UFT Token Burn: 30% of Protocol flash loans fees will be used to acquire & burn UFT upon our mainnet launch on March 30th!

TL;DR:

UniLend Finance will initiate a token burn mechanism alongside the launch of our flash loans product, which will reduce the overall supply of UFT.

This token burn mechanism is linked to our flash loans functionality.

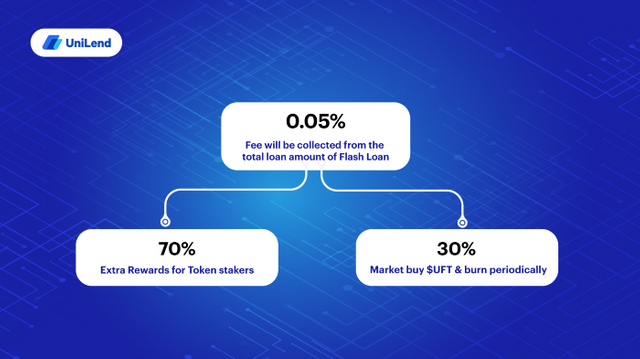

The UniLend flash loan fee of 0.05% will be divided as follows:

70% will be rewarded to UFT stakers

30% will be used for market buying UFT, which we will then burn

Our token burn mechanism will therefore make the UFT token deflationary over time while further rewarding UFT stakers.

If we achieve a similar amount of flash loans traction as Aave’s flash loans (which are much less competitive compared to UniLend’s flash loans), this would result in $1.7 million of value transferred back to the UFT ecosystem each year.

Making UFT deflationary while providing more incentive to stake UFT is therefore poised to massively benefit token holders on multiple levels.

With the recent announcement that UniLend Finance will soon offer the industry’s most cost-effective and comprehensive flash loans product comes yet more major news for token holders - UFT will become deflationary with the launch of our token burn mechanism!

A portion of the fees collected from each flash loan on UniLend will be used to market buy UFT tokens for the sole purpose of burning. This will reduce the overall supply of UniLend’s native UFT token, which is great news for our token holders. In addition, the remaining percentage of flash loan fees will be rewarded to UFT stakers.

Say hello to a deflationary UFT token with added benefits for holders!

Deflationary Economics

Permanently removing a certain amount of tokens from circulation is called a token burn. Token burns benefit token holders by decreasing the total supply, which theoretically increases the value of each token in circulation. This is due to simple supply and demand.

Binance has proven this model time and time again with their token burns, as each time they’ve burned BNB, its price has increased. While we cannot declare, and are not declaring, that token burns necessarily have a direct impact on the price of a token, simple supply and demand dictates that as an asset becomes scarcer with constant or increasing demand, the asset becomes more valuable.

In addition to creating scarcity by deflating the supply of UFT, our token burn mechanism will also incorporate added benefits for UFT token holders.

The UniLend Token Burn Model

UniLend’s token burn mechanism is directly linked to our flash loans fee structure. The UniLend flash loan fee of 0.05% will be divided as follows:

70% will be distributed to UFT stakers

30% will be used for buying UFT on the market, which will then be burned

As the number of flash loans on UniLend increases, so will the number of tokens burned alongside the number of tokens awarded to UFT stakers.

Potential Scope of Impact: An Example

For instance, the leading existing flash loans provider Aave - which offers a much less competitive flash loans product than UniLend - processed $67 million in flash loans last week:

Excerpt from Aave’s most recent weekly update (Week 11 of 2021). Source: https://governance.aave.com/t/aave-weekly-protocol-performance-governance-update/1660/39

If UniLend were to process a similar amount, we would collect approximately:

$67 million (flash loans value processed) x 0.05% (UniLend’s flash loan fee) = $33,500 in flash loans fees per week

This is $1,742,000 per year in flash loans fees

70% of these fees will be distributed to stakers, and the remaining 30% will be spent buying UFT on the market which will then be burned.

$1,742,000 x 70% = $1,219,400/year distributed to UFT stakers

$1,742,000 x 30% = $522,600/year for market buying UFT and burning

This would reduce the supply of UFT considerably over time

Clearly, even a small flash loans market share would have a considerable impact. It’s important to note, however, that UniLend’s lash loans - offering the most cost-effective and comprehensive product on the market - are so competitive that we believe that more flash loans will be processed through UniLend than any of our competitors.

A Scarcer, More Attractive UFT Token

We believe that, due to the advanced features and ultra competitive costs of UniLend’s flash loans compared to our competitors, we’ll attract an even larger market than they have already. Thus, we believe our token burn mechanism will benefit UFT token holders considerably in both the short and long term.

If you’re a token holder and you haven’t joined our social platforms yet, then what are you waiting for? Please feel free to come introduce yourself to our friendly global community. Remember we’re here to help so don’t hesitate to ask questions. We love to hear from new community members and we invite you to get involved in the conversation.

Website | Telegram Community | Announcements Channel | Twitter | Blog | Github | Reddit