The World of Initial Coin Offering (ICOs) - Everything you need to start investing

- What is ICO (Initial Coin Offering)?

- How does it work?

- What is White Paper

- How to contribute to an ICO

- ICO vs. Token launch

- Pros vs. Cons

- Avoiding scam

- Conclusion

ICO, also known as Initial Coin Offering is unregulated way by which funds are raised by startups or existing companies for a new cryptocurrency venture. It is used by companies to bypass regulated capital-raising process required by venture capitalists or banks. In ICO, percentage of the total cryptocurrency is sold to backers in exchange for other cryptocurrencies, such as Bitcoin or Ethereum.

People may wonder why do companies do Initial Coin Offering? In order to get funding in the Development Life Cycle, companies ask for funds. Marketing, development, hiring, renting, etc. Everything costs. This way, if enough funds are gathered, they have money for everything they need so they can focus on the development of the product or service 100%. In most cases, ICO takes place before the end product is ready, sometimes even before the product even started development phase.

If an individual is the backer of the ICO, it means that he is interested, that he shares the same vision and that he willingly spent his money in order to follow the idea of the project and got rewarded with tokens or coins in return. If the project backed up by that individual succeeds and the coin hits the exchange, that coin he received, in the beginning, have some real value which is often many times more than an initial investment.

In chapter above, we’ve spoken about what the ICO is. Now, we will move on the explanation on how actually ICO works. To repeat, it’s the easiest and most efficient method for companies and individuals to fund their projects. On the other side, people invest in projects that they see as perspective and that they share the same vision for. ICO is the event that usually takes a period from one week to one year (EOS) and in which either everyone or whitelisted (allowed, pre-registered emails) can participate in.

ICO ends either when the project gathers enough funds (cap published in white paper; read about it in next chapter) or the time limit passes with satisfying amount of funds gathered. ICO can fail as well when the soft cap is not satisfied, meaning not enough funds are gathered and all the backers are refunded the amount they sent. There are 2 types of ICO supply, static and dynamic. Static means that no matter what, the price of the ICO coin won’t change throughout the ICO period. Contrary, dynamic ICO tends to let the demand dictate the coin price due to public interest and coin amount purchased.

Another important thing to mention is that ICOs can be either premined, which means that all of the coins are created at the same time and kept in the company’s wallet, or they can be mined using GPU or similar type of miners which use computational power to solve math problems and that way earns coins which can be transferred to money in return. In order for company to have an ICO, they do the prep-work and get the project to a natural technical milestone. After that, the company must publish so called “White Paper” (read more below) and disclosure and give the people a change to read it and comment. Mostly, these threads are developed via Reddit, Bitcointalk, Slack and Telegram. After everything is setup from their side, they make a landing page on their website stating the exact date and time when the ICO will take place.

Before an individual actually decides to invest into ICO, he not only should but must take a peek into projects White Paper. But what the White Paper is? White Paper is an authoritative in-depth report on a specific topic where the problem is presented and the solution for the problem is provided. Translated, the purpose of the ICO coin and what problem does it solve. Every project announcing ICO must have one in visible spot on their website.

Although it’s common to have these, the best practice, standard or universal structure is lacking which might cause some confusion if you read a lot of about perspective incoming ICOs. In general, this is what each and every White Paper should have included: 1. Problem 2. Solution of the problem 3. Token/coin implementation 4. Team involved in product 5. Token deployment and plan. How do I decide what ICO to join? First, the product must present the innovative solution to a problem. Ideally, something no one implemented before. Second, detailed use of funds gathered. To the last penny. When they will spend our money, how it will be distributed etc. Moving on, I always tend to search for a good team with various experiences within the crypto field since it has a greater chance of succeeding. Blockchain engineer should be one of the positions already filled before the ICO. Detailed development roadmap for at least 12-24 months ahead should be present in White Paper in order to gain my trust. When the coin will hit the exchange so the people involved cannot manipulate the price in advance. In order to buy the product, you must trust it enough.

If something looks out of order, it probably is. Move on, search for your trustworthy coin. Read more white papers. That way you’ll learn to predict what products are trustworthy. There’s no easy path really to know on which ICO you will earn money on, some coins will lose in value when they hit the exchange and some will increase few thousand percent. But all in all, you can do your research and gain trust for coin. And that’s a pretty good start.

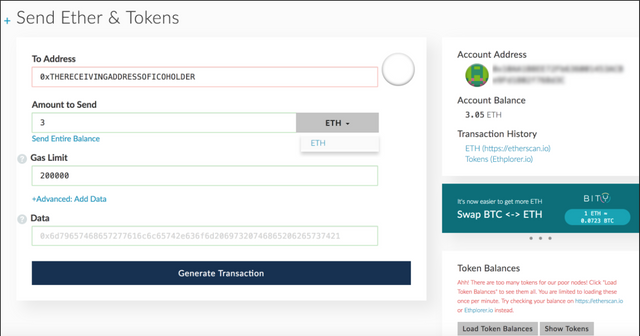

Since the majority of the ICO’s are Ethereum-based, you need ERC20 compliant (very important) Ethereum wallet. ERC20 is token standard which describes functions and events that Ethereum token contract has to implement. Just to clarify, none of the exchanges like Bittrex, Poloniex, Kraken etc. CANNOT be used to buy ICO coins. In order to buy coin in ICO, the easiest way is to create MyEtherWallet (www.myetherwallet.com) which is ERC20 compliant and can be used to receive tokens. In most of cases, ICO has detailed explanation of how to contribute. I will show you how to contribute with screenshots below. Let’s say you registered to MEW, logged in and you have some ETH in your wallet ready (account balance). You are good to go as soon as the ICO is launched. This is the MyEtherWallet screen you should be on when contributing.

Don’t let this screenshot above confuse you since it’s really simple. On the right side there’s your unique ETH address with your current balance that your wallet holds. And that’s what’s important pretty much. If you have account balance, you’re ready to contribute.

On the left side, there are 3 important fields that we want to look at.

- To address – this is the ETH address of ICO you are contributing to, every ICO has unique wallet address where they receive ETH contributions to

- Amount to send – basically how much in ETH you want to contribute in. In the example picture above, I’m able to contribute maximum of 3.05 ETH

- Gas limit - In Ethereum, gas is a measure of computational effort. To each operation, a fixed amount of gas is. For normal transactions, it should be set to around 21000 but for ICO contributions around 200000. You might ask why is that. Let’s say we have to take a car trip that takes 30 litres of gas to destination in ideal conditions. In order to be sure we will get there we will tank 50 litres and we will keep around 20 when we get there. Basically, we put more gas in order to be sure our trip (transaction) will go through properly. Any gas not used by transaction will be refunded to our MEW.

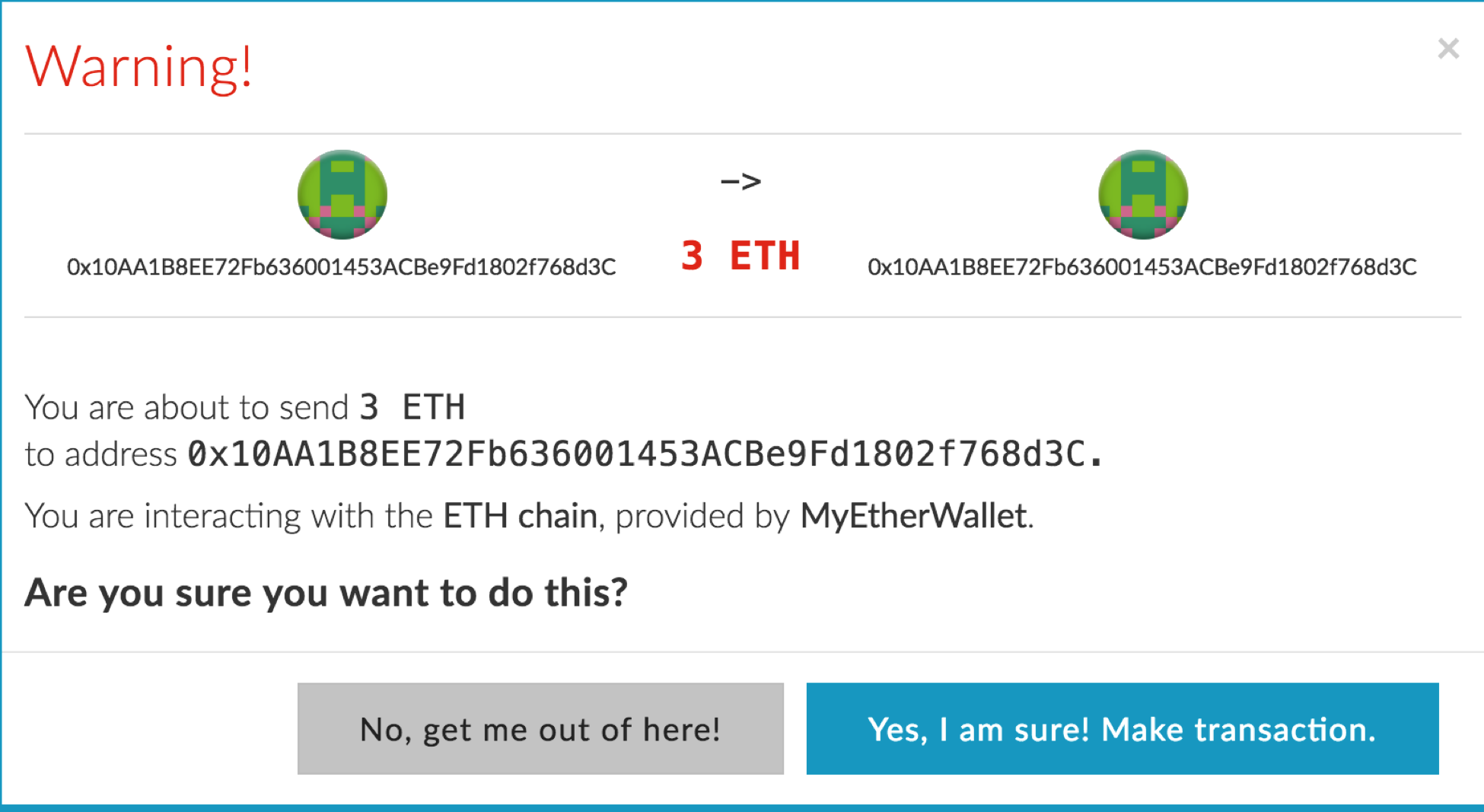

After that, we’re set to contribute. Just click Generate Transaction, Send Transaction and confirm this popup with Yes, I am sure and that’s it. You’ve contributed to your first ICO.

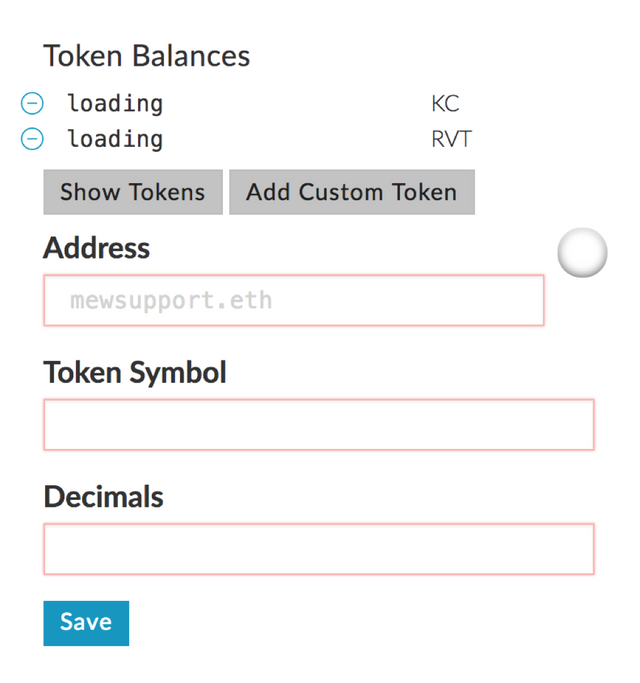

What to do after I contribute you might ask? Well, the answer is nothing actually. Just wait. Depending on ICO you contributed to, you will either get the tokens immediately or after the ICO is finished. Anyway, you will get them. How to check if you got the tokens? Easy, actually. When the product announces it distributed tokens, either they will appear automatically in your MEW, or you will have to add them manually.

If they do not appear in your Token Balances automatically, just ask the ICO holder to provide you with their Address, Token Symbol and Decimals fields and you fill the data and press save. Tokens should be there. Congratulations, you just contributed to your first ICO!

As stated in the beginning of this paper, ICO is a term created to gather funds. Many misunderstood its meaning and although it has similarities with public IPO’s, it has differences as well in which I won’t go into it in this paper. I will try to put a line between coin and token sales as simple as possible.

I will quote Medium’s article to make it a bit clearer about the difference between the two:

“Bitcoin is basically a distributed ledger that performs best as digital money — a simple example of the power of decentralization. Satoshi Nakamoto’s consensus process is revolutionary! But you can’t build much with it. Ethereum can do what Bitcoin does. It can be digital money too, but unlike Bitcoin, Ethereum is highly programmable — it’s designed to accommodate the construction of complex applications. Bitcoin produces “coins”. Ethereum generates “tokens”. A “Token Launch” is an Ethereum thing. An “ICO” is a bitcoin/altcoin thing.”

Coins have one and only utility – to act as a store of value with limited to no other functionality. Example of coin are Bitcoin and Ethereum.

Tokens are completely different since they can store complex, multi-faceted levels of value. They are generated by a Smart Contract System and are highly programmable and because of that they are have multi-functionality. Examples of tokens are OMGToken, EOS, Qtum etc. Built on Coin platform (ETH)

After we’ve been through all of this, you may ask “Should I invest?”. In most cases, the answer is no. But, on the other side, there are times the answer is yes. As with all high-risk potential high-reward investments, buying crypto currencies is risky. Buying ICOs is even riskier. The most important thing to remember is that you don’t invest more money then you can afford to lose. Below are listed the most important pros and cons.

ICO pros:

- Capital gain – investing in ICO can make you filthy rich. I mean it. You can become a millionaire with investment of only $1000 in the right ICO. There are cases where the coin’s value increased 50000% since the ICO. Probably you wouldn’t hold that coin for so long and you would take the profits much earlier and be happy with it. But, if you’re patient for long time it can be very very useful.

- Liquidity – the crypto currencies are highly liquid assets. If you need money in the future, it is very easy to pull the plug and cash out the profits.

- Experience – no matter how ICO goes, you gain experience which helps you understand the ICO world and helps you with future investments

ICO cons:

- Potential Scams – as pretty much everything in life, crypto world is not immune to scams. Scammers spend months and years to prepare for successful scam ICO which if implemented properly can make them rich and leave investors without their money. It is up to you to research every ICO up to smallest detail properly before investing.

- Volatility – like Bitcoin, pretty much every other coin can be highly volatile in price. Latest Bitcoin price surge was from around $5000 to $2900 in only few days. You might watch out for price surge and cut your losses in time if this happens.

Although there’s no definite template for spotting the scam ICO, there are many ways of research that will help you figure out if you trust it. Not all of the honest ICOs will succeed as well. There are many things to take into consideration.

Unrealistic goals – some of the scam ICOs have unrealistic expectations. If they state they will replace Bitcoin, have 10.000.000 users in first few months, price will rise few 100% in no time, add them to your scam list and run away from them.

Complicated words – “Our decentralized blockchain-based platform will disrupt the landscape of cryptocurrency investment while building a trustless network of pseudonymous users that leverage swarm intelligence technology to provide real world financial services in a tokenized ecosystem.” Sounds amazing right? Wrong. They have tendency to use complicated words in order to turn out a really boring stuff with no meaning into something exciting. If the ICO product needs to have something like this on their page, it is likely a scam. Run away.

Whitepaper – as stated above in one of the chapters, whitepaper is very important. If you want to recall why, just scroll and read the entire chapter devoted to whitepaper.

No code – if the product doesn’t have code available on Github or Sourceforge, don’t go with it.

Team – investigate If people listed in team part of the landing page reflect actually who they are and that they’re involved into project. Scammers often use people’s photos and names without their permission in order to gain trust from potential backers.

In my opinion, ICO’s are here to stay. In order to involve in one, you should consider if you want to flip the ICO (sell as soon as the price spikes; coin hits the exchange) or to hold for it longer period of time. Some ICO’s are good for one thing, others for both of that, majority for none. Do your research. Be involved in Slack, Telegram, Bitcointalk forums for the ICO. You have to trust it in order to make money. Do not invest in shady ICO’s. Be patient. Read the white paper. Ask unanswered questions. Participate in community. Do not give money to people claiming to have bigger bonuses then the ICO originally planned. Always check URL you’re investing to, make sure you don’t fall into scam. Secure your assets, if possible with hardware wallet (my suggestion is www.trezor.io).

If you have any questions or suggestions, feel free to ask or write in comments.

If you appreciate this post and want to see more posts from me in the future, feel free to share it on social media or contribute on one of the wallets below:

Bitcoin BTC - 1ET63nYjj3bkmg82ys6jGMVXEdJdVJSzLW

Ethereum ETH - 0xb8a8e3182a3f6145f6890f37638eefaf377c2122

My Twitter - @dcryptosloth

Congratulations @asimd! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPgreat read, this make it much easier to understand ICO's from a laymans perspective. thank you!

I guess the white paper is kinda like technical analysis info they use on the stock market? all those charts and data about the company and so on

Exactly. You're correct, it must give us an answer to the next questions: "Why should we pick you among hundreds of others ICOs", "How do you plan on achieving your goal" and "How will you distribute the money you ask for".

If you like it, give me thumbs up and share it, I would appreciate it :)

I re Steemed for you and an upvote!

also do you know of any good Ethereum wallets that ERC20 but have mobile versions?

Try Jaxx

great thanks!

Nice post @asimd... It will defenitely help the newbies in the cryptospace who wonders what an ICO is.. What is your favorite ICO as of now.?

Thanks man. I am currently in Rivetz, Link and few more but the sale is finished. I think I'll write the post about the potentially good investment ICO's, until then vote up and resteem is appreciated. Thanks again :)

Good work

Congratulations @asimd! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @asimd! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!