Extra Gains and Impermanent Loss on Liquidity Pools

Investing in the liquidity pools of decentralized exchanges is a very attractive option for cryptocurrency investors. Because when they invest in liquidity pools, they earn because of the value increase of the crypto coins they invest, as well as the crypto of the swap application.

There is also a burden that comes with this extra gain: the risk posed by investing in liquidity pools. This risk is called impermanent risk.

Investors are investing a crypto pair in the liquidity pools to be traded with each other. Thanks to these crypto coins, which are deposited in equal monetary amounts in liquidity pools, customers give one of the cryptos and buy the other through the corresponding swap application. This leads to a temporary deterioration in the balance of the amount of cryptocurrency in the pool. If large changes occur in the parity of the cryptocurrency pair in one direction, a monetary loss occurs in the pool.

From the perspective of the investor, permanent loss is the difference in value between depositing two cryptocurrency assets within a liquidity pool or simply holding them in a cryptocurrency wallet.

Impermanent loss creates a negligible loss compared to the return obtained when there are such changes in the parity of the invested cryptocurrency pair as 5%, 10%.

However, for example, if the price of one cryptocurrency that we invest in does not change, while the price of the other doubles, we have 5.72% less money compared to keeping the relevant crypto coins in our wallets. In this case, for example, our investment of 500+500=1000 dollars reaches a value of 1424.21 dollars instead of 1500 dollars.

In the coming weeks, Steem will also take part in liquidity pools via Robiniaswap. Thus, users of the Binance Smart Network will be able to buy and sell a pegged version of Steem via Robiniaswap.

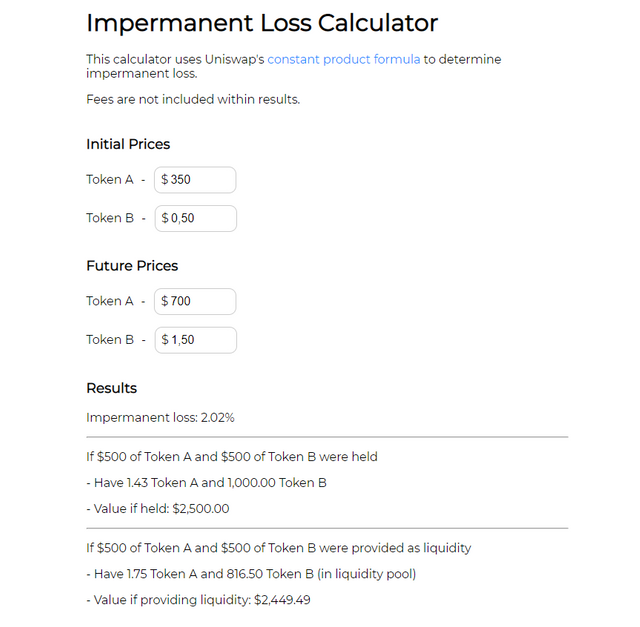

Let's say you invested in the BNB-Steem pair on Robiniaswap. Let's call BNB Token A and Steem Token B. And let's say that Steem price has increased by 3 times after a year. BNB, on the other hand, rose only 2 times.

As you can see in the image above, by investing $ 1000 in the liquidity pool, we make a profit of $ 1449 instead of $ 1500. On the other hand, if the BNB-Steem pool has an extra 20% return, we earn $ 200 extra and get more than the $ 51 return that we were deprived of.

By the way, I would like to note that in the case of a price deceleration in one or both of the invested cryptocurrencies, an impermanent loss also occurs. You can try it via https://dailydefi.org/tools/impermanent-loss-calculator/ how can there be consequences in different scenarios.

Thank you for reading.

Image Source: https://unsplash.com/photos/ZVprbBmT8QA and https://undraw.co/

Very informative and instructive information my friend @muratkbesiroglu very purposefully with the opportunity that is presented to us through the robinia project, knowing how liquidity pools operate and the benefits (or losses) that may arise are elements that will allow us to make the decision more successful in terms of the most correct way to invest our funds.

While some win, others lose, but that's the risk some of us have to take, it's the only way we can win, and sometimes lose.

I am aware that no one ever wants to lose.