My Best Posts: Part-Time Jobs, the Real Price of Gold and Silver, the Longer-Term S&P 500 Sectors Performance

Surprising charts about the past gold and silver price peaks adjusted now with the inflation. Do you imagine gold price beginning with “3” and silver price in the triple-digit territory? It happened before. An infographic about the sector-race in the S&P 500 index, and a post about freelancing and part-time, passive income work.

I always say finances are “Ageless” – many things which happen now happened before. Precious metals were moving in a strong bull market this year, gold reached new all-time highs, silver also jumped. But if we adjust the prices with inflation, we see a very different picture. Earlier tops were much higher in reality, converted to actual price levels. Wild precious metals price predictions are no longer only products of crazy fantasy.

My other post is about what people do if jobs and also part-time jobs are scarce? Freelancing and passive income may be solutions. And a comprehensive comparison of the shorter and longer-term S&P 500 sector performances. I call the sectors the “11 Riders of the Cataclysm”.

This is my post recommendation for you with a few new publications on my financial web page, Ageless Finance. Shorter and longer, comprehensive articles about investing, and personal finance themes. With many charts and lists. If you are interested in more details, just click on the images.

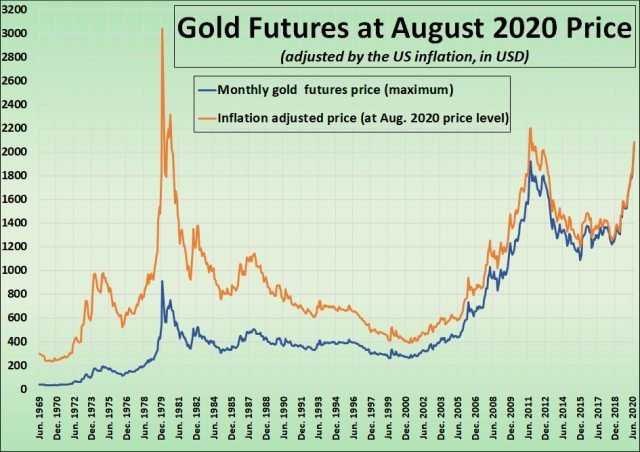

Gold, Inflation, All-Time Highs–Good to Know Where the Real Top Was

The gold price reached all-time highs in August, by 2,089.2 USD (futures price). It entered a correction later, but it is still one of the best investments in the last couple of years. But inflation puts the price tops in a new context.

- Gold, inflation are closely related, as people buy metals to protect their wealth from depreciation

- Also, by low inflation, gold reached a new all-time high this August.

- But this is only a nominal top, nothing special in real terms.

- The real top in gold prices was much higher, calculating inflation-adjusted prices.

- New highs to expect if inflation increases.

Click the picture to view the full post:

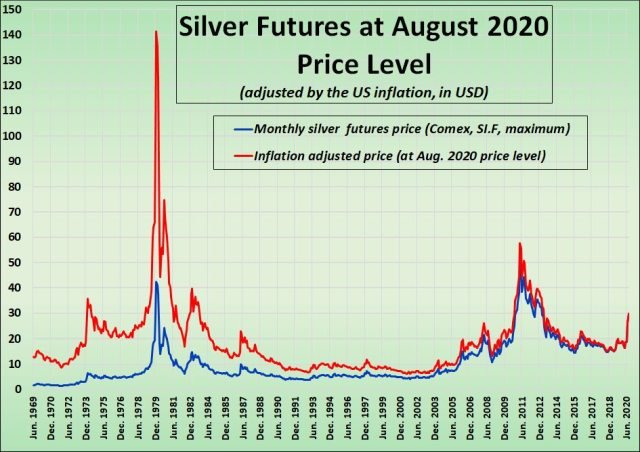

What Was the Highest Price of Silver So Far? (Not the One You’re Thinking About)

Similar to gold, inflation puts silver prices in a new context. The real top in silver prices was much higher if we calculate inflation-adjusted prices. In the triple-digit territory.

- The highest price of silver by the statistics was $49.50. But a long time ago.

- Today’s inflation-adjusted price is already in the three-digit range.

- Silver price is influenced by many factors.

- There are four main outcomes. New highs of silver are yet to come?

Click the picture to view the full post:

What to Do If Part-Time Jobs Are Scarce?

Unemployment is better now in most countries than in the worst lockdown-months in spring. But still very high. And “under-employment” is another big problem. A lot of people have work, but less than they wish to have. Part-time jobs, side-hustles used to be very popular in crisis times.

- The crisis affects employment hard, also freelancer work, and part-time jobs.

- People rush to freelancing sites and payments are sinking for everyone.

- But if you have skills, you can still prosper.

- Passive income ideas may be also a solution–in the long term.

Click the picture to view the full post:

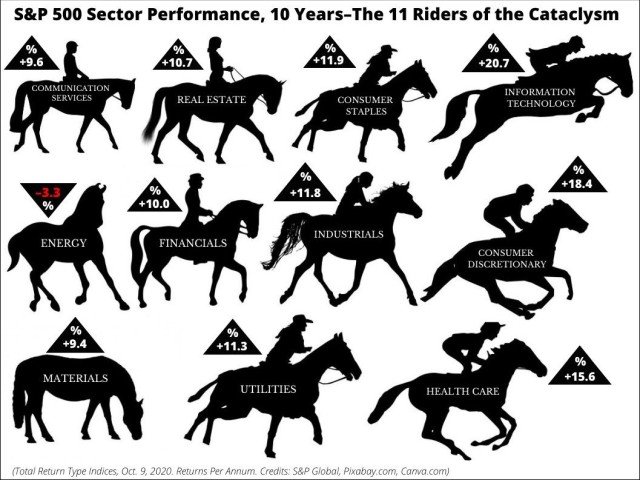

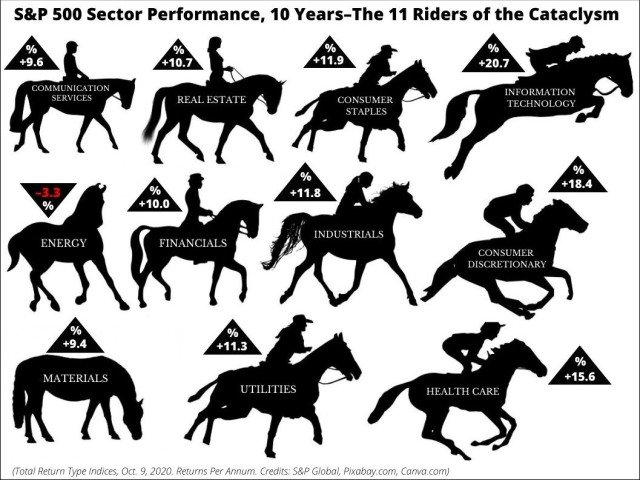

S&P 500 Sector Performance in 2020–The 11 Riders of the Cataclysm

The best sector, “Information Technology” returned 52.69 percent. The worst, energy, –41.01 percent in 365 days. What I find interesting is that in the last 8 or 10 years, the S&P 500 sector performance was very similar to the last 12 months. Information Technology, Consumer Discretionary, and Health Care were the big winners. Energy, Real Estate, or Materials lagged far behind the others.

- The S&P 500 sector performance in 2020 was very similar to the long-term picture. (With infographics.)

- The crisis didn’t change the prospects of all industries.

- Some keep underperforming or overperforming for many years.

- There is only one sector in the negative over ten years.

- Dividends are important but don’t change the big picture.

Click the picture to view the full post:

Follow me!

You can follow me on Twitter, Telegram, Facebook, Steem, Hive, and Mastodon.

My Previous Chart and Post Recommendations:

Extreme Crypto Transaction Fees, Natural Gas Price Explosion, Traps in Blogging SEO–Posts of the Week

The Down of Fiat Currencies? Golden Age of Silver and Gold

How to Dictate Your Posts? Which Are the 3 Biggest Challenges in Personal Finance Today?

13 Brilliant Free Apps for Bloggers, Investors and Freelancers, DIY Fake News Generator

29 Zoom Alternatives, 4 Main Ways to Buy Gold, Surprisingly Stable Real Estate Prices

7 Reasons Not to Gamble, Robinhood and The Woods of the Contrarian, 17 Quarantine Ideas Useful Forever

The Real Value of Gold, is Stamped on our U.S. Bullion Coinage... The Ten Dollar Eagle needs a Weight Change...

October 12, 2020... 12.3 Hollywood Time...

They could mint The Ten Dollar Eagle from copper, and the 10,000 Dollar Eagle, from gold.

Our Ten Dollar Gold Eagles need a Weight change from 1/4 oz to 1/5 oz...

Our U.S. Bullion Coinage will Range from $5 to $100, with the "Spending Power" Ranging from 500 to 10,000 of Today's Fiat Dollars...

October 15, 2020... 3.5 Hollywood Time...

You did an in-depth analysis of the performance of gold and silver. Thanks also for the external links you provided.

Nice piece buddy

Thank you.

Excellent and complete analysis on gold and the silver, very complete I congratulate you, great job

Thank you.