ICO Pools Market Overview

Investing in ICOs (Initial Coin Offerings) through pools is becoming more and more popular, with many pools offering tempting incentives such as discounts and bonuses. In order to help investors navigate in the chaos of information our analytics department prepared ICO pool market overview according to data from our site ICOPools.io, there are currently over 200 open pools. As ICOs are become trendy, and their number grows, investors have difficulty figuring out which pools they should join. However, ICO pools remain risky for investors because pools themselves are in a regulatory grey area. There are no foolproof, objective metrics that can help one select a scam-free ICO pool.

Note: In this article, an ICO will be defined as a company that sells tokens to crypto-investors under certain conditions. By our definition, it is not mandatory for the ICO to have a public crowdsale phase. ICO pools are communities where cryptocurrency investors come together to make collective investments.

The increasing popularity of ICO pools

On one hand, the concept of collective investment is already well-known, and it goes back to the concept of crowdfunding. In general, buying something for joint benefit is a very ordinary concept. On the other hand, to understand the rapid mushrooming of ICO pools, you need to examine ICOs themselves.

Some ICOs do not run crowdsales at all, instead raising money through pre-sales only. Or they highly restrict access to a crowdsale. Often, the ICO simply does not want to deal with small investors; also, they want to minimize the chance of a flood of tokens into the market after the completion of the crowdsale. In this situation, using pools helps solve both of these problems through more direct arrangements with the ICO.

Small discounts and bonuses can be offered by an ICO with basic terms. In exchange, pools can promise that an ICO will raise large amounts of funding, and subsequently will receive more preferential treatment from a willing ICO. An ICO needs volume, and pools are ready to provide it.

The widespread introduction of KYC (“Know Your Customer”) procedures has somewhat cooled the ardor of crypto-investors. It’s not about the unwillingness of investors to disclose their identity, but rather the hassle of having to repeatedly pass a verification procedure for each new ICO. Pools, at least in the beginning, offered the option of investing without the need for KYC procedures.

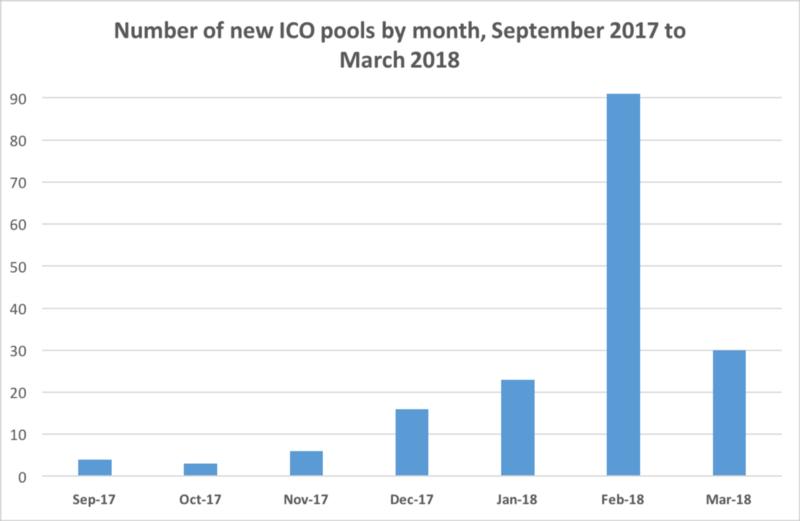

The month-by-month growth of ICO pools

While single pools were created even before September 2017, the majority of them were established in February 2018. March, according to data from ICOPools.io, demonstrated fewer pool appearances, since the crypto market has been increasingly bearish, and large communities had already launched their pools in January and February 2018. Once the market becomes bullish again, the number of ICO pools will likely experience another surge.

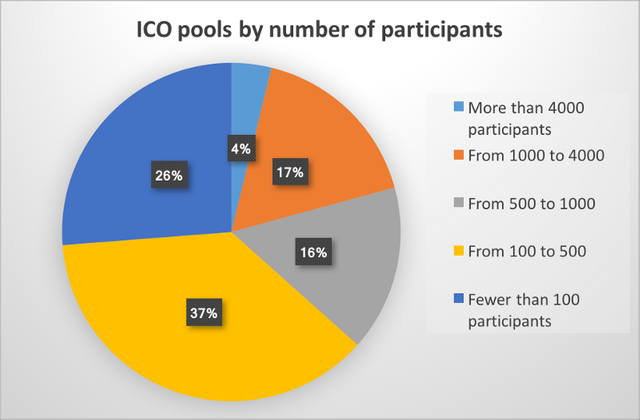

The number of participants in ICO pools

The majority of ICO pools are small communities of up to 500 people. Pools with more than 4,000 participants are very rare.

Types of ICO pools

There are so many criteria which could be used for classifying ICO pools, so we will cover only three: whether they are open to investors, whether they disclose themselves to an ICO or conceal themselves, and whether they employ KYC procedures.

Is an ICO open to all investors or does it permit membership by invitation only?

The difference between these types of pools is not large. If an ICO is open to all investors, the link to the ICO pool community is generally public and advertised everywhere. In an invitation-only ICO pool, while there is no public link, any pool participant can invite a new member to the pool. More rarely, there is no public link at all, and the only administrator can personally invite selected members.

As an additional criteria, we must highlight the need for passing a preliminary certification in order to join an ICO pool, but often it's just a formality. Some pools are more careful and require the approval of participants for membership, withholding access on that basis. However, the pool does not cease to be classified "open" in such cases.

Is an ICO pool’s link to an ICO public or deeply hidden?

Here the division is more serious, because in fact it breaks the pools into “honest guys” and “deceivers.”

By deceivers, we do not necessarily mean scammers. These people simply violate ICO rules and create an alternate reality. Most often they are present themselves to the ICO as accredited investors who can promise a certain amount of raised money. Next, the proposal is relayed to the pool’s members and crypto-investors get the opportunity to get involved with some hard-to-access ICO. Such pools shy away from publicity, since they risk running into sanctions from the ICO. At the same time they are wildly risky, since there is no protection against anyone among the pool’s participants disclosing the offer.

In this situation, it is very strange to play such a dangerous game. Almost none of these pools maintains the anonymity of transfers and can only hope for the secrecy of the transaction. These pools do confer benefits to investors, providing access to rare ICOs or to ICOs that categorically do not want to work with small investors. However, they still do not work towards anonymous transactions.

The honest guys are completely transparent. They are all for publicity because they work openly. They often obtain additional ICO information for their participants, inviting founders of the ICOs to the AMA (“Ask Me Anything”) sessions. Such pools, in our opinion, will become the main driving force of ICO pools, since the level of investor trust is definitely higher. But we will return to the issue of trust and possible criteria for its evaluation later.

Does an ICO pool support KYC procedures or not?

This measure is very important because it actually means whether the pool is completely in the “white zone” or whether it remains in a gray area. KYC is a tedious procedure and contains unnecessary steps. However, the absence of KYC in ICO pools will sooner or later lead to legal consequences. More and more countries are mandating laws regarding the turnover of crypto-currencies and tokens, and ICOs have to take this into consideration very seriously to avoid violating these laws. Plus, KYC support is an open demonstration of the integrity of the pool. Of course, it is quite difficult to guarantee that an ICO pool is completely above board.

Currently, no more than 3 percent of ICO pools support KYC procedure.

Measuring the success of ICO pools

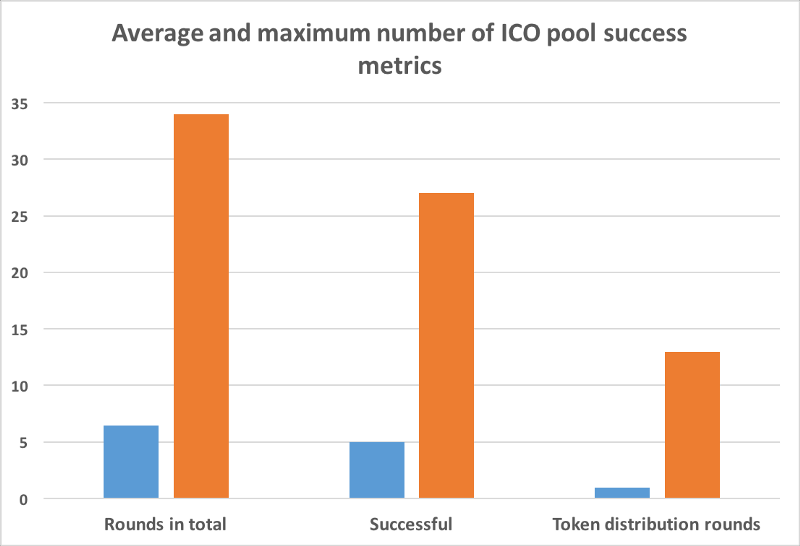

Averages (in blue) and maximum values (in orange) for the total number of rounds, successfully completed rounds, and token distribution rounds

The average pool has completed 6 rounds (the highest number being 34) so far. The average ICO pool had 5 successful rounds (one ICO pool had 27). The average ICO pool had 1 token distribution round, whereas the highest amount measured was 13.

Note: The token distribution round is considered complete if investors receive tokens. If tokens are frozen in the admin’s wallet, this round is considered incomplete.

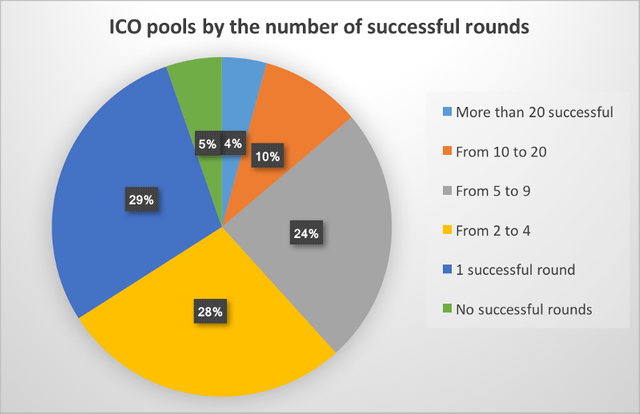

The overwhelming majority of the pools have had fewer than 10 successful rounds. As can be seen from ICOPools.io data, almost 95 percent of ICO pools have at least one successful round.

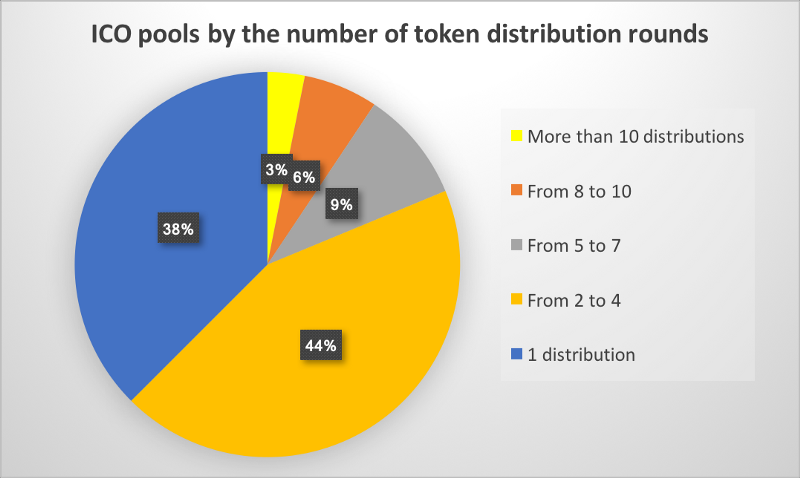

The majority of pools have had no more than 5 token distribution rounds. More than 80 percent of ICO pools have not yet implemented any distribution of tokens to investors, despite the fact that nearly 95 percent of the pools have had at least one successful round. It would be a mistake to classify all these pools as fraudulent, since many of them are new and have not had the chance to distribute tokens. However, in working with pools, the investor should be cautious since trust is accumulated only in the long term.

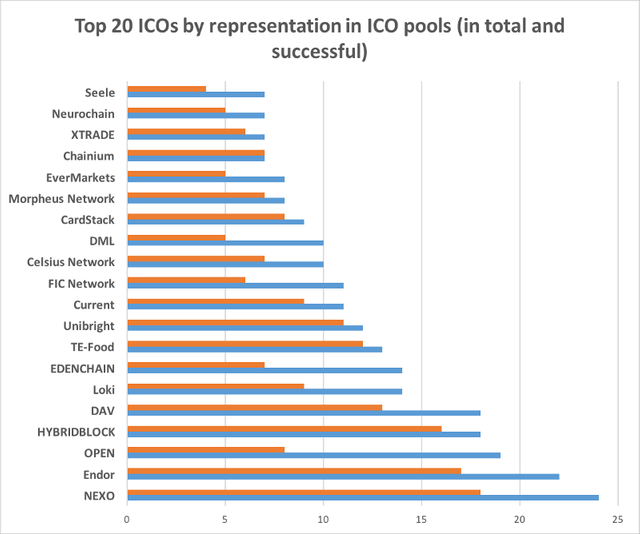

The most popular ICOs represented in the pools

In total, there were more than 210 ICOs seen in the pools. The diagram below illustrates the Top 20 ICOs.

Blue represents the total amount of ICO pools raising funds. Red represents the number of successful pools.

The blue bar in the diagram represents the total number of pools that started raising rounds for this ICO. The red bar shows the number of pools that managed to succeed. It should be noted that some ICO’s rounds are ongoing, and they exhibit a smaller number of successful pools (OPEN Platform and EDENCHAIN are examples).

Measuring the reliability of ICO pools

When talking about the reliability of an ICO pool, we prioritize protecting the interests of the crypto investor. Namely, what is the probability of receiving the purchased tokens and how promising these tokens will be. Accordingly, the following metrics can be singled out:

The number of token distribution rounds

This can include both the absolute number for a given pool, and the ratio between total rounds held and the rounds of token distribution. An example of the average and maximum values can be found above in the section "Measuring the success of ICO pools.”

The probability of successful round completion

This is the ratio between the number of rounds completed and the number of rounds completed successfully. An overview for such ratio can also be found in the section "Measuring the success of ICO pools.”

Participation in the top ICOs

If the pool participates in the top ICOs, then the level of confidence in that pool is higher. If a pool is seen to connect with dubious ICOs, then an investor must exercise caution. Proper due diligence includes analyzing all ratings and expert reviews of an ICO. This will help any investor orient him or herself within the constantly changing ICO climate.

It is unreasonable to rely only on one metric, so we believe that a qualitative assessment of the reliability of the pool is always a complex of metrics, which can include both those listed above as well as others, including the presence of KYC procedures and the amounts raised.

In the absence of access to a comprehensive toolkit, it is recommended that investors carefully study the history of the pool and be very selective in their investment choices.

Future development of the ICO pool market

Since Facebook, Google, and Twitter have created policies banning all ads promoting both cryptoprojects and ICOs, pools have become harder and harder for ICOs to ignore. It is the pools that now serve as a kind of “gold reserve” for ICOs, since they provide these ICOs with access to large amounts of funds.

In this regard, what we would call “white” pools - those that are reliable and with above-board practices - are likely to come out on top. In close conjunction with an ICO, this type of pool will grow and attract new supporters.

White pools will also tend to support KYC procedures, especially in such a way that they need to be followed just once to allow an investor to work with all ICOs. Another aspect of the trend toward transparency will be to incorporate ICO pools in jurisdictions where tokens are not considered securities. This is done to protect both the interests of pools and investors.

Fraudulent pools will find it more difficult to function, as awareness spreads about ICO pools and ICOs in general. Using ratings and listings in order to identify and tag scammers will become much easier. Despite some skepticism from experts and a number of ICOs, there have not been many documented cases of fraud. From our side, we monitor these movements very closely and label the found scammers in our databases.

Hidden pools will continue to work with hard-to-reach ICOs, but they will be forced to introduce payment anonymity mechanisms to protect their interests.

As the market changes from from bearish to bullish, the number of new pools will continue to grow.

Due to information noise and the absence of a single center of pool concentration, investors have been joining dozens of them. After the appearance of ratings and pool listings, this fermentation process will slow down and investors will begin to settle in the large reliable pools.

Of course, the trends within the ICO pool environment will also depend on the quality of the ICOs itself and on the friendliness of conditions that they supply when working with pools. But most likely, despite the current downturn of the crypto market in general, there will be a successful future for the ICO pools. They offer tangible benefits to all three stakeholders in the crypto game: they provide ICOs with the required volume, pool admins with net income, and investors with access to bonuses and hard-to-reach ICOs.

The review was prepared by the analytics department of ICOPools.io, the first service that rates ICO pools, thus protecting the interests of crypto-investors. Do you have any questions regarding ICO pools? Talk to us in our Telegram chat room (https://t.me/icopoolsen).

✅ @icopoolsio, let me be the first to welcome you to Steemit! Congratulations on making your first post! I gave you a $.02 vote! Would you be so kind as to follow me back in return?