Savvy Investors Are Quietly Rolling Over IRA and 401(k) Funds into Tax-Advantaged Bitcoin and Bitcoin Mining Contracts

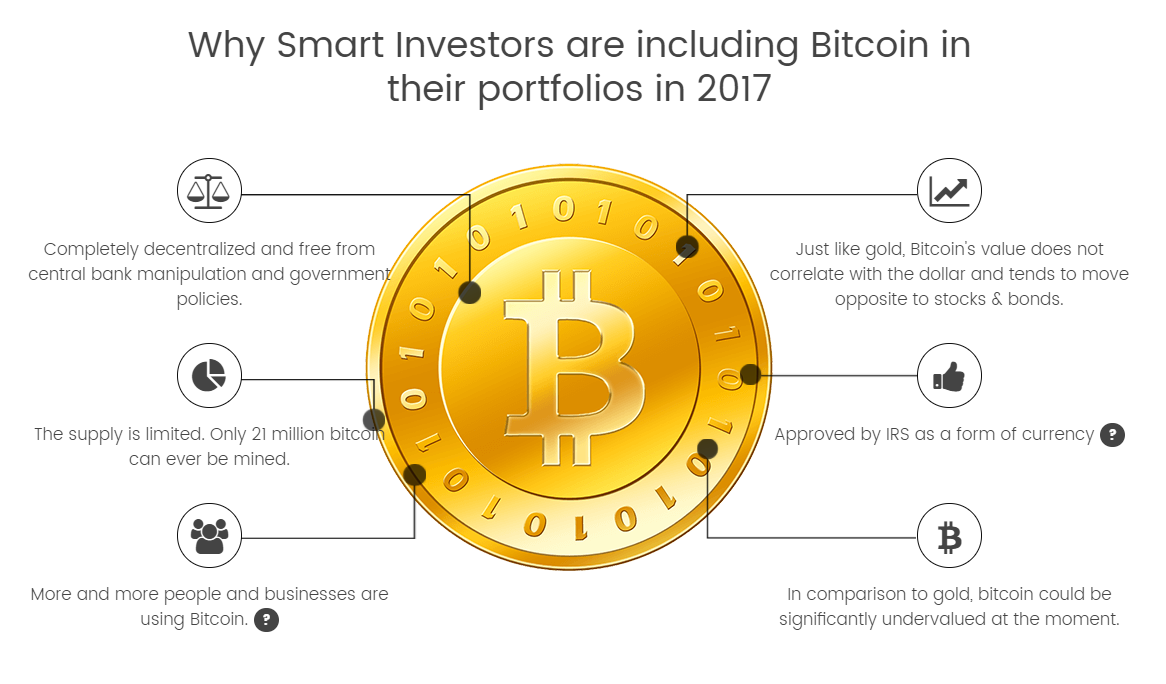

The IRS has ruled that virtual currencies, such as Bitcoin, may be held for investment in your qualified Retirement Savings Accounts. Click to view IRS PDF detailing their rules for virtual currency

If you own a Qualified Tax-Advantaged Retirement Savings Account, such as a traditional IRA, SEP IRA, 401(k), 403(b), TSP, etc. you might want to consider diversifying into this emerging asset class known as Bitcoin and Bitcoin Mining Contracts.

Notably, Market Cap in Bitcoin and other virtual cryptocurrencies currently exceeds $100 Billion.

What Does the IRS Say About Bitcoin Investments for Your Qualified Funds?

In 2014 the IRS ruled that Bitcoin or other cryptocurrencies as “…virtual currency may be used to pay for goods and services, or held for investment. Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value… it operates like ‘real currency’ – i.e., the coin and paper money of the United States or any other country…” IRS PDF detailing their rules for virtual currency

Taxes And BitcoinIn the same document, the IRS defined virtual currency status: “For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.”

This is a significant IRS ruling because it means that appreciation/depreciation of virtual currency is treated as a capital gain/loss event, as opposed to earned or ordinary income. https://www.irs.gov/uac/newsroom/irs-virtual-currency-guidance

In January 2017, the Government Accountability Office (GAO) issued a report providing guidance and clarity on the tax consequences of Bitcoin and other cryptocurrency investments. https://en.bitcoin.it/wiki/Tax_compliance

But, it took until late-Summer 2016 before a couple of IRA service providers for alternative investment vehicles realized the significance of this ruling, and began facilitating the purchase of Bitcoin and Bitcoin Mining Contracts as qualified investments to be held in IRAs, 401(k), 403(b), SEP IRA, TSP, etc.

Since then savvy investors have quietly been capitalizing on the IRS ruling; thus far they have rolled over tens of millions of dollars in qualified funds into this attractive asset class, whose value has surged in recent months, with no end in sight.

Investors may buy and hold Bitcoin for long term appreciation, and/or they may purchase Bitcoin Mining Contracts with their tax-advantaged funds, to earn generous, daily profits that they can re-invest within their IRAs.

Bitcoin Mining Contracts produce daily profits regardless of whether the underlying virtual currency has increased or decreased in value on any given day.

Along with enjoying the appreciation of the value of the underlying Cryptocurrency, Bitcoin / Cryptocurrency Mining Contracts produce consistent 10%-15% monthly returns on investment.

Bitcoin Mining Contract investors earn income based on their contractual terms. They also participate in market fluctuation of the underlying virtual currency. In January 2017, Bitcoin was valued at $900+/-. Today June 24, 2017 it is valued at $2450+/-.

Investing in Bitcoin or Bitcoin Mining Contracts within an IRA is no different than investing in traditional investment vehicles. They are assets that qualify to be held in Retirement Savings Accounts and their value fluctuates in the same manner as stocks and bonds.

Investing in Bitcoin, as a relatively new asset class that has surged in value in recent months, has captured the keen interest of those that invest in traditional investments such as stocks and bonds, hopeful of accelerating growth within their retirement portfolios.

Baby-Boomers love the ability to create ongoing income by investing in Bitcoin Mining Contracts that offer a generous stream of income, while simultaneously benefiting from Bitcoin appreciation.

The Gen X and Millennials populations are enamored with this new asset class because it “speaks their language” They have grown up in a digital world. They are very comfortable with anything “virtual.”

Investors that like to buy and hold are enjoying meteoric profits as Bitcoin increases in popularity with the big business, and governmental acceptance as a legitimate “currency” has skyrocketed.

While there is no legal difference in an IRA account’s status based on the investment, most traditional IRA providers only service stocks and bond investments.

To invest qualified funds in vehicles outside of stocks and bonds, such as Bitcoin and Bitcoin Mining Contracts (virtual, aka cryptocurrencies), real estate, businesses, mortgage notes, tax-lien certificates, private equity, etc., investors must transfer or rollover their traditional IRA to a Self-directed IRA with an approved IRA custodian.

Because income generated from businesses qualify as valid IRA investments, some investors have even included income-producing assets such as cattle and trucks in their Self-directed IRAs.

Approximately 33% of Americans utilize IRAs as a retirement savings vehicle. http://money.cnn.com/2017/01/24/retirement/ira/index.html?section=money_retirement

In a recent article the Wall Street Journal focused on the importance of 401(k) holders to consider investing “like the pros” in alternative assets to optimize retirement portfolios. While not specifically mentioned in the image below, one such asset class is Bitcoin and Bitcoin Mining Contracts.

How Do I Set Up My Self-Directed IRA?

BitcoinInvestment.news is a full-service facilitating provider that has contracted with the premier IRA custodian in the United States, who also specializes in digital (virtual) assets. The IRA asset custodian has partnered with leading digital currency service providers to offer an approved custody solution for those looking to invest in Bitcoin, Ethereum, Ripple and Bitcoin Mining Contracts.

These currency service providers utilize state-of-the-art encryption and authentication measures conforming to the most rigorous industry standards. Multiple keys protect against single-machine compromise or the loss of single keys.

Enhanced security features such as: kill switches, wallet freezing, 24/7/365 monitoring and 99.9% uptime protect against theft, which could otherwise result in the event of system compromise.

As an additional layer of protection, BitcoinInvestment.news is fully-insured, carrying $1 million dollars in coverage to safeguard consumers against fraud.

Although the IRS chimed in and issued its Notice 2014-21 directive to guide investors in virtual currency investments back in 2014, it has only been in the last 6-8 months that investors have become aware of this little-known asset class as a viable and potentially lucrative alternative to stocks and bonds. IRS PDF detailing their rules for virtual currency

Nonetheless, investing in Bitcoin and Bitcoin Mining Contracts is experiencing a meteoric surge, growing exponentially as more investors become informed and elect to participate in this attractive asset class.

Qualified investment account owners may choose Bitcoin, Ethereum, Ripple and/or Bitcoin Mining Contracts to be held in their IRAs.

Investors with 401ks through their employers may also be eligible to transfer funds into such IRAs under certain circumstances.

Investors from all walks of life are flocking to this attractive investment vehicle as a diversification within their tax-advantaged retirement funds. They all have one thing in common – they all wish to participate in the explosive growth of this asset class commonly referred to as Bitcoin.

Why Are Investors Interested Now?

The skyrocketing increase in value of Bitcoin and Ethereum has sparked the interest of more traditional investors. Bitcoin has almost tripled in value since January 2017. Notably, Ethereum has surged over 900% during that same period.

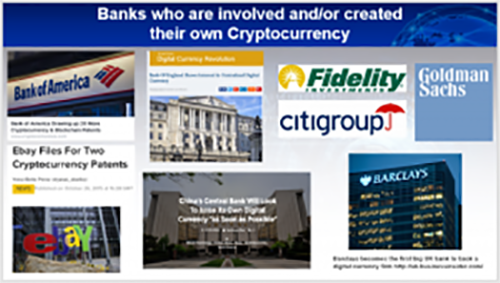

Banks Involved With BitcoinFinancial industry experts such as behemoth investment firm, Fidelity Investments’ CEO, Abigail Johnson is bullish on Bitcoin. Fidelity accepts Bitcoin for employee payment in their cafeteria at their corporate offices.

More recently, Ms. Johnson has announced that Fidelity Investments have recently purchased highly specialized computer equipment to begin mining Bitcoin. http://www.zerohedge.com/news/2017-05-23/fidelity-mining-bitcoin-abigail-johnson-says

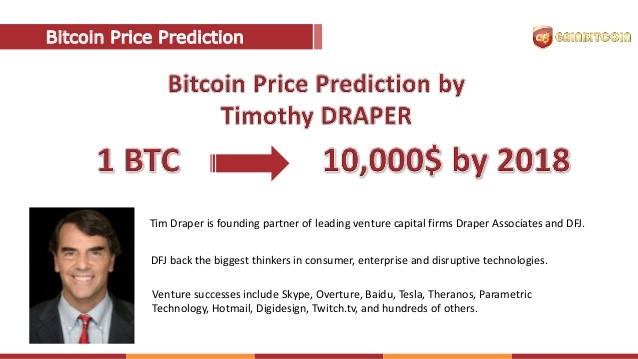

World-renown Billionaire, Venture Capitalist, Tim Draper predicts Bitcoin will reach $10,000 valuation in 2018.

Financial industry experts believe (Bitcoin) cryptocurrencies will one day soon be as commonly held an asset in IRAs as are stocks and bonds today.

Many countries around the world have declared virtual currencies as equivalent to their fiat currencies. The United States also recognizes Bitcoin as a legitimate “currency” and has placed it in a preferred status relative to taxation and investment.

If you travel to Europe you will find over 5,000 Bitcoin ATMs that have already been installed. In the United States, Florida and California have taken the lead with Bitcoin ATMs.

Cryptocurrencies such as Bitcoin and Ethereum are a well-suited asset class to be held in IRAs due to their deflationary nature, and their historical propensity to increase in value over time.

For more information on how you can roll over some of your qualified funds to diversify your portfolio into a Self-directed IRA where you can invest in Bitcoin or Bitcoin Mining Contracts please click the following link: Bitcoin Mining IRAs

Or you can call us:

Zaydee Rule

Virtual Currency IRA Specialist

(406) 518-1084