Top 20 ICOs. Intro to Tezos

This time we will tell you about the project in the second place of our rating— Tezos.

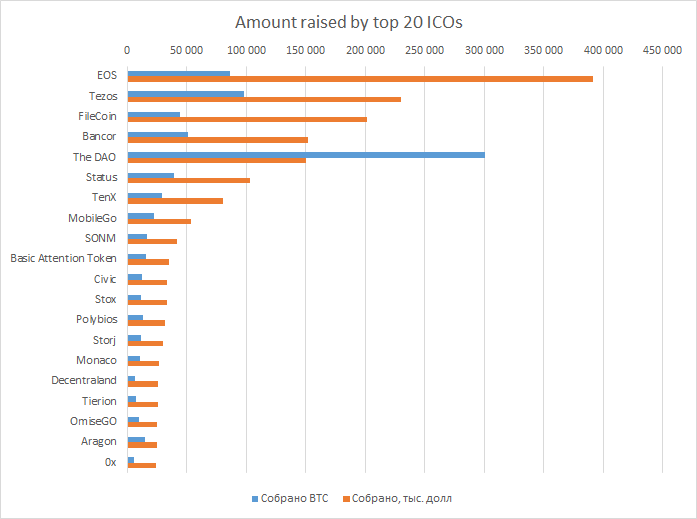

Here is the rating:

And here is more about Tezos:

ICO 01.07.17–14.07.17

Country of origin: Switzerland

Tezos create their own blockchain platform

No upper limit for funding

The problem being solved

Tezos is a startup presenting us a brand new blockchain releasing the users of the previous iterations of this kind of product from some of the detected problems.The main solution to be presented by Tezos is the opportunity to upgrade the system without the hardfork. Tezos implements the proof-of-stake mechanism and uses a new programming language OCaml, which will allow the adaptation of any new protocol without the fork.Tezos aspires to become a decentralized system, where every token-holder has the voting right and can shape the further development of the system.Earlier all deficiencies detected in a blockchain system used to be the reason for creation of a new cryptocurrency without these deficiencies. Tezos plans to become the last cryptocurrency since it would be able to upgrade and internalize all innovations created by other strat-ups.

Roadmap

The team started working on Tezos started in 2014.

| January 2014 | L.M. Goodman verbalized the idea |

|---|---|

| March 2014 | Start of the own financing |

| August-September 2014 | Publication of Position Paper and White Paper |

| January 2015 | Zooko became an advisor |

| June 2016 | Andrew Miller became an advisor |

| September 2016 | Arthur Breitman presented Tezos at the StrangeLoop conference |

| February 2017 | Emin Gün Sirer – became a technical advisor , Release of the test version |

Over the period since the January 2016 till the March 2017 attracted financing from funds or individual investors to fund the project. The overall sum comprised $612 000. A part of it was provided by three funds, the rest was collected as individual contributions from seven persons.Before the start of ICO Tim Draper, a well-known venture investor, stated his intention to participate in the crowdfunding for first time and buy some XTZ tokens.Tezos described 4 development scenarios depending on the funds raised during the ICO. At the same time the team presented two more scenarios that they find desirable, but don’t pledge to achieve the,Taking into account that the number of the raised funds considerable outreaches the set sums, it is necessary to describe more optimistic plans for the project:First of all, the team plans to attract 9 more experienced engineers. Secondly, engage the IC3 team to conduct research. As a marketing step they plan to conduct three annual conferences for developers in Europe, America and Asia, maintaining existing liaisons with advisors and conducting additional events. In the sphere of legal matters they need to keep the specialists and to study alternative structures to spread the project outside Swiss. To hire personnel and a PR- manager for promotion of the business in China. Apart from that Tezos plans to run three-month training sessions on protocol development in OCaml and smart-contracts.All objectives listed above have been evaluated in cash equivalent, however did not set any time boundaries. The first thing speaks about the detailed elaboration of the plan of attracting the required resources. The second point hampers tracking of the progress. Anyway, the team is planning to develop such features as security, scalability, confidentiality and usefulness. To enhance the security level the team plans to continue testing of the core codes, improvement of proofs of correctness, will make proposals concerning the upgrades of protocols when needed, increase the block generating process, publish recommendations about the operative security of the block control. The scalability will be reached through the enlargement of the block’s size and the reduction of intervals between their generation. They also plan to scrutinize and apply more effectively Zero-Knowledge Proofs pf Knowledge, Proof-of-Stake, decentralized control and stimulation structure.It is worth to note a so called ‘martian plan’ that the team is planning to implement. They want to hire a few teams of engineers to develop various enhancements and the further integration of best innovations. To create a department of computing science with continuing staff of professionals and to provide students with considerable grants for their inventions in area of formal check. To use street posters on crowded streets and on TV channels with high ratings. To finance the translation of legislation in Tezos language. To set up a convention with a small country so Tezos is acknowledged as one of the official currencies. To establish a school developing functional programming and creating reliable smart-contracts.In the core of Tezos lies the idea that token holders would manage the system on their own and develop in the most convenient and profitable way.

Team

The Tezos team comprises 11 persons and you can see the list of them on their website and in the documents. The information about the overall experience of the whole team and more details about three of them is given.The work on the project started in 2014. The founders worked in DLS at that time. One of the founders Arthur Breitman worked in finance on Goldman Sachs and Morgan Stanley. Kathleen Breitman worked in The Wall Street Journal, Bridgewater Associates, Accenture and R3.The developers team works with Tezos through a collaboration with OCam;Pro company. Most of them have PhD in computing sciences and rich experience in theory of programming languages.The project has people, who have been familiar with the sphere for a long time and who actively work in it among their advisors.Zooko Wilcox is a scientist in computing science and a leader of ZCash project, designer of net protocols with complex structure and a member of ZRTP and BLAKE2 developers team.Emin Gün Sirer is a professor at Cornell University studying operational systems, nets and distributive systems. He is one of IC3 directors in Cornell and has contributed greatly to Bitcoin while working on keys and mining mechanisms.Andrew Miller is a professor of computer engineering and computing science at University of Illinois, one of IC3 directors in Cornell and advisor of ZCash. He also studies cyber security, paying special attention to the security of decentralized systems ans cryptocurrencies.There is no information about particular experience of other team memebers, however two of them have detailed score about their work and career in social media.Bozman Çağdaş — http://cagdas.bozman.fr/Alain Mebsout — https://mebsout.github.io/The project plans to engage more personnel to develop nets and running research.4. MarketTezos is entering the marker of decentralized cryptocurrencies, such as Bitcoin, Ethereum, CryptoNote or Zerocash The developers team started their work on the project in 2014 and observed the changes appearing on the market. Once the first cryptocurrency — Bitcoin, — emerged, more and more projects have been appearing, detecting and troubleshooting drawbacks of the previous systems. Tezos plans to be the last cryptocurrency by the virtue of integration of mechanisms of emerging protocols. At the same time, another thing that distinguishes the project is the opportunity of token holders to control and shape the development of the net directly.Main competitors of the project: Bitcoin, Ethereum, EOS, CryptoNote and Zerocash5. Business modelThe monetization of the project is vague. The team reckons with the growth of the token price through the increase of the users number.6. AuditThe auditing of the source code has not been conducted, yet it is uploaded to Github.

Market

Tezos is entering the marker of decentralized cryptocurrencies, such as Bitcoin, Ethereum, CryptoNote or Zerocash The developers team started their work on the project in 2014 and observed the changes appearing on the market. Once the first cryptocurrency — Bitcoin, — emerged, more and more projects have been appearing, detecting and troubleshooting drawbacks of the previous systems. Tezos plans to be the last cryptocurrency by the virtue of integration of mechanisms of emerging protocols. At the same time, another thing that distinguishes the project is the opportunity of token holders to control and shape the development of the net directly.

Main competitors of the project: Bitcoin, Ethereum, EOS, CryptoNote and Zerocash.

Business model

The monetization of the project is vague. The team reckons with the growth of the token price through the increase of the users number.

Audit

The auditing of the source code has not been conducted, yet it is uploaded to Github.

Prototype

Tezos released the test version in February, 2017. It almost fully reflected the functional capacities of the Tezos net and was released to detect bugs, but is still has to pass security check.

Token allocation

The overall emission of tokens hasn’t been initially determined.

The first part should be allocated to investors, participated in the ICO. They purchased tokens for 5000 XTZ/BTC

The second part will be distributed to the DLS company that invested $893 201 in the project.

Tokens valued $317 000 will be allocated also to the developers team as a bonus to their revenues; $75 000 tokens ) to advisors; $30 000 to marketing companies.

10% of all tokens collected during the ICO will go to the Tezos Foundation and will be available during the next 4 years.

Other 10% will be reserved as a share of DLS securities and will be available during the next 4 years.

Motivation of the team

The Tezos founders are also the founders of the DLS company that sent part of its securities to Tezos. The payment for the securities can be received only once the following conditions are met:

· Tezos has been launched and operates successfully as a public blockchain for 3 months

· The work is carried as it described in white paper and technical paper and conforms to what has been promised to the community before the ICO.

As a result, DLS gets 8,5% of funds raised during the ICO.

Apart from that, 10% of tokens will pass into their ownership 4 years after the ICO, which stimulates the development of the project and maintenance or growth of the token price.

The Tezos Foundation company will also have the opportunity to receive 10% of the tokens 4 years later.

Analytics provided by Ekaterina Sebechenko, leading anylist in Dolphin BI.

The article was firstly published in our blog on Medium https://blog.dolphin.bi/top-20-icos-intro-to-tezos-c7790a53ab70

Visit our website http://presale.dolphin.bi and subscribe to the Telegram channel https://t.me/dolphin_bi!

Thanks for sharing...

tkx for this info

Paulo Aboim Pinto

Wanna try some passive income?

Control-Finance

https://control-finance.com/?ref=AboimPinto

BitPetite

https://bitpetite.com/?aff=aboimpinto

Chain Group

https://chain.group/5503

ReganCoin

https://regalcoin.co/ref/ABOIMPINTO