FintruX — Making Unsecured Loans Highly Secure

Strategy

To further enhance our offering, we will make our platform available to partners such as fraud and identity service agents, credit scoring and decision agents, wallets, exchanges, banks, asset managers, insurance companies and technology companies; to offer new investment and borrower products, and develop new tools for use on our platform. These ecosystem partners can transact directly with our marketplace or leverage our automated administration tools to build financing portfolios to suit their or their opportunities provided by these ecosystem partners will help expand the attractiveness and availability of our network.

We generate revenue from charging participants transaction fees in FTX Token. Lenders can charge their desired fees to their borrowers. Lenders can also reward borrowers with FTX Tokens if paid on time. We do not assume credit risk or use our own capital to invest in financing facilitated by our platform. The capital to invest comes directly from a wide range of lenders, including retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, university endowments, and through a variety of channels.

Market Overview

Peer-to-peer lending is also called marketplace lending. This type of consumer lending in the UK grew at 81.2 per cent a year between 2010 and 2015; SME lending growing at 6 per cent a year during the same period; the total number of active borrowers almost doubled in 2015 alone. According to Morgan Stanley, while marketplace lending in 2015 was still ~1% of unsecured consumer and SME lending in the US, it can reach ~10% by 2020 and expect China, the UK, and Australia to follow. The global market can grow to $150–490 billion by 2020.

Traditional local banks and credit unions offer unsecured loans. However, it is notably difficult to get an unsecured business loan through traditional lenders; especially if your business is relatively young It can also take months to apply and get approved. Generally, banks focus their operations in determined geographic locations, which makes it difficult for people in different areas to connect for purposes of credit transactions.Private lenders are few and far in between and scattered throughout the country.

There exists tougher requirements to be approved for a private loan, as the repayment method is not automated. Alternatively, online platform lenders such as direct and peer-to-peer lenders can offer a faster, easier online application process.Peer-to-peer platform lenders use other investors to fund their loans. This means that the money for your business loan might be originating from dozens, or even hundreds of individual investors all over the world. They usually offer more flexible approval and repayment terms than either bank or direct online lenders, but their interest rates are generally a bit higher.

Benefits to Borrowers

Access to Affordable Credit. Our innovative marketplace model, online delivery, process automation, and credit enhancements enable us to offer borrowers interest rates that are generally lower on average than the rates charged by other unsecured loan P2P lending platforms and traditional banks, not to mention credit cards.Superior Borrowing Experience.

We offer a fast and easy-to-use online application process and provide borrowers with access to live support and online automation throughout the process and for the lifetime of the financing. Our goal is to form long-term relationships with borrowers, facilitating their access to an array of financial products that meet their evolving needs over time.

Branding Opportunity. Lenders can provide ratings and transparent reviews on a blockchain to establish trusted borrowers and agents within the ecosystem. With better ratings, borrowers can save on interest rates on subsequent loans. Moreover, borrowers can take this opportunity to give unfiltered feedback to share their opinion and provide a basis of comparability between different lenders.

Transparency and Fairness. Each customer contract is written as a fully-customized smart contract on a blockchain. It is secure, transparent, immutable, and censorship resilient. Historical data and expected obligations are at a borrows fingertips.

Lowered Transaction Fee. Consequently, since each smart contract is fully-customized and simplified for each borrower contract, it is much easier to understand and without ambiguity. No more “if … then … else” statements and unnecessary code. Smaller programs lead to lower gas fee; in fact, this is paid for by FintruX Network.Super-Fast and Efficient Funding.

We leverage online data and intelligent technology to instantly match risk, credit rating and any unique parameters pre-determined by lenders in decision tables to suggest appropriate interest rates. Borrowers can evaluate options and are instantly matched to lenders of their choice without impacting their credit score.

Self-Service. All available options such as refinance, prepayments, etc. can be done online within minutes, on all devices including mobiles.

Benefits to Lenders

Access to Risk-Reduced Investing. Credit enhancements historically only available to securitization funding of large portfolios is now available to lenders on FintruX Network. By applying cascading credit enhancements, FintruX loss.

Superior Lending Experience. We offer a fully automated application process and provide lenders with access to live support and online tools throughout the process and for the lifetime of the financing. Our goal is to form longterm relationships with lenders, facilitating their relatively risk-free offerings to their borrowers.Branding Opportunity. Borrowers can provide ratings and transparent reviews on a blockchain to establish trusted lenders within the ecosystem.

With better ratings, lenders can build up their brand and reputation. Moreover, lenders can gain access to qualified feedback and market research data to enhance the service they provide to borrowers. Access to a Network of Expertise. A network of rated agencies such as fraud, identity, credit scoring and credit decision are readily available.

Attractive Returns. By having access to lower risk of funding and cutting major costs associated with administering the financing, these savings become additional profit margins. Once their decision tables are chosen and configured, this automated money machine can generate revenue while the lenders spend time with their families.No Upfront Cost to Lenders. No lump-sum license fee, no enhancement fee, no maintenance fee, no support fee for a system; in fact, no upfront cost is necessary.

The only fee to a lender is a transactional based fee and servicing cost that can be transferred to the borrowers. Each financing is managed programmatically by individual and independent smart contract. It is essentially a self-serve engine for the borrowers; saving labor and time servicing the borrower contract.

More Satisfied Customers. Self-service increases customer satisfactions. It is fast, efficient, transparent and time saved to service their borrowers better. More satisfied customers can turn into more business.

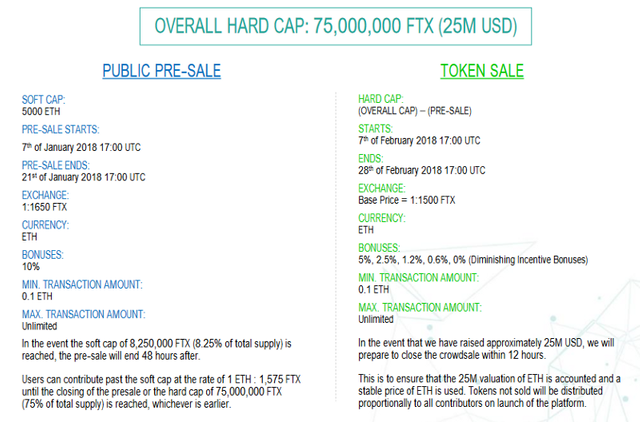

CROWDSALE

More Info: