**Decentralized Finance (DeFi)**: Weigh the pros and cons of DeFi applications on the blockchain.

Hello everyone I am @shahariar1 mod of Steem of Animals Community.I am From #Bangladesh

.png) |

|---|

The financial sector has shifted to the use of decentralized finance also commonly known as DeFi which is an open-source network that relies on the use of the blockchain. Here, let me explain more details of DeFi applications and their advantages and disadvantages on the blockchain so that it can give a holistic view of the same.

Accessibility and Inclusivity:

Global Reach: DeFi platforms are available to anyone that has access to the internet regardless of the location that they are in. This inclusivity it offers is of great benefits to the people especially in the developing countries where access to banking facilities is rare.

Permissionless: They do not require a lot of identity verification processes compared to existing banking institutions thus enabling the basis of the unbanked population in the economy.

Transparency:

Open Source: DeFi has been noted to be open-source and anyone is free to scrutinize and review the program’s code. It helps to establish the trust and to encourage the innovation among the members of the community.

Immutable Ledger: Numerical transactions are made through the blockchain technology where the software provides the public ledger so that all activities are open to the public, hence limiting fraudulent activities.

.png) |

|---|

Control and Ownership:

Self-Custody: The use of the private key gives the whole control to the users and NOT some third party like banks. This model of having control over the funds is self-custody, which is in tune being decentralized.

Decentralized Governance: A good number of DeFi projects integrate decentralised governance voting systems through which users can decide on changes in the protocol.

Innovation and Interoperability:

Composability: This integration can also be termed as a “money Lego” where several de-fi applications can operate together where different de-fi protocols can be connected in order to develop other novel financial services and products.

Rapid Development: The decentralised and competitive characteristic allows for constant innovation, as evidenced within the Defi domain, and continues to expand by providing better solutions.

Cost Efficiency**:

- Lower Fees: Thus, DeFi can cut out intermediaries, which means that the number of transaction fees and operational costs will be lower. To a larger extent, this efficiency is very useful in cross border transactions and remittances.

.png) |

|---|

Security Risks:

- Smart Contract Vulnerabilities: Smart contacts form a backbone in DeFi protocol, yet they can have software glitches and are exposed to hacking attempts if not audited. Heights and scams have taken place, which have cost a lot of money to fix.

- Phishing and Scams: Due to the Decentralized and Pseudonymity nature of DeFi it has become a hunting ground for Default and borrower scams, scams where scammers deceive users into providing their private key or transferring their money.

Regulatory Uncertainty:

- Lack of Regulation: The current status of regulation regarding decentralized finance remains ambiguous and unstable, which may lead to legal concerns and lawsuits for both customers and creators. There is always the possibility of legislators placing some restrictions which may affect the expansion and functionality of DeFi projects.

- Compliance Challenges: Also, the permissionless nature of DeFi made it challenging to meet the current financial laws like AML and counter-terrorism financing.

User Experience and Education:

- Complexity: It must be said that DeFi platforms now can be described only as very labyrinthine and, therefore, confusing for the majority of users. Some of them include the requirement to grasp the concept of private key management, wallets, and interacting with the protocol.

- Lack of Support: This approach is far from what these DeFi platforms would do, since most of them do not have customer support services as is the case with most traditional financial institutions.

.png) |

|---|

Scalability and Performance:

- Network Congestion: Most of the widely used DeFi applications are developed on Ethereum, and they face issues related to congestion that results in Small, large gas fees and slow transaction rates at some times of the day.

- Scalability Solutions: As for scaling, Layer 2 solutions, and other forms of handling congestion, solutions such as layer 2 scaling or other types of blockchains still are a work in progress, which means that scalability is one of the principal concerns in DeFi at the moment.

Market Volatility:

- Price Fluctuations: Despite the real value of assets in DeFi, their price may be very unpredictable due to actual moods and the emergence of new news about differently positioned tokens. This volatility can also pose a risk to the users especially to those that carry out lending/borrowing services.

.png) |

|---|

Conclusion

Decentralized applications on the blockchain for DeFi have several benefits which include the following; mostly, openness, decentralization, and promoting of new services. But they also entail drawbacks and problems like security, regulatory, and UX ones at the same time. In light of this, the above challenges will have to be solved to facilitate the sustained future development and widespread adoption of DeFi solutions.

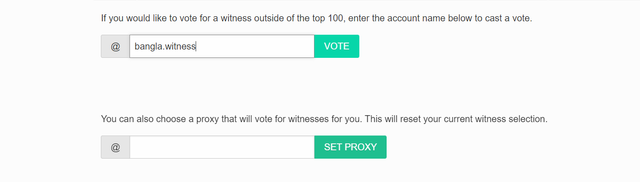

Support @bangla.Witness by Casting your witness vote

VOTE @bangla.witness as witness

X promote link : https://x.com/Shahari73599011/status/1817152829993161020

Note:- ✅

Regards,

@theentertainer