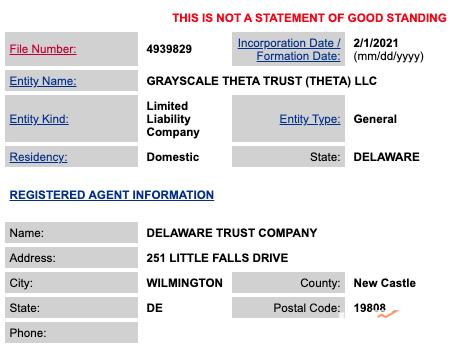

Grayscale recently registered the 8th trust fund THETA

@kawasanz reports that Grayscale recently registered a THETA trust fund product. Registration time is February 1, and the document number is 4939829. (In addition, Grayscale recently registered a UNI trust fund product on January 27. The document number is 4887456.) This is the eighth recent Grayscale registration after AAVE, ADA, ATOM, EOS , XMR, DOT, and UNI. Trust Fund. Grayscale CEO Michael Sonnenshein has said that the registration of the trust entity does not mean the product in question will be launched, and the application does not mean the product will be introduced to the market.

Theta is a decentralized video platform based on blockchain technology. Currently, the Theta blockchain is the only peer-to-peer infrastructure for streaming and distributed video delivery. It does not belong to the DeFi concept which was popular last year, nor does it belong to the concept of rebase, but rather creates a unique track-a decentralized streaming media network. In response to the slow loading of high-resolution content facing the media industry, Theta provides a technical and economical solution. The emergence of THETA brought new opportunities to the decentralized video field.

Theta technology is somewhat similar to previous fast broadcasting technology, using distributed nodes (CDN technology) to increase the speed of the video network. The traditional centralized content distribution network CDN requires the construction of a large-scale base station, which not only requires a large investment, but also the network transmission efficiency and quality cannot be guaranteed. On the Theta network platform, users need to contribute their own free bandwidth to make their device a cache node on the network. Users watching the video can obtain video content from the nearest cache node, not from the CDN server base station.

Unlike regular CDN servers, Theta aggregates distributed user machines, provides distributed services, and uses tokens as incentives. Users can get token rewards by sharing them with other users while watching video content. The more you watch, the more you earn.

Theta's core team are all well-known figures such as doctors and experts from the industry. Its founder is Mitch Liu, who has a bachelor's degree in computer science from MIT and an MBA from Stanford University. This person is also the co-founder of Tapjoy, Gameview Studios, and other projects. Its chief product officer Ryan Nichols was the project director of Tencent WeChat. In addition, Theta. In terms of consultants, there are also celebrities such as Yotube founder Chen Shijun and Sequoia Capital Zhang Fan. In terms of partners, there are well-known video platforms like Samsung and ZNN.

found that Theta has undergone 5 rounds of financing since 2017, led by leading investment institutions such as DHVC, SONY, SAMSUNG and Samsung NEST.

Theta introduces a multi-layer BFT proof-of-stake consensus mechanism. This consensus method is much faster than traditional proof-of-work (POW) systems. The multi-layer BFT mechanism uses a small group of nodes to speed up the approval process, giving a higher Theta TPS.

In the Theta economic system, two token models are designed, namely: the Theta token and the TFUEL (Theta Fuel) token.

Theta Coin completed a token sale in January 2018. As a long-term and sustainable reward mechanism, it encourages all stakeholders to participate in a decentralized video streaming network.

The total issuance of THETA is 1 billion copies, of which 40% are sold to the public, and 30% belong to Theta Labs, which is reserved for future R&D, marketing and community development; 20% is used for market development as initial and end user partners; 10% Remain as a consultant, partner, and motivational employee. At the same time, compared to other tokens, the distribution of Theta chips is more spread out, and the risk of price manipulation is lower.

found out that on March 15 last year, the Theta mainnet went live. THETA tokens in the ERC20 format are mapped to the mainnet native tokens at a 1: 1 ratio. In addition, to incentivize early holders, Theta sends TFUEL other mainnet assets at a ratio of 1: 5 to users holding THETA tokens. (Theta Fuel).

TFUEL (Theta Fuel) is a Gas Token issued under the Theta network. Theta edge node devices can earn TFUEL tokens on the Theta blockchain because of their contribution. Users can use TFUEL tokens to reward their favorite authors, and after mainnet 3.0, which is scheduled to launch this spring, online, users can also earn income by betting TFUEL tokens in their hands. In addition, this version will also have a mechanism online destruction. In Theta 3.0, at least 25% of TFUEL fees paid to edge networks will be destroyed.

At the same time, I learned that the following plans were introduced in the 2021 development roadmap released by Theta last year:

In the first quarter, the NFT trading platform and decentralized exchange based on the Theta blockchain were launched.

Mainnet 3.0 Theta was released in the second quarter, introducing TFUEL's pledge function and a crushing mechanism, and plans to integrate with LINE Dapp.

The third quarter plans to resolve new use cases for edge caching (game patches, software updates, etc.).

In the fourth quarter, we plan to complete a test version of edge storage or IPFS integration.

The price of THETA tokens has increased since late last year, and the current market value of THETA has reached 14.26 billion US dollars, ranking 22nd.