The Bull Market || What is it and how can it be identified?

When the crypto market has the prices of assets pump or rise over a sustainable period of time characterized by increased demand for cryptocurrencies and market optimism and also increase trading volumes and positive market sentiment is called The Bull market.

It is a year where the prices of Bitcoin pumps to a considerable high price consistently overriding the bear which all Traders are looking forward to. If you can relate, there was a time the price of steam reached $1 plus and this was as a result of the increased price or demand for steems then.

Bitcoin become so scarce a coin and many look forward to getting one as they have seen future in it. When that bull market came, a lot of Steemians had smiles on their faces not to talk of Traders and investors who uses that time to gain back what was lost and also make it in life.

People ask, when does the time comes and what actually are the signs accompanying this market, how can it be identified and what can I do to benefit from the market? These questions will be considered in the course of this content.

Understanding the Bull Market |

|---|

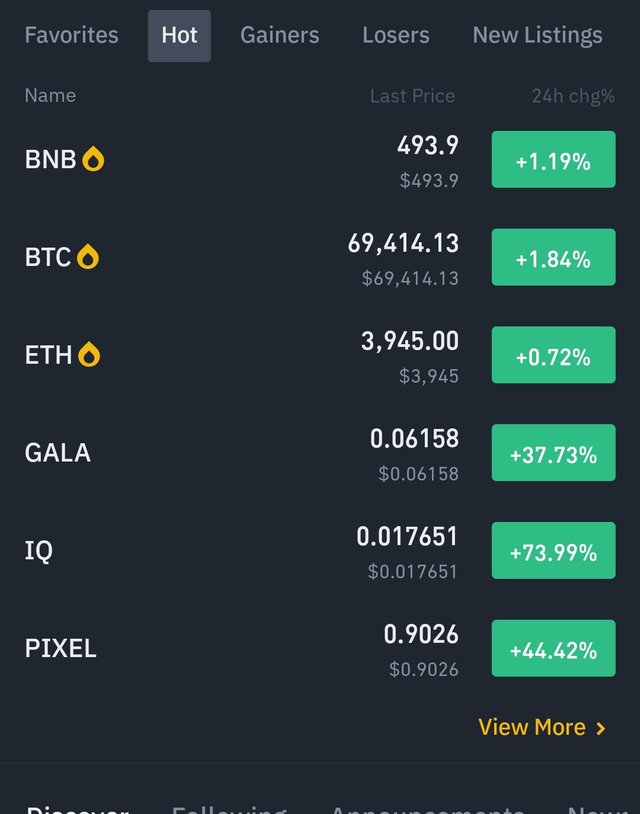

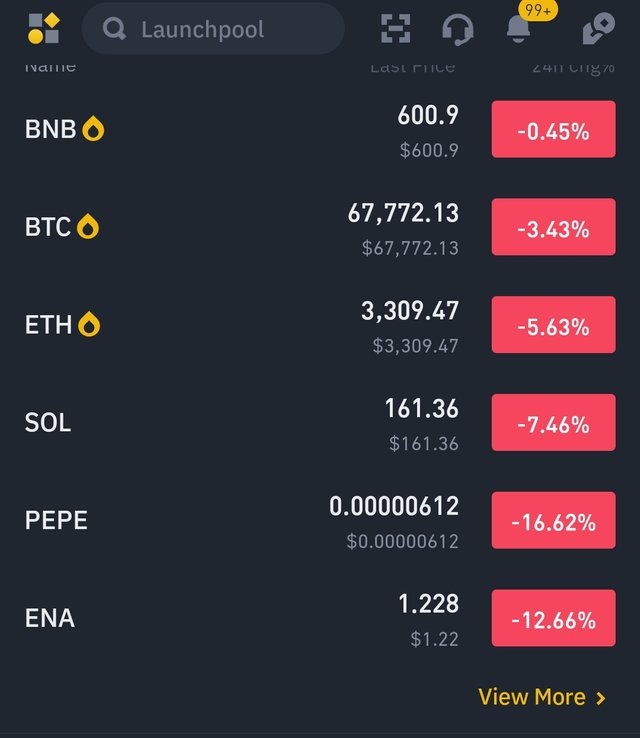

Let's talk about market trends first to enhance understanding. Market trends are the general direction or movement in which a market moves over a lengthy period of days weeks or months and can be grouped into bullish, bearish and sideways. A bullish trend is marked by the movement in which there is an increase price of an asset or the upward movement in the market.

The sideways trend is marked by a lack of significant movement in the market of which prizes of assets trades within a narrow range. The bearish trend is the general downward movement of the market as it's shown in the screenshots.

These trends of the market gives us an insight to study the health of the crypto market guiding or investment decisions and fundamental analysis to watch trends in the market closely. These trends should also be considered with other factors.

A bull market or bull run as is usually called is a state in which the market has prices of assets rise over a sustained period of days, weeks or months. This bow market is often used in the stock market but can also be used in forex and crypto. This boron refers to a prolonged rice in the valley of an asset which includes bitcoin, ethereum and many other assets.

The opposite of bullish market is the bearish market which is the period of falling prices in an asset. It is also worthy to note that during this period, the market sometimes slip or fluctuate. Prices won't keep on going in an uptrend consistently as some may think but it is more sensible to consider this bull market on longer frames.

Investors change to have this positive view on the future of the market during the boron and these leads to increase demand, increased cryptocurrency market capitalization, higher volumes in Trading and rising prices creating what is called FOMO in the market and also lead to increased buying activity and higher prices of an asset that may not be sustainable in the long run. These markets can also affect the behavior of an investor.

In what sense? During the bull run, investors may be more willing to take risks in order to gain enough profit in the market's upward price movement. But it is important to be cautious and not allow greed or hype get into us as the sentiment in the market can change at anytime. So while this market can be beneficial it is important to note that there is always the risk of sudden market correction.

How can we identify a bull market? |

|---|

Investors and Traders should combine different indicators instead of relying on one to conduct thorough research before making decisions relative to investment which is the key to taking advantage of rising prices in a bullish market. Some factors we must note includes, the market capitalization which would be increased as it is the total value of all crypto combined.

|  |

|---|

This can be assessed using on-chain data analysis tools. Market sentiment involves investors overall attitude toward crypto which can drive cryptocurrency prices higher.

Trading volume and on-chain activity would be increased, indicating that the Investor's interest is increased. They will also be a sustained of what movement in prices of an asset which can be observed by looking at certain indicators or historic prices of an asset. Are there another ways and when is this bull market? This would be considered in my next post.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

https://twitter.com/bossj23Mod/status/1778917337896296626?s=19

what is the purpose of this post. what important things that you are sharing in this post. everyone knows that bullish and bearish market depend on news and events.

Ohkay. Wanted to share how it can be identified as some new traders think the upward movement in the price of an asset is a bull market. Anyways, I'll try being more practical and avoid using familiar contents that most traders have knowledge about. Thanks for highlighting using questions.

Note:- ✅

Regards,

@theentertainer

I love the sentence thorough research before making decisions on investments