Bitcoin Holder Has Increased 11% So Far This Year While Fear And Greed Are Around 90 Points.

Bitcoin continues to achieve new highs after having broken the $70,000 barrier, registering a brutal rise that was very little expected and that is demonstrating the true potential behind this asset. In addition, the feeling of euphoria is reaching more and more investors than before. After going through the longest bear market to date, they are beginning to get more and more excited about the possibility of one of the biggest bullruns for cryptocurrencies beginning.

Although it is still hard to believe, bitcoin has done it again and after having a strong correction last week that set off alarms and left more than a trillion dollars in liquidations, touching 58,000 again this weekend, the price of bitcoin has continued with the uptrend breaking its all-time high and surpassing 70,000 for the first time in its history.

This was a rise that very few expected, especially after the year 2023, which closed with more than 146% growth, however, the trend of bitcoin has only improved since the approval of the ETF, registering a rise of more than 87% since January 24 after the correction of ETFs and a return of more than 8% so far this year.

These figures have reached a historical maximum for the first time before the halving, surpassing the highest point of the previous cycle almost two months before, which reflects how perfectly this cycle is being and could be completely different from everything we have seen to date. .

| But why do we believe that? |

|---|

Well basically because of the interest and demand that we are experiencing from the main institutions in the world that since the approval of the ETF are causing what is called a demand shock, causing the demand for an asset in this case bitcoin to skyrocket. in recent weeks with purchases of thousands of bitcoin every day that are causing great momentum and optimism in the price of this asset.

Without a doubt, a movement that, if it continues like this, could evolve from a shock in demand to a shock in supply. Currently, the majority of the supply of bitcoin is in the hands of holders who, after having experienced a very hard bear market and seeing the rise in Bitcoin and how it is being so loved and valued have chosen in many cases not to sell and hold their Bitcoin thanks to its scarcity.

This has caused the supply of bitcoin in the exchanges to continue to fall, having dropped by 11% and threatening to go down if the pace of purchases continues along the path of an event that, if fulfilled, would have an impact on the price of bitcoin is difficult to imagine combined with the madness of Wall Street and its rush to not be left out of the bitcoin laser market, which is becoming less and less available and with the expected halving that is already around the corner.

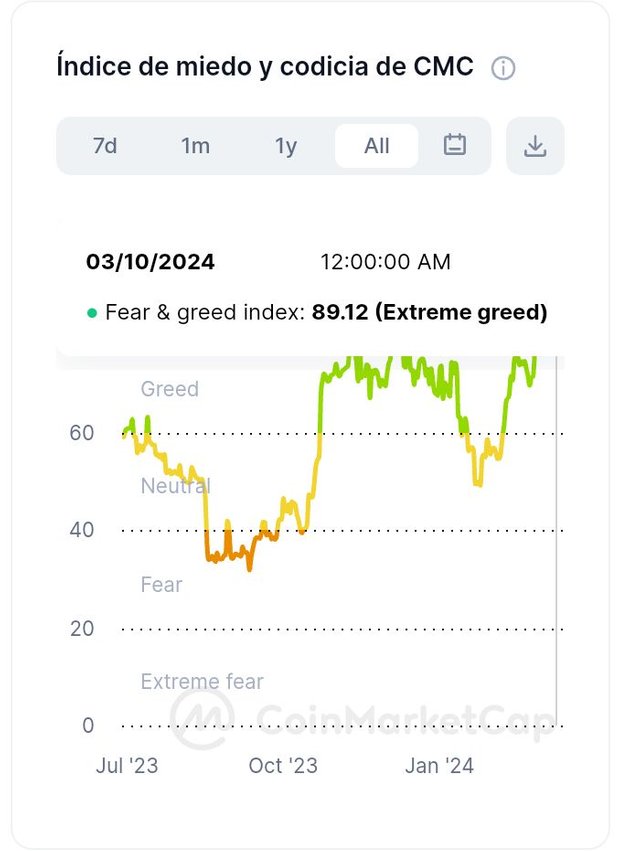

Since we are only 34 days into an explosive mix that more and more investors have begun to get excited, leaving the market sentiment once again touching extreme greed and if we take a look at the greed fear index it has once again exceeded 89 points, rising almost 10 points compared to the month of February and more than three since last week, a growth that has taken us to fomo levels that are close to reaching those of the previous market

bullish.

When at the end of 2020 and beginning of 2021 with the first rise above 60,000 or in November 2021 with the second Rally took us to a new maximum of bitcoin and the sentiment was very bullish with the fear and greed indicator that exceeded the 90 points.

| Bitcoin on everyone's lips |

|---|

This feeling is beginning to be transferred little by little to retail, which although it is still somewhat dormant and far from the levels we had in the previous cycle, we are already beginning to see how the bitcoin phenomenon is beginning to spread everywhere as For example, it has happened with the former president of the United States Donald Trump who, after announcing a few weeks ago that if he is elected president, he would not allow the development of CBDCs (Digital Money) in the United States.

Donald trump took the opportunity to also say a few words about bitcoin, highlighting two interventions, one in which he announced that the growth of bitcoin adoption is unquestionable and that currently many people are adopting bitcoin and he sees that more and more people want to use it as a medium. payment.

| In conclusion |

|---|

If Bitcoin continues like this this year it could surpass the $100,000 barrier every day, more new investors are holding their bitcoins to wait for such a long-awaited event and if Donald Trump's words of being president come true, this would give the green light to the United States to Using bitcoin as a legal means of payment would undoubtedly explode its price through the roof.

| Source linked to the article: |

|---|

|  |

|---|

https://twitter.com/joel_jai1/status/1768026811324068184