Tutorial: How to Build a Well-Balanced Crypto Portfolio [#club75 and #Burnsteem25)

Hello Steemians

Greetings to you and welcome to my post today. Here I have discussed about how you can set up a well-balanced crypto portfolio for yourself.

Balancing a crypto portfolio is the same thing as balancing a traditional portfolio that you have been doing. Balancing a crypto portfolio, can help you minimize your risk according to your Investment strategy and profile. In doing this, all you have to do is to start by diversifying your crypto Investments into different digital assets.

In order to mange your portfolio better, you will need to make use of a third party crypto portfolio tracker like CoinMarketCap, Delta and Coingecko or you can be recoding your transactions on a spreadsheet manually. Some of these affomentioned trackers can be linked to your personal crypto wallets or your personal crypto exchange, making the process more easy for you. Now, the question is what is crypto portfolio. Let's take a look it below.

What is a crypto portfolio?

Okay friend, a crypto portfolio is simply a collection of collection of cryptocurrencies owned by a crypto trader or an investor. Basically speaking, crypto portfolio contain a variety of different cryptocurrencies, including both crypto financial products and altcoins.

Honestly, there is no much different between a crypto portfolio and that of traditional Investment portfolio, unless a trader or an investor is only sticking to one type of asset. As I have said earlier, as a crypto trader or an investor, you can easily track your crypto portfolio through the use of specialised tools and software of third party or by doing it manually with your spreadsheet in such a way that you can be able to calculate your holdings and that of your profits at the same time.

In order for you to succeed better as a crypto trader or an investor, it is advisable that you have a crypto trackers from Coinmarketcap, Coingecko or Delta as said earlier before now.

It is also advisable that before you start creating an investment portfolio or crypto portfolio you should have a knowledge of the following concepts which is asset allocation and diversification.

Asset allocation simple refer to investing your money in different asset types for example, cryptocurrency, bonds, stock, cash and many more.

Assets diversification refer to the distribution of your Investment funds across multiple sectors or assets. For example, you could diversify your money into different cryptocurrencies, such as Steem, TRX, BTC, ETH etc.

In the concept of industry, you could diversify your funds by investing in different companies (industries), such as technolgy, healthcare, agriculture and real estate. By applying these two strategy (asset allocation and diversification), can help reduce your risk.

How you can build a well-balanced crypto portfolio

Every trader or Investor will definitely have their own point of view on what makes a well-balanced crypto portfolio. But, the fact is that there are some general rules that need to be consider first which are;

Make sure you split your portfolio between high, medium, and low risk Investment and give them suitable weighting. Any portfolio that contains a large portion of high risk is not definitely a well balanced investments. Such an investment may lead you to greater losses. So it's always nice to mix your Investments.

You should consider holding some stablecoins that can help you provide liquidity for your crypto portfolio. Stablecoins are the deriver to so many DeFi platforms in the crypto industry. By holding stablecoins you can easily lock in your gains (profits) or exit a position quickly.

Rebalance your crypto portfolio if needed. It is of no doubt that crypto market is highly volatile, which means that you should change your decisions base on the current market situation.

After you have rebalance your portfolio, you can then allocate new capital strategically to overcome overweighting any one area of your crypto portfolio. Don't be a greedy interfer,with your gain. If you have recently make gains from a certain crypto coin, you can be tempted to pump in more money which might lead to your losses.

Carryout your own research. It is always advisable that one you have decided to invest your money on any coin,you should do your own research first.

Finally, invest the amount of money that you can afford to lose. Once you have invested a huge amount of money your mind wouldn't be at rest and by disturbing yourself your portfolio balanced would be affected because you can easily scatter what you have built. Always have other alternatives.

Crypto portfolio trackers

Okay friend, crypto portfolio trackers is simply a service/program that allows you to monitor (trace) the movements of the cryptocurrencies you are holding. With portfolio trackers, you can track your progress, current allocation stacks up both with your short term and long term goals. The three affomentioned crypto portfolio trackers below are the best that I know for now.

- CoinMarketCap

- Coingecko

- Delta

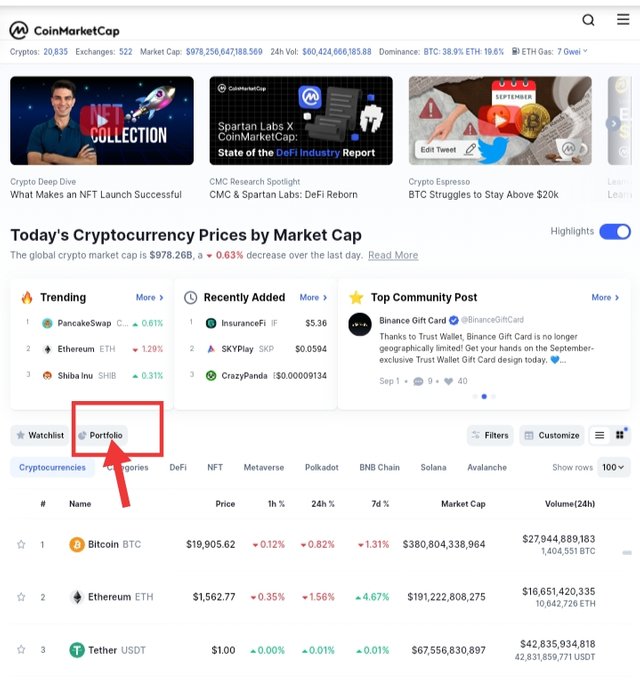

CoinMarketCap

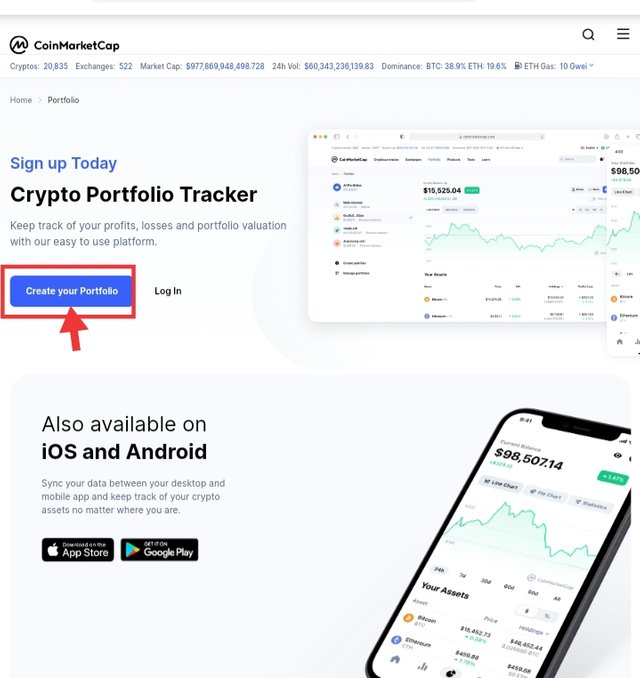

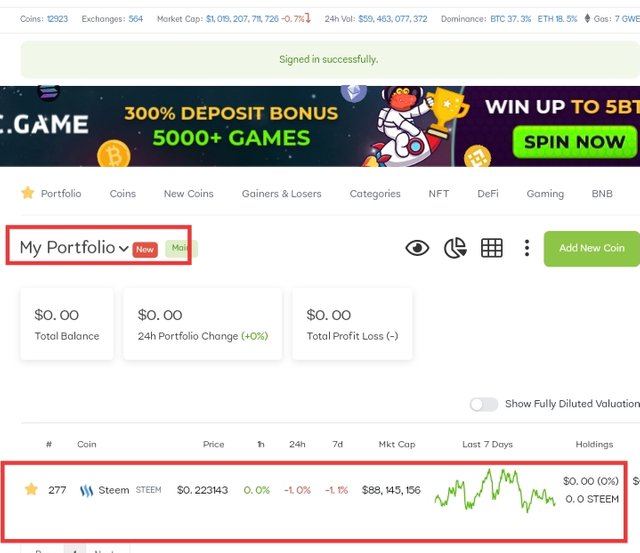

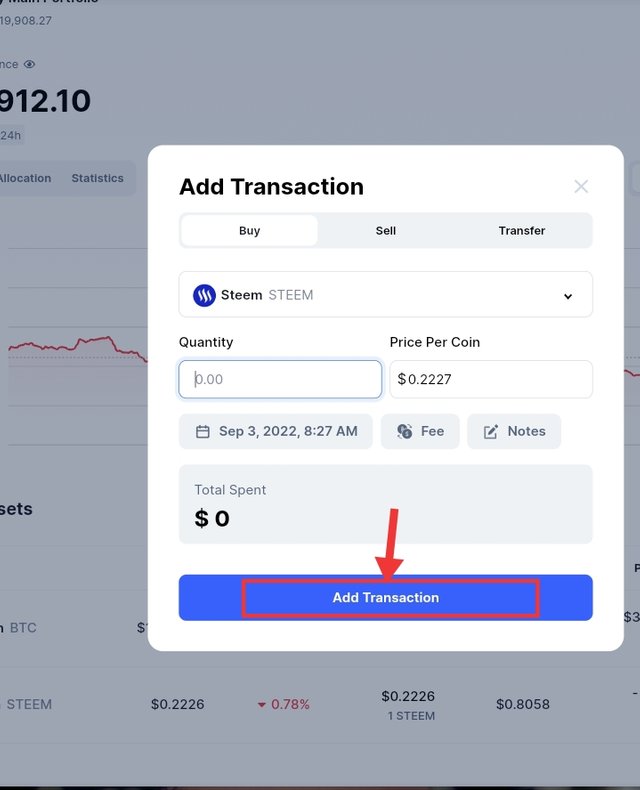

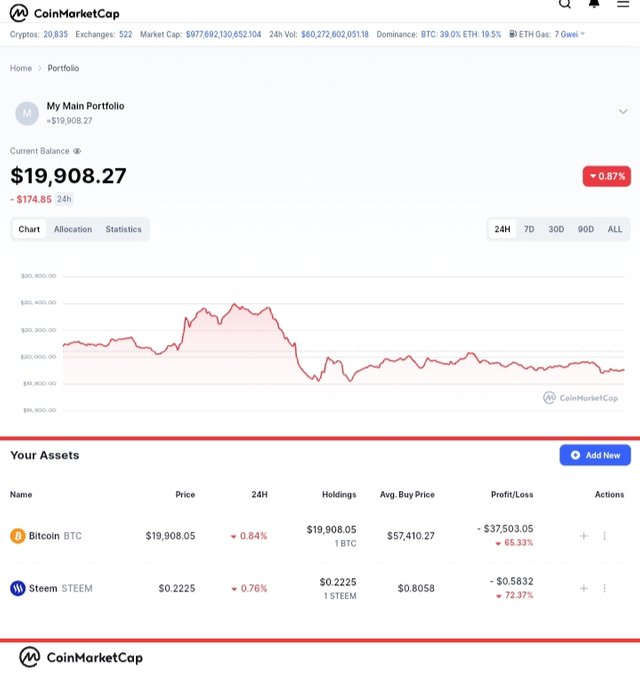

CoinMarketCap is one of the best known price tracker that has its own portfolio feature. Coinmarketcap portfolio tracker can be accessible on both mobile devices and desktop. All you have to do is to add in your holdings manually and start tracking your assets. In order to accurately track your can you can add the price at which you bought your coin.

How to create Portfolio on Coinmarketcap.

- Once you have logged into Coinmarketcap, at the top you will see "Portfolio" on the navigation bar. You can then begin creating your crypto portfolio by clicking on "Create your Portfolio" as shown below.

|  |

|---|

- Once you are done with that above, you can select the token or coin that you wish to add to your portfolio.

Add a Buy transaction or a transfer in transaction

After doing the above, you can then navigate to the main portfolio page and view your crypto portfolio.

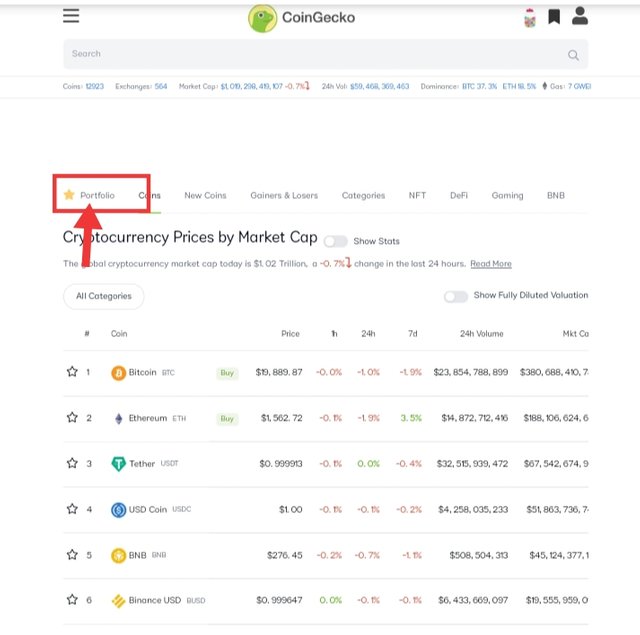

CoinGecko

|  |

|---|

CoinGecko is bestly known for crypto price tracking also, that comes has an option for portfolio. CoinGecko is free to use just as it brother Coinmarketcap. You can access Coingecko portfolio option on your mobile devices or desktop as easy as ABC.

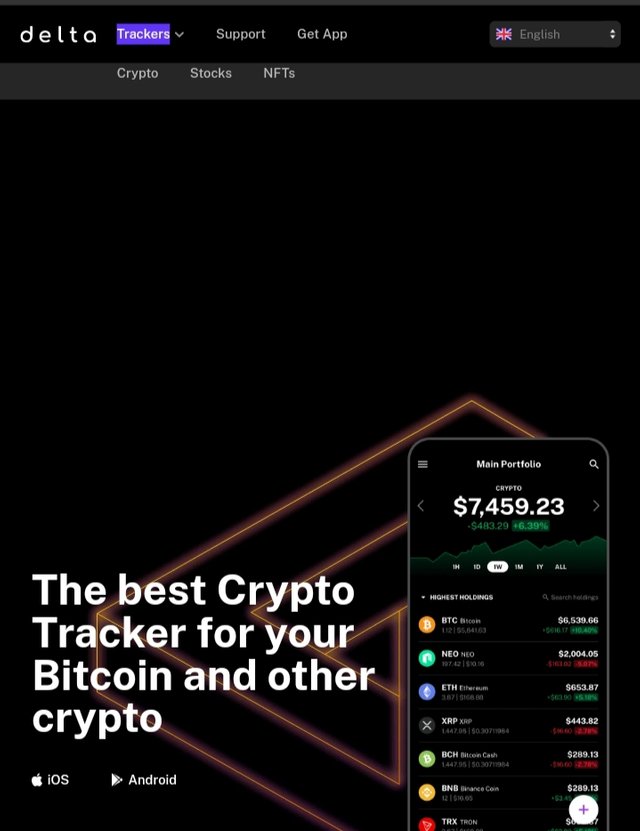

Delta

Delta is another good crypto portfolio tracker that you can access on your mobile device i.e app. Delta allows you to view both your traditional Investment and crypto portfolio. One good thing about Delta is that is connect can be connected with more than 20 exchnges with different variety of wallets, including Binance exchange. However, Delta offer both free to use services and paid services and you can use the App for your trading.

Conclusion: Crypto portfolio is the easy means that you can use and track your crypto Investments. In this post, I believe you have learned something new from it. Thank you for stopping by am grateful.

Thank you for sharing posts, improve the quality of your posts and stay original.

Have a nice day !

Agree with you. Who handle Traditional investment portfolio correctly they may easily handle crypto investments too.

Yes,our investments must be split accourding to low,medium and high risk category.

This type of investments always give good earnings to us also minimise our investment risk too.

Nice information from you. Take care.

I am glad that you fine my post worthy a enough. Thank you for stopping by.

Its really very informative.

Curated By - @simonnwigwe

Curation Team - Team 3