BTCarnage

This is one of those days when we see who can hold their emotions in the cryptosphere. Bitcoin dropped like 20 percent in 24 hours; there's "blood in the streets", as they say... I'm not worried though, and I'll try to explain why.

source: YouTube

When I got ready to go to bed last night, I looked at the bitcoin chart and saw the price had dropped to below 40,000 dollar; the price had been dropping since Elon Musk tweeted that Tesla wouldn't accept bitcoin for their cars anymore. And that was right in the middle of a FUD (Fear, Uncertainty and Doubt) campaign about the negative effect on the environment of bitcoin mining. Bitcoin had been dropping all through that campaign, and when Elon Musk decided to throw gas on that fire we saw a massive spike downwards. Looking back, that was the start of a massive market-manipulation campaign; and that's the point of this post, it's all market-manipulation by whales who spread fear and doubt, so that they can buy your bitcoin at a massive discount. If you've been in bitcoin for more than one market-cycle, you'll recognize this, it's nothing new...

You KNOW it's manipulation when you look at what happened since Elon's tweet. Since "Elon-gate" there's been a barrage of fake bitcoin "news-articles" to spread even more fear. Every mainstream news-outlet published articles about China banning bitcoin. Does that sound at all familiar? It should if you were invested in bitcoin during the last bull-run of 2017-2018; we had the exact same news back then! Here's one of the many 2017 articles about that: Bitcoin has now dropped $500 after more reports China will ban cryptocurrency exchanges In fact, we already had that news in 2013 as well! And if you think the constant whining about bitcoin's effect on the environment is new, well just take a look at this December 2017 article from CNN Business: Bitcoin boom may be a disaster for the environment. Yes, Elon knew all this before he started the FUD...

In times like these it's important to not panic and re-evaluate why you're in this space in the first place. If you're invested in bitcoin solely to turn a quick profit, you should know about the risk involved in any young and growing asset; it's going to be volatile as hell, and while it's still young, it's going to be manipulated by large investors as well. But if you're like me and are invested for the long term, you just need to hold on. When I woke up today, I saw that bitcoin dropped all the way down to 30,000 dollar: that's more than 50 percent down from its recent all-time high of 64,000 dollar. And all I could think was "damn, I wish I was awake when that happened so I could buy some at that discount!" In my book these drops are an opportunity, not a reason to throw my hands up in the air in desperation, not a reason to sell. If you sell, you're selling your bitcoin to one of those market-manipulators who want your bitcoin.

ELON MUSKS SECRET CRYPTO END GAME

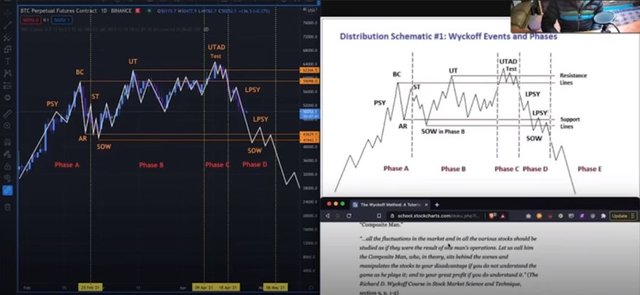

Also remember that fundamentally nothing has changed. On-chain data shows that the amount of bitcoin stored on exchanges, that's the amount of bitcoin ready to be traded, has been dropping these past few years; at any moment now there's only 2 to 3 million bitcoins on exchanges, out of a total of more than 18 million. This means that all the manipulation and volatility is caused by that small amount, and that most bitcoin hodlers have their bitcoin in cold storage, stashed away to never be touched; it still is "digital gold." Have you ever heard about the "Wyckoff distribution model"? Richard Wyckoff was an early 20th-century pioneer in the technical approach to studying the stock market. He followed the trades of the trading titans of his time, and saw that these whales consistently manipulated small retail investors into losing their money:

From his position, Mr. Wyckoff observed numerous retail investors being repeatedly fleeced. Consequently, he dedicated himself to instructing the public about “the real rules of the game” as played by the large interests, or “smart money.” In the 1930s, he founded a school which would later become the Stock Market Institute. The school's central offering was a course that integrated the concepts that Wyckoff had learned about how to identify large operators' accumulation and distribution of stock with how to take positions in harmony with these big players. His time-tested insights are as valid today as they were when first articulated.

[...]

The pioneering work of Richard D. Wyckoff in the early twentieth century was centered around the realization that stock price trends were driven primarily by institutional and other large operators who manipulate stock prices in their favor. Many professional traders today use Wyckoff's method, but his overall approach is still not widely-followed among retail traders, even though his educational efforts were intended to teach the public the “real rules of the game.” Nonetheless, his stock selection and investment methodology has stood the test of time, largely due to its thorough, systematized and logical structure for identifying high-probability and highly profitable trades. The discipline involved in this approach allows the investor to make informed trading decisions unclouded by emotion. Using Wyckoff's method, one can invest in stocks by capitalizing on the intentions of the large “smart money” interests, rather than being caught on the wrong side of the market. Attaining proficiency in Wyckoff analysis requires considerable practice, but is well worth the effort.

source: StockCharts

Guess what; bitcoin followed the Wyckoff pattern to a tee; watch the below linked video from one of the YouTubers I follow on bitcoin to see just how this played out. I'm not a trader myself, I just buy and hold, but this is something anyone in the cryptosphere should be aware of. So don't panic, my crypto brothers and sisters. Is the dump over? Who knows; there are no guarantees in this space, and you should always do your own research, especially if you are a trader. And if you are, it could pay off to read the Wyckoff article linked above in full. And to end this, please also watch the above linked video: it's a possible explanation of Elon Musk's tweets and actions regarding bitcoin and dogecoin, one that might shed a different light and paints Elon as not all bad after all. Always try to look at all sides, even if it's a billionaire w're talking about!

MASSIVE MANIPULATION CAUSING THIS CRASH - ELON MUSK A PUPPET? - Wyckoff Theory

Thanks so much for visiting my blog and reading my posts dear reader, I appreciate that a lot :-) If you like my content, please consider leaving a comment, upvote or resteem. I'll be back here tomorrow and sincerely hope you'll join me. Until then, keep safe, keep healthy!

Recent articles you might be interested in:

| Latest article >>>>>>>>>>> | Jewish Supremacy? |

|---|---|

| Tax The Rich | Lunartics! (repost) |

| Overview Effect (repost) | Funding Apartheid |

| The Musk Myth | Best Ad Ever! |

Thanks for stopping by and reading. If you really liked this content, if you disagree (or if you do agree), please leave a comment. Of course, upvotes, follows, resteems are all greatly appreciated, but nothing brings me and you more growth than sharing our ideas.