To the new economy: Please consider a Bitcoin-centric commercial banking system

How can emerging economies lead cryptocurrency reforms in commercial banks and enjoy economic renaissance based on sound monetary policies?

Introduction

A recent Coindesk interview with Nic Carter provided a very good use case for the Bitcoin banking system. However, from a long-term perspective, Bitcoin will play an important role in the reform of traditional banking. I want to look at this issue from another perspective, that is, from the perspective of emerging economies.

It includes all those markets/economies that have not entered the small clubs of fully developed economies, such as Europe, the United States and Japan. Now China and Russia also belong to this small club. Regardless of the definition, emerging economies have one thing in common: their currencies are relatively weak, the risk of sudden capital flight, and the immature banking and credit systems.

This is one of the main factors hindering local investment and economic development.

The partial dollarization of these economies is common, and it at least mitigates the catastrophic effects of hyperinflation or double-digit inflation suffered by local populations such as Venezuela, Argentina or Turkey. As more and more cryptocurrencies are used globally and reduced, the effectiveness of capital controls will be greatly improved in the future. Therefore, emerging economies will accelerate the pace of local currencies to replace encrypted currencies and encrypted fiat currencies (ie stable currencies), such as Bitcoin or Tether/USDt, true USD or USDC, which are easily available and will gradually replace national currencies.

On the contrary, it may be conducive to seamless integration and transactions between local currencies and foreign stablecoins while promoting a Bitcoin-centric banking system instead of a dollar-centric solution. It is the emerging economies that need to insulate the market from currencies Alternative impact solutions and strengthen the banking system to promote investment in the local economy.

The economic and geopolitical risks of dollarization are well known. So, how can a Bitcoin-centric economy play a role while maintaining the local currency and its full convertibility with Bitcoin, other national currencies, and stablecoins?

The lost art of commercial banking

In 1974, the self-taught American economist EC Harwood wrote an article entitled "The Lost Art of Commercial Banking". Harwood founded the American Institute of Economic Research in 1933, predicted the economic recession in 1929, guided clients to invest in gold, witnessed inflation in the 1970s, and wrote the book "The Art of Lost Commercial Banks." After Nixon’s infamous US dollar default in 1971 and breaking the peg of gold to the US dollar, currency devaluation was the hottest topic at the time.

EC Harwood pointed out that the period from the end of 1800 to 1914 before the First World War represented the peak of the development of Western civilization in monetary affairs. It promotes business development and makes long-term accounting records that are meaningful rather than false. The development of savings institutions, life insurance and pension funds not only encouraged trade between countries, but also encouraged a substantial increase in useful capital.

It is generally believed that this period may mark the most far-reaching progress that mankind has made in the evolution and development of the monetary and credit system serving modern industrial society. Another fact is that at that time gold was the common international monetary base of all the major industrial countries and many other countries in the world.

But Harwood is not a standard radical. He is a pragmatic man, rich in common sense, not a theorist. He understands the history of currency, and in the era of globalization and increasing trade, he proposed practical solutions to the well-known devaluation of French goods.

In fact, he also criticized the more radical stance of supporters of the 100% reserve gold standard, "They restrict the buying media to gold and possibly silver or banknotes, as well as checking accounts that directly represent these. The buying media used is restricted to Gold, silver or banknotes and checking accounts that directly represent these currencies. They can be traced back to the Middle Ages, when there was no sound commercial banking system. In modern industrial civilization, they did not make suggestions about how they would deal with the sale of a large number of products Other proponents of the gold standard have proposed a simple solution, which is to increase the "price" of gold and restore the convertibility of currency and gold.

But they don't seem to realize that the existence of a large amount of inflationary buying media is destroying the world's money supply, just like polluting billions of counterfeit money. "

In fact, even the gold standard itself cannot solve the problem of currency devaluation unless people apply what he defined as the "basic principles of sound commercial banks," that is, commercial banking is a lost art. So, what is this lost art?

The normal operation of the commercial banking system is essential to the development of the capitalist economy. Its two main functions are savings and borrowing, and its core is to make a profit between the savings interest rate and the loan interest rate. But banks can lend by withdrawing deposits or creating new currencies. Harwood believes that the differentiating factor is that new money is created only when the money is used for productive investment, that is, when the money increases the number of goods and services in circulation (that is, the company builds factories to make cars), and It is not when the money is used to fund consumer spending or any other non-productive investment (that is, an individual gets a loan to buy the car). In the first case, bankers can create new currency because it is non-inflationary.

In the second case, purchases should be made by withdrawing funds from savings/deposits, because the creation of new currency (which will not be offset by increased productive goods) will lead to inflation.

Although the gold standard system was effective at the time, whenever banks neglected to use the basic principles of a sound commercial bank and started a money printing frenzy, a banking crisis similar to "Wildcat" Bank or Bank of Scotland would occur. After all, this is an era of free banking, and bank bankruptcy is common.

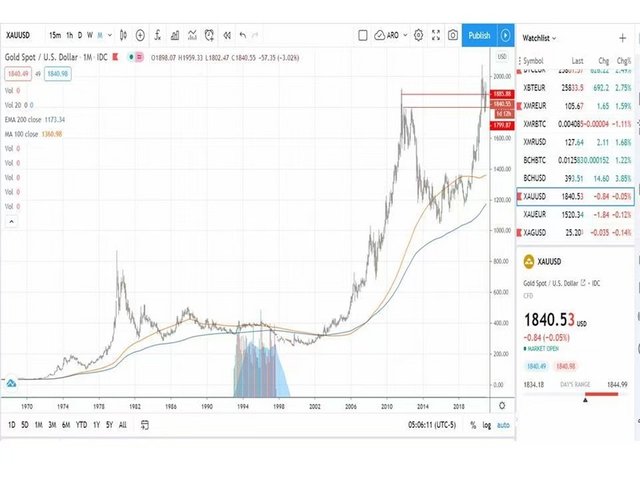

Today, this situation will not happen, the reason is simple, because there is no fixed relationship between French goods and real assets such as gold. But the impact of a large-scale devaluation is the same, but this impact will be diluted in time, and due to the intervention, manipulation and bailout of the central bank, this situation will not appear immediately. Looking at this chart of gold against the US dollar, you will find the hyperinflationary loss of purchasing power since the exchange rate of gold against the US dollar became 35 US dollars in 1971. Today, you need $1830 to buy an ounce of gold. This means a 52-fold increase in 50 years.

Opportunities for emerging economies: Bitcoin-centric commercial banking system

Now let us fast forward to 2021 and see how the responsible commercial bank of EC Harwoods can implement it today.

The first thing to consider is that we are unlikely to return to some degree of gold standard. Or at least not like it used to be. For various reasons, our economy and society today need a different type of hard asset/stable currency, on which a new financial system can be established. Gold is not suitable for this use case for many reasons, three of which are the most important:

1. The audit of gold is subjective.

2. Auditing gold reserves means trusting auditors. This is a subjective evaluation, not an objective evaluation.

3. Gold is difficult to circulate, withdrawing is complicated, and storage is expensive. These issues are feasible for central banks and gold banks, but they are major obstacles for smaller commercial banks and their customers.

4. It is impossible to track the claim of gold. In a fractional banknote system, gold is re-collateralized many times, and it cannot determine how many claims/IOUs exist per ounce of physical gold. It is reported that more than 100. Some people said more. Basically, the excessive financialization of paper gold makes it worthless as collateral unless you are prepared to actually hold it. If you do not own it, you do not own it.

Of course, gold still plays an important role at the government and central bank level in the international monetary system. It may be used in what some people call "currency reset" or the new Bretton Woods system, where governments and central banks around the world decide to remonetize gold, and its price will be several times higher than the current price. .

Balance their huge debts and support their rapidly expanding French goods.

Below this level, the modern digital commercial banking system needs a new hard asset/stable currency to perform its reserve function. Such assets can be easily stored, withdrawn, and kept, and are 100% reliable and objectively audited.

And this asset can only be Bitcoin.

Why Bitcoin is digital gold? I explained in some previous articles that central banks in smaller countries and developing economies should hold Bitcoin instead of gold as a currency reserve.

Bitcoin can be audited for 100% reserve proof, and the carrying cost is zero, and it can be easily kept and withdrawn to personal wallets, which makes it a perfect modern reserve asset and collateral that can be established on this basis A solid banking infrastructure. Designed to rebirth Harwood's benign commercial bank.

First of all, it will force commercial banks to create fiat currencies only within certain strict parameters without causing a currency explosion, because everyone can transparently see the number of new encrypted fiat currencies created by banks in real time on the blockchain And combine it with the amount of Bitcoin held by the bank as a reserve. Second, if the bank withdraws excessively due to the creation of cryptocurrency legal tender, the depositor can withdraw the bitcoin lent to the bank, thereby increasing the risk of a bank run. Therefore, if banks want to maintain their solvency, they will have the incentive to remain effective within accepted parameters and there will be no emergency assistance. The market is free to price the risk of each bank. Banks with full reservations will pay lower deposit rates, while some reserve banks will pay higher rates because they are considered riskier.

If you think I'm just fantasizing, then you are wrong. This art of crypto banking already exists, and it will continue to exist and replace the banking industry today.

BlockFi founder Zach Prince said: "We provide these banking products because we are operating in the first world with a cryptocurrency, a global and digital scale that is impossible to achieve in the context of a traditional banking industry. If we can start building new infrastructure from the mindset of blockchain and cryptocurrency first, we can still bring capital from the old world. We can provide these products for Bitcoin. This is where we are really excited."

In other words, with BlockFi, you can borrow or lend Bitcoin and cryptocurrency dollars. BlockFi uses the traditional cheap dollar credit liquidity pool, swaps fiat currencies into stable currency dollars (such as USDt), and lends it to customers in emerging economies to obtain higher returns, while holding Bitcoin as collateral. They adopt a strict loan/collateral ratio and liquidate when the collateral ratio falls below a certain safe level. The borrower of the stable currency dollar is happy because he can borrow in a stronger currency and lower interest rates than the local currency.

Because companies like BlockFi or Compound Finance will first target customers in emerging economies, the real risk is that the local banking sector will be avoided and the local economy will be crypto-dollarized (through the use of USD-denominated stablecoins). This will bring long-term adverse consequences to emerging economies, whether it is geopolitical or economic.

Therefore, political and business leaders in these countries should quickly realize that there are not many opportunities to enter the Bitcoin field and reshape the local banking industry around a Bitcoin-centric model instead of a dollar-centric model. At least in addition to being a sound currency, Bitcoin is neither anyone’s money nor everyone’s money. It does not carry geopolitical prejudices or political risks.

Emerging economies also have the advantage that the local banking system has not yet reached the full maturity of the United States or Europe, which makes the former more flexible and responsive to sudden changes than the latter.

However, moving towards the aforementioned Bitcoin standards in the commercial banking sector is not just the task of the local banking department. This is a transformational process involving the entire society, requiring smart and brave political leaders and regulators to grasp the opportunities they face as soon as possible. If they can do it, emerging economies will be able to lead this revolution, and in 5 to 10 years they will find themselves in a great advantage over direct competitors and developed economies.

Emerging economies need to develop a competitive framework to start the crypto industry and activate a virtuous circle:

(a) Adopt cryptocurrency-friendly regulations, mainly dealing with the identification and legal status of digital tokenized assets (such as stablecoins and tokenized securities). The regulatory frameworks implemented by Liechtenstein, Switzerland and Wyoming in the United States are good examples.

(b) Implement a flexible cryptocurrency bank charter, which mainly supervises the issuance and custody of cryptocurrency assets, as implemented by Wyoming for use by special-purpose institutions. AvantiBank recently granted a charter to the Wyoming Crypto Bank to custody crypto assets and issue crypto fiat dollars. It is worth noting that the U.S. Office of the Comptroller of the Currency recently issued a letter of opinion that allows Bank of America to use blockchain infrastructure and existing stablecoins or issue their own stablecoins. If confirmed by coherent government policies, this may be a fundamental paradigm change that may trigger a global shift to cryptocurrency banking.

This is an important issue that regulators and politicians in emerging economies should carefully consider: the U.S. regulator has proposed the simplest and fastest of all solutions. Just connect to the Bitcoin blockchain to establish one New banking infrastructure, this is a very smart way.

(c) Encourage the establishment of local cryptocurrency exchanges.

(d) Adopt a central bank digital currency that is 100% interoperable with encrypted currencies to achieve barrier-free transactions with Bitcoin and stable currencies. If a digital currency based on financial technology cannot interoperate with encrypted currency, it will not achieve the goal I described. Obviously, it does not have to be decentralized like Bitcoin, nor does it need to be unlicensed. It is completely okay for it to perform the same functions of fiat currency completely centrally, but the most important thing is that its money supply should be fully audited on the blockchain, just like the current stable currency. In fact, its architecture can easily imitate similar stablecoins.

(e) Provide incentives to attract crypto capital/investors and excellent human capital. Tax incentives are very important. Funds flow to places with better treatment. But human capital will also migrate to places with better business opportunities and living standards, at least for better prospects. Citizenship acquired after several years of investment or permanent residence is also sought after. In the crypto field, there are many very talented individuals and investors who are ready to leave Europe or the United States and move to places where their capital treatment is better, basic freedoms are truly enforced, and the crypto investment environment is more friendly. This is a fast-growing global movement. Right now, Europe and the United States are rapidly becoming the core of oligarchic operations, damage, the "police state" and high taxes will confiscate the remaining wealth. Once the middle class (of course not the super-rich) is produced, emerging economies in South America and Asia can provide an opportunity Encrypted capital and talented people provide a safe haven. Small countries such as Uruguay (also known as Switzerland in South America), Costa Rica or Singapore can reap huge dividends from this smart policy.

Bitcoin reset

The lost art of commercial banking described by Harwood is essentially the foundation of industrial capitalism. Paradoxically, according to the American economist Hudson, this is exactly what China is doing now: "The United States does not obtain wealth through investment. But in terms of finance, China obtains wealth through traditional methods of production. No matter what. You call it industrial capitalism, state capitalism, national socialism or Marxism. It basically follows the logic of real economy, real economy, not financial expenditure. Therefore, China is operating as a real economy and is increasing Production becomes the world’s factory, just like Britain used to."

In essence, this is a contest between industrial capitalism and financial capitalism.

"The capitalist thinking of the 19th century was to get rid of the landlord class. It was to get rid of the rentier class. Essentially, it was to get rid of the banking class."

"Americans today say that public investment is socialism. This is not socialism. Industrial capitalism. This is industrialization. This is basic economics. The concept of how the economy works and how it works is so distorted academically. This is completely contrary to what Adam Smith, John Stuart Mill and Marx are talking about. For them, a free market economy is an economy without rentiers. But now Americans mistakenly believe that a free market economy allows Rentiers, landlords and banks are free to make a fortune. The United States concentrates planning and resource allocation on Wall Street. This kind of central plan is more corrosive than any government plan."

This is a good summary of what the fully developed Western economy has become: the new feudal economy, the new rentier society, very far away from the industrial capitalist model, and the industrial capitalist model made us prosper and led the world from 1800 to In 1970.

As Parker Lewis of Unchained Capital said, financialization is "the direct result of misplaced monetary incentives, and Bitcoin reintroduces appropriate incentives to promote savings." More directly, the devaluation of monetary savings has always been the main driver of financialization. The force stopped completely. If currency depreciation leads to financialization, it is logical that a return to sound monetary standards will have the opposite effect. "

Of course, this will have terrible consequences for the Western traditional financial system. The ruling elite will continue to delay time and maintain the status quo as much as possible. But in the end, the unsustainable situation will not be sustainable, and the entire system will need to be reset around the only two actual currency assets that have no counterparty risk-Bitcoin and gold.

to sum up

Definancialization, the end of negative interest rate deviation, and the return to a capitalist production society based on sound money will all be the positive consequences of the system reset. What’s even better is that a new economic revival is approaching. It is based on hard currency, a sound banking system and principles. These principles are not instructions from above, but free market forces and well-coordinated incentives. The result of the action. Emerging economies should wisely position themselves at the center of the new Bitcoin standard. They can stand at the forefront of the new economic renaissance, which may imitate the success of the small and wealthy Italian Maritime Republic, which has led the world's economic and cultural development from the end of the Middle Ages to the Renaissance. But they will never lose anything, but will gain everything.

Just like Bitcoin, this is an asymmetric bet, and emerging economies have unlimited upside potential.