DIGITAL BANK TO FUSE ISLAMIC BANKING

HADA DBank

Banking can be exhaustng. Eventually we have had terrible encounters when managing conventonal banks; either because of high administration charges or the absence of sympathy amid dealings with their work force. HADA DBANK expects to change this. At HADA DBANK, we are building up a thorough Blockchain Digital Bank that will make life simpler for everybody, paying little heed to their statuses. They will have the capacity to perform banking actvites with 0% charges and at the same tme appreciate quality administration from us. We are here not to simply benefit, yet rather to make justfied benefit while guaranteeing a beter banking knowledge.

HADA DBANK will be the world’s first Blockchain-based Digital Bank to meld Islamic Banking Module with Blockchain Technology, to make a moral and dependable banking biological community. As existng Digital Banks and recently made Blockchain Banks are centered around Conventonal Banking services,we champion Islamic Banking administrations because of the absence of such office. In 2016, Islamic banking was worth USD1.5 Trillion globally.¹

Our Headquarters will be situated in Zug, Switzerland — the Crypto Valley of the world. We intend to utilize our pre-ICO continues to apply for a FinTech License from the Swiss Financial Market Supervisory Authority FINMA. All the while, an applicaton for a New Bank Start-Up Unit permit will be connected with the Bank of England Prudental Regulaton Authority and Financial Conduct Authority. With respect to nations that by and by don’t have any existng Digital Bank License set up, we will apply for E-Money Licenses.

WHY ISLAMIC BANKING?

Our reason is straightforward. We seek to be an ‘only’ organizaton in the budgetary business. The money related emergency of 2007–2008 fills in as a troubling update how a few flippant players can overturn an entre industry, putng millions in monetary remains. Islamic banking, because of its straightforwardness, benefit and misfortune sharing idea, will limit advertise manipulaton and wipe out another domino crash.Islamic Banks are not so much dangerous but rather more flexible than their partners, because of the parts of their bank capital necessities and mobilisaton of stores. Instead of Conventonal Banking,depositors to Islamic Banks are enttled to be educated about what the bank does with their money.They additionally have a say in where their cash ought to be contributed. Islamic banks additionally endeavor to maintain a strategic distance from enthusiasm at all levels of budgetary transactons and advance hazard sharing between the loan specialist.

There are two essential standards in Islamic banking. One is the sharing of benefit and misfortune; and two, altogether, the prohibiton of the collecton and installment of enthusiasm by loan specialists and investors.Collectng premium or “Riba” isn’t permited under Islamic law. On account of benefit, both the bank and its client share in a pre-concurred proporton. On account of a misfortune, every single monetary misfortune will then be borne by the bank. In additon to this, Islamic bank can’t make obligation without products and enterprises to back it (i.e. physical resources including apparatus, gear, and stock). Henceforth reserve funds, stores and ventures with our DBank will be sponsored by physical resources, for example, valuable metals and gemstones.The request in Islamic banking is colossal. There are 1.7 billion Muslims around the world, and this number is developing. Overall Islamic Bank add up to resources were estmated at between USD1.88 Trillion

to USD2.1 Trillion of every 2016 and are relied upon to achieve USD3.4 Trillion by 2018. HADA DBANK gives alternatve budgetary administration optons to all customers and financial specialists. The current worldwide monetary emergency showed the flexibility of the Islamic banking and budgetary industry. In 2008–2009, the Islamic banking industry was estmated to have encountered resource development of 31.8% contrasted with 12.6% in conventonal banking sectors.¹

You may believe that Islamic banking is just for Muslims. It isn’t. In June 2014, Britain turned into the principal non-Muslim nation to issue Sukuk; what might as well be called a bond (the word itself is the plural of Sakk, which implies contract or deed). In September 2014, the administrations of Luxembourg and South Africa and also the Hong Kong Monetary Authority made issuances. Be that as it may, Sukuk isn’t restricted to sovereigns: in September 2014, Goldman Sachs issued a USD500 Million Sukuk and Bank of Tokyo-Mitsubishi Malaysia raised its first USD50 from its USD500 Million issuance. These enttes need to take part in the USD2 Trillion Islamic money related market.

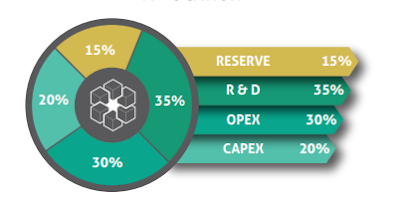

ALLOCATION

35% of the capital raised through our PRE-ICO exercise will be allotted for R&D (Research and Development).We plan to enlist and hold no less than 50 PC software engineers, coders and IT staff to additionally build up our banking platorm and framework, too improvement of future items. 7 labs will be built up in 5 years in which the first and second lab will be situated in Switzerland and Estonia respectvely.OPEX (Operaton Expenditure) will make up 30% of the financial plan. Employing of administration executves will be our principle actvity under this segment, to guarantee that the best accomplices and abilities from related ventures join HADA DBANK administration and operatons. We intend to advertise forcefully and are presently cooperating with an accomplished Marketng Partner, to enable us to put our name to the focused on business sectors, globally.CAPEX (Capital Expenditure) will get 20% of the capital raised. Among actvites will be the securing of workplaces, interests in equipment for our R&D division, vital business resources, and recious metals and gemstones (gold, silver and precious stones), to be utilized as insurance for future clients’ funds, speculations and HADACoin’s value.The last 15% will be kept as RESERVE. This Reserve won’t be utilized unless for most extreme need and strict principles will be set. The choice to utlize this hold will be controlled by the best administration collectvely and collectively, to guarantee there is no blunder and abundance use of the Reserve. We will build HADA DBANK’s Reserve to 30% of the aggregate capital, in the closest future in agreement to Islamic Financial Laws. More Info Visit ;

Website: https://www.hada-dbank.com/

Whitepaper: https://docs.wixstatic.com/ugd/ebee66_358411d0184e449185537180dd06b54c.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=2607739.0

Bounty: https://bitcointalk.org/index.php?topic=2611797.0

Twitter: https://twitter.com/HadaDBank

Facebook: https://www.facebook.com/hadadbank.official/

Telegram: https://t.me/HADADBan

Penulis: mohamad alwi

https://bitcointalk.org/index.php?action=profile;u=2081190;sa=summary

Hey. I signed up for your blog. I'm a developer of bots! If you need to promote something in automatic mode or a poster, you can write to me in the @coinshelper telegram. I also sell programs for telegrams. User parser and the inviter in groups. Subscribe to me @bot.creator! I signed and licked you!