[ICO]CRYPTOCOIN INSURANCE -The first option exchange with insurance

Greetings to you all readers, in this article i will be discussing what exactly this brand new and groundbreaking innovation http://ccin.io/ is all about and i will appreciate your standing by till the end.

In the modern internet space, more and more attention is paid to cryptocurrency investments and the investment market and Blockchain is becoming the cornerstone of modern innovation and has the potential to revolutionize the world. Recognizing this potential, we at CRYPTOCOIN INSURANCE have assembled a professional team of budding entrepreneurs and seasoned investors to create an all-encompassing blockchain trading platform. Since cryptocurrency is designed for mainstream adoption, our platform will be a stop-shop for clients that intend to earn huge returns on investment. We will create a user-friendly system that incorporates both traditional markets and the blockchain based assets.

Trading in the cryptocurrency market has gone through several stages of development: from the first centralized exchanges, where there were virtually no volumes, to several hundred exchanges, where the market leader's turnover exceeds one billion dollars a day. Recently, the Securities and Exchange Commission (SEC) authorized the trading of bitcoin futures on major US exchanges.

The market is becoming more like normal stock and commodity markets. However, one of the segments that many players, and especially hedgers, can not handle is completely unavailable today. It's about options.

The facts

For the government, it will be almost impossible to prove that anyone is insured against any law. Neither they can reveal the given people receive their insurance money because no cash or traditional bank transfers are involved.

Government officials have limited sources to penalize all entrepreneurs; they will always choose only some "victims," therefore more paid insurants the anonymous insurance companies will have, lower insurance rates will be.

Less ignorant and immoral laws mean less feasible business case of anonymous insurance companies.

Both anonymization technology and state dictatorship are always improved over time. Therefore the existence of anonymous cryptocurrencies is the only question of time.

The war of governments with anonymous insurance companies can be partially won by abolishing of all stupid regulations and restrictions most people consider to be unethical.

The anonymous insurance against wrong laws can create an incentive for many decent non-technical people to use bitcoins or other cryptocurrencies to protect their property.

The government can increase fines to kill all businesses that break any law and strictly enforces it. In the given situation, the best solution will be to move the business to a different country, or stay and pay high insurance fee.

The government can hire 4x more employees, does strict checks of EET legislation, issues 3x more penalties to entrepreneurs at the same time, therefore forces anonymous insurance companies to bankrupt.

This scenario is for sure possible. But it is necessary to realize the anonymous insurance does not need to be applied to the EET legislation only, but to any stupid/unethical law. The state simply does not have enough sources to check if all people or companies follow each law people/companies may be insured for. The situation for the state is asymmetrical with an apparent advantage for anonymous insurance companies.

CRYPTOCOIN INSURANCE allows you to insure price falls or growth risks for major cryptocurrencies.

Pay customers to deposit indemnification for the amount of 0.1 bitcoin in the amount of 3 Bitcoin. If the price fell by 15% in 3 days, he is eligible to receive indemnification in the amount of the deposit fell - 0.45 Bitcoin. In terms of indemnification, reward CRYPTOCOIN indemnification customers antecedently received from indemnification. If it is not an indemnification claim, indemnification paid by the customer will be the company's turnover.

Problem:

There is no solution to insure the deposit in Bitcoin or Ethereum from falling. At the same time in this market there is increased volatility that makes people be afraid to store large funds in the cryptocurrency. On the other hand, large companies are slow to enter the market (for example, to accept payments in a cryptocurrency) for the same reason.

Solution:

The exchange will start operating with 5 cryptocurrencies that have the maximum market. Furthermore, as the demand and turnover increase, we will add other cryptocurrencies. CRYPTOCOIN INSURANCE sells both Bitcoin or Ethereum growth and fall insurance. Thus, it hedges its risk. No competition in the market allows maintaining a significant margin on the level of 20%. CRYPTOCOIN INSURANCE repackages and sells/buys its own risk as options on its own exchange.

CRYPTOCOIN INSURANCE has no competition and occupies the entire market.

Description of the problems

- There is no solution to prevent a deposit from falling into Bitcoin or Ethereum.

At the same time, there is a heightened volatility in this market that causes people to be scared of storing large amounts of money in the cryptocurrency. On the other hand, big companies are slowly entering the market for the same reason (for example, they do not accept payments in the cryptocurrency). - There is no special crypto change where you can buy / sell options.

The main fear of such an exchange is the increased volatility. For all those who are concerned with stock options, oil or wheat, the risks seem to be great. - There is still no possibility of short selling in the cryptocurrency market.

No one can sell the cryptocurrency that is physically non-existent on the account for a short time. This reduces the ability of speculators to smooth price swings in other markets. This in turn leads to an increase in volatility and the consequences listed in paragraphs 1 and 2.

SOLUTIONS - CRYPTOCOIN INSURANCE allows you to insure risks of growth or price decline for key cryptocurrencies.

The advantage of the crypto currency market is that unlike the stock or commodities, it operates 24 hours a day. And for the entire duration of its existence (about 10 years), there was not a single message that would quickly move the price of bitcoin or etherium by at least 30-50%. In fact, if we talk only about blue chips, the crypto currency market is far safer for option sellers than other markets we're used to.

- Options allow short selling.

If you do not have physical Bitcoin or Etherium, you may be given an option to drop them but actually implement an uncovered sale. - This opportunity brings many new traders, investors and speculators, as well as hedge funds, into the market, investing not only in growth but also in the case of markets.

Option Exchange

Profits are engendered as trading commissions by each store on buy or sell options. This is 0.5% per transaction or 1% per circle for each transaction party.

Taking into account the volatility of the options and the immensely colossal profit opportunities, this commission is not consequential for the market participants. However, this sanctions the stock exchanges to earn a high income compared to the customary crypto currency exchanges because of the lack of competition. For future competitors, the amount of the exchange commission can be proportionally reduced.

indemnification company

Turnover is engendered through the sale of magnification / fallback cryptocurrencies.

CCIN TOKEN MAGNIFICATION POTENTIALS

CRYPTOCOIN INDEMNIFICATION CRYPTOCOIN INDEMNIFICATION has developed a simple and understandable model to increment the value of CCIN tokens. 30% of each commission engendered through the exchange of options will be transferred to liquidity mazuma. The following month, CRYPTOCOIN INDEMNIFICATION sent this fund to buy and burn CCIN tokens from the market.

This business model was only accepted for the benefit of our investors. The promise to buy tokens from future profits can not be transparent. In integration, exchanges or platforms can never physically benefit. In the case of CRYPTOCOIN ASURANSI tokens, investors are well cognizant that each buy / sell option engenders a cash flow that is utilized to buy tokens.

This sanctions for a constant shift in market balance and an incrementing demand for CCIN tokens.

If the revenue is $ 50 million per day, the commission for both sides is $ 500,000 or $ 15 million per month. Thirty percent of this amount, or $ 5 million, is sent each month to buy CCIN tokens from the market.

100,000,000

CCIN tokens are issued.

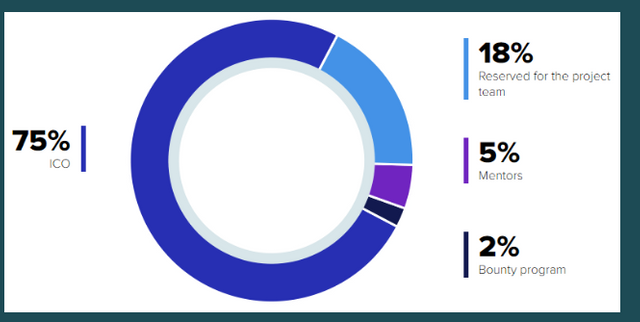

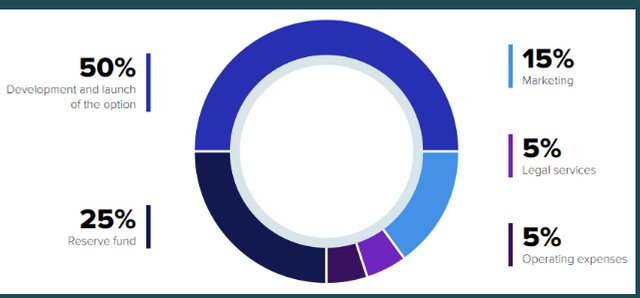

Token allocation

CCIN TOKEN

Growth potential

CRYPTOCOIN INSURANCE has developed a simple and understandable model to increase the cost of the CCIN token. 30% of every commission received from the stock exchange flows into the liquidity fund. Within the next month, CRYPTOCOIN INSURANCE sends these funds to buy CCIN tokens from the market and burns them.

This business model is used exclusively in the interests of investors. The promise to buy tokens from future profits can not be transparent. In addition, a stock exchange or platform can never physically benefit. In the case of CRYPTOCOIN INSURANCE, investors know exactly what each buy / sell transaction generates for a transaction that generates the cash flow used to buy tokens.This allows you to constantly shift the market balance and increase the demand for CCIN tokens.If the revenue is $ 50 million per day, the commission for both sides is $ 500,000 or $ 15 million per month. 30% of this amount, or $ 5 million a month, will be sent to buy CCIN tokens from the market.

This allows you to constantly shift the market balance and increase the demand for CCIN tokens.If the revenue is $ 50 million per day, the commission for both sides is $ 500,000 or $ 15 million per month. 30% of this amount, or $ 5 million a month, will be sent to buy CCIN tokens from the market.

for more information visit the following link:

For more detailed informations , visit:

WEBSITE: http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official

Authorship: Joecolern

BTT profile link- https://bitcointalk.org/index.php?action=profile;u=2246034