Mini Crypto Program Part 2|| “How Psychology Influences Market Cycles" by @nurdeen

Hello, I am very happy to participate in this mini-crypto for beginners on this noble platform. It is a pleasure to do the assignment post about psychology's influence on market cycles. This is going to be an awesome course for beginners in the crypto currency market like myself. Some of us are detained by our reputation and experience in the crypto market world to enter the crypto academy to learn more about crypto currency on this platform.

This is now a chance and an opportunity for us to learn more about crypto currency and the risks involved in it. This is my first home post on steem education mini crypto and I hope that I will be corrected if I am mistaken in my post.This is my understanding of the home work given by our mentor @liasteem on the following questions;

1.Visit the website, coinmarket, and explain what FOMO is!

2.Explain what FUD is.

3.Explain where FOMO occurs. (I need screenshots)

4.Explain where FUD occurs? (I need screenshots)

5.Choose the 2 cryptocurrencies you want, then use the graph of the 2 cryptocurrencies to explain where FOMO and FUD occur! (I need screenshots)

Visit the website coinmarket to understand what FOMO is.

FOMO is a more personal thing. It’s the dread of missing out on something that others are enjoying (for example, the fear of missing out on Bitcoin rises while others are picking up their Lambos or profits). FOMO may cause you to buy into a coin, not take profits on a coin, or not invest in a coin that has already skyrocketed in value.

It is the idea you get in your head that rational profit picking or waiting for a reentry point now will result in you missing out. This FOMO is what drives people to buy at higher prices or hold on during a fall in the market after making profits (only to lose some or all of their profits again). People can be said to get FOMO when they act on decisions due to the fear of missing out.

FOMO usually happens to people with little knowledge about crypto currency and the trends in marketing in the world. Novice traders and investors frequently buy crypto currency at higher prices or sell it at lower prices, only to come to regret their decisions. Fomo can simply be explained as a factor that causes investors to invest even at higher prices. The increasing nature of the prices directly triggers novice traders to invest at those higher prices, thinking of making profits within a short period of time. The rate at which the prices of cryptocurrency fluctuate with time can drop or rise at any moment in time.

EXPLAIN WHAT YOU MEAN BY FUD.

FUD is fear, uncertainty, and doubt, which often circulate on social media or in mass media. FUD can cause a decrease in the price of a particular coin, not based on fundamentals or pictorial representations, but based on the bad news that circulates on social media.

Especially since well-known real investors in cryptocurrency withdraw their money, if you want to avoid a loss, withdraw before they withdraw their money. Which is false, causing people to panic and withdraw their money, which affects the prices of the crypto market.

This false information leads to the falling and rising of the various coins. And the perception that certain coins have an influence on the prices of other coins, which affects the market drastically.

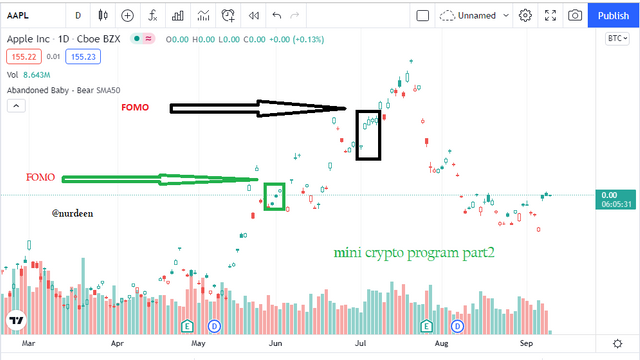

Explain where FOMO occurs

The graph shows where fomo occurs in the graph above. The fear of losing the chance of being rich causes more people to invest, which will rise for some time, and decline drastically at some time again. This either brings a loss or profit on your investment.

Many people invest in the high price of coins to make profits, which is why there is always a change in price every second. Whenever there is a decline in the price of the various coins, it could lead to deep frustration for a novice investor like me.

Explain where FUD occurs

The screenshot above with marked lines indicates where FUD occurs in the chart. All these investors intend to sell their crypto currency due to the decline in prices of the crypto currency. Because of fear, uncertainty, and doubt, you waited till it was at its highest peak before intending to trade. which was not the right time to invest and trade, and may have caused losses in your investment. These incorrect trades in your investment are caused by fear, uncertainty, and doubt. And because FUD, you could sell because of a little drop in price, and could also make losses when the price rises within the next second.

You must trust and have knowledge of this investment or any online trading before putting money into it. This will reduce your losses in that investment.

Choose the 2 cryptocurrencies you want, then use the graph of the 2 cryptocurrencies to explain where FOMO and FUD occur!

BTC and Ethereum are the currencies I prefer and am unfamiliar with.These currencies are explained by the places where fomo and fud affect them.

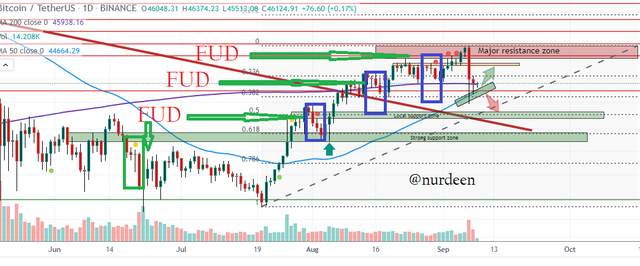

Bitcoin (BTC)

The chart above shows that in early July, FOMO occurs, which leads to a rise in the price of bitcoin. which attracts more investors and traders to buy bitcoin at that moment. This was due to you passing up an opportunity to expand your reach or profit from your investment.

There was a decline in prices the next day, which called for the massive selling of bitcoins as a result of fear, uncertainty, and doubt. In mid-july, there was another FUD that occurred in the cryptocurrency market.

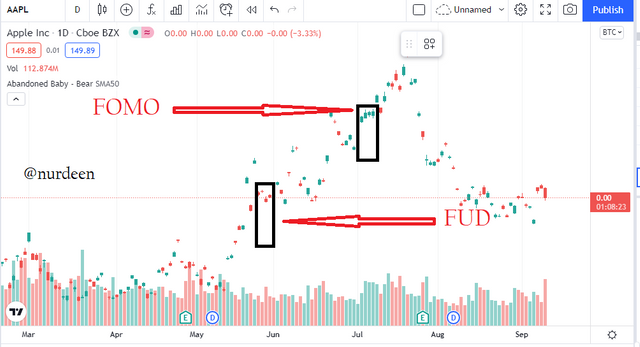

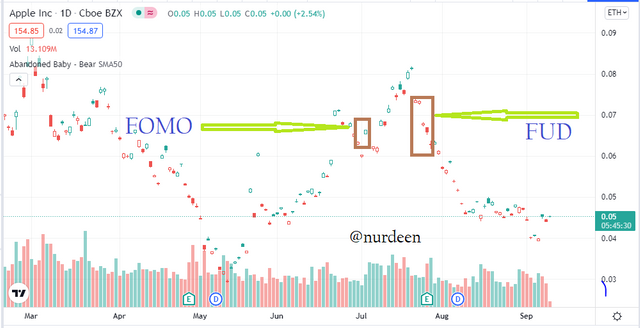

ETHEREUM (ETH)

From the chart above, it can be seen that FOMO and FUD have really affected the market for ethereum. which brought scattered chart points indicating there is no stable price for ethereum coin in the crypto currency market. Until June 30th and early July 1st, prices of the ethereum coin will be affected. It was at its peak closer to mid-july, showing how investors and traders were buying ethereum due to the increase in prices of the coin, and the likelihood of making profits when you invest.

The next day, it falls and then rises to the higher peak within two days before FUD affects it again. Some of the investors turned to selling their ethereum coins, which led to prices decreasing.

In conclusion

From the mini crypto program part 2 organized by @liasteem, I have been able to learn and understand FOMO and FUD. The effect of FOMO and FUD in the crypto currency market. There may be some mistakes in this home work post and hope to be corrected if necessary.

I would like to invite @reeda07, @fathiafatawu, and @greris to take part in this mini crypto program part2

10% to steem education

Dear @nurdeen ,

Thank you for participating in this Mini Crypto program, I really appreciate your good intentions and your efforts in understanding our practice this time.

Here is an assessment of your practice;

FOMO and FUD are not always above the trend line or below the trend line. FOMO and FUD happened because of several things before it.

FOMO and FUD cross each other but they have a negative value and can affect market trends.

use the simplest markdownstyle if you are very young to know markdownstyle.

In graphic shooting, you can use the desktop screen.

use markdownstyle to write to make it look neater and easier to read.

use clear graphics, you must master the chart settings first, this will give you convenience in making exercises or courses at Crypto Academy later.

Don't doodle too much.👌

Thank you very much, we will waiting for your next exercise, and we will waiting you at the season 4 of Crypto Academy. 👍💪

Has been assessed by;

@liasteem

@steem.education