Keeping up with the DeFi Economy

Decentralized Finance

DeFi

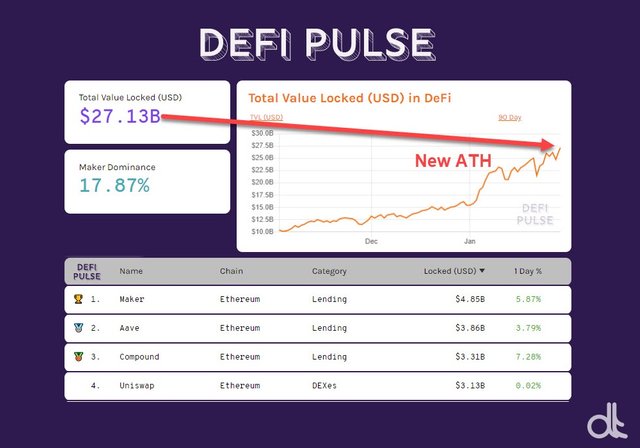

The continued growth of Decentralized Finance or DeFi as it is called is continuing in 2021. In 2020 it grew exponentially from Millions of USD locked in Smart Contracts on various platforms to billions by year end. That growth continues this year as we continue to reach and breach historic landmarks.

Bitcoin and Altcoins

Bitcoin reached its all time high of 42,000 USD on January 7th, 2021 and it;s market cap broke the ultimate number One Trillion Dollars in Marketcap and took a breather.

Bitcoin

Source

In what appeared to be a move out of Bitcoin into Altcoins the much anticipated Alt Season has begun. The most famous sentence now in cryptocurrency land is; “If your our Altcoins aren’t pumping you have the wrong Altcoins.”

Ethereum pumped to a new all time high of 1440 USD on January 22. And is having almost 5 billion USD of daily trading volume.

The Great Tokenization and NFT Art

According to my sources trading volume on decentralized exchanges, or DEXs, has greatly increased to just under an astronomical 60 billion USD tied up in Smart Contracts, most of it in Ethereum and of course Bitcoin.

We appear to be reaching historic heights and some feel this large trading volume is also accelerating what I call “The Great Tokenization” defined as a historic turning point resulting in the exponential acceleration of the tokenization of physical assets from this huge movement of money into DeFi fueling the need for and acceptance of NFT tokens representing cryptocurrency like Bitcoin, works of art, real estate and the newest financial phenomenon NFT Art with the recent $370,000 USD sale of one NFT Art Token, we are entering a new era.

As a side not, Latest figures from DeFi pulse indicate there are 44,000 Bitcoin currently Tokenized. Compound is the leader with T over 70% of that tokenized Bitcoin. The top three platforms for tokenized Bitcoin are MakerDao, Compound and Curve.

DeFi Numbers

There are six platforms of note, three trading platforms and three lending platforms.

Trading Platforms

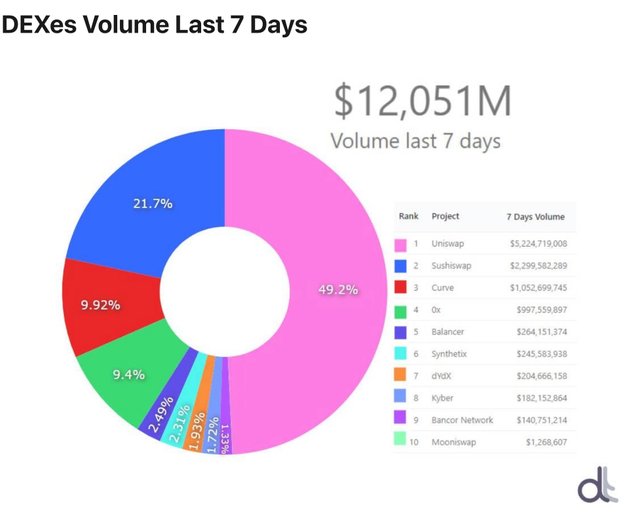

The top three platforms are Uniswap with over $5.2 billion or 49% of total trading volume. SushiSwap, a fork of Uniswap's code, with $2.3 billion or 21.7% and Curve with just over 1 billion USD or 10% market share. See below graph for all players, courtesy of DeFi Today newsletter.

Lending Platforms

The top three include the MakerDao 4.7 billion USD, Aave 3.8 billion USD and Compound 3.3 billion USD.

DeFi Revolution

The financial world is changing, and we may be living in the early days of the New World Order. It’s more important then ever to learn about DeFi, blockchain, cryptocurrency, Bitcoin and Ethereum.

@shortsegments appreciate your effort always having Interestingly info I believe the world is gradually embracing the crypto space daily and it also means there will be much better market cap for coins and altcoins in near future.

Thanks for sharing.

Thanks for sharing this information. You provide a very good intro into understanding the various spaces. Would be nice for people to spend some time getting to know the crypto space. What I hope we don't see is large scale pump and dump of altcoins and tokens. That would be unfortunate!

this year looks a lot like 2016 where it seemed that coins were the solution to everything but then the market collapsed and the rest is history, from my point of view you have to be very cautious in the projects you plan to invest in on the other hand DEFI is minting the coin ecosystem so it is possible that this time as you say "it is the early days of the new world order" with only one coin,