TIB: Today I Bought (and Sold) - An Investors Journal #493 - Gold Mining, Europe Technology, US Retail, US Banks, Social Media, Healthcare, Consumer Goods, US Media, Agriculture, Marijuana, Bitcoin

Markets bounce back on strong jobs report after a few tough China trade related down days. Trade action has been some value picking and some profit taking in Europe technology, in healthcare, in social media and in media software. Agriculture has not been kind.

Portfolio News

Market Rally

Market mood is a mix of value picking and technology momentum as earnings season closes.

The fear of recession seems to be receding maybe even until after the US election - funny to hear talking heads still talking about 2019 recession with 4 weeks to go.

Treasury yields are thinking that way with rates holding around the 1.8% level on the 10 year for a few weeks now

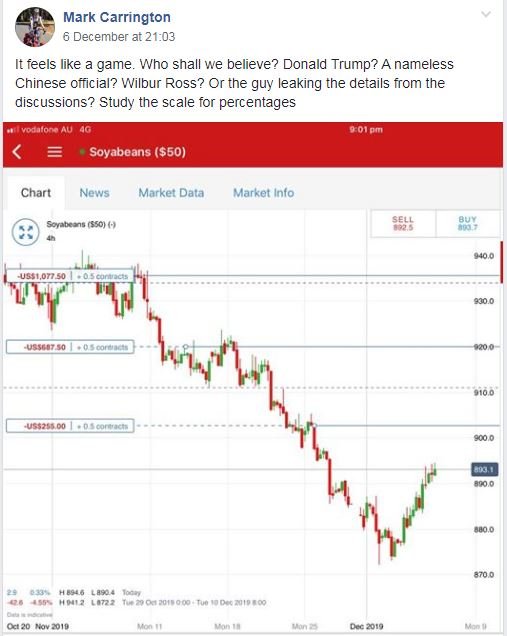

It is hard to know who to believe on China trade discussions. Markets wobble early in the week when Donald Trump says he can wait to get a deal until after the election. Then China says the deal is not on track and another official says it is on track.

I know from watching soybean prices that somebody inside the talks is leaking the data - prices react here much more reliably and rapidly than they do in other markets.

Bought

ETFS Gold Mine Index (AUCP.L): Gold Mining. Averaged down entry price in one portfolio utilising spare British Pounds. This portfolio will pay half of its proceeds to UK-based beneficiaries in Pounds. This trade hedges markets and Pound exposure. This is the 5th tranche purchase since April 2011 and is 3rd most expensive (i.e., two tranches were bought lower and are showing 75% and 47% profits thus far.) which shows the power of averaging down (especially on hedge trades)

The Bank of New York Mellon Corporation (BK): US Bank. Trade of the day idea on CNBC Market Zone. Bank of New York is a leading custodian bank. Its share price has lagged JP Morgan Chase (JPM) appreciably which in turn is outperforming S&P 500. Dividend yield 2.54%. Two charts showing how Bank of New York (BK - light blue line) has lagged the industry (SPDR Banks ETF - KBE - black bars) one from the 2012 lows and one from the 2016 lows.

The other laggard is Citigroup (C - blue line) in which I do hold positions. I have long closed out positions in the leaders JP Morgan (JPM - orange line) and Bank of America (BAC - red line) though I do have an open call spread options trade on BAC

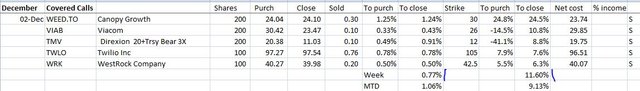

ViacomCBS Inc. (VIAC): US Media. Viacom and CBS completed their merger with holders of Viacom shares receiving 59.625% of the combined entity. I rounded up the number of shares to be divisible by 100 so that I can write covered calls on the whole holding. Dividend yield 1.77%.

Canopy Growth Corporation (WEED.TO): Canadian Marijuana. Price has showed some stability holding above $24 - added another small parcel in one portfolio.

The Clorox Company (CLX): US Consumer Goods. Price has proved it does not want to drop - initiated holdings in 2 portfolios in two tranches following Jim Cramer idea to add. He likes their positioning relative to US consumer with low exposure to China trade

Twilio Inc (TWLO): Cloud Computing. Price has recovered losses from earnings guidance. Added a small parcel to round up to 100 shares and then wrote a covered call.

Sold

Ditech Holding Corporation (DHCPW): US Mortgage Servicing. Ditech entered Chapter 11 for the 2nd time in October. Warrants issued at the first restructuring were cancelled when the stock was delisted this week. I had rounded up the holdings at that time (August 2018). Seems that the new team could not pull off a rescue - a lot of insider stuff happening I seem to recall.

Winning Call Spreads

A few winners banked in call spread land.

Amdocs (DOX): Media Software. With price closing at $69.30 closed out January 2020 62.5/67.5 bull call spread for 157% profit. I wrote in TIB435 that price is quite volatile around earnings and there were two earnings cycle before expiry.

The updated chart shows how price sagged through the first earnings (trade time is the start of the rays) and then soared through the second to make for a winning trade (new pink arrow is same shape and size as the blue arrows). Now there is scope for this trade to repeat the cycles as it has just reached the 2018 highs.

Lennar Corporation (LEN): US Homebuilding. With price closing at $59.80 closed out the call spread leg of a January 2021 47.5/52.5/35 call spread risk reversal for 49% profit. If I was to close out the sold put at current prices profit would be 121%. I will take my chances on price not falling 71% between now and January 2021 expiry. Trade opened in March 2019

UnitedHealth Group Incorporated (UNH): US Healthcare. With price closing at $280.19, closed out January 2021 250/280/220 call spread risk reversal. Profit on the call spread alone (250/280) was 48% and overall trade profit buying back the sold put (220) was 265% since February 2019. I chose to buy back the put as I am not comfortable laying out $22,000 for 100 shares (1 contract)

Profit taking

I needed funds in one portfolio (to fund the margin calls) - started to tidy up some small holdings.

iShares STOXX Europe 600 Technology ETF (EXV3.DE): Europe Technology. 16% profit since July 2012. While this is a profit it has certainly lagged US technology over the same time by a huge margin.

SAP AG (SAP.DE): Europe Technology. 33% blended profit since November 2018/January 2019.

JC Penney (JCP): US Retail. Took profits on tranche of shares bought in August 2019 for 82% profits (for tax purposes). This is not all a happy trade story with the 1st tranche bought in August 2017 at a much higher price - blended loss would be a 47% loss

Facebook, Inc (FB): Social Media. 7% profit since June 2019.

Agricultural Pain has come through the on-off trade talks

Corn Futures (CORN): Corn. Two trades closed for $9.70 per contract average loss (-2.4%). The losing trade was a margin call execution while I was asleep. I would not have closed.

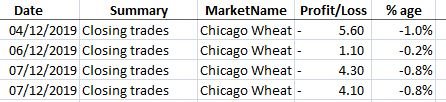

Chicago Wheat Futures (WEAT): Wheat. 4 trades closed for an average $3.77 per contract loss (-0.7%). Wheat has certainly been in the cross hairs of the on-off China trade discussions. I did put stop losses in place for these trades.

Income Trades

Written 5 covered calls at average premium of 0.77% and coverage ratio of 11.6%. Month to date premium is 1.06% at 9.13% coverage.

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. Two naked put trades expired in my favour (Dec 6). Replaced with a new January 2020 strike 26 put. This is working out as a tidy hedging trade - I collect a premium while I line up a possible entry price below the market.

Cryptocurency

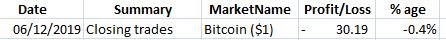

Bitcoin (BTCUSD): Price range for the week was $685 (9.2% of the open). Price traded up to resistance at $7761 with a bullish engulfing bar and then faltered. That bar contained the high and low for the entire week. Good news is that low was a higher low for the cycle from last week's test down to the level below BUT no higher high yet.

One trade closed - I started trading with stop losses to test a different strategy. The spreads are hard to make this work - I will switch to trailing past breakeven only.

Ethereum (ETHUSD): Price range for the week was $11 (7.2% of the open). Price tested down to support at $146 also with a bullish engulfing bar. Price then traded up off of support in a quiet week.

Ripple (XRPUSD): Price range for the week was $0.02284 (10% of the open). Price also made the low for the week on a bullish engulfing bar but then traded higher to make a higher high by 3 pips.

CryptoBots

Profit Trailer Bot No closed trades

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 22 trades on AUDNZD, EURUSD, NZDUSD, AUDCAD, USDMXN, USDJPY, CADJPY for 1.9% profits for the WEEK. Trades open on AUDUSD, EURJPY, EURUSD, USDJPY (0.12% positive)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

December 2- 6, 2019

Hi, @carrinm!

You just got a 0.4% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

@carrinm You have received a 100% upvote from @steemguardian because this post did not use any bidbots and you have not used bidbots in the last 30 days!

Upvoting this comment will help keep this service running.