that the marginal utility of this strategy is greatly diminished - many focused on this call it lack of "dry powder".

While I do not necessarily have links on hand to show a change in narrative, it is something I have qualitatively been noticing over the past several months. It has everything to do with how the bond markets are being presented and how the US deficits are being emphasized that leads me to believe that confidence is weakening.

China is making some very bold moves and is setting itself up to directly compete with the USD Petrodollar hegemony. It is a rather gradual process and it requires China to over-leverage itself, but...

And beyond this, I have noticed a considerable shift in tone towards Europe and China, which is a direct result in changing confidence levels towards USD safe haven status. Some have even argued that Chinese bonds are attractive moving forward (I disagree), which is interesting to note just how much the narrative is changing. European bonds are even scarier.

Of course, on the longer term horizon the USD Petrodollar remains dominant, and should a deflationary environment emerge (which I believe is still a few years off, barring a Black Swan) capital will definitely flow back into US bonds/dollars because most market participants have this bias baked in, so in that sense it is a safe haven because it holds such a significant psychological place in the minds of the majority.

Currently, my thesis is that while the USD/bonds are viewed as the safest havens, they are no longer the absolute safe haven. This discrepancy leaves trillions of dollars up for grabs in other market sectors when it must re-shuffle itself accordingly. I plan on generating a post that goes a bit more depth into why I think although we may have inflation in the near term (1-3 years), the ultimate cycle turn may result in a serious deflationary environment (3-5 years).

No matter the case, commodities are undervalued and when they get to breaking out and ripping past new highs they have lots of daylight ahead of them. Definitely a de-risked situation to be investing in a sector of the market talking about bankruptcies/liquidations that we can confidently know will be around for decades to come. After all, who doesn't acknowledge we require raw materials and energy as a "modern" civilization? Especially one in which we are constantly evolving, progressing, producing, and consuming.