The Bank Stocks Aren’t Fine

The US Fed held the target for the benchmark rate steady at 2.25% to 2.50%. Fed Powell indicated no rate hikes 2019. With rates potentially at their peak for this cycle and future GDP projections declining slashed, this recipe could spell trouble for the bank stocks.

Typically, financial entities like banks, insurance companies, brokerage firm generally benefit from higher interest rates. Increases in interest rates, mean the economy is doing good. Banks make loans to borrowers at a higher rate than non-performing assets such as savings accounts and CDs and profit from the difference. However, in an environment in which the yield curve is flattening, Banks' margins are adversely affected.

So I’m not sure why SunTrust Chief Markets Strategist Keith Lerner thinks the banks will be fine:

“The reason financials — and specifically banks — are likely doing fine despite lower interest rates is bank lending trends are strengthening,” suggests SunTrust Chief Markets Strategist Keith Lerner. “On a year over year basis, C&I (consumer and industrial) lending is up more than 10%, the best since early 2016 and overall C&I lending is at a record high.”

Lerner adds that overall bank lending is hovering near its best pace since early 2017. In other words, despite what looks to be sluggish first quarter GDP growth due to the after effects of the government shutdown and inclement weather the banks are lending at a good clip in advance of a likely second half economic rebound. Steady job growth is also probably a key contributor.

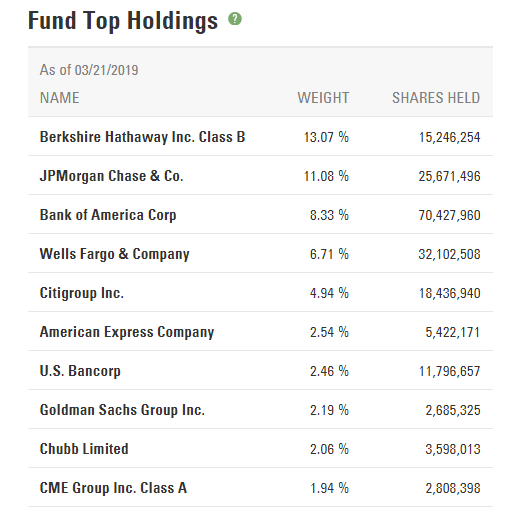

The Financial Select Sector SPDR® Fund (XLF) seeks to provide precise exposure to companies in the diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts ("REITs"); consumer finance; and thrifts and mortgage finance industries. The top holdings include:

And when I look at the chart on the XLF, I don’t think the banks are fine. After hitting the monthly supply at $30.50 in January of 2018, price has just been trending lower.

And since that time, price has formed a weekly supply at the $28 level.

The chart suggest, price is headed back down to the weekly demand at $22.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

#ShortTheBanks!

LOL..most definitely.

Yield curve may the least of their worries as the defaults in some sectors may start to pick up and the float they have will no longer be able to cover write offs. Delinquent loans will be the key factor going forward.

Posted using Partiko iOS

Wonder how much car loans are on their books as this sector is about to blow up.