Coronavirus — a False Trigger

For the last ten days, Stock Exchange is falling like a stone. DJIA has dropped 4000 points and had a breather only during weekends, despite enormous amounts of fresh fiat paper emitted by the FED. Is the history repeating?

If you are following NYSE, then you must have seen this graph:

It is dropping again… Bring in the corporate media! CNN, MSNBC, Bloomberg, Forbes… They will all “explain” how this fall is just a reaction to the Coronavirus outbreak, which has hardest hit on the World’s factory — China. A Black Swan! Despite the fact that World Health Organization (WHO) has called on investors to stop panicking and focus on facts. Their (spin)doctors are claiming that the fall which has already wiped $5 trillion off stocks, doesn’t have anything to do with so called FED’s repo loans, that are injecting over $100 billion every night since September 2019 — just to support the largest financial bubble in human history with global derivatives estimated at $1.2 quadrillion (20 times the global GDP!) But seeing the cliff at the graph above, even the most naive among the sheeple, would have to search for a second opinion. Where?

A History Lesson

I think it was Winston Churchill who said: “The farther back you can look, the farther forward you are likely to see” meaning “If you want to see deeper into the future you have to look deeper into the past.” If you are wondering what will happen, you will probably find the best answer in history.

Instability is inherit to capitalist system, with crises that on average come in cycles of every 4-7 years. If the period is longer, the crash gets bigger and more catastrophic. You can see a full explanation in an excellent lecture of the economy professor Richad Wolff, titled “How Capitalism Works”. The last big crisis was in 2008, which means we are long overdue, at least 5 years, for the next one. Do we have a historic precedent for a 12 years period with a crash? The one from 1990 to 1999? No, the closest one would be 1919–1929 ending with the catastrophic crash — that lead to the great depression:

The bull market lasted for 10 years then. Now we have 12…

.jpg)

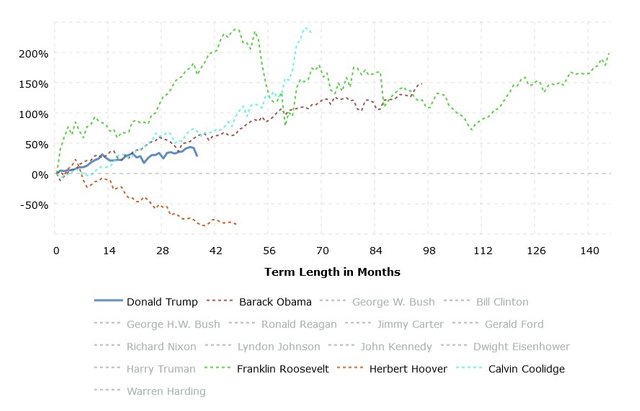

There is another interesting comparison with the pre-Great Depression period – let’s look at the Presidents performance then and now:

Looking at this graph we can see that Calvin Coolidge had a constant rise, much like Obama. Herbert Hoover had a constant fall, which is not consistent with Donald Trump, right? Yes, Trump has inherited Obama’s inertia, and Hoover didn’t have J. Powell at the head of FED. One big drop could bring Trump in the position of Herbert Hoover, and open up the way for the next FDR. Either that or… Hold that thought for a moment.

Coronavirus scam

Don’t get me wrong, I’m not saying that Coronavirus is not dangerous for your #health. I’m saying it is MUCH LESS dangerous than hysteric hype propagated through corporate media. It has a bit over 3% death rate, and many of the infected people have already recovered. It is dangerous for the people with weakened immune system and for children in whom the immune system has not yet been developed enough. But it is not necessary deadly, as can be seen with people recovered without any vaccine. Let’s remember that SARS (2002-2004) killed around 4500 people all over the World, and it had 10% death rate. In that period, 44 persons died from SARS in whole Canada. Every year on average 41 person dies in the traffic accidents — in Toronto only!

So, all the Coronavirus fuss was primarily primarily intended for the severing of the routes Chinese goods flows into Europe and United States. It is aimed as a full economic impact on China. Unfortunately, the rest of the World is so much depending on China already, that it is not possible to hit Chinese economy without the consequences for the rest of that same World. You can find out more on this topic in an excellent text titled Why the Coming Economic Collapse Will NOT be Caused by Coronavirus by Matthew Ehret, Editor-in-Chief of the Canadian Patriot Review. You really should be very worried for your financial health.

And now, let’s go back to that thought we have on hold…

Back to the Great Depression

While all those amazing similarities in the graphs above does not neccessarilly means the events will unravel in the same manner, we cannot ignore almost identical “handwriting” seen through these graphs. The “handwriting” indicates a disastrous turn, like in 1929. That we cannot escape. The Coronavirus scam is just another way how plutocracy is trying to evade responsibility. The question is — what will be after the crash. In 1929, feeling the hot breath of revolution, plutocracy reluctantly handed over the reins to Franklin Delano Roosevelt:

“The money changers have fled from their high seats in the temple of our civilization. We may now restore that temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.”

– Franklin Delano Roosevelt, first Inaugural Address 1933

So, we may hope for the incarnation of another FDR, or we can expect revolution. Unfortunately, only then it will be known how deadly is the real virus in the system — FED!

BTW, have you check lately relation of Bitcoin and Gold?

March 2nd, 2020. 15:00 CET

Xe.com: BTC to Gold Ounce

1 BTC = 5.50361 oz

Xe.com: BTC to Gold Ounce

1 BTC = 5.50361 oz

Instant Access to Steemit

Instant Access to Steemit

Universal Basic Income

Universal Basic Income

Google detox starts here!

Google detox starts here!

PocketNet

PocketNet

PocketNet

PocketNet

Check out ABRA and easily invest in 28 cryptocurrencies or BIT10, an index of the top cryptos. Use this link to sign up and get $25 in free bitcoin after your first Bank/Amex deposit, or 1.5% cash back when you exchange cryptos

The impact of COVID-19 should not be ignored but I fully agree that the outbreak is probably a convenient scapegoat to explain an inevitable stock market crash. The world stock markets were hooked to Feds uncontrolled money printing. There is excess credit in the system leading to ridiculous stock valuation. A great purge has to happen eventually to clear up the system.

All this being said, the Feds still have some room for rate cuts and of course unlimited amount of money they can print. Of course, this time might be different and all these "tools" that worked 12 years ago may not work this time.

Hello @lighteye

Thank you for choosing to post within project.hope HIVE/community. I was wondering if there is any way to DM you as I would like to explain little bit about our community goals and structure.

Do you use telegram or discord? If you do then join our server and give me a shout. I would gladly share with you goals of our community and explain our project.hope economy.

Discord sever: https://discord.gg/yzMFjR

Upvoted already,

@project.hope team

Discord server gives me this message, @project.hope:

Somehow link above expired.

Couly you please try this one: https://discord.gg/BFMqNy

Dear @lighteye, @culgin

Interesting choice of topic buddy.

With current ammount of FIAT being printed and pumped into financial economy - we can only witness even bigger gap between financial economy and real economy.

The way those funds are being distributed makes me feel, that central banks will do anything and everything to support growth on stock markets. Taking care of rich and wealthy in the first place.

Reason behind this crisis was different. Based on my understanding - lack of liquidity was the trigger. And that was caused because currencies were pegged to gold (limited resource).

I believe that you're wrong. Mass media have been doing everything to make problem look small. If anyone believe that China would decide to clamp down so many cities and put entire economy on hold, bringing unstability within their communist party and for the first time in 10 years facing enormous recession - then we really do not know much about china. Don't get me wrong. I think we should be scared.

Upvoted already,

Yours, Piotr

Resteemed already. Upvote on the way @lighteye