Education Series: How do ICOs work

Quick shameless plug: My Edenchain ICO review is shortlisted on their bounty contest. I’d appreciate if you could take two seconds to vote for the Quantalysus post amongst the finalists (vote here).

Nowhere in the crypto industry is the siren call of riches as alluring as the Initial Coin Offering (hereon referred to as an ICO). Promises of 10X or 100X gains on your investment are omnipresent. It sounds too good to be true. I will let you be the judge of that. The point of Quantalysus is to increase adoption of digital crypto assets by providing educational content so that you can make your own decisions. This space is ripe for opportunity but at the same time ripe for manipulation and scams. My hope is the more you know, the better you are at assessing opportunities and risks.

An ICO is a fundraising mechanism for companies. Similar to its equity based cousin, the Initial Public Offering (IPO), the ICO allows the public to participate in providing capital to the company. The ICO differs from the IPO in that it offers a digital tokenized asset in return instead of a stock certificate. Classifying these tokens in the eye of regulators and tax authorities around the world are still very much in discussion. Amongst the investment community the utility of these tokens is still up for debate as well. When it comes to investing in crypto assets you can pretty much say the cement is still wet. What is clear is the ICO could be the most efficient form of capital fundraising the world has ever seen. Take for example the SingularityNet ICO. In 60 seconds this ICO raised an incredible $36M! The speed and size of raising so much money makes it an attractive alternative for companies. Conversely, tales of riches made overnight investing in the right projects are both true and false. The opportunity to join the nouveau riche is drawing new investors (or speculators as I like to say). So how did we get to this point?

The History of ICOs

In 2013, the first ICO took place with Mastercoin running a monthlong fundraiser. After it was all said and done Mastercoin had raised 5,000 Bitcoins (BTC) for an estimated sum of half a million dollars. Since then, the numbers of ICOs have escalated and the sums have grown enormously.

Ethereum launched its ICO on July 23rd, 2014. The project was founded by Vitalik Buterin, a Bitcoin developer and founder of Bitcoin Magazine. Enamored by the idea of using the blockchain to create a decentralized global computer, he set off to put his idea into practice. To get the network up and running Vitalik and his co-founders set a presale event to bootstrap the network. In exchange for Bitcoin, presale participants would receive Ethereum's native token Ether (referred to as ETH hereon out). To deal with the legal, financial, and operational complexities of conducting the presale the Ethereum Foundation was established in Zug, Switzerland. The final result of the presale netted 31,591 BTC (worth $18,439,086 USD) in exchange for roughly 60,102,216 ETH.

First Came Currency Then Came Fundraising

Bitcoin is said to be the first useful application of blockchain technology. It enabled a cryptocurrency that was first thought to be a replacement for fiat currency but is now widely recognized as a useful store of value. Please see the History of Bitcoin post to learn more about it overall. Ethereum launched a blockchain with smart contract capability, essentially creating the opportunity to run applications natively on its blockchain. For better or worse, Ethereum smart contracts enabled one particularly attractive application: a smart contract for fundraising. It's quite easy to create an Ethereum smart contract, in fact here's a 20 minute guide on how to create one. In exchange for ETH the project raising an ICO will return to the contributor a set amount of their native token. With Ethereum's ERC20 token standard, the ICO space exploded. I'd like to think the crypto universe expanded faster and faster like the Big Bang of the Universe.

2016 Marks the Big Bang

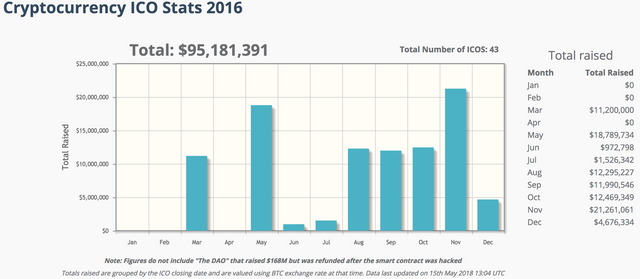

Forty three ICOs were raised in 2016 totaling a combined $95M (excluding the hacked and refunded DAO ICO). Since then, the sums have grown exponentially. Critics will point to an ICO bubble and proponents will argue ICOs have enabled a decentralized form of fundraising for emerging technologies and startups in capital starved locales. In 2017 there were 210 ICOs raising a total of $3.9B according to Coinschedule.com. Other estimates I've come across estimate as much as $6B was raised. Through April of 2018, $6.8B was raised with 266 ICOs, averaging an amazing $25.5M each. These sums would normally be reserved for tech startups raising a Series B round. To get even sillier, Series B companies are often battle tested in their markets. They have figured out their product-market fit and have paying customers. Their major challenge is typically to figure out how to widen their product adoption past their low hanging fruit customers. With cryptocurrencies a forked GitHub repo, a cleverly written whitepaper, a bot driven Telegram group, and a sparkly website would be more than enough to raise Series B sums of money.

Source: Coinschedule.com

Legal Issues

Conducting and participating in ICOs are clouded with legal uncertainty. In certain countries hosting an ICO is deemed illegal. At the investor level, the KYC (Know Your Customer) and AML (Anti-Money Laundering) standards in the USA have compelled many companies hosting ICOs to exclude US citizens. Companies who wish to raise legally with US citizens have the option to file a Regulation D or Regulation A with the SEC. I cover this topic in my Education Series article on regulation. American crypto investors frustrated with exclusions due to regulation uncertainty have been driven to either pick up tokens when they first hit centralized/decentralized exchanges or stealthily participate in public pools.

Pools

Pooling is a term referring to multiple entities combining their resources. In the early days of ICOs it was easier to invest/speculate into these companies. As companies started to understand the legal risks of hosting an ICO they began to shrink their investment pool to the wealthy accredited investors and venture funds accustomed to taking risks in early stage companies. This left retail investors to combine their resources together to have an opportunity to invest in ICOs. I want to make clear I am not advising you to join a pool. There is a significant risk you are taking by participating in these groups. Firstly, pools are led by an individual or a group of individuals who are negotiating on your behalf with projects. Their goal is to sign a SAFT (Simple Agreement For Tokens). After this is signed, they will work with their pool members to contribute their funds together. Collecting funds is either done manually or into a smart contract tool such as Prima Block. Secondly, you are colluding with individuals you may not know. Think of your normal investments. Would you willingly give up your funds to someone you've never met and does not have a fiduciary responsibility over your funds? Thirdly, investing in ICOs is a crowded space for phishing attacks. Scammers pose as the company in several ways to cajole you of your hard earned assets.

Scams

A quick list of potential scams.

- You receive an email from a similar looking website and they've asked you to send ETH to their address

- The DNS of the website was compromised and the legitimate URL was redirected to a phishing site

- A scammer poses as an admin and solicits funds from you privately within Telegram

Prima Block

If you're going to pool I highly suggest you understand a tool called Prima Block. For those doing pools with ERC20 tokens Prima Block is a great tool to get familiar with. Please note that you are at risk of trusting the individual who runs the pool still. The Prima Block is not a completely trustworthy tool. You still have to trust the people you are working with. To get started, you need an ERC20 enabled wallet. Applications such as MyCrypto or MetaMask. I do not include MyEtherWallet as I've personally stopped using it due to a recent DNS attack. Rather than explaining how to use Prima Block here is a really dramatic music filled video of how to use it.

Fundraising Rounds

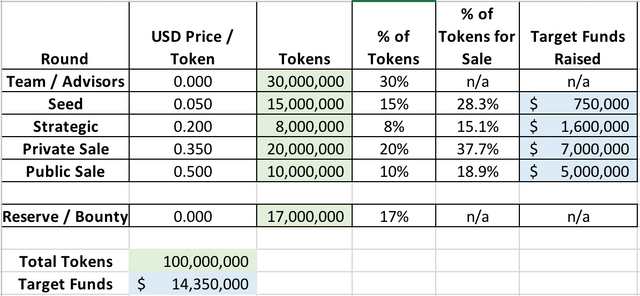

Companies may have several rounds of fundraising. I'll give an example with fictitious numbers but the scale of each round is very similar to a project I consulted for. Below is the "cap table" (capitalization table) of the fictitious ICO.

Let's break down this cap table.

- Team / Advisors are entitled to 30% of tokens in exchange for their "sweat equity". Rather than paying for their tokens, they earn their tokens through their hard work. Let's assume a three year vesting schedule that looks like this:

- After 1 Year: 33% of tokens released

- Year 2 - Year 3: 1/36th tokens released at the last day of each month after year 1

- Seed round is entitled to 15% of tokens at a discounted rate of $0.05 per token.

- Lockup of 1 year, all tokens released after 1st year

- If token remains the same price after year 1 at the public sale price, the seed round investors would 10x their investment (public sale is $0.50 per token).

- If token price doubles from ICO price (I use public sale ICO price) then seed investors would 20x their investment.

- Strategic investors are entitled to 8% of tokens at $0.20 per token. The project will look for investors who provide some sort of value that is key to the project's success. Value could come in the form of:

- Marketing / PR

- Operational advisory

- Go-To-Market support (business development, partnerships, product distribution)

- Private Sale investors are entitled to 20% of tokens at $0.35 per token.

- These are typically accredited investors

- Upon ICO the private sale investors would gain 30% if the price remains flat at the public ICO price.

- Private sale investors often receive a bonus. In this case, the bonus averaged across all private sale investors will be 40% (calculated by taking the $7M total raised by private sale and $5M raised by public sale). Some private investors will receive a 50% - 60% bonus if they provide more funds or services, and others will receive a lower bonus. Overall, the project will try to manage the bonus to average 40%.

- Public Sale investor are entitled to 10% of tokens.

- The ICO will provide a whitelisting process

- Based on the number of participants a hard cap will be calculated for individual investors

- If 5,000 people are whitelisted then that will leave a $1,000 hard cap for each investor.

Having success with ICOs

The million dollar question is, "so how can I do well with ICOs?" For starters, this is not financial advice directed to you, but this is the advice I give myself. There are a few strategies and frameworks you can use. I'll list them out for you.

- Always have a set of hypotheses of where the market is going. For example, Bitcoin maximalists will tell you that everything except Bitcoin is meaningless - they might have a point. For the high speed blockchain crowd banking that decentralized computing is the wave of the future, the big question is what obstacles need to be overcome to get to that utopian technological state. You might consider the following questions:

- Decentralization of data storage and retrieval

- Decentralization of data processing

- Technical architectures to enable decentralized applications (blockchains aren't the only game in town)

- Use cases where decentralization makes sense (for example, digital gold or money with Bitcoin, or crowd fundraising with Ethereum... though the intent of Ethereum is to be a global computer)

- Get into the public (pre-sale or crowdsale) sale. This approach is meant to be the "great democratizer" of wealth approach. Anyone can join as long as you pass KYC/AML and reside in the appropriate countries. Scammers will try to phish you and talk you out of your wealth by posing as admins in the community. Buyer beware.

- If you do not have money to invest, but you do have time and energy... then why not consider contributing to the community with your "sweat equity". Earn tokens through their bounty program instead of fighting the crowds. Build a content website, or send me an email with a writing sample and let's talk. Build a YouTube channel. Get involved.

- Bring something of value to these closed networks of investors and entrepreneurs. Rather than asking for something, why not provide something of value in return. Building an audience, building a network of confidants, building a network of investors/developers/entrepreneurs together can be much more valuable than the nest egg you're trying to parlay into riches via ICOs.

- This is not advice for you but this is one strategy that I use. I do pool with a trusted network. I place my trust in these people and I provide something in return when I can. I am well aware of the risk and accept full accountability. If you go this route I suggest you look yourself in the mirror and say... I am fine with the risk I take with pooling.

Thanks for reading

Now that you've made it this far let me say thank you. Thank you for reading and following me. I hope you learned something along the way here. Follow me on Twitter, Medium, and Steemit (my information below).

Good luck to you.

If you're a project and want to discuss consultation services please contact me at [email protected]. My background is in finance, operations, and sales. Let's connect.

Source:

Thank you for coming to the site. Quantalysus publishes blockchain research and analysis for the crypto community. Please follow on Twitter, Steem (please follow and upvote if you can – thanks!), Telegram channel (New!), and Medium to stay up to date.

If you want to earn Aelf (ELF) tokens for just using Twitter and Reddit, sign up for their candy / bounty program.

If you learned something:

- Please consider donating to keep this website up and running

- Earn Aelf tokens by following them on Twitter (my referral link)

- Follow me on Steem (@quantalysus). I appreciate upvotes!

- Follow me on Twitter (@CryptoQuantalys)

- Education Series: Why we need Bitcoin

- Education Series: The History of Bitcoin

- Education Series: Sybil Attacks

- Education Series: Airdrops

- Education Series: Byzantine General’s Problem

- Education Series: Regulation A and D

- ICO Review: Arweave

- ICO Review: Lightstreams

- ICO Review: Hero Node

- ICO Review: Solana

- ICO Review: Phantasma

- ICO Review: Holochain

- ICO Review: Edenchain

- ICO Review: Quarkchain

- ICO Review: DAOStack

- ICO Review: Alchemint

- ICO Review: Loki Network

- Coin Review: Nexo

- Coin Review: Ontology

- Coin Review: Aelf

- Coin Review: Mithril

- Coin Review: Qtum

- Coin Review: Waves

- Coin Review: Banyan Network (BBN)

- Opinion: Token economics

- Opinion: ICO paradox

- Opinion: Why we love Steem

- Analysis: Starkware Industries

- Analysis: If Steem were a country, it would be the most unequal society

This is a complete package of ICO. Full of important informations and seem that you have done a lot of hard work to write this. As one of the new crypto investors it will help me a lot. Thanks for sharing.

Thanks for reading!

Dogggy coin my favourite, that look is priceless.

RESTEEMED | UPVOTED | FOLLOWED | THANK YOU

I think any article written to educate people on ICOs should avoid claims that can be misleading for people.

An ICO is an illegal way adopted by new companies for raising funds that they otherwise will unlikely be able to raise, because either the idea is rubbish or because they will fail due diligence.

It is not similar to the other forms of fundraising mechanisms - equity financing or debt financing. Even in the case of IPOs, only start ups that have demonstrated the usecase of a product and have been thoroughly vetted by private investors, are able to list and raise money publicly.

Once shares start trading, companies are accountable to shareholders - have to release accounts quarterly, audited accounts, and hold investors calls.

ICOs do not offer speculators any asset, digital or physical. Tokens do not offer any ownership or legal rights.

What is clear is the ICO could (definitely is) be the most efficient form (fastest way which doesn't mean efficiency) of capital fundraising (stealing money without accountability by scamsters), the world has ever seen.

I hope people find the comment educating.

Thanks for reading. I agree with your points on it differing from debt or equity. At a base level it could be considered a sale of a digital good with network utility but with the expectation of a financial return (a security with additional properties). Whether all of this has intrinsic value... Time will tell

Great article. thanks for sharing. I've smashed the upvote button for you! There needs to be more articles like this to allow mass adoption.

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

Interesting. I'll bookmark and check it out. What kind of feedback are projects looking for?

good ico dooge

Everyone loves Doge

dogecoin clickbait

I embrace that. Woof!

be honest sir some of it is very interesting and informative but as i don,t know much about crypto so many thing are difficult for me to understand indeed some time i can Thanks @quantalysus

Please review ICO ETHERCToken Sir. I think this ICO is good project.

Good I found this article! Really interesting and full of knowledge about ICO's. Really helpful to a newbie like me, as the moment I'm finding many articles like this to gain knowledge and to understand more about ICO how does it work. Thank you for posting this article!

Thanks for reading! I publish reviews frequently so feel free to check back in.