How To Retire Earlier A Baby Boomer’s Dilemma: Your Mind Says You Want to Retire, But Your Retirement Income Strategy Says, Not Yet…

We all know our retirement income strategy should begin in our twenties, but how many of us followed that advice? And, even if we did, how many of us chose the right investment vehicles to reap the rewards we desired for our future?

Many Baby Boomers are finding themselves falling way short of their retirement financial goals, and are now compelled to work into their late 60s, 70s… or for the rest of their lives.

Many of us are now seeking solutions to this problem, mostly to no avail. The good news is that it may not be too late for you, just as it was not too late for us. In the words of Sir Francis Bacon: Knowledge Is Power. But, it’s up to us to take-action.

Because not all investment vehicles are created equal, let’s compare three investment asset classes, each with a one-time $10,000 investment, all made in mid-2010. What would these investments mean to you in June 2017?

The investment vehicles we shall review are Gold, S&P 500 and Bitcoin. We shall also compare creating an immediate stream of income, versus the power of compounding at an accelerated rate, to dramatically reduce the amount of time normally necessary to achieve retirement objectives.

According to http://Investopedia.com June 9, 2017 “If you invested in gold in July 2010, your investment would have essentially stayed the same at this point. By May 25, 2017, your investment would be worth about $10,230. Gold, seen as a safe haven asset, has generally flatlined in recent weeks and months. On one hand, gold has performed exactly as a safe haven asset should: it has maintained its dollar value. However, a closer look reveals that this is not really true. In fact, accounting for changes in the market and for inflation, gold has actually declined somewhat in value. Can it still be considered a safe haven asset?”

Millions of investors buy gold in the hopes of increasing their net worth, and to augment their future retirement income. Sorry to say, but retirement would still not be a reality for those that solely relied on gold in 2010 with aspirations of having a nice nest egg in 2017.

Now, let’s look at the most popular asset class typically recommended by financial “experts” and “advisors: – the S&P 500. A one-time $10,000 investment “in a broad array of stocks from the S&P 500 in July 2010 would have done quite a bit better than one in gold. By May 25, 2017, you would have $26,037, according to data provided by Pension Partners.” Without a doubt, increasing your money by 2.5 times, in 7-years is not a bad return, but would this increase in your net worth provide sufficient additional income for you to retire earlier?

During the same 7-years, a rapidly emerging asset class astronomically outpaced both gold and the S&P 500. Did you know that investing $10,000 in this relatively new asset class in mid-2010 in Bitcoin would have had the highest impact by far? Your initial investment of $10,000 in 2010, “would have grown to be worth more than $309 million by late May 2017. While much of those gains have been achieved in the past few weeks, Bitcoin has continued a meteoric rise in price.” www.investopedia.com June 2017.

For instance, in March 2017 Bitcoin was valued at $900+/-. Three months later, on June 15, 2017, Bitcoin is valued at $2274.

“Kay Van-Petersen, the analyst who predicted the Bitcoin price going up to $2,000 now has another prediction, and this time, it’s even more astonishing. According to his newest prediction, the price of Bitcoin might even reach $100,000 during the next decade. If true, this newest prediction would mark a 3,483% rise” from today’s valuation. https://themerkle.com/bitcoin-price-continues-to-rise/

In fact, Bitcoin went from “a fledgling and largely unknown commodity in the early part of the decade to one of the most talked-about global currencies toward the end of the period. Many investors and financial experts see Bitcoin and other digital currencies as representative of a new trend in the financial world. As the earliest successful and most prominent of the cryptocurrencies, Bitcoin has garnered both the highest levels of attention and the largest investor interest, along with the most dramatic jumps in price.

That being said, it’s unclear if anyone had the foresight and patience in 2010 to invest $10,000 in the fledgling currency” www.investopedia.com June 2017.

Second ChanceOf course, most of us are not visionaries, nor do we have a crystal ball, so, don’t kick yourself for having missed that opportunity.

For the millions of us that did not foresee Bitcoin’s future popularity as a new asset class, here’s the question. Do we sit on the sidelines and continue to miss out on what experts and financial analysts believe might turn out to be the financial opportunity of our lifetimes, or do we jump on the train to make up for lost time, and accelerate our retirement goals?

I am a married Baby Boomer, and for us, the answer to that question was obvious… we were given a second chance, so we enthusiastically and gratefully jumped on that train!

Frankly, until we discovered Bitcoin, and an investment vehicle known as Bitcoin Mining Contracts, we did not think retirement was in our near future. And, the last thing we wanted was to rely on our children, for financial assistance, during our “golden years”, pun intended.

As the image above poignantly illustrates, there are 4 ways to accelerate the journey to financial freedom. In our case, we could not increase our income, since we were both already working as hard as we could for maximum earnings. However, that income did not allow for sufficient savings, or for massive investment. So much for options 1, 2 and 3! If we were to retire at all, our only hope was option 4.

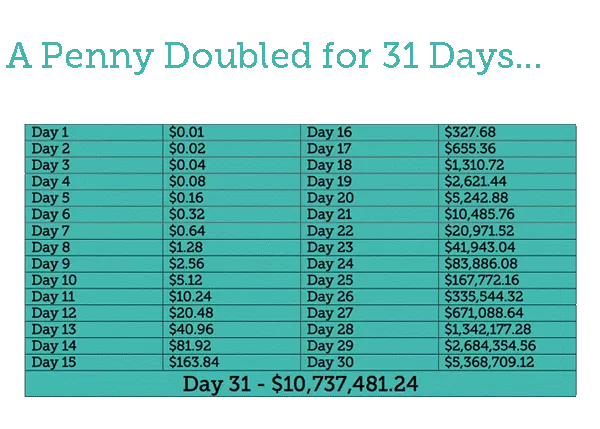

At some point in your life you have probably heard of the Power of Compounding. Look below at an illustration of how doubling a penny for 31 days can lead to over $10 million dollars in just one month…don’t believe me? See for yourself, below.

As undeniable and astounding as the “Penny Doubled for 31 Days” chart may be, we would only have been able to continue our doubling strategy up to Day 24. But, notice how fast compounding grows “pennies” from Day 24 to Day 31… all the way to over $10 million dollars!

Unless you are lucky enough to discover an investment vehicle that pays a significant rate of return, it normally takes a lot of time to reach your investment goals.

Think about those Days from 1-31 as if they were years… it is not until after Day/Year 24 that amount you receive becomes very relevant. This is the reason why we are advised to start our retirement investment strategy in our twenties.

As illustrated earlier, investing in Gold and the S&P 500, at our Baby Boomer ages, was not an option because revenue growth takes too long if we rely on conventional strategies, and we no longer had the time. Our goal was to retire in the next 12-18 months.

Realistically, we did not expect to generate the astronomical returns of the last 7-years with Bitcoin… but we were searching for an option to accelerate the growth of our money, to the point where we could retire, passively generating at least as much income as we were earning while working full time. In other words, there had to be a better way… and that way is Bitcoin Mining Contracts.

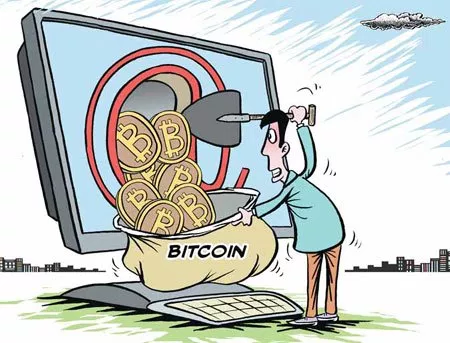

What are Bitcoin Mining Contracts?

Have you ever heard of an annuity? They are a popular investment vehicle, designed primarily for Baby Boomers. You invest a lump sum of money with an insurance company, in return for an “Annuity Contract”.

The company’s business model is to invest the money you gave them, in exchange for a monthly stream of income (a monthly annuity payment). In other words, you purchase a stream of income. Depending on your preference, you can elect to take the stream of income over a time-certain (such as 10, 20 years) or you can take it for “life.” The longer the time period you choose, the lower the monthly income. The company’s expectation is that their investments will yield a greater profit than what they share with their “annuitants.”

Bitcoin Mining Contracts are similar.

You invest a lump sum of money. In this case your purchase is with a Bitcoin Mining Company, whose business model is to validate Bitcoin Financial Transactions in exchange for Bitcoin and transaction fees, much like Visa or Mastercard transaction fees paid when a customer makes purchases of goods and services.

Just as in the Annuity Contract the company’s expectation is to receive a higher yield with their business model than what they share with the Bitcoin Mining Contract owner.

Bitcoin Mining companies perform their services in a transparent environment. They solve complex mathematical equations. Once they solve the equation they are rewarded with “newly-minted” Bitcoin that are then placed on the public “Ledger” for everyone to confirm their existence. There is no ambiguity as to where their income is coming from, or how much is being generated in Bitcoin profits. They also generate ongoing transaction fees as people use their Bitcoin for purchases of goods and services.

As with annuities, the Bitcoin Mining Company provides a stream of income based on the Bitcoin Mining Contract terms. But, unlike annuities, the Bitcoin Mining Company begins paying you a stream of income immediately, since they generate income, daily by performing their services in behalf of the international Bitcoin community or ecosystem, 24/7/365.

Bitcoin Mining Contracts pay a much higher daily rate of return; therefore, our money generates a higher stream of income than with some other asset classes.

You can elect to pocket your profits, daily, if you are seeking immediate income. Or, unlike annuities, you can elect to compound your earnings by reinvesting all or some of your daily earnings, to increase your overall return on investment (ROI) over a period-of-time.

Whereas annuities do not increase your monthly income based on the company’s increased profits, your Bitcoin Mining Contract profits are also tied to the value of Bitcoin… so, as the value of Bitcoin increases, so do your daily profits.

For example: Let’s say Bitcoin is valued at $2300 when you purchase your Bitcoin Mining Contract. You will earn a daily return based on the $2300 Bitcoin valuation.

If Bitcoin appreciates to $3500, your daily earnings will increase, reflecting the higher value of Bitcoin. Conversely, if Bitcoin takes a temporary downswing to $2000, you will earn a smaller profit during that period.

Another advantage of a Bitcoin Mining Contract is that, if you are seeking a certain level of monthly income, but you do not have the capital to purchase a large enough Bitcoin Mining Contract to achieve those goals, you have the option of compounding your daily earnings (remember a penny doubled…) until they reflect the amount of income you desire.

For example, you want a monthly stream of income of $10,000 per month, or approximately $330.00 USD per day.

However, you do not have sufficient capital to purchase that size stream of income.

You can purchase a smaller Bitcoin Mining Contract, and then you can do two things:

You can compound your profits until they yield your desired stream of income, and/or

You can add to your Bitcoin Mining Contract on-a-monthly basis to increase your desired daily yield.

In case you wondered, Bitcoin Mining Contracts are currently yielding approximately 15%+ per month. Because the yield is so lucrative, your power of compounding your earnings is dramatically accelerated… it takes much less time to reach your financial goals than in other asset classes, as discussed earlier.

A one-time $10,000 investment yields approximately $1500 per month starting Day One.

It yields more than that as the value of Bitcoin increases.

If your monthly income goals are greater than that, you may either purchase a larger Bitcoin Mining Contract, or you can utilize one of the strategies mentioned above using the power of compounding to accelerate and achieve your income goals.

As an example, by compounding your daily profits for only 12 months, given the current value of Bitcoin, that one-time $10,000 investment, today, can grow to $273 per day, which equates to $8,318 per month income. That amount assumes Bitcoin does not rise in value… If it does, your daily/monthly return could be much greater.

Now that you have learned about this second chance option to achieve your financial goals – remember, Sir Francis Bacon – “Knowledge Is Power”.

Your next step is to take action by visiting the website that provides you with more information and refers you to where to purchase a Bitcoin Mining Contract with the top Bitcoin Mining Companies in the world. You can also use the “investment calculator” you will find on that website to review your income goals and how to potentially achieve them.

Please logon to: http://BitcoinInvestment.news

Zaydee Rule

Co-Founder: Bitcoin Investment News

http://bitcoininvestment.news